- 3 Big Scoops

- Posts

- McDonald's Partners With Krispy Kreme

McDonald's Partners With Krispy Kreme

PLUS: Larry Fink warns against rising debt pile

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

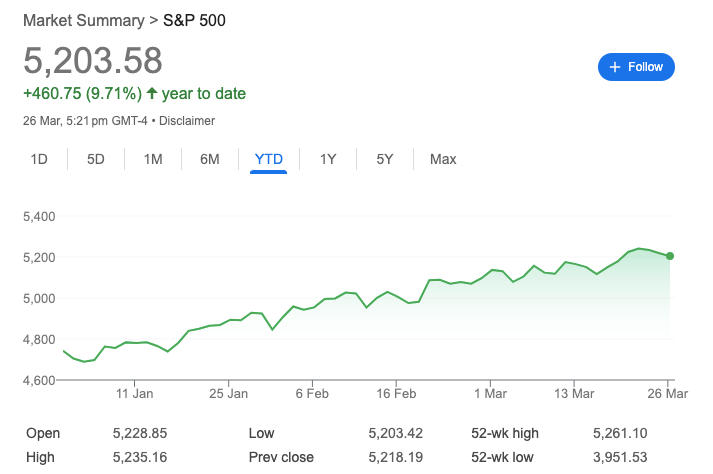

S&P 500 @ 5,203.58 ( ⬇️ 0.28%)

Nasdaq Composite @ 16,315.70 ( ⬇️ 0.42%)

Bitcoin @ $70,379.50 ( ⬇️ 0.21%)

Hey Scoopers,

Happy Wednesday! Let’s see what is moving the markets 👇

👉 McDonald’s lands a partnership

👉 Is a debt crisis looming?

👉 A Bitcoin short squeeze?

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index fell for a third consecutive session on Tuesday but is still up over 2% for the month. Future optimism in the market is likely to come in the form of growing earnings estimates.

Earnings are expected to grow by 10.7% year over year for the S&P 500 in 2024. Moreover, earnings growth might accelerate to 13.3% in 2025, a positive sign for the market.

While market sentiment and inflation suggest a modest pullback in the near term, key drivers of the equity market include a Fed pivot and the AI megatrend.

Trending Stocks 🔥

Reddit - Shares of the social media company popped 15% following its blockbuster debut last week. The stock surged 48% on its first day of trading.

Trump Media & Technology - Shares of former President Donald Trump’s social media company rose 35% after it began trading on the Nasdaq.

McCormick - The stock jumped 10% after the spice maker topped earnings and revenue estimates in fiscal Q1.

McDoughnuts: I’m Lovin’ It

McDonald’s announced plans to sell Krispy Kreme doughnuts at all its restaurants in the U.S. by the end of 2026.

The rollout will begin in the second half of 2024 as Krispy Kreme aims to ramp up its distribution in the next two years to satisfy the partnership. Shares of Krispy Kreme soared over 39% yesterday following the announcement.

The partnership is a major opportunity for Krispy Kreme to expand its reach. It currently delivers doughnuts to 6,800 third-party stores. Comparatively, McDonald’s has 13,500 locations in the U.S., with plans to open 900 new locations in the country by 2027.

Source: CNBC

The two chains began their relationship in late 2022 when McDonald’s began selling Krispy Kreme doughnuts at nine locations as a test. The partnership was then extended to 160 restaurants.

Krispy Kreme expects to reach over 100,000 points of access for its doughnuts globally, up from its prior outlook of 75,000 locations. Today, its doughnuts can be found at 14,100 locations in 39 countries.

A Boeing Downgrade?

Moody’s Rating placed Boeing’s Baa2 senior unsecured rating and Prime-2 short-term rating on review for a potential downgrade. Moody’s previous outlook for Boeing was stable.

The downgrade indicates the rating agency’s lack of confidence in Boeing’s ability to deliver sufficient volumes of its 737 model to expand free cash flow and service interest payments.

UPS Stock Feels the Heat

Yesterday morning, UPS announced long-term financial targets. It forecast revenue between $108 billion and $114 billion in 2026, up from $91 billion in 2023.

UPS forecasts an oversupply of parcel capacity which might raise questions around its expected spread between revenue and cost per piece.

Morgan Stanley has an underweight rating on the stock and claimed the courier company’s targets were quite bold.

Equities, Debt, and Consumer Confidence

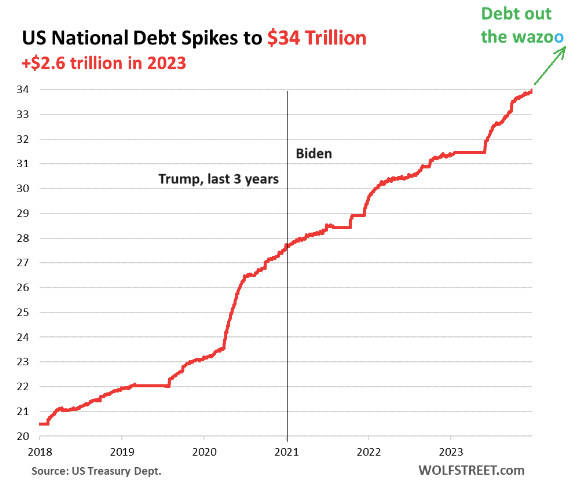

Larry Fink, the CEO of BlackRock, warned against rising U.S. debt levels in his annual shareholder letter. Fink emphasized that the public debt situation is “more urgent than I can ever remember.”

Fink stated that the country needs to adopt policies to spur economic growth, and investors might not keep buying U.S. Treasuries after the country issued $11.1 trillion of additional debt since the pandemic.

The total U.S. debt stands at $33.17 trillion, accounting for 123% of the total GDP. According to Fink, the U.S. government can’t just rely on taxes and spending cuts to resolve its debt crisis, which might lead to a period of economic stagnation.

The country’s huge debt pile lowers regulators' flexibility to raise rates without adding to an already unsustainable debt-servicing bill.

On the other hand, equity investors might experience another solid month of returns. April has been the second-best month of the year for the S&P 500, based on average performance dating back to 1950.

Alternatively, stock market performance in April has been muted in recent decades. It is the third-best month when looking at just the past 20 years. April slides to the fourth spot when evaluating the past 10 years exclusively.

When averaging just past presidential election years, April has provided the fourth-strongest monthly performance for the S&P 500.

Finally, the consumer sentiment index for March was below estimates. In March, U.S. consumer confidence stood at 104.7, lower than estimates of 107.

Confidence rose among consumers aged 55 and over but deteriorated for those below 55. Moreover, consumers in the $50,000 to $99,999 income group reported lower confidence in March, while confidence improved in all other income groups.

Can Bitcoin Touch $75,000?

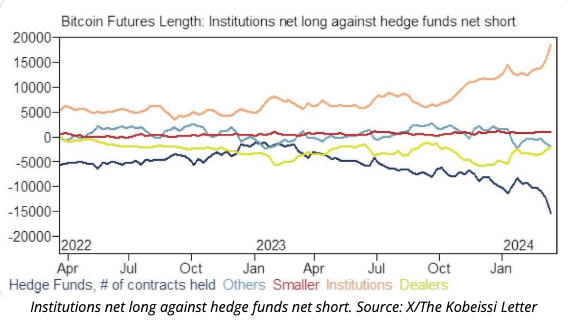

A report from CoinTelegraph explains Bitcoin short-sellers are feeling the pressure as the digital asset trades over $70,000.

In case BTC prices move higher, short-sellers will be forced to liquidate their positions, making another uptick in prices almost inevitable.

As the above chart shows, the margin between institutional long positions and hedge fund short positions is at record highs. Hedge funds hold 15,000 net short contracts, while institutions hold roughly 20,000 net long contracts.

If Bitcoin prices touch $71,000, $156 million in short positions will be liquidated. Further, a climb to $75,000 will liquidate $3.85 billion in short positions.

Headlines You Can't Miss!

China opens WTO dispute against U.S. subsidies

Cocoa prices are soaring to record levels

Apple could double down on the Chinese market, says Wedbush

10-year Treasury yield slips lower on tepid economic data

KuCoin indicted for multi-billion criminal conspiracy

Chart of The Day

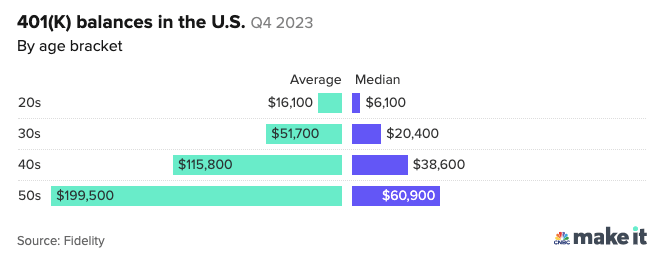

Americans in their 30s have close to three decades before they reach retirement age. But do they have enough savings to retire comfortably?

On average, the magic retirement number for Americans is $1.3 million. Alternatively, the median 401(k) balance for account holders in their 30s is around $20,400, as per data from Fidelity Investments.

Around 33% of Americans claim rising living costs are hampering their savings ability, while 27% say lowering credit card debt is a barrier.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.