- 3 Big Scoops

- Posts

- Amazon Joins the Dow Jones

Amazon Joins the Dow Jones

PLUS: Goldman Sachs turns bullish

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

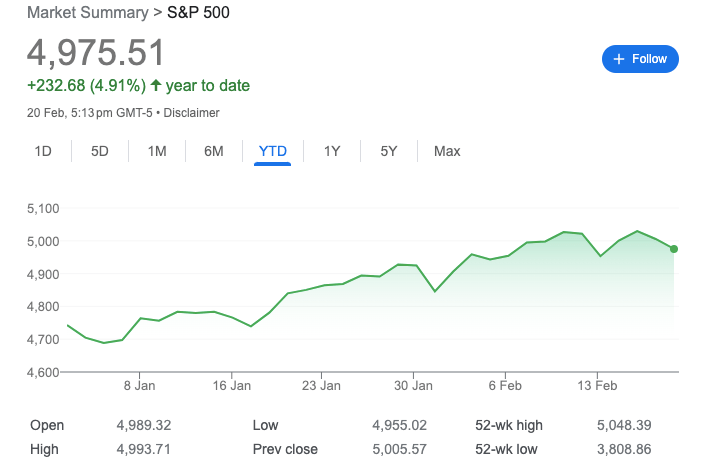

S&P 500 @ 4,975.51 (⬇️ 0.60%)

Nasdaq Composite @ 15,630.78 ( ⬇️ 0.92%)

Bitcoin @ $51,670.40 ( ⬇️ 1.1%)

Hey Scoopers,

Get ready for a big day in finance! Here’s what we’re covering in this issue:

👉 Amazon replaces Walgreens in the DJIA

👉 Goldman Sachs’ outlook for 2024

👉 Crypto’s record week

So, let’s go 🚀

Market Wrap 📉

The U.S. stock futures for all three major indices are trading lower today, fueled by a decline in Nvidia. The S&P 500 index has fallen in the last two trading sessions and might remain under pressure in the near term.

Shares of Nvidia fell 4.4% yesterday and are down 2% in early-market trading today as the chip giant is expected to report quarterly results in the next few hours.

Nvidia’s steep valuation is now a cause of concern, as the stock has more than tripled in the past year. Investors are also wary about the lofty valuations surrounding the broader tech sector.

Trending Stocks 🔥

Palo Alto Networks - Shares of the cyber-security company are down 21% after its full-year guidance missed estimates. Palo Alto Networks expects full-year revenue growth between 15% and 16%, lower than its earlier guidance of 18% to 19% growth.

Diamondback Energy - Shares of the energy heavyweight are up over 1.5% after it beat consensus estimates in Q4. It reported revenue of $2.23 billion vs. estimates of $2.17 billion, while earnings stood at $4.74 per share vs. estimates of $4.66 per share.

Caesars Entertainment - The hotel and resorts stock is down 1% after it posted a revenue miss in Q4. It reported revenue of $2.83 billion, lower than estimates of $.285 billion.

Amazon to Join the Dow Jones Index

Amazon is all set to replace Walgreens Boots Alliance in the Dow Jones Industrial Average or DJIA index. The DJIA is among the oldest indices in the world and manages the price-weighted measurement of 30 stocks.

The change reflects the evolving nature of the U.S. economy and increases retail exposure for investors, in addition to other business areas.

Amazon is one of the largest companies globally. It started as an online retailer of books and has since expanded into other segments such as gaming, online streaming, cloud computing, and digital advertising.

In fact, the cloud business accounts for 14% of sales and most of Amazon’s profits. Comparatively, its ad sales increased 27% year over year in Q4, growing faster than peers such as Alphabet and Meta.

Walgreens has been part of the Dow Jones index since 2018 when it replaced GE. In Q4, Walgreens reported a loss of $278 million, narrower than its prior-year loss of $3.8 billion.

On the other hand, Amazon’s net income surged from $278 million to $10.6 billion in this period.

Goldman Sachs Upgrades S&P 500

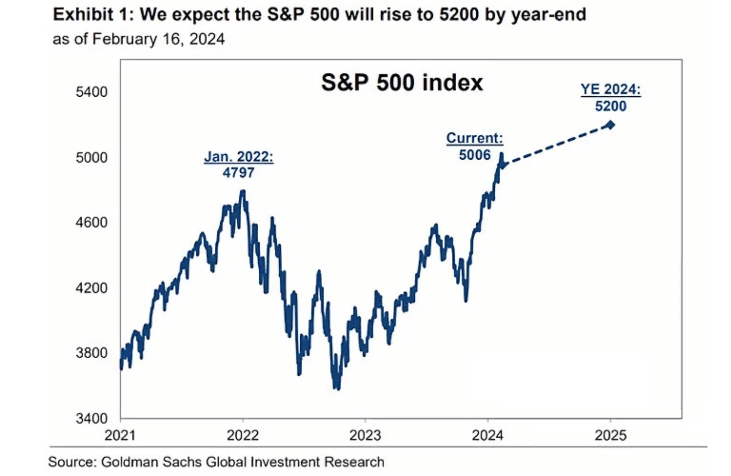

Goldman Sachs eagerly upgraded its predictions for the S&P 500 index this year, stunned by US stocks’ record-breaking run.

What does this mean?

Wall Street started penning in predictions for US stocks months ago, but the ink isn’t dry yet. The S&P 500 index, which tracks the biggest US companies, has been breaking record after record – and that has analysts scrambling to rewrite their expectations for this year.

Goldman Sachs just upgraded its forecast for the third time, projecting that the index will reach 5,200 by the end of 2024. While that’s only 4% higher than today’s point, it’s a serious increase from the 4,700 that Goldman predicted back in November, making the big bank one of the most optimistic in the market.

Why should I care?

The bigger picture: America’s buckling down and beefing up

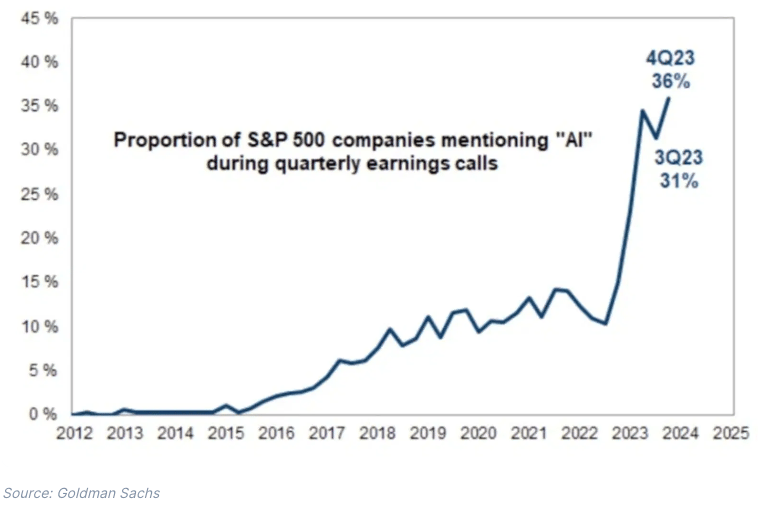

Goldman also pushed its 2024 earnings-per-share forecast for the index up slightly to $241 – or around 9% more than last year. What’s more, Goldman estimates that AI will make stateside companies more productive over the next ten years.

And because higher productivity has historically turned into fatter profit margins, the big bank reckons that the tech could pull the biggest US firms’ margins up from 12% today to 16% over the next decade.

Zooming in: Welcome to the land of opportunity

If Goldman’s right, those souped-up profit margins should translate into 3% more profit a year for S&P 500 companies. That’s worth watching for investors because the stock market’s returns should match that uptick.

On top of that, remember that many of the most promising AI-focused firms are in the US. So far, investors have been rewarding the companies that stand to build a super-smart future, and that’s unlikely to stop anytime soon.

Crypto Investments Attract Inflows

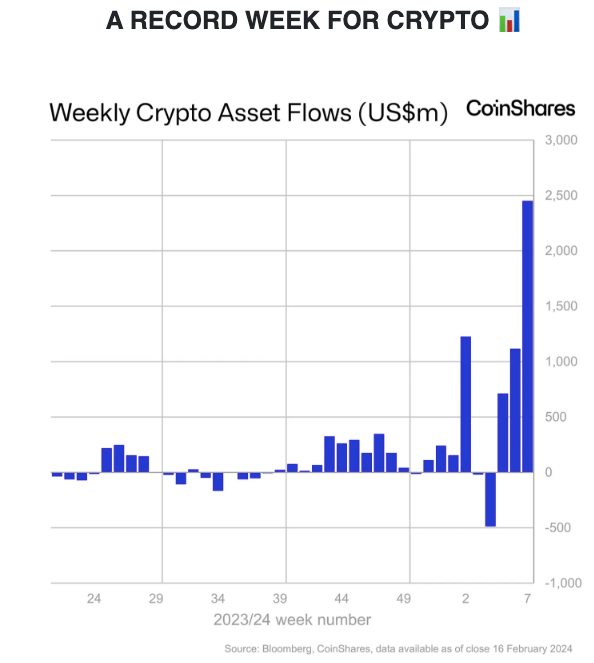

Crypto investment products saw $2.45 billion of inflows last week, the largest weekly inflow on record.

A report from CoinShares states:

👉 Assets under management stand at $67 billion.

👉 Year-to-date inflows have totaled $5.2 billion. In comparison, total inflows in 2023 stood at $2.25 billion

These record numbers have driven crypto prices higher.

👉 Ethereum briefly hit $3,000 for the first time since April 2022.

👉 Bitcoin closed the week above $52k for the first time in two years.

Headlines You Can't Miss!

Jeff Bezos sells Amazon stock again!

Nigeria is facing an economic crisis

TSMA and ASML shares slump before Nvidia’s earnings

SolarEdge stock tumbles on weak guidance

Bitcoin is an exit strategy, says Michael Saylor

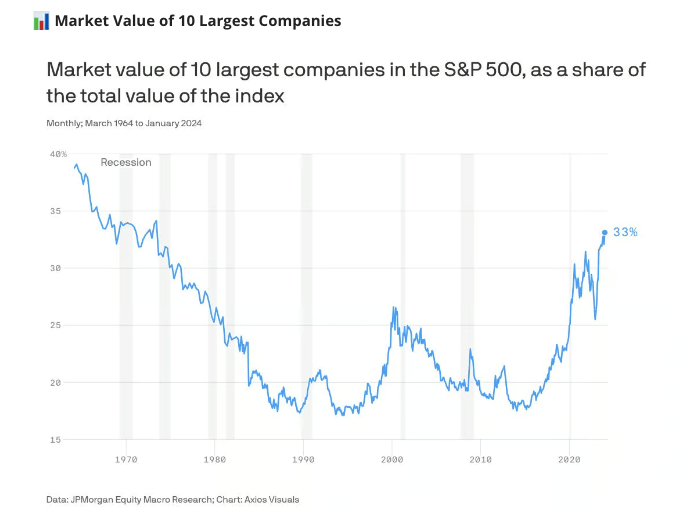

Chart of The Day

Source: JPMorgan

The ten largest companies now account for a whopping 33% of the S&P 500 index.

Despite multiple headwinds, such as elevated interest rates, inflation, geopolitical tensions, and an uncertain global economy, the S&P 500 index is trading near all-time highs.

However, investors should note that big tech companies such as Microsoft, Apple, Nvidia, Meta, and Amazon have primarily fueled the rally.

Several other companies part of sectors such as energy, utilities, infrastructure, and real estate are still trailing the market by a wide margin.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.