- 3 Big Scoops

- Posts

- Financial Independence: 101 💰

Financial Independence: 101 💰

How to retire early?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,005.57 ( ⬇️ 0.48%)

Nasdaq Composite @ 15,775.65 ( ⬇️ 0.82%)

Bitcoin @ $51,775.90 ( ⬇️ 0.02%)

Hey Scoopers,

Happy Tuesday! We are in the midst of a busy week, so let’s take a breather.

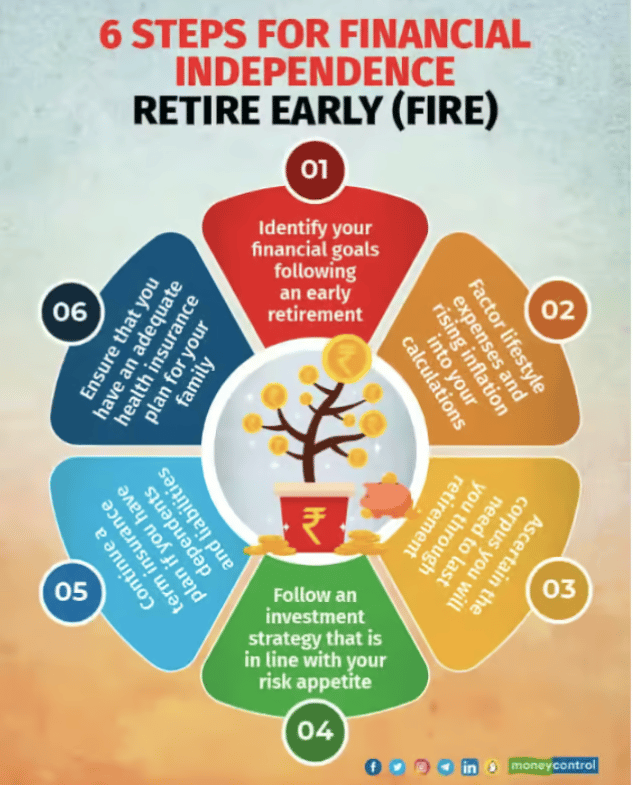

In today’s newsletter, we look at the ways you can achieve FIRE (Financial independence and retire early).

So, let’s go 🚀

On Reddit, half a million people are obsessed with FIRE. But don’t worry, they’re not a bunch of oversharing arsonists. These people are part of a community who want “financial independence, retire early”: the freedom to stop working forever.

That’s a thing you can do?! With really careful management and a bit of luck, it might be. The financial independence movement is basically about saving enough money during your working years to have a big enough pot to see you through the rest of your life.

There are people in this movement who’ve managed to retire in their 30s as a result – a pretty exciting prospect.

Why do people do this? Some want to retire because they hate their jobs. But others just want the freedom that comes with having a big enough savings pot.

They might not actually quit their jobs, but it’s quite liberating to know that you’re choosing to work rather than needing to. That independence is a big driver of the movement: the idea that we can be empowered through having financial stability.

So how do I do it? The basic concept is pretty simple: spend less, save more, invest wisely. But of course, that’s all much easier said than done. In this pack, we’ll look at exactly how to set yourself up for a magical future, going through how much you’ll need and how you can get there.

Start dreaming about that Mexican beach house… and let’s kindle the FIRE.

How Much Will You Need?

Cut to the chase: how much do I need to retire? It depends (doesn’t it always!). First, you need to figure out how much you’ll have to spend each year during your retirement.

Be very careful when estimating this number: you’ve got to take into account your mortgage, bills, grocery shopping, and any fun spending you want to do on top of that (a 50-year-long retirement with no McDonald’s trips might not be worth living).

It’s always better and safer to overestimate this number. For our purposes, we’ll use the median American income of $60,000.

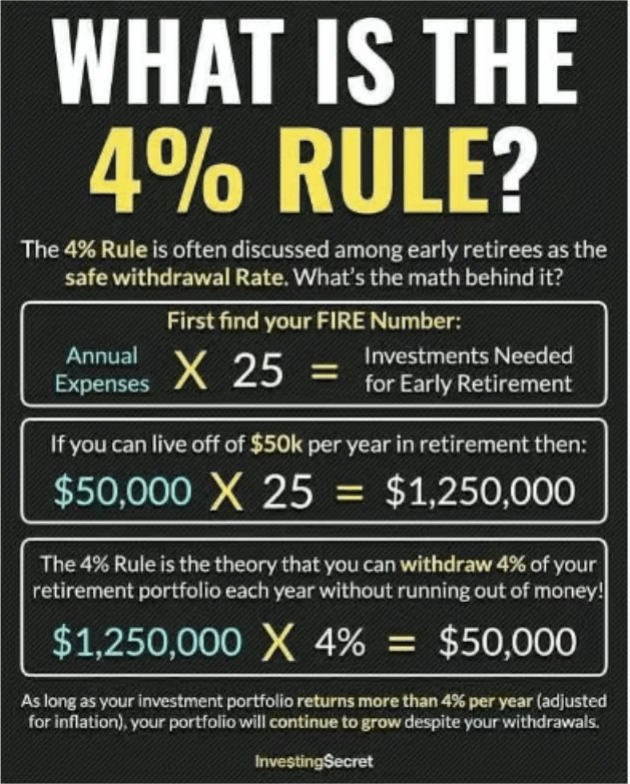

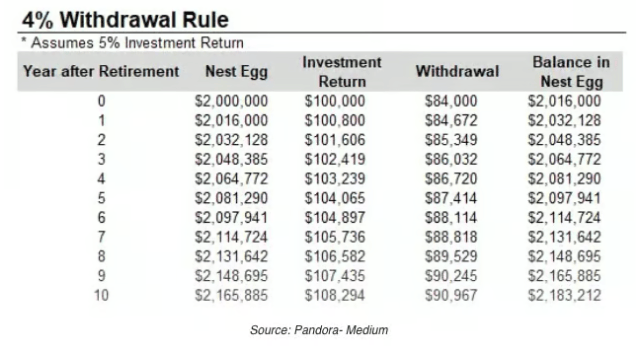

You then want to multiply this number by 25. Financial independence relies on the idea of a “safe withdrawal rate”. The goal is to have a huge sum of money in a safe investment portfolio of stocks and bonds that you draw from every year.

According to the famous Trinity Study, you can safely withdraw 4% a year for 30 years without running out of money – that’s accounting for inflation. Your portfolio should always be growing more than the amount you’re withdrawing, putting you in a pretty great position.

That means that for annual spending of $60k, you need $1.5 million saved up. That’s a big sum, but, as we’ll see, it’s not unattainable.

How safe is the safe withdrawal rate? That’s up for debate. The initial study was done back in the ‘90s when interest rates were way higher than they are now.

It also assumed a shorter life expectancy than is now predicted (American life expectancy has gone up by about four years since then). If you’re an American woman in your 20s now, you’ll probably live until your mid-80s, which might mean a really long retirement.

The Trinity Study found there was a 96% chance of not running out of money at a 4% withdrawal rate and a 30-year retirement – but when the study was re-run using 2013 interest rates, the authors found that there was only a 43% chance of success. With that in mind, you may want to account for a lower withdrawal rate and boost the savings pot even more.

But what about annuities? Traditionally, many retirees would purchase an investment product called an annuity. In return for a hefty lump sum, an annuity pays you a guaranteed income until your death.

They’re almost impossible to buy until you’re at least in your 50s, however, so they’re not really applicable for those wanting to truly FIRE.

Now you know what to aim for, we’re going to discuss how to actually save that much.

Boosting Your Income

We’re going to start talking about saving. The quickest way to save more, of course, is to earn more. Many people in the FIRE community advise you to pick your career based on earnings potential: whether it pays well now and whether your salary will progress at a nice clip as you get older.

You probably won’t be surprised to learn that lots of FIREs are highly paid software engineers! But you need to do what’s right for you: think about if it’s worth sacrificing doing something you love now for the prospect of independence later in life. If you can find a high-paying job that you also love, then you’re really winning.

You might also want to explore getting a “side hustle” – a second job that you can do in your spare time to bring in some extra income. Think about if any of your hobbies can be monetized, browse sites like Upwork for freelance gigs, start a blog, or open up a small Amazon shop. You could even drive an Uber on the side.

Is there any way to earn more without taking on an extra job? Many people are enamored with the idea of “passive income,” earnings that roll in without you having to do anything.

This might include buying and renting out a flat, putting your spare bedroom on Airbnb, or writing an eBook that will bring in sales for years to come. In reality, though, none of these are really passive: they all involve a lot more work than you might first imagine.

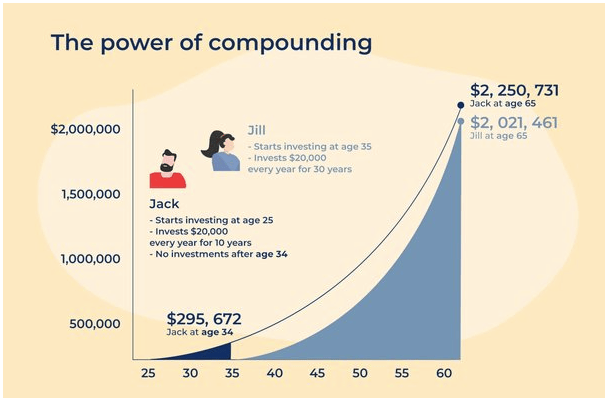

If you’ve already got a pool of money, investing is a good way to build a small passive income – and if you reinvest that income, you’ll quickly grow your overall stash.

How does that work? It’s all from the magic of compounding. Let’s say you’ve got $1,000 in investments that pay a 4% return each year (so you earn $40). At the end of the year, you’ll have $1,040 in the account – and then you’ll get paid 4% on the original $1,000 and the extra $40. Over time, this snowballs quite quickly, especially if your contributions are in some kind of tax-free account.

The amount of risk (the potential for both larger gains and losses) you should be able to tolerate in your portfolio will probably reduce as you near retirement.

Next, we’ll figure out how to cut your costs so you can save even more.

Frugal Living

Time for the bit everyone dreads: reducing your spending.

Cutting costs isn’t as hard as you might think. The quickest way to make a difference is probably to set a budget and stick to it. Just being more aware of your spending will help you to manage your finances.

You can also try to cut down on unnecessary luxuries: instead of eating out every lunchtime, cook at home and bring food into the office instead. It’s worth making sure you don’t let “lifestyle creep” affect you too much: as you start to earn more, save that extra income rather than spend it.

Some people take FIRE quite seriously – and cut down on almost all their spending. That might mean no holidays or boozy evenings out for a while. Some even relocate to a cheaper part of their country – or move to another country entirely.

You need to think about what level of sacrifice you’re happy with while remembering that the more you can save each year, the sooner you’ll be able to hit financial independence.

How about once I’ve retired – how do I live on less? Within the FIRE community, there’s a subset who subscribe to the idea of “lean FIRE”: living on as little money as possible.

That obviously makes it much easier to achieve FIRE because you need a much smaller pot of savings. This involves living a really frugal life, though: they aim to spend less than $40,000 a year.

One effective way to do this is by moving to a country with a low cost of living: Southeast Asia and South America have several destinations where you can live pretty comfortably for $40k.

But that comes with its own risks: you might not like the lifestyle there (especially if you’re missing Western creature comforts), and if you do end up needing a job, it might be tricky to find one. What’s more, you’re exposing yourself to currency fluctuations: if all your savings are in euros but you’re in Costa Rica, a drop in the euro could completely destroy your lifestyle.

The biggest mistake you could make is underestimating your living expenses: as we’ll see, FIRE involves a lot of uncertainty, so it’s a big assumption that you’ll be able to live on $40k forever.

Things to consider

As we’ve said, FIRE involves a lot of assumptions. If you’re 20 and hoping to retire at – say – 40, you’re trying to predict things 50-plus years into the future – and that’s hard!

Interest and inflation rates, your life expectancy, taxes… everything might be completely different by then. You also need to account for things going drastically wrong: what if you get seriously ill and have high care costs when you’re elderly?

What else is there to worry about? Well, you might not actually enjoy being retired: 30-odd years is a long time to spend sitting around! And you might find that the quality-of-life sacrifices you had to make to achieve financial independence weren’t actually worth it in the long run.

You need to think really hard about what you want from life: if financial independence means more to you than having a fulfilling career and great holidays in your 20s, for instance.

There’s also one larger problem. If everyone joins the movement, makes plenty of money, and retires when they're 40, who's gonna produce these people's food and clothes, generate their electricity, and make their phones?

FIRE only works if a subset of the population does it, and realistically, it’s not an attainable goal for most people. You need to be saving a really large amount each month, and that’s unfortunately not possible for many of us.

That said, the same tips apply to retirement in general: so even if you can’t retire early, you might still be able to achieve financial independence one day. And FIRE might be a useful goal to help you get on the track to a more stable (and happier) financial life!

If you’re interested in learning more about this, the Reddit Financial Independence community is one of the internet’s largest.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.