- 3 Big Scoops

- Posts

- McDonald's Eyes Expansion

McDonald's Eyes Expansion

McDonald's , Jamie Dimon and Inflation

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,585.59 ( ⬆️ 0.80%)

Nasdaq Composite @ 14,339.99 ( ⬆️ 1.37%)

Bitcoin @ $43,163.72 ( ⬇️ 1.59%)

Hey Scoopers,

Happy Friday. We made it!!!

Here’s what’s on the menu for today:

👉 McDonald’s bets big on China

👉 Did oil companies drive up inflation?

👉 Jamie Dimon tears into Bitcoin (again!)

So, let’s go 🚀

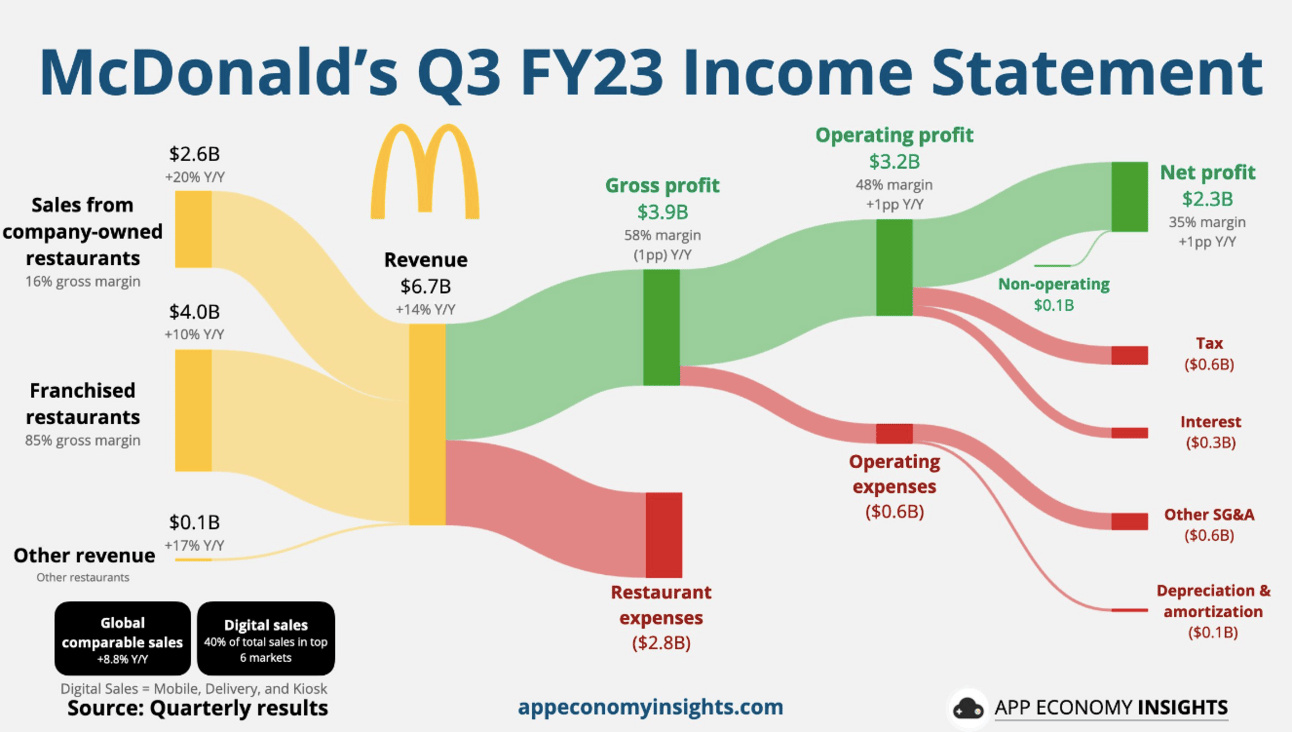

McDonald’s To Open 9,000 Restaurants

McDonald’s plans to open about 9,000 locations and add 100 million members to its loyalty program in the next four years. These targets are part of the fast-food giant’s long-term target to grow revenue.

McDonald’s has projected net new restaurant growth at 4% for 2024. Next year, around 2% of systemwide sales growth will come from new stores.

Post 2024, it aims to grow the restaurant count between 4% and 5% annually. It also expects new locations to contribute 2.5% of systemwide sales growth in this period.

To support this growth plan, McDonald’s will spend $2.5 billion in capital expenditures in 2024, up from $2.3 billion in 2023. Between 2025 and 2027, it is expected that CapEx will increase by around $400 million annually.

Basically, it has targeted a global footprint of 50,000 locations by 2027. The fast-food heavyweight ended Q3 with a restaurant count of 41,198. So, which regions will drive store count growth for the company?

In the next four years, McDonald’s will open:

900 locations in the U.S.

1,900 restaurants in international markets and

7,000 units in its international developmental licensed (IDL) markets division

International markets include regions such as France, Canada, and Australia, which account for 50% of total sales.

Further, the IDL segment includes China, which will account for more than 50% of new locations.

Big Energy Pushed Up Inflation?

A new report published by the U.K.’s Institute for Public Policy Research and Common Wealth blamed major companies in the energy and food sectors for inflation, which touched multi-year highs in 2022.

The report analyzed financial reports from 1,350 companies listed in the U.K., U.S., Germany, Brazil, and South Africa and found nominal profits at the end of 2022 were 30% higher compared to 2019.

It suggests higher prices were passed on to consumers by companies with pricing power, allowing them to reap excess profits.

The report emphasized that corporate profits were not the sole driver of inflation as energy prices rose following Russia’s invasion of Ukraine.

However, it argued, “In an energy shock scenario, if costs were equally shared between wage earners and company owners, one would expect the rate of return to fall as firms do not increase prices fully to make up for higher costs, and wage earners do not fully keep up with inflation. But this is not what happened.”

Companies that saw profits far outpace inflation include Shell, Exxon Mobil, Glencore, and Kraft Heinz.

Jamie Dimon Slams Bitcoin

Jamie Dimon, the CEO of JPMorgan, recently slammed Bitcoin and other cryptocurrencies. Dimon claimed, “The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.”

Source: Yahoo Finance

Meanwhile,

👉 In 2019, a ship owned by JPMorgan was seized by the U.S. and was found with 40,000 pounds of cocaine

👉 The largest U.S. bank was hit with $200 million in fines after employees used WhatsApp to evade regulators

👉 JP Morgan paid close to $1 billion in settlement fees after it was accused of defrauding the precious metals and Treasuries markets in the U.S.

👉 Since the start of this century, JPMorgan has paid $39 billion in fines. The four largest U.S. banks have been fined over $180 billion in the past 23 years.

Our take

Bitcoin is decentralized and will eventually replace banks and most other financial institutions, making them irrelevant.

Headlines You Can’t Miss!

AMD stock gains after company launches AI chips

Google shares gain post Gemini launch

Japan’s Q3 GDP numbers decline as consumption lags

Australia’s energy giants to merge in $52 billion deal

VanEck expects Bitcoin to surge to $100,000 by the end of 2024

Chart of the Day

Source: Visual Capitalist

The top seven stocks of the S&P 500, called the Magnificant Seven, now account for 25% of the index. Here are the seven companies with their stock returns in the last five years:

Apple ⬆️ 250%

Microsoft ⬆️ 224%

Alphabet ⬆️ 141%

Amazon ⬆️ 63%

Nvidia ⬆️ 783%

Meta ⬆️ 118%

Tesla ⬆️ 829%

The Magnificent Seven stocks are mega-cap companies that capitalize on tech trends such as AI, cloud computing, digital advertising, self-driving, and more.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.