- 3 Big Scoops

- Posts

- Microsoft Expands AI Portfolio

Microsoft Expands AI Portfolio

PLUS: Are equities in a bubble?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

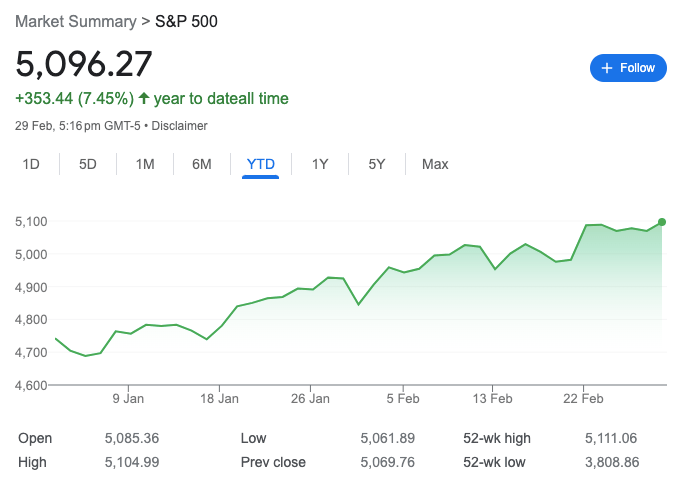

S&P 500 @ 5,096.27 (⬆️ 0.52%)

Nasdaq Composite @ 16,091.92 ( ⬆️ 0.90%)

Bitcoin @ $61,306.65 ( ⬇️ 1.7%)

Hey Scoopers,

Happy Friday! The weekend is on the horizon, and we’re wrapping up. Here’s what we are covering today:

👉 Microsoft’s new AI tool

👉 Will the AI bubble burst?

👉 Bitcoin remains steady

So, let’s go 🚀

Market Wrap 📉

Stock futures are little changed in pre-market trading today after the market wrapped up its fourth winning month as the tech-heavy Nasdaq Composite index reached an all-time high.

The major indices ended another positive month as the rally was driven by the boom in AI-powered stocks and hopes of rate cuts. In February:

👉 The Nasdaq Composite surged 6.1%

👉 The S&P 500 gained 5.2%

👉 The Dow Jones added 2.2%

Markets now expect the Fed to cut interest rates by June after inflation data showed the personal consumption expenditures price index rose in line with expectations.

Trending Stocks 🔥

Dell - Shares of the PC manufacturer are up over 18% in pre-market after it posted better-than-expected Q4 results while showcasing strong demand for AI servers. It raised annual dividends by 20% to $1.78 per share.

New York Community Bancorp - The regional bank's shares shed over 20% after the lender announced a leadership change while disclosing issues with internal controls.

Viking Therapeutics - Shares of the drug manufacturer fell 15% after it raised $500 million in an equity offering.

Ready to elevate your investing journey to new heights?

Unlock the power of informed decision-making with our daily newsletter, tailored to empower investors like you. The Early Bird delivers crucial insights that keep you ahead in the stock market, ensuring you make profitable decisions.

Why Join The Early Bird?

Join millions who trust us

Discover daily recommendations

Unlock hidden opportunities

Make informed investment decisions

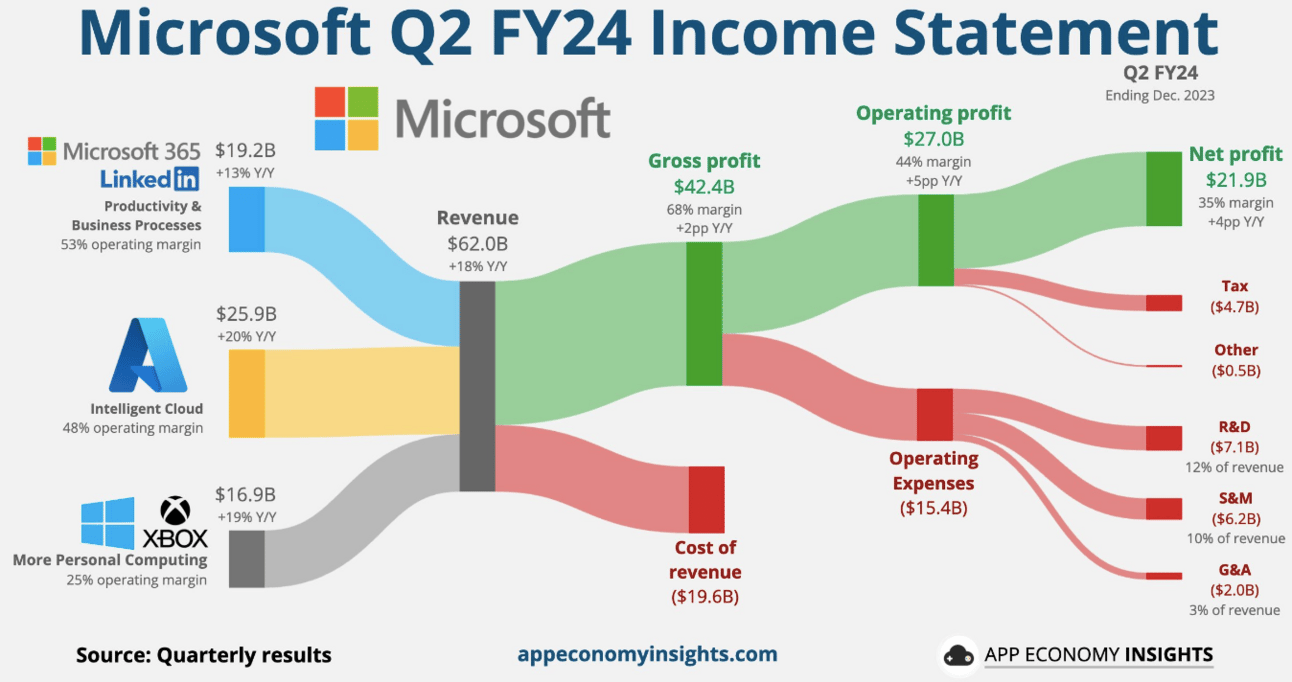

Microsoft Launches AI Chatbot for Finance

Yesterday, Microsoft announced it would release a Copilot chatbot capable of performing critical tasks for people working in finance. It already has a Copilot for general-purpose industrial use in Office applications and released Copilots for sales and customer-service domains.

The Copilot for finance will initially run a variance analysis, reconcile data in Excel, and accelerate the collections process in Outlook. Moreover, the software will be able to access information stored in SAP and Microsoft Dynamics 365.

According to Microsoft, the new tool might reduce manual reconciliation work for the finance team from a couple of hours each week to just a few minutes.

Several other business software providers, such as Salesforce and Hubspot, have also been working on supercharging existing products with AI capabilities to improve operational efficiencies.

But it’s clear that Microsoft enjoys a first-mover advantage due to its multi-billion-dollar investment in OpenAI, the parent company of ChatGPT.

Valued at more than $3 trillion by market cap, Microsoft is the largest company in the world. Despite its massive size, the tech giant is forecast to grow sales from $211 billion in fiscal 2023 (endedin June) to $279 billion in 2025.

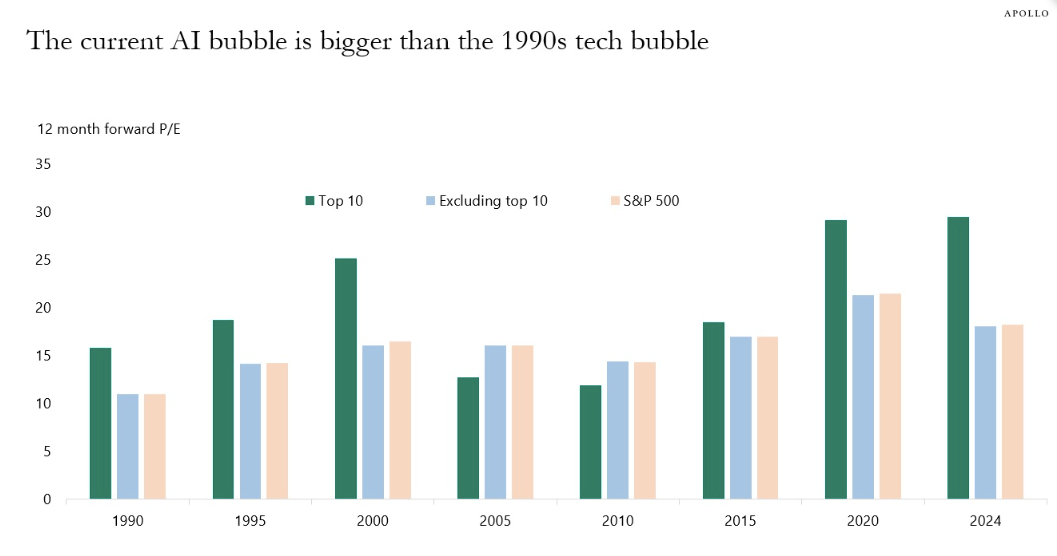

The AI Bubble Will Not Burst

As indices are trading at all-time highs, investors may be worried if we are in the midst of a stock market bubble. A bubble is generally defined as a period where asset prices inflate rapidly, potentially much higher than their intrinsic value.

There are several factors that point to a market bubble, including high valuations of stocks such as Nvidia and Microsoft. Moreover, in a market bubble, investors are very concentrated in a single sector (tech in this case).

So, what’s different this time?

If we look at the dot com bubble in 2000 or the housing bubble in 2007, a key characteristic was investor leverage. The markets had high retail and institutional leverage through borrowings and derivatives.

A major problem of the 2008 market crash was the large quantities of derivative positions and the lack of risk management policies surrounding complex financial products, including collateralized debt.

Unlike the last two bubbles, it seems the leverage levels are quite low while investor cash positions in money market funds is relatively robust, indicating high liquidity reserves.

Bubble or not, investors should note that timing the markets is almost impossible.

For instance, in the last 24 years, we have witnessed the dot com bubble, the financial crash, a period of low oil prices, the COVID-19 pandemic, and ongoing interest rate hikes. In this period, the S&P 500 index has surged from 1,424 to 5,096.

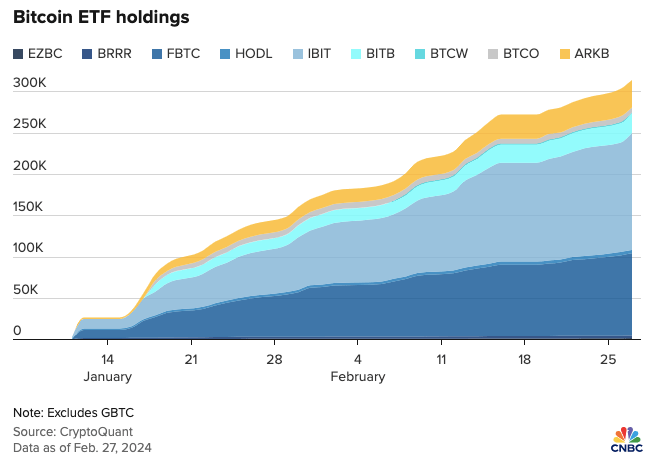

Bitcoin Ends February On a High

Crypto prices extended recent gains on Thursday as Bitcoin and Ethereum closed out their best months since 2020 and 2022, respectively.

Bitcoin prices rose 3% to $62,216.43 on the last day of the month and touched a 100-week high of $64,000 before a wave of liquidations pulled back prices.

While Bitcoin took a breather yesterday, it is on pace for a weekly gain of 21%, rising 45% in February, marking the sixth consecutive monthly gain.

On Wednesday, daily net inflows stood at a record $677 million, the third straight day where inflows surpassed $500 million.

The spot Bitcoin ETFs are attracting billions of dollars in investments, acting as a critical catalyst of prices in the near term.

Headlines You Can't Miss!

Tesla’s massive EV charging bet

India to invest $15 billion to manufacture semiconductor chips

Japan’s factory activity contracts most since 2021

Boeing agrees to $51 million settlement related to export sanctions

Gemini to return $1.1 billion to customers

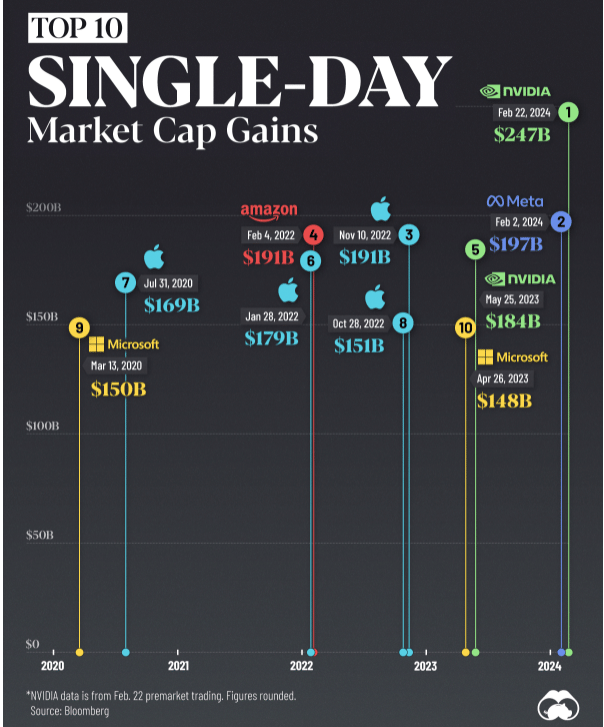

Chart of The Day

Tech stocks in the U.S. have led the broader markets by a significant margin, sometimes experiencing valuation gains of several billion dollars in a single trading session.

Earlier this month, Meta set a new record for the most significant single-day gain following its Q4 results while also announcing its first-ever quarterly dividend.

The record lasted just 20 days, as Nvidia stunned Wall Street and gained $247 billion in a single day.

These numbers are massive, given the average market cap of an S&P 500 company is less than $40 billion.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.