- 3 Big Scoops

- Posts

- Investing in Restaurant Stocks

Investing in Restaurant Stocks

McDonald's, Chipotle, and Domino's

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,774.75 ( ⬆️ 0.42%)

Nasdaq Composite @ 15,074.57 ( ⬆️ 0.54%)

Bitcoin @ $42,665.56 ( ⬆️ 0.03%)

Hey Scoopers,

Happy Wednesday!! Ready to tackle the midweek hustle?

Today, we look at top restaurant stocks that have created game-changing wealth for shareholders in the last two decades.

But do they remain enticing bets at current valuations? Let’s see.

Best Restaurant Stocks In 2024

The restaurant industry was bruised and battered at the onset of COVID-19. While soaring demand for restaurant delivery helped keep the lights on, grocery stores scooped up consumer-oriented food spending amid shutdowns.

As lockdowns were relaxed, restaurant spending made a comeback. Throughout 2021 and 2022, restaurant spending outpaced spending at grocery stores.

Yes, success within the industry has been uneven, as some restaurants thrived while others struggled in a post-pandemic world.

In recent months, restaurants have been wrestling with a new set of problems ranging from labor shortages to cost inflation and a sluggish macro environment.

But these three restaurant stocks have thrived across market cycles, creating massive wealth for long-term investors.

Even with the restaurant industry's challenges, investing in quality restaurant stocks can prove to be a winning bet.

The industry might be in turmoil for a bit, but these three stocks should deliver solid returns in the upcoming decade.

McDonald’s

A fast-food giant, McDonald’s easily navigated the COVID-19 pandemic. Around 95% of the company’s restaurants in the U.S. are equipped with a drive-thru, enabling it to remain open during lockdowns.

McDonald’s is also investing heavily in digital sales and delivery. It launched a revamped mobile application in 2017, allowing customers to place orders and make online payments.

McDonald’s also partnered with DoorDash in 2019, expanding its delivery to more than 10,000 locations.

MCD stock has returned 1,006% to shareholders in the past two decades. After accounting for dividends, total returns are closer to 1,900%. Moreover, the food giant offers shareholders a dividend yield of 2.3%.

McDonald’s has raised its dividends by 15% annually since 1994, which is exceptional for investors.

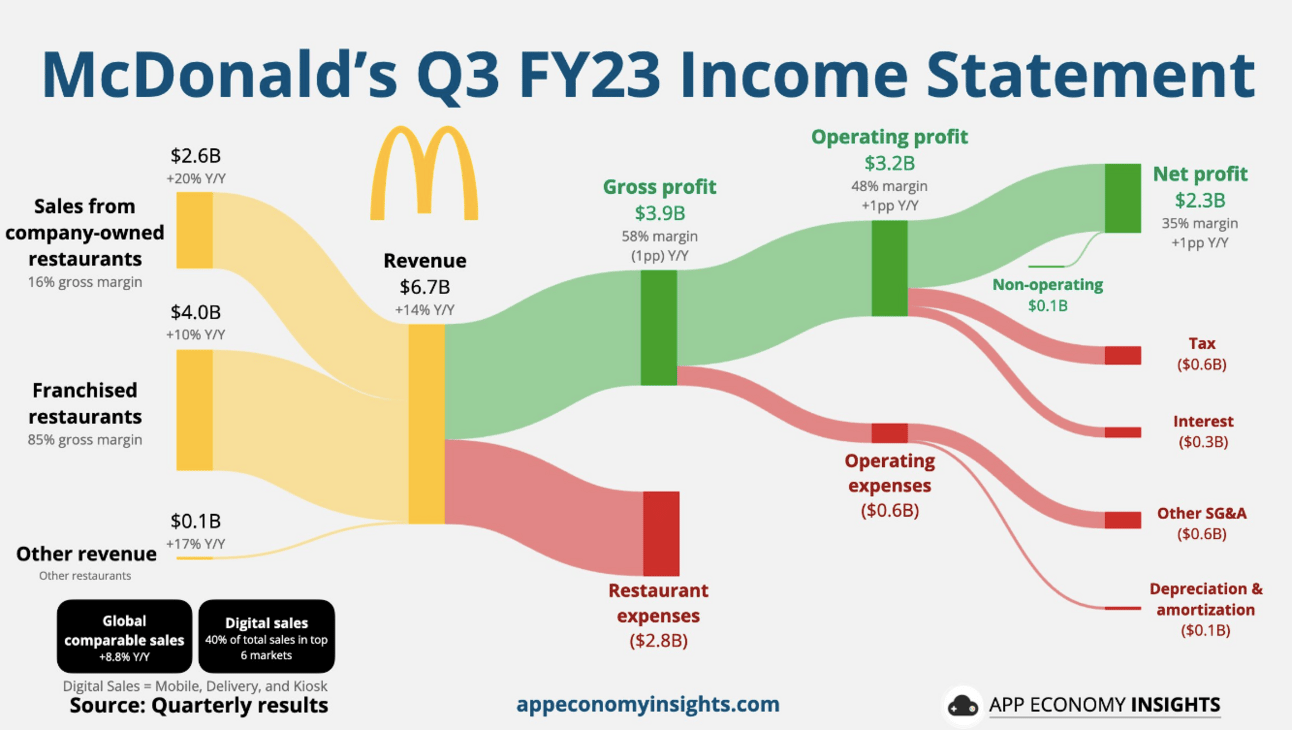

McDonald’s ended Q3 with 41,198 locations in over 100 countries. It owns and operates roughly 5% of these restaurants, and the rest are operated by franchises.

McDonald’s owns most of its locations, which it leases to franchises. The property value on the balance sheet is $42 billion, allowing it to earn close to $10 billion in annual rental income.

So, 60% of franchise-based sales originate from rental income, and rental sales now account for a whopping 40% of McDonald’s total sales.

Its growth story is far from over, as McDonald’s will open 9,000 locations in the next four years.

Priced at 25x forward earnings, MCD stock might seem expensive.

Chipotle Mexican Grill

While rising food and restaurant prices are hurting cash-strapped consumers, the footfall in restaurants is bound to decline in 2023.

However, Chipotle has successfully positioned itself as a go-to option for a healthy meal at a reasonable cost.

In Q3 of 2023, Chipotle opened 62 new locations, taking its total restaurant count to 3,300, less than 50% of the company’s long-term goal of 7,000 locations.

Further, Chipotle has just 65 locations in international markets such as Canada and Europe. So, it has barely scratched the surface in terms of global expansion.

In the last three quarters, Chipotle increased sales by 14% year over year to $7.4 billion. As expenses were up 10%, its net income surged 40% to $947 million.

Chipotle's stock went public in 2006 and has since returned 5,170% to shareholders, easily outpacing the broader markets.

Priced at 44x forward earnings, Chipotle stock is expensive. But its adjusted earnings are forecast to rise by 26% annually in the next five years.

Domino’s

With 20,000 locations, Domino’s Pizza is the world’s largest pizza company. But how much money do you think it makes from selling pizzas each year? Is it $1 billion, or is it $10 billion?

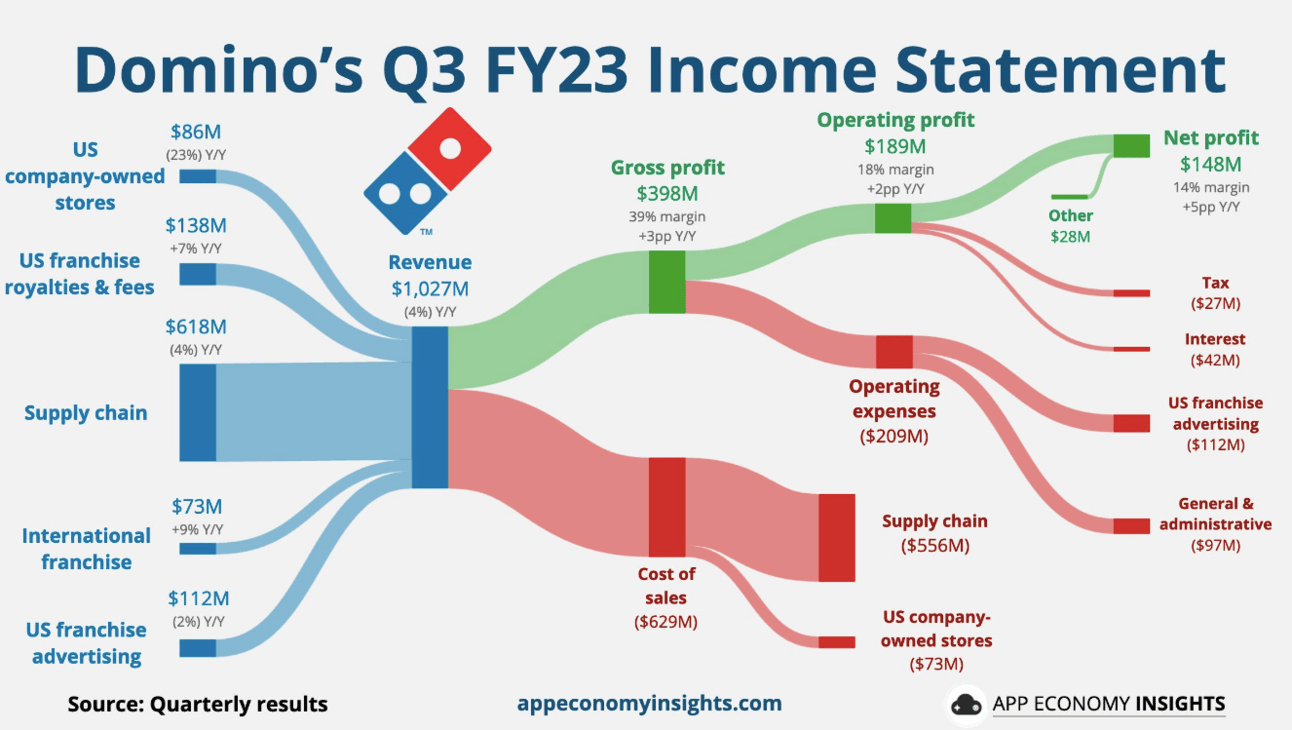

Well, actually, the number is less than $400 million. This figure might seem absurdly low, but most of the company’s revenue comes from what it calls supply chain sales.

In the last 12 months, Domino's supply chain revenue stood at $2.7 billion, accounting for 60% of total sales.

Domino’s owns just 1% of its total locations. So, 99% of its locations are owned by franchises who can source their own supplies. But Domino’s has found a way to get franchises to choose its supply chain instead.

Domino’s has a fleet of 1,000 tractors and trailers that deliver supplies and equipment to company-owned and franchise stores.

Further, Domino’s incentivizes franchises to purchase its supplies by sharing 50% pre-tax supply chain profits with franchise partners. Due to this business model, Domino’s supplies to more than 7,200 locations.

After adjusting for dividends, Domino’s stock has returned over 6,000% to shareholders since its IPO in July 2004. It also pays shareholders an annual dividend of $4.84 per share, indicating a yield of 1.2%.

These payouts have risen by 14.9% annually in the last 18 years.

Other Restaurant Stocks You Can Own

In addition to the three blue-chip giants, you can consider diversifying your portfolio by owning shares of Starbucks, Restaurant Brands International, Yum! Brands, Papa John’s Pizza, and Wendy’s.

Fast food restaurants can leverage investments made in digital and delivery to drive growth in the upcoming decade. Moreover, as fast food chains focus on offering value, a tough economic environment poses fewer risks.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.