- 3 Big Scoops

- Posts

- McDonald's in Q4: Not Lovin It

McDonald's in Q4: Not Lovin It

PLUS: Mortgage rates soar over 7%

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

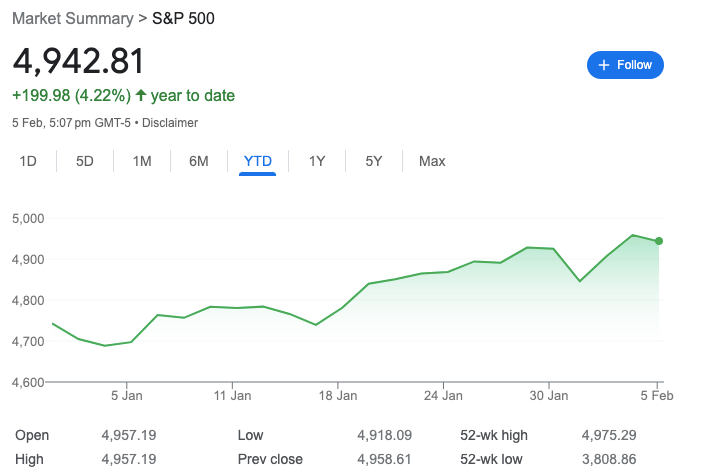

S&P 500 @ 4,942.81 (⬇️ 0.32%)

Nasdaq Composite @ 15,597.68 ( ⬇️ 0.20%)

Bitcoin @ $42,865.24 ( ⬇️ 0.42%)

Hey Scoopers,

Buckle up coz we have some of the juiciest updates and stories coming your way. Here’s what’s brewing this morning.

👉 McDonald’s misses revenue estimates

👉 Mortgage rates tick higher

👉 What is Dogecoin?

So, let’s go 🚀

Market Wrap

Equity markets moved lower on Monday as Treasury yields spiked on concerns that the Fed may not cut rates as expected. Lackluster results from McDonald’s also dampened investor sentiment (more on this later!).

The yield on the 10-year Treasury note moved higher by 13 basis points to 4.166% as the economy remains resilient, suggesting interest rates might remain elevated in the near term. The benchmark yield traded at 3.81% last week.

Fed Chair Jerome Powell recently emphasized a rate cut in March was unlikely. Expectations for a cut have since eased, with the probability of a rate cut in March at 16.5%.

McDonald’s Disappoints Investors

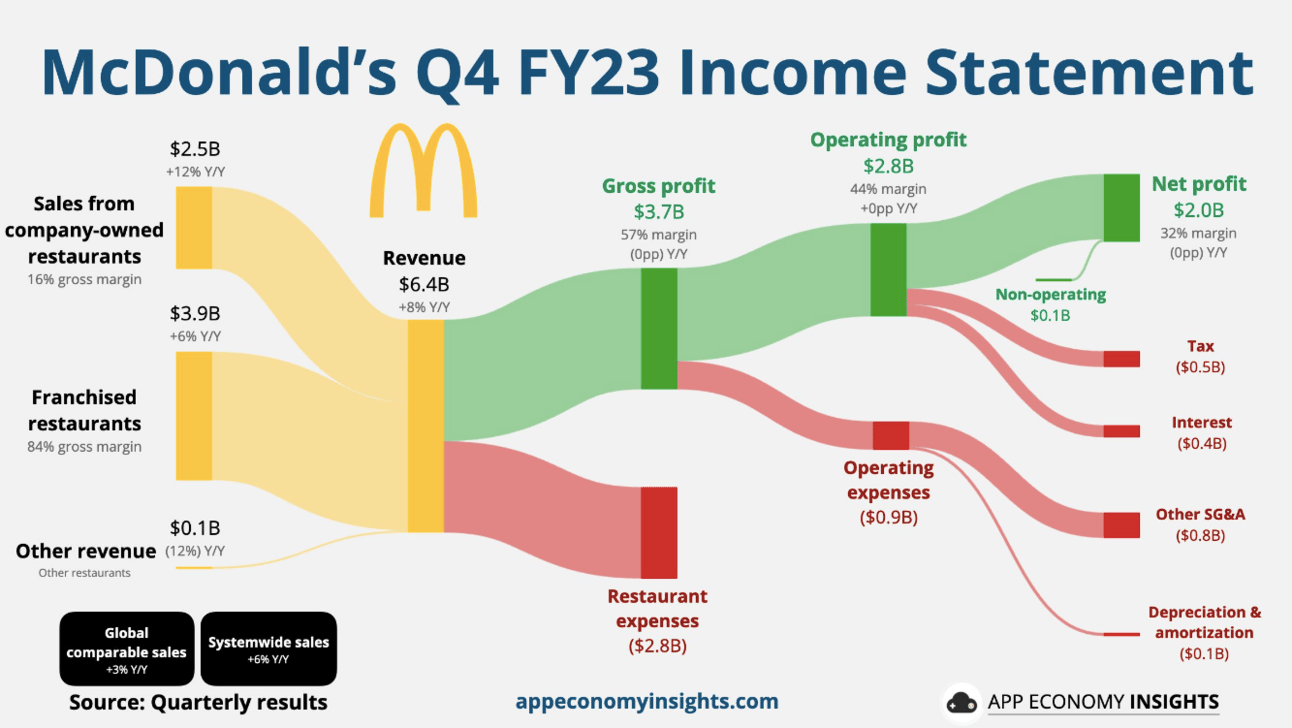

McDonald’s shares fell 4% yesterday after the fast-food giant announced its Q4 results, reporting:

👉 Revenue of $6.41 billion vs. estimates of $6.45 billion

👉 Earnings per share of $2.95 vs. estimates of $2.82

Its net sales were up 8% year over year, while net income grew to $2.1 billion. Its same-store sales were up 3.4%, below estimates of 4.7%.

McDonald’s attributed its lower-than-expected same-store sales to the ongoing war between Israel and Hamas. Its sales declined in the Middle East after the company’s Israel-based licensee offered discounts to soldiers.

In 2024, McDonald’s expects systemwide sales growth at 2%. The quick-service giant plans to open 2,100 new locations this year and has allocated $2.6 billion in capital expenditures.

Our take

MCD stock has been among the top performers in the last two decades. Since February 2004, shares of the company have surged over 950%. After adjusting for dividends total returns are closer to 1,700%.

With an operating margin of 44%, MCD has a unique business model that is fairly recession-proof.

Mortgage Rates Spike

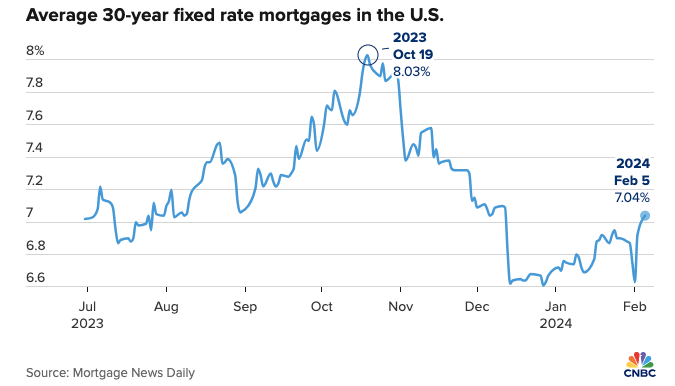

The average rate on the 30-year fixed mortgage crossed over 7% yesterday for the first time since December. It comes after the rate experienced its sharpest jump in more than a year last Friday due to a better-than-expected employment report for January.

Mortgage rates have been on an absolute tear in the U.S., surging to a 20-year high of 8% in October 2023.

The Fed began raising interest rates in 2022 to offset inflation. Despite multiple interest rate hikes, consumer spending remains resilient due to a robust job market.

The double whammy of high prices and low supply made 2023 the worst for home sales since 1995.

However, the median price of an average home sold in December stood at $382,600, rising 4.4% year over year. It was the sixth consecutive month of year-over-year price gains.

Small rate swings have a significant impact on monthly mortgage payments due to elevated housing prices. For instance, a half percentage point increase can cost or save a buyer $200 per month based on median prices.

A Meme Coin Valued at $11 Billion

Created as a joke in 2013, Dogecoin is currently valued at a market cap of $11 billion. The meme coin was built using the underlying technology from Litecoin and has a circulating supply of 132 billion coins.

In recent years, Doegcoin has attracted a passionate group of investors, making it the world’s biggest meme-coin in 2021. In fact, Dogecoin prices surged by a whopping 15,000% in the first six months of 2021.

Similar to other cryptocurrencies, Dogecoin uses blockchain tech to maintain a decentralized ledger that records all Dogecoin transactions.

Like Bitcoin, Dogecoin uses the proof-of-work method and the mining process to validate transactions. Right now, Dogecoin’s mining process is much more efficient than Bitcoin in terms of cost and environmental impact. Moreover, transactions processed on Dogecoin are faster than Bitcoin.

However, Dogecoin remains a high-risk investment as it doesn’t derive value from another asset (like stablecoins do), nor does it add value to a financial system such as Ethereum.

Dogecoin has thrived due to its entertainment value and its passionate community. As it does not have any intrinsic value, Dogecoin’s popularity determines its worth.

Dogecoin can produce massive short-term gains but may not be a viable strategy for long-term success.

Headlines You Can’t Miss!

BP stock surges over 6%

Nintendo expects to sell 15.5 million Switch consoles

Toyota hikes annual profit forecast after Q3 results

Snap to lay off 10% of its global workforce

Ethereum Name Service partners with Godaddy

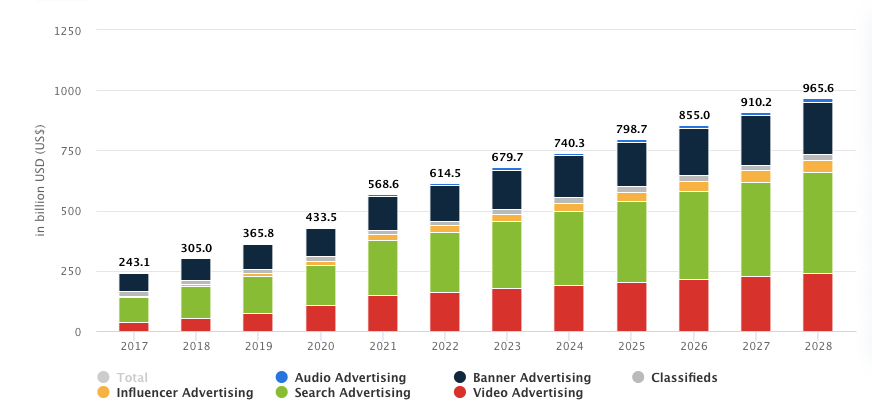

Chart of The Day

Global Digital Ad Spending

Source: Statista

In Q4 of 2022, Meta’s ad sales fell by 4%, while Google’s ad business suffered a similar decline due to headwinds such as inflation, supply chain issues, and geopolitical conflicts.

However, the macro environment has improved in recent months as Q4 ad sales for:

👉 Meta jumped 24% to $38.7 billion

👉 Amazon grew by 27% to $14.7 billion

👉 Google rose by 11% to $65.5 billion

China was a key driver for Meta’s ad sales. For instance, companies such as Shein and Temu are spending heavily to reach customers around the globe. Meta confirmed China accounted for 10% of sales in 2024.

Big-ticket ad events such as the Summer Olympics in Paris and the upcoming presidential election should act as key drivers for digital ad spending in 2024.

A report from Insider Intelligence expects global ad spending to rise by 10% in 2024, up from 6.3% in 2023.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.