- 3 Big Scoops

- Posts

- Boeing Surpasses Q4 Estimates

Boeing Surpasses Q4 Estimates

PLUS: Small-caps poised for breakout

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,845.65 ( ⬇️ 0.06%)

Nasdaq Composite @ 15,164.01 ( ⬇️ 2.23%)

Bitcoin @ $42,175.70 ( ⬇️ 0.88%)

Hey Scoopers,

Happy Thursday! We have an excellent newsletter for you today!

👉 Boeing takes-off

👉 Small-cap stocks are attractive

👉 Celsius exits bankruptcy

Boeing Reports Revenue of $22 Billion

Boeing shares are trading higher in pre-market today after the company announced its Q4 results and reported:

👉 Revenue of $22.02 billion vs. estimates of $21.1 billion

👉 Adjusted loss of $0.47 per share vs. estimates of $0.78 per share

Boeing reported a net loss of $30 million or $0.04 a share in Q4, narrower than the prior-year loss of $1.06 per share or $663 million. After adjusting for one-time items, its net loss was $0.47 per share in Q4.

Source: Reuters

The company increased sales by 10% year over year while reporting a free cash flow of $2.95 billion in the December quarter.

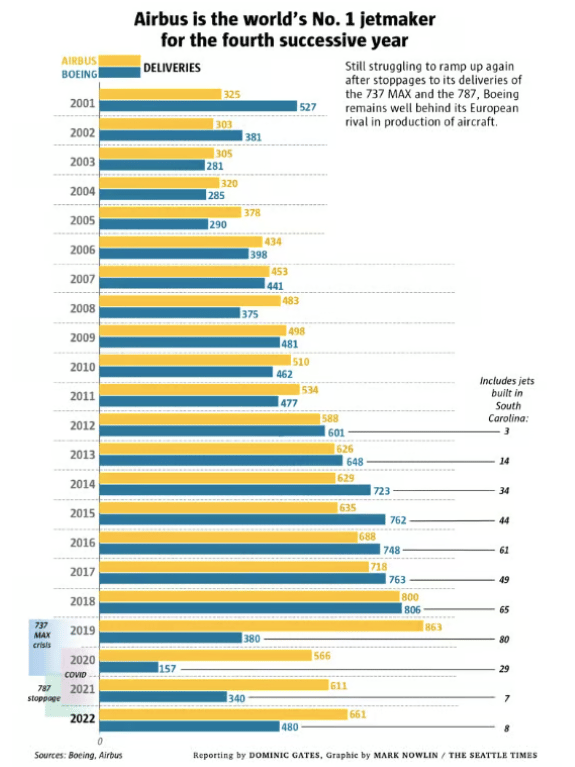

Boeing delivered 528 airplanes to customers in 2023, up from 480 in 2022. Two years back, Boeing targeted annual deliveries of 800 planes in 2025 and 2026.

While Boeing narrowed its losses in Q4, the company CEO, Dave Calhoun, refused to provide any guidance for 2024 as the airline manufacturer wrestles with the fallout from a fuselage panel that fell out midflight on one of its new 737 Max9s last month.

These production flaws are expected to impact airline deliveries for Boeing in the near term, allowing its rival Airbus to benefit from a higher order book.

While the FAA (the airline regulatory agency in the U.S.) has cleared the Max 9 to fly again, the regulator emphasized it would halt the planned ramp-up in production.

For instance, Boeing aims to manufacture around 50 Max planes a month in 2025 and 2026. Yesterday, Boeing confirmed it is currently building 28 Maxes each month.

The Boeing 737 Max is the company’s bestselling plane, and a delay in production will hamper financials while impacting suppliers and customers preparing for higher output and post-COVID-19 travel demand.

However, Boeing reaffirmed its 2025 and 2026 financial targets, aiming to reach $10 billion of free cash flow and $100 billion in sales by early next year.

Small-Caps Ripe for a Rebound

Stocks valued between a market cap of $300 million and $2 billion are small-cap stocks. Generally, these companies grow much faster than large caps, allowing investors to benefit from outsized gains over time.

But in the last 20 years, small-cap stocks have underperformed the S&P 500 index by a wide margin.

Since the start of February 2004, the Russell 2000 index (an index that tracks small-caps in the U.S.) has returned 240%, compared to the S&P 500 gains of 332%.

While the S&P 500 is trading near all-time highs, the Russell 2000 index is down 20% from record levels and is a compelling investment right now.

According to Tom Lee, the head of research at Fundstrat Global Advisors, the Russell 2000 index can rise to 3,000 by the end of 2024, indicating a gain of 51%. Comparatively, the S&P 500 index might surge by ‘just” 7% this year.

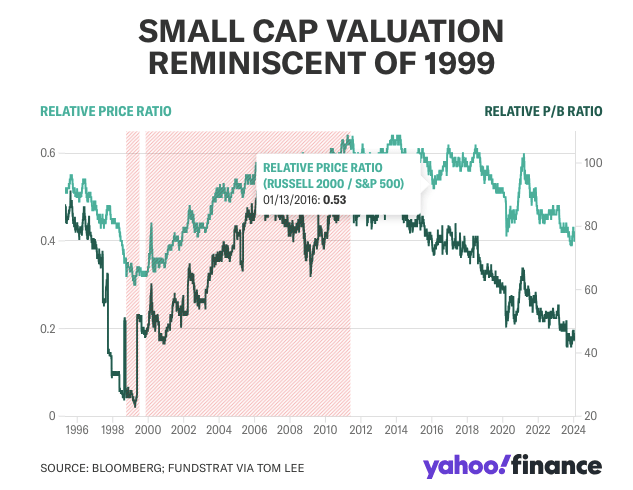

With multiple interest rate cuts forecast in 2024, the time is ripe for small caps to take off. According to Lee, the Russell 2000 is discounted by 44% compared to the S&P 500 if we consider the price-to-book ratio.

Moreover, the small-cap index was at a similar level in 1999, after which it outpaced the S&P 500 index for more than a decade.

Celsius Will Distribute $3 Billion to Creditors

Celsius was down in the dumps after it froze customer accounts 18 months back amid mounting losses, forcing it into bankruptcy. Now, after a complex restructuring process, the lending platform won court approval as it aims to pay back creditors $3 billion, allowing Celsius to emerge from bankruptcy.

Source: Celsius

Celsius also plans to launch a Bitcoin mining company after winding out its legacy operations. The mining firm is called Ionic Digital and will be publicly traded once the approvals are met.

Celsius CEO Chris Ferraro stated, “Today, over 18 months after Celsius paused withdrawals, we began distributing over $3 billion of cryptocurrency, fiat, and stock.”

Headlines You Can’t Miss!

Mastercard unveils AI platform

Shell beats Wall Street estimates in Q4

Eurozone inflation eases

Social media companies may face a crackdown

Binance launches marketplace for inscription tokens

Chart of The Day

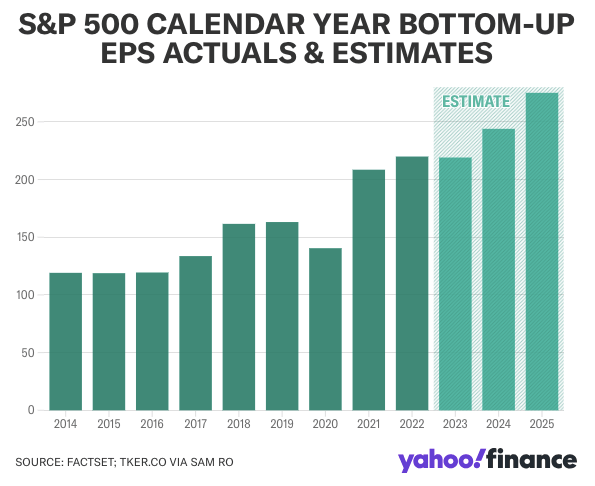

The S&P 500 index has created massive wealth for long-term shareholders, rising close to 10% annually in the past six decades after adjusting for dividends.

According to Warren Buffett, investing in the S&P 500 index will help you beat the majority of shareholders on Wall Street as it provides you exposure to some of the world’s largest companies.

Despite an uncertain macro environment, the S&P 500 earnings are at all-time highs and are expected to rise to new records in 2024 and 2025.

Historically, the expansion of corporate earnings has acted as a tailwind for stocks and is a key driver of stock prices in the long run.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.