- 3 Big Scoops

- Posts

- Tech Earnings Roll In

Tech Earnings Roll In

Salesforce, Snowflake, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

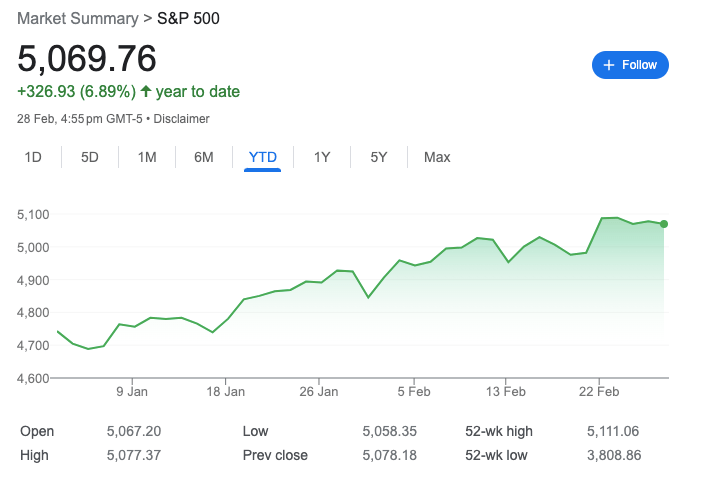

S&P 500 @ 5,069.76 (⬇️ 0.17%)

Nasdaq Composite @ 15,947.74 ( ⬇️ 0.55%)

Bitcoin @ $62,678.10 ( ⬆️ 5.13%)

Hey Scoopers,

Happy Thursday! Here’s today’s breakdown:

👉 Growth stocks report earnings

👉 All eyes on inflation

👉 Bitcoin’s on fire

So, let’s go 🚀

Market Wrap 📉

All three major stock market indices inched lower yesterday as the 30-stock Dow fell for the third consecutive session.

Despite the recent pullback, all three indices are on track to end the current month in the green, while investors remain nervous about the AI-fueled rally.

In February 2024:

👉 The S&P 500 has gained 4.6%

👉 The Nasdaq Index has surged 5.2%

👉 The Dow Jones has risen 2.1%

Trending Stocks 🔥

Duolingo - Shares of the language learning platform soared 22% after it surpassed quarterly estimates and reported strong monthly average user and booking numbers. The company also provided revenue guidance, which was higher than estimates.

MicroStrategy - Shares of the bitcoin-focused enterprise software company surged over 10% yesterday due to the ongoing rally surrounding cryptocurrencies.

Okta - Okta has surged 24% on better-than-expected quarterly results and first-quarter guidance.

Snowflake and Salesforce Decline

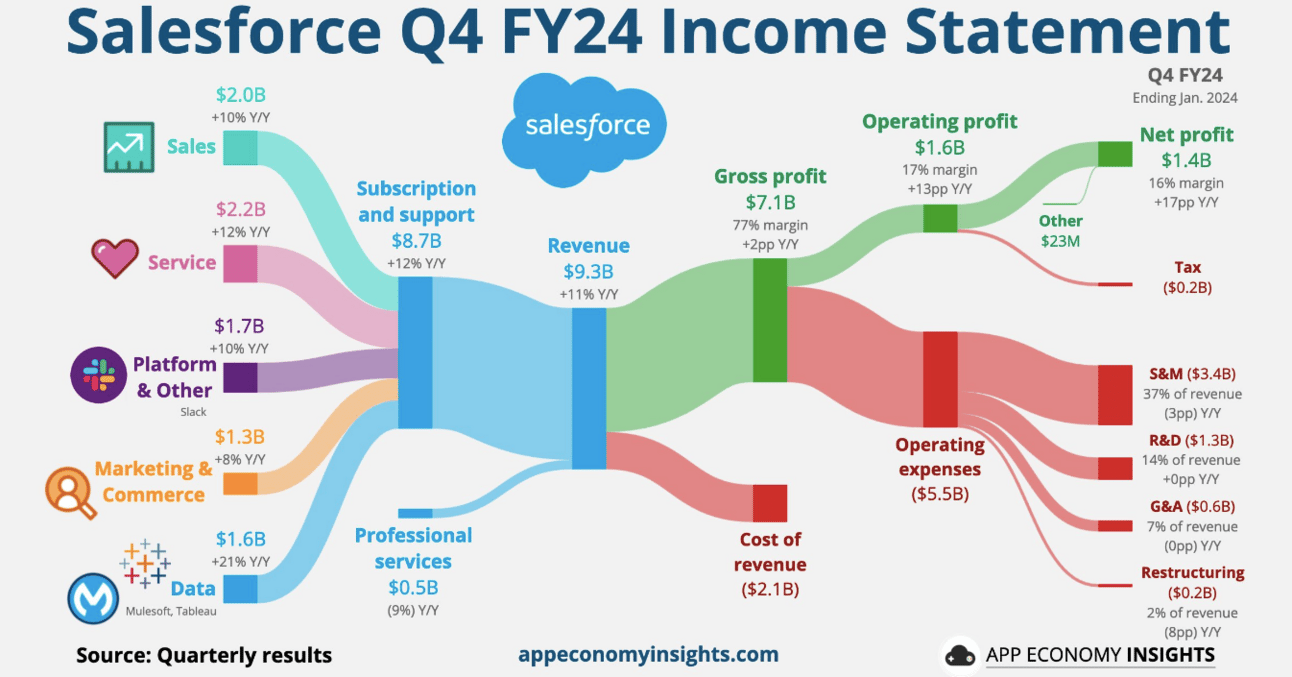

Shares of Salesforce are down almost 2% in pre-market trading after the software giant issued a light revenue forecast for the new fiscal year.

In fiscal Q4 of 2024 (ended in January), Salesforce reported:

👉 Revenue of $9.29 billion vs. estimates of $9.22 billion

👉 Earnings of $2.29 per share vs. estimates of $2.26 per share

Salesforce increased revenue by 10.8% year over year in Q4 on the back of steady bookings growth. The tech heavyweight also stated it would acquire sales commission software startup Spiff for an undisclosed sum.

In Q1, Salesforce estimates revenue between $9.12 billion and $9.17 billion, with earnings between $2.37 and $2.39 per share. Analysts forecast sales at $9.15 billion and earnings at $2.20 per share in Q1.

In fiscal 2025, Salesforce estimates revenue between $37.7 billion and $38 billion, below the consensus forecast of $38.6 billion. Its earnings expectations range between $9.68 and $9.76 per share, higher than estimates of $9.57 per share.

Salesforce is now a slow-moving giant growing sales by high-single-digit percentages. It announced a quarterly dividend of $0.40 per share for the first time ever, translating to a forward yield of 0.54%.

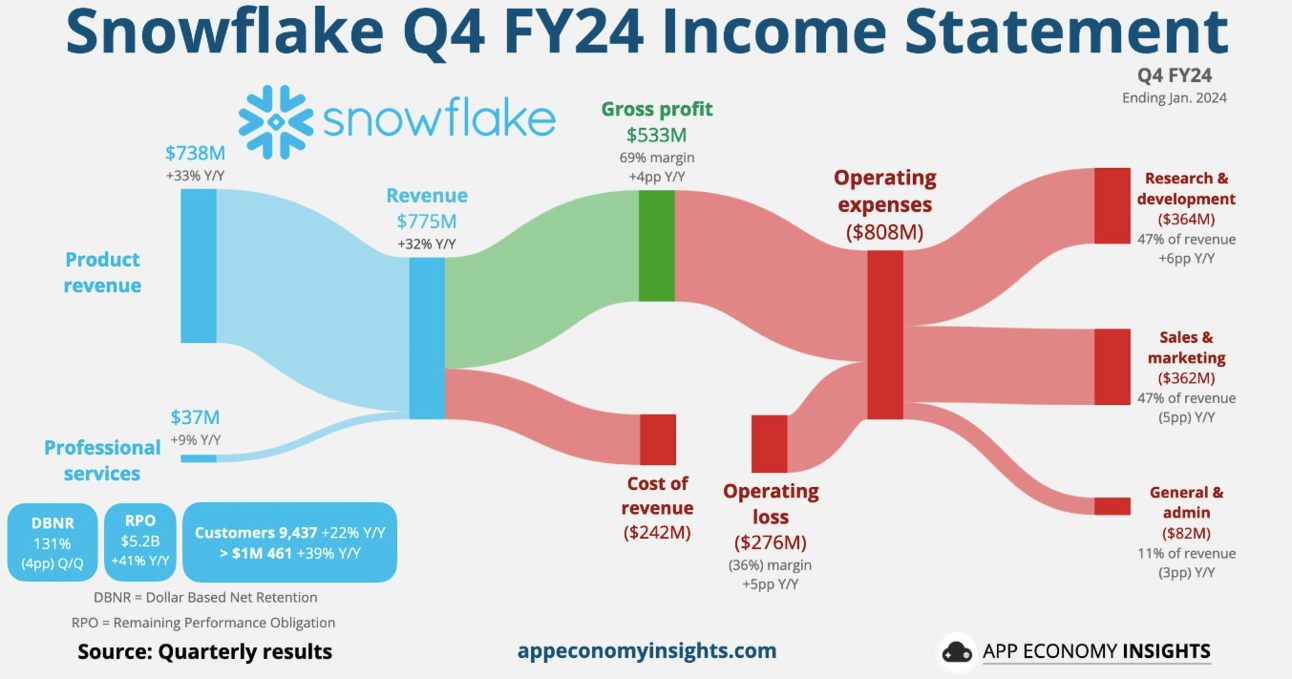

Slootman Exits Snowflake

Shares of one of the fastest-growing SaaS (software-as-a-service) companies, Snowflake, are down over 20% in early-market trading following its fiscal Q4 of 2024 (ended in January) results.

In Q4, Snowflake increased sales by 32% year over year to $775 million. Its operating losses totaled $275.5 million, up from $240 million in the year-ago period.

Snowflake forecasts product revenue to range between $745 million and $750 million in Q1, lower than estimates of $759 million. The company also expects its Q1 operating margin to range around 3%, much lower than the estimates of 7.2%.

Further, Snowflake announced its CEO, Frank Slootman, is retiring and will be replaced by Sridhar Ramaswamy, a former Googe executive. Slootman joined Snowflake in 2019 and took the company public in 2020. In the last five years, the CEO has helped increase Sowflake’s valuation from $4 billion to $74 billion.

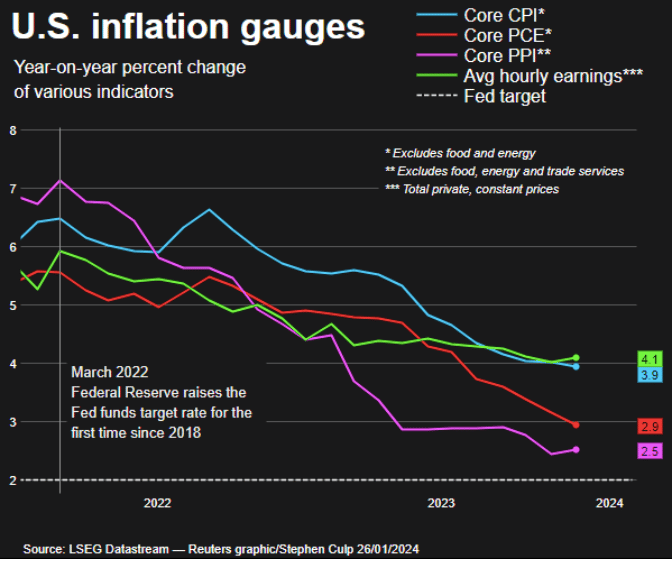

Will Inflation Cool Down?

The most watched macro indicator in the last two years has been inflation. The Federal Reserve raised interest rates several times in the previous 24 months to offset inflation that touched 40-year highs in 2022.

Today, Wall Street anxiously waits for the personal consumer expenditures (PCE) reading for January. Economists expect a monthly gain of 0.3% and a year-over-year increase of 2.4%.

A higher-than-expected print could dent equities and further delay interest rate cuts. Initially, it was expected the Fed would reduce rates by six times in 2024. Instead, it seems like we will end the year with three rate cuts.

Bitcoin Tops $63K 🚀

Bitcoin is unstoppable. The world’s largest cryptocurrency is up more than 5% in the last 24 hours and has surged 42% in 2024 and 165% in the last year, valuing it at a market cap of $1.23 trillion.

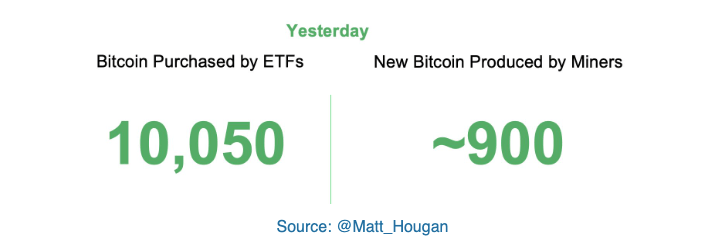

The launch of nine spot Bitcoin ETFs has increased the demand for Bitcoin in the past month. For instance, around 900 BTC was mined yesterday, while the ETFs purchased more than 10,000 BTC.

The total trading volume on the ETFs surpassed $6 billion on Wednesday, an all-time record. In fact, there are four Bitcoin ETFs in the top 20 in terms of trading volumes.

BlackRock’s spot Bitcoin ETF attracted capital inflows totaling $520 million in a single day and now manages roughly $7 billion in total assets.

Headlines You Can't Miss!

AB InBev sees an increase in profits

Alibaba Cloud slashes prices by 55%

Water scarcity might push chip prices higher

Disney and Reliance might enter into a $8.5 billion JV

Bitcoin bull Michael Saylor nets $700 million this week

Chart of The Day

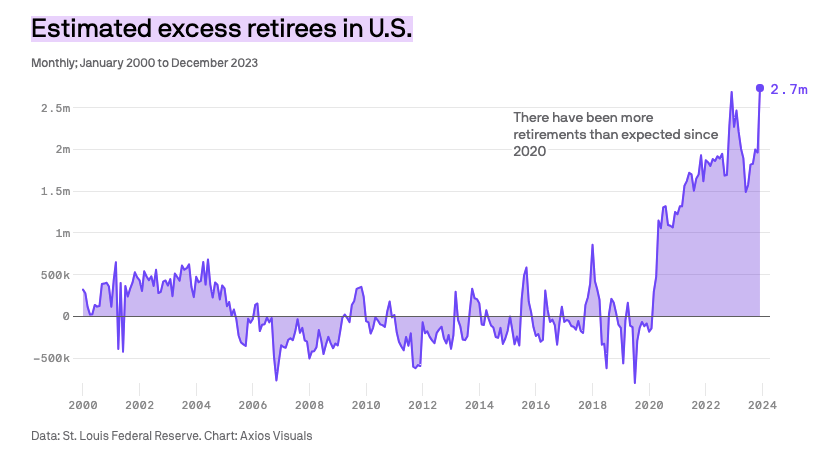

A report from Axios states that Americans are leaving the workplace in huge numbers again, a trend first witnessed during the COVID-19 pandemic.

The above chart shows that the U.S. has 2.7 million more retirees than initially predicted. This number was 40% lower at 1.5 million six months back.

The dreaded pandemic has altered the labor force at a fundamental level as people are dropping out of the workforce as well, in addition to retiring.

A robust stock market and inflation-beating returns have also contributed to early retirements.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.