- 3 Big Scoops

- Posts

- Is $1.2 Million Enough for Retirement?

Is $1.2 Million Enough for Retirement?

Calculate your magic retirement number 💰

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,704.81 ( ⬇️ 0.80%)

Nasdaq Composite @ 14,592.21 ( ⬇️ 1.18%)

Bitcoin @ $43,169.74 ( ⬆️ 0.74%)

Hey Scoopers,

Happy Thursday!!

Today, we take a look at your magic retirement number. While reaching this retirement goal might seem impossible initially, it is not out of reach if you are disciplined and have a long-term investment horizon.

So, let’s go 🚀

What Is the Magic Retirement Number?

Most people work to save enough for a comfortable life in retirement. But how much do you need to retire comfortably? Is it $1 million? Is it $2 million? Or is it $5 million?

Financial planners recommend replacing 80% of your pre-retirement income to sustain a similar post-retirement lifestyle. So, if you earn $100,000 annually, you need at least $80,000 per year in retirement. Why?

Because when you retire, you are likely to eliminate certain expenses. For example:

👉 You no longer have to save for retirement (duh!)

👉 You will save on commuting expenses and other job-related expenses

👉 You ideally should have paid off your mortgage by the time you retire

👉 You may not require life insurance if you are financially stable

But retiring with 80% of your annual income may not be ideal for everyone. This number may be higher or lower, depending on your retirement lifestyle.

For those planning to travel frequently in retirement, you may want to aim for 100% of your pre-retirement income. Alternatively, if you move to a smaller city and downsize your living situation, you should live comfortably on less than 70% of your pre-retirement income.

So, if you and your spouse earn a total of $120,000 each year, you should expect around $96,000 in annual income at retirement, amounting to $8,000 per month.

How do you get here? Should you just depend on your savings in retirement? Well, the answer is no.

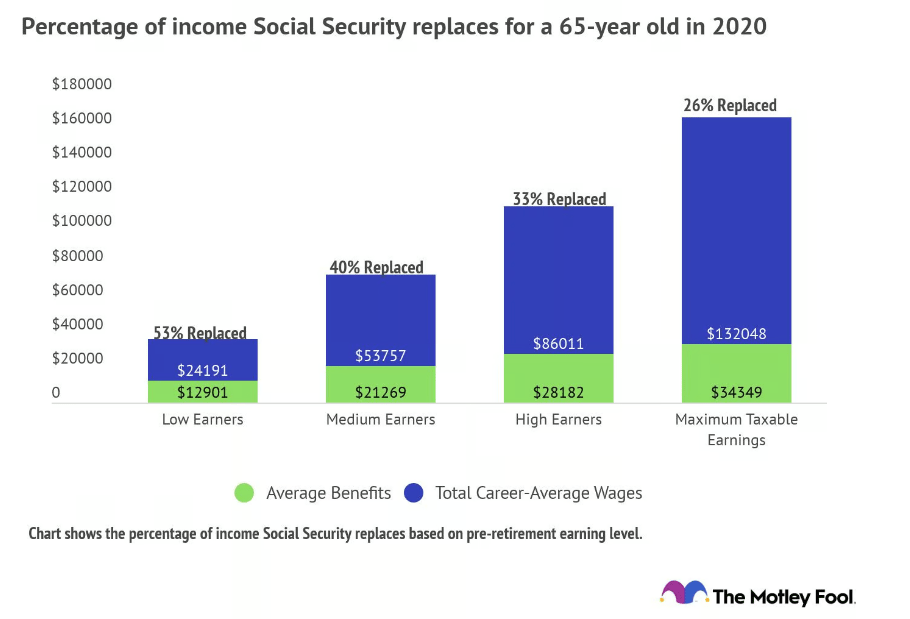

Social Security benefits can help you earn a passive income stream for life and can be a significant income source.

However, the percentage of income replaced by Social Security benefits is lower for higher-income retirees. For example, according to Fidelity, Social Security will replace roughly 35% of income for someone earning $50,000 each year. This number falls to just 11% for someone earning $300,000 annually.

If you aren't sure how much you can expect, check your Social Security statement or create a My Social Security account to get an estimate based on your work history.

Further, if you have pensions from your previous jobs, account for income from these sources. The same applies to other predictable sources of income, such as an annuity or a home equity through a reverse mortgage.

Continuing our above example, where a couple needs $8,000 each month, there is a good chance they would earn about $4,000 from Social Security benefits.

The other $4,000 must come from other sources, such as investments and savings.

The Retirement Calculator

It’s time to determine how much savings you’ll need to retire. Once you have figured out the income you need to generate from savings, it’s time to calculate the size of your retirement nest egg.

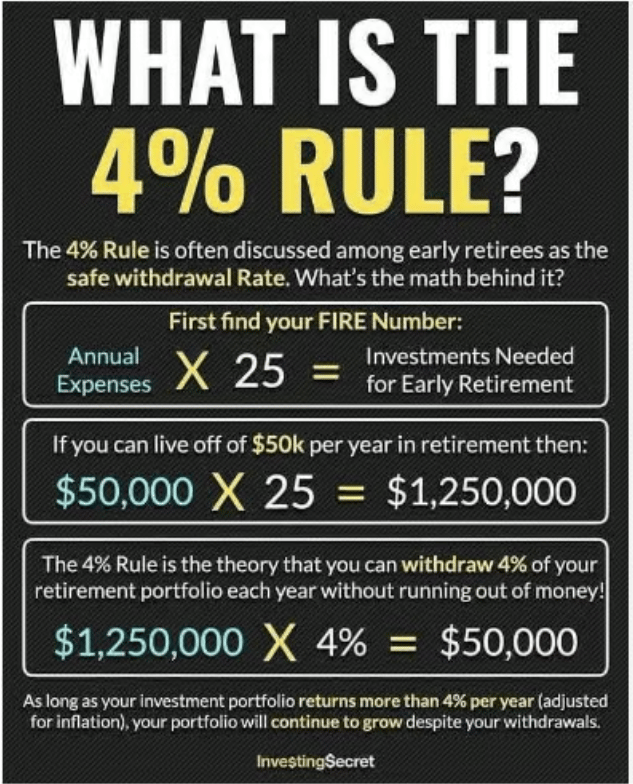

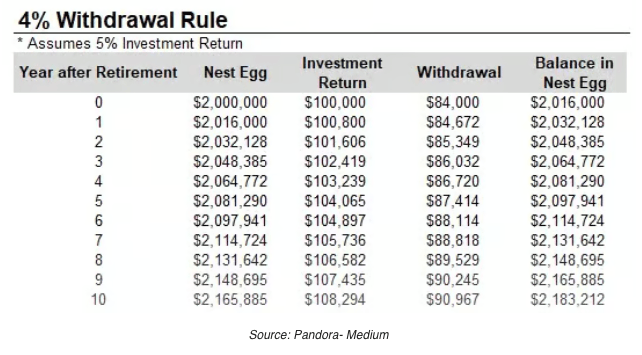

The 4% rule has become increasingly popular in recent years. In 1994, a certified financial planner called William Bengen used historical market and inflation data to conclude that retirees could withdraw 4% of their portfolio without running out of money for 30 years.

If you have saved $1 million, you can take out $40,000 during the first year of retirement. This amount would be adjusted to account for inflation in subsequent years.

Now, a couple that needs $8,000 each month in retirement must save $1.2 million if they earn $4,000 in Social Security every month.

It’s essential to note that the 4% rule has certain flaws. It assumes you will withdraw the same amount every year in retirement after adjusting for rising costs.

The rule also assumes your portfolio would be split equally between stocks and bonds throughout your retirement.

However, the amount you eventually withdraw may depend on factors like the state of the equity markets. In a stock market correction or during bear markets, limiting your withdrawals is ideal to give investments time to rebound.

How Much Should You Save Each Month for $1.2 Million?

According to a study from Northwestern Mutual, the average American thinks they need $1.2 million to retire comfortably. However, the median retirement account balance in the U.S. is around $27,376.

So, how do you get to the $1.2 million retirement number? The S&P 500 index has returned 10% annually on average in the past five decades. Given this rate of return, you will have to invest 👇

👉 $1,000 each month for 24 years

👉 $2,000 each month for 18 years

👉 $3,000 each month for 14.5 years

👉 $4,000 each month for 12.5 years and

👉 $5,000 each month for 11 years

The Final Takeaway

While having a retirement savings number in mind is helpful, it can also feel intimidating for someone starting from scratch.

It would be best to focus on your savings rate, the percentage of your annual income set aside for retirement. Typically, Fidelity recommends a savings rate of 15% for individuals.

Saving for retirement may seem like a steep mountain, but the climb doesn’t have to be as steep as it looks.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.

Social Security, Pensions, and More