- 3 Big Scoops

- Posts

- Wall Street Dumps Snap

Wall Street Dumps Snap

PLUS: Gold vs. silver

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

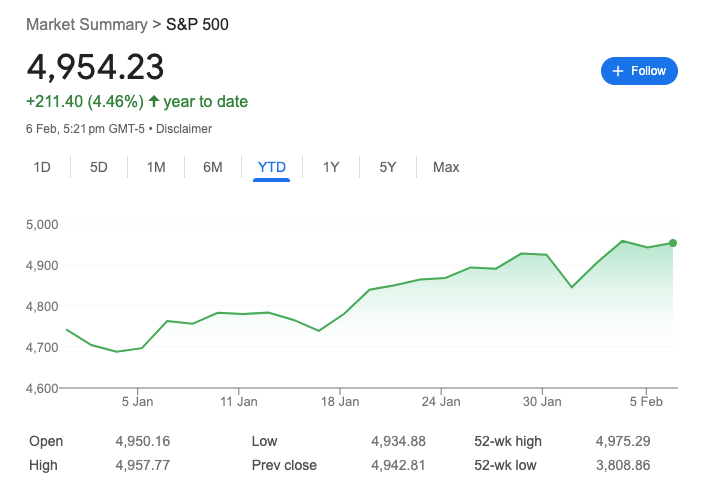

S&P 500 @ 4,954.23 (⬆️ 0.23%)

Nasdaq Composite @ 15,609.00 ( ⬆️ 0.073%)

Bitcoin @ $43,114.40 ( ⬆️ 0.04%)

Hey Scoopers,

Happy Wednesday! Ready to tackle the midweek hustle? Here’s what’s brewing this morning.

👉 Snap disappoints investors

👉 Can silver beat gold?

👉 Solana slumps lower

So, let’s go 🚀

Market Wrap

Tuesday’s results marked the halfway stage for the earnings season in Q4. So far, so good, especially for Big Tech.

Social media giant Snap is pulling back significantly after missing Q4 estimates (more on this shortly). Alternatively, shares of auto giant Ford and restaurant behemoth Chipotle are trading higher post Q4 results.

Today, investors will closely watch a fresh batch of quarterly results from companies including Disney, Uber, and PayPal.

Snap Stock is Down 30%

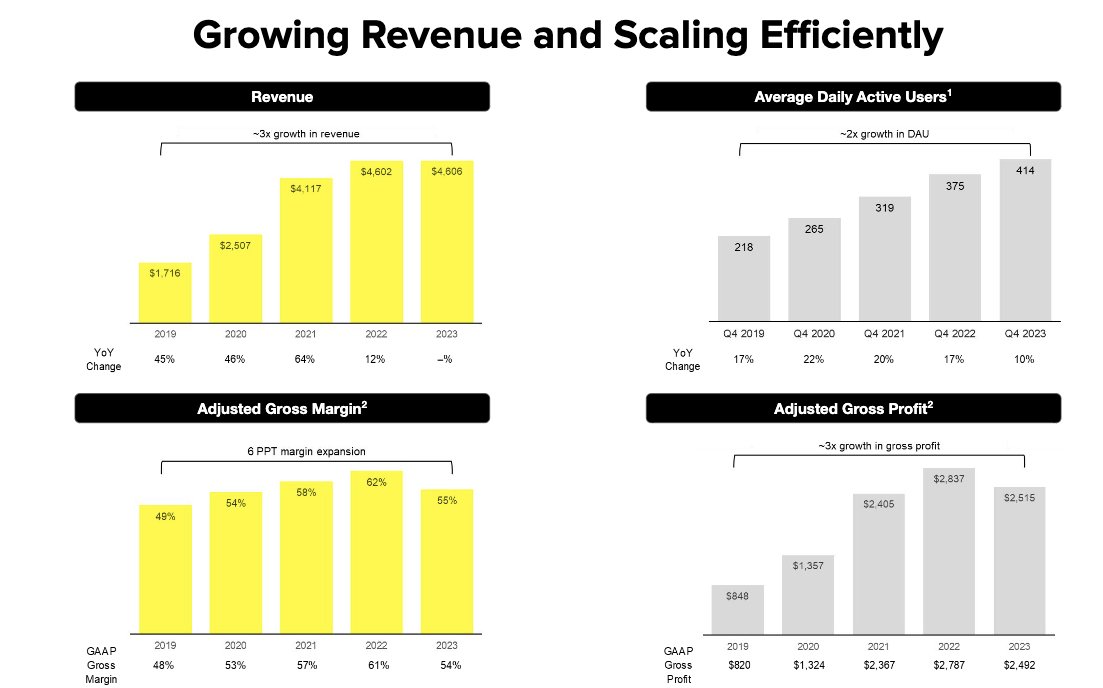

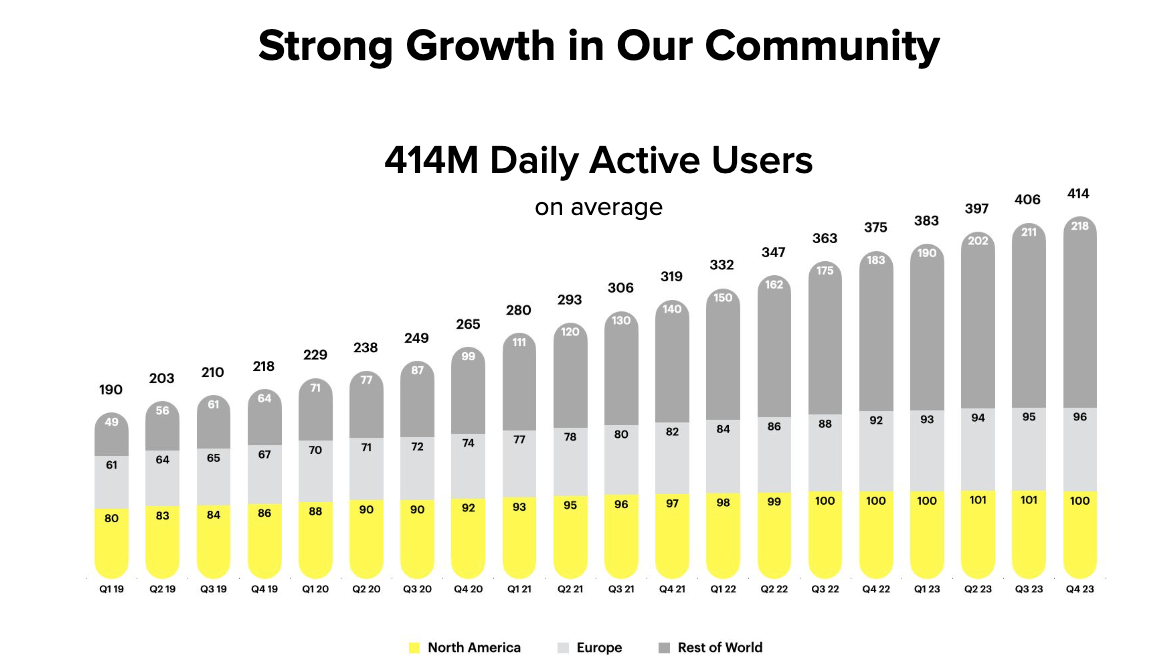

Shares of Snap are down over 30% in pre-market trading today after the company announced Q4 results, reporting:

👉 Revenue of $1.36 billion vs. estimates of $1.38 billion

👉 Earnings per share of $0.08 vs. estimates of $0.06

Despite an improving macro environment, Snap continues to struggle, reporting six consecutive quarters of single-digit growth or revenue declines.

In Q4 of 2023, its sales grew by just 5% year over year, much lower compared to other digital ad companies such as Meta and Alphabet. Snap attributed weakness in top-line growth to the ongoing war between Israel and Hamas.

It now forecasts sales between $1.095 billion and $1.135 billion in Q1 of 2024, indicating growth rates between 11% and 15%. Comparatively, analysts expect sales to increase 13% to $1.117 billion in Q1.

Snap disclosed sales for its subscription service called Snapchat+ for the first time. The business ended Q4 with an annualized revenue run rate of $249 million after increasing the subscriber base to 7 million in the last quarter.

What next for Snap?

Snap’s forecasts daily active users at 420 million in Q1, higher than estimates of 419.3 million.

Snap stock currently trades 85% below all-time highs after surging 89% in 2023. Earlier this week, Snap stated it would reduce its workforce by 10% to focus on lowering its costs. Around 18 months back, Snap reduced its workforce by 20%.

Its GAAP net loss in Q4 narrowed to $148.2 million or $0.15 per share, compared to a loss of $288.5 million or $0.18 per share in the year-ago period.

Snap expects an adjusted EBITDA loss between $55 million and $95 million in Q1, higher than consensus estimates of $21.9 million.

Silver Poised to Hit 10-Year High

2024 could be a breakthrough year for silver, according to the Silver Institute. Global silver demand is forecast to touch 1.2 billion ounces this year, marking the second-highest level on record.

The Institute explains, “Stronger industrial offtake is a principal catalyst for the rising global demand for the white metal, and the sector should hit a new annual high this year.”

Source: CNBC

Primarily used for industrial purposes, silver is incorporated to manufacture automobiles, solar panels, and electronics.

Trading at $22.4 per ounce right now, silver prices might surge to $30 per ounce by the end of 2024 due to demand across industries.

The Institute sees a 9% climb in demand for silverware and a 6% rise in jewelry demand (mainly from India) in 2024. A recovery in consumer electronics should also act as a tailwind for the precious metal.

Similar to gold, silver, too, has an inverse relationship with interest rates. A higher interest rate environment hurts demand for silver and gold as they do not earn any yield, making them less appealing in the process.

As silver is used extensively in industrial applications, its performance is tied to the health of the economy. In contrast, gold prices move higher during periods of economic uncertainty.

Solana Suffers Network Outage

Solana prices were trading 4% lower yesterday after the blockchain network suffered its first major outage in almost a year.

Developers investigated the cause and attributed the outage to a “performance degradation.”

Valued at $41.4 billion by market cap, Solana is the fifth largest cryptocurrency in the world. In the last 12 months, Solana prices have surged over 300%, making it one of the hottest cryptocurrencies in town.

Headlines You Can’t Miss!

Chipotle surges post Q4

ESPN, Fox, and Warner Bros . team up to launch sports streaming platform

Chinese stocks are undervalued, says Clocktower

Meta trounces Snap in digital ads

Ripple is gearing up to enter the U.S.

Chart of The Day

Source: Finimize

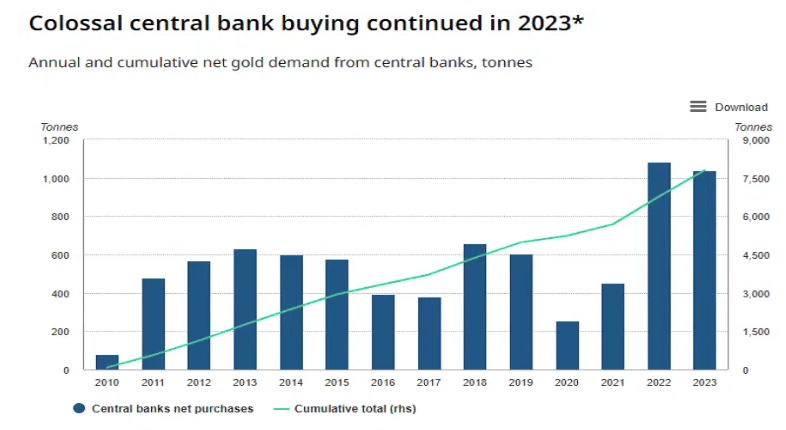

Gold may have lost a bit of its luster among central banks last year, but its total demand was shinier than ever. And that might continue.

Total global demand for the yellow metal rose by 3% in 2023 to hit a record 4,899 metric tons, according to the World Gold Council.

It includes net buying from central banks (blue bars), demand from jewelry makers, investors, industrial manufacturers, and over-the-counter purchases – an opaque source of buying by the super-rich, sovereign wealth funds, and futures market speculators.

All that buying helped send the price of gold 13% higher in 2023 to a record in December despite significantly higher bond yields.

And that’s pretty striking: investors tend to favor bonds over gold when yields look nice, for the simple fact that gold doesn’t generate income, and bonds do. That’s precisely what happened last year, with investor demand for gold plunging to a ten-year low of 945 tons.

Offsetting that weakness was some blistering central bank buying and strong jewelry demand in China. Central banks bought 1,037 tons of the metal – just 45 tons shy of the record set in 2022.

Gold’s new allure among central banks in recent years comes as countries seek to hedge against inflation and diversify their reserves to reduce their exposure to the US dollar. China’s central bank made the biggest move last year, buying 225 tons of gold.

Chinese consumers have also taken a shine to gold of late, snapping it up as a potentially safe store of wealth as the country faces a property crisis, a weakened yuan, a drop in bond yields, and a slumping stock market.

In China, investment demand for gold increased by 28% last year to 280 tons, while jewelry purchases increased by 10% to 630 tons.

And like the perfect pair of gold earrings, this demand isn’t likely to fall out of fashion this year, the World Gold Council says.

It sees total global demand for the shiny metal climbing again in 2024, with geopolitical tensions on the rise and the Federal Reserve expected to reduce interest rates.

Gold’s got a reputation as a safe-haven asset, after all, and it has particular appeal when interest rates start to come down, benefiting from lower bond yields and a weaker US dollar.

This metal may not seem like a bargain, but keeping some of its bling in your portfolio might not be a bad call. A good, cost-effective way to do that is via the abrdn Physical Gold Shares ETF (ticker: SGOL; expense ratio: 0.17%).

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.