- 3 Big Scoops

- Posts

- 🗞 Apple Turns Intelligent

🗞 Apple Turns Intelligent

PLUS: Bitcoin tops $70k (again!)

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

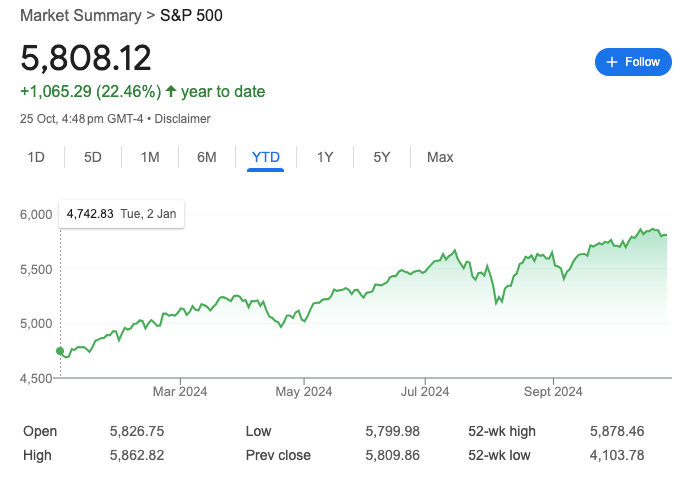

S&P 500 @ 5,808.12 ( ⬇️ 0.030%)

Nasdaq Composite @ 18,518.60 ( ⬆️ 0.56%)

Bitcoin @ $67,127.58 ( ⬇️ 0.28%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Delta Air Lines sues CrowdStrike

👉 Spirit Airlines takes off

👉 KeyBanc downgrades Apple

So, let’s go 🚀

Market Wrap

The Nasdaq Composite index climbed to an all-time high on Friday, boosted by megacap tech stocks. Tech stocks pushed the market ahead of their upcoming earnings, with Nvidia, Meta Platforms, Amazon, and Microsoft trading higher.

The S&P 500 and Dow Jones Industrial Average snapped a six-week winning streak. While the S&P 500 fell 1%, the Dow index was down 2.7% last week. Meanwhile, the tech-heavy Nasdaq notched its seventh weekly gain, advancing 0.2%.

An E. coli outbreak linked to McDonald’s, dragged shares of the fast-food chain to their worst week in more than four years. MCD stock tumbled close to 8% last week, its biggest weekly loss since March 2020, when it tanked over 16%.

The 10-year Treasury yield cooled off from its three-month highs after breaking above the 4.25% market last Wednesday.

Trending Stocks 🔥

HC Healthcare - HCA Healthcare plunged close to 9% after it warned its near-term outlook could be impacted by hurricanes. It posted an adjusted EBITDA of $3.27 billion in Q3, below estimates of $3.28 billion.

L3Harris Technologies - Shares rose 3.5% after the defense company expects adjusted EPS between $12.95 and $13.15 per share in the current quarter, compared to estimates of $13.04 per share.

Colgate-Palmolive - The household goods producer fell over 4% despite beating consensus estimates in Q3. It reported revenue of $5.03 billion with adjusted earnings of $0.91 per share, vs. estimates of $5 billion and $0.89 per share, respectively.

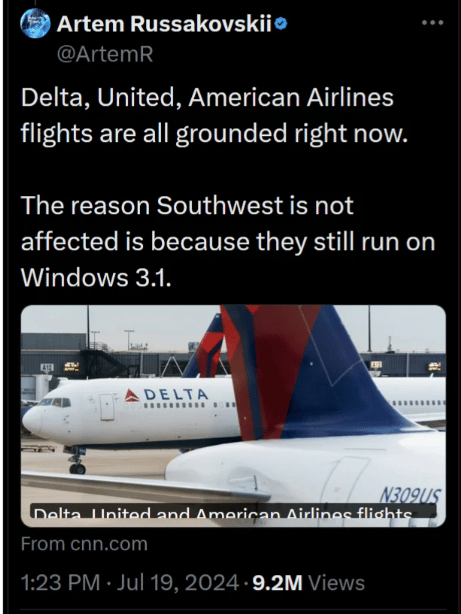

Delta Air Lines Filed a Lawsuit Against CRWD

Delta Air Lines filed a lawsuit against CrowdStrike, accusing the security software vendor of breach of contract and negligence after a July outage brought down millions of computers, prompting roughly 7,000 flight cancellations.

Delta claimed the incident impacted revenue by $380 million and increased costs by $170 million. The flawed software update affected computers running Microsoft’s Windows operating system.

Delta stated that the outage amounted to a 45-cent hit to adjusted earnings, which came in at $1.50 per share in Q3, compared to estimates of $1.52 per share.

“CrowdStrike caused a global catastrophe because it cut corners, took shortcuts, and circumvented the very testing and certification processes it advertised, for its own benefit and profit,” Delta said in its complaint.

In the lawsuit, Delta explained that it disabled automatic updates from CrowdStrike. Despite this restriction, the update reached its computers.

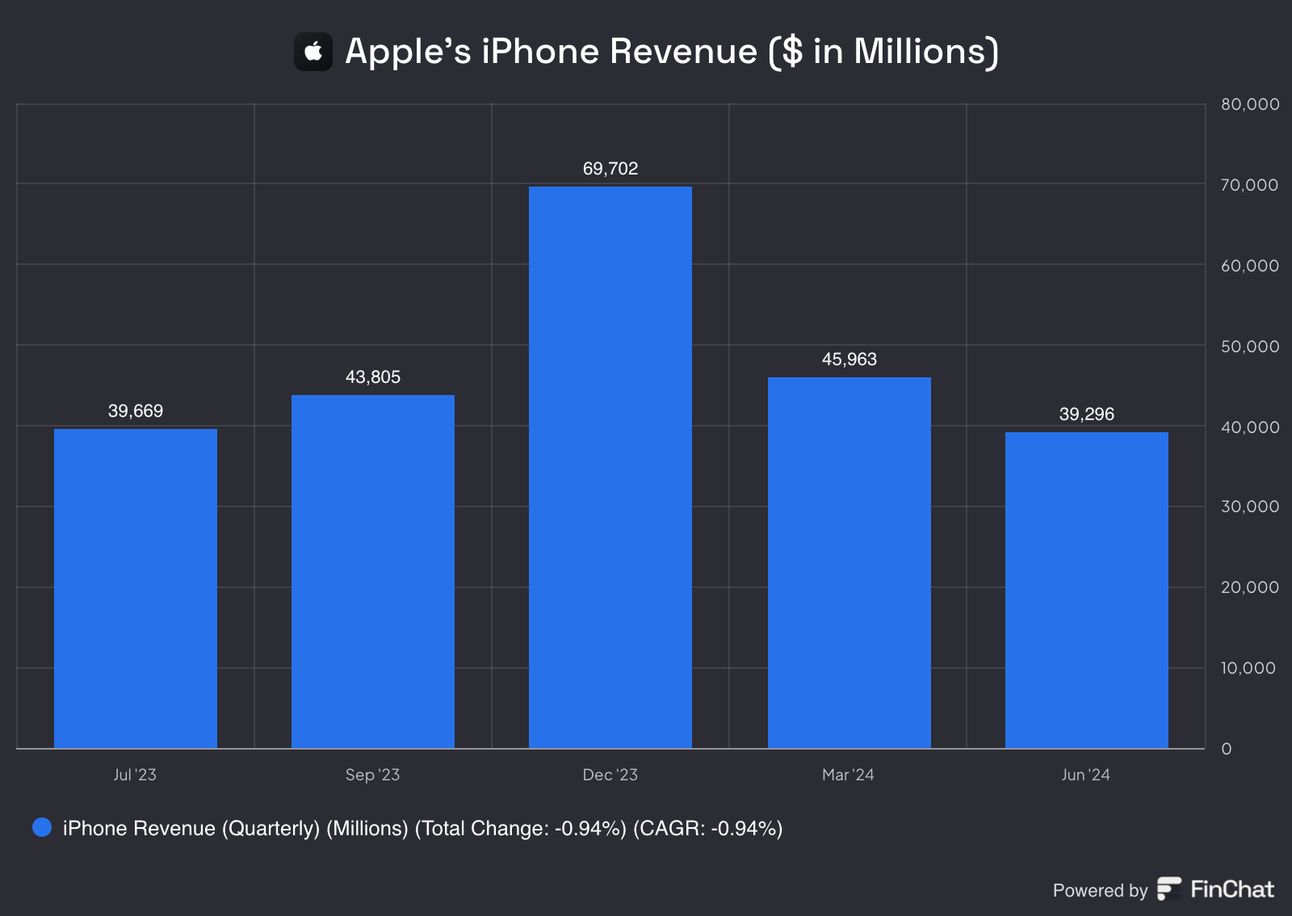

KeyBanc Turns Cautious on Apple

Investment firm KeyBanc downgraded Apple to “underweight” from “sector weight,” setting a price target of $200, below its current trading price of $231.41.

KeyBanc reported a consumer study showing that 61% of respondents who wanted to upgrade to the iPhone 16 also indicated interest in the iPhone SE.

The iPhone SE may not be additive to iPhone sales, could have adverse effects on average selling prices, and could result in the cannibalization of iPhone 16 sales.

Further, KeyBanc noted sluggish iPhone upgradation rates in the U.S. In the last 12 months, the upgrade rate has fallen to 3% from 3.3%.

The investment firm projects upgrade rates to drop by mid-single digits in Q4 and low single digits in early 2025, which will still be a modest improvement over recent quarters.

Finally, KeyBanc raised questions over Apple’s capacity to grow earnings across products and markets, emphasizing that current consensus estimates are lofty and optimistic.

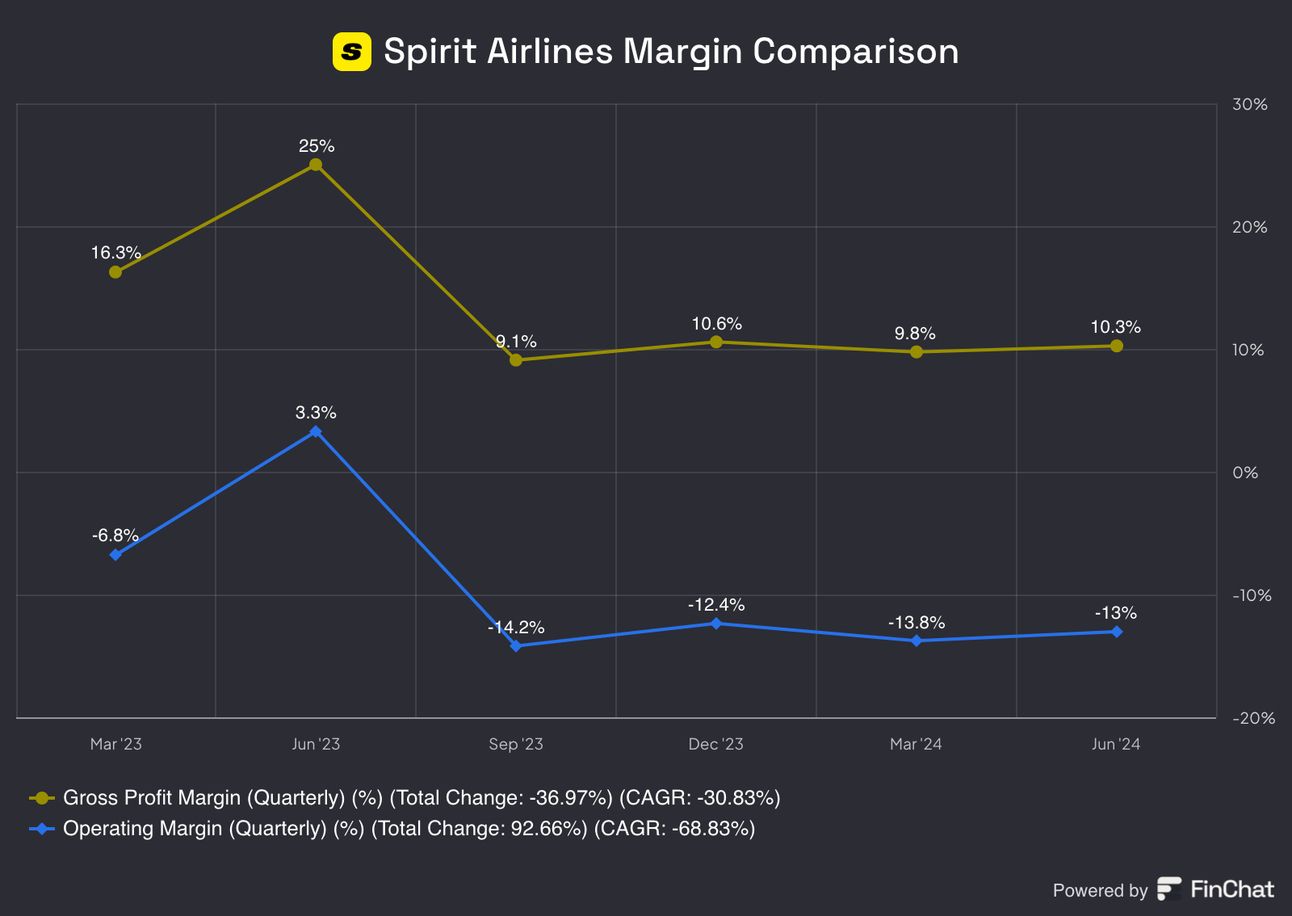

Spirit Airlines Surges

Spirit Airlines stock soared over 15% on Friday after the struggling budget carrier disclosed plans to cut jobs and sell its aircraft.

The airline company laid out plans to reduce costs by $80 million and bring in $519 million by selling 23 older Airbus aircraft.

Earlier this month, Spirit Airlines delayed a deadline to refinance over $1 billion in debt until the end of 2024, providing it with some breathing room with its credit card processor.

Spirit has wrestled with negative profit margins amid a challenging macro environment, facing a shift in travel demand and the grounding of several Pratt & Whitney-powered aircraft.

In Q3 of 2024, Spirit Airlines reported a negative operating margin of 24.5%, better than a previous estimate of -29% for the three-month period.

Despite the recent rally, the stock is down over 80% in 2024 after a judge blocked the company’s planned acquisition by JetBlue Airways.

VaultCraft V2 secures $100M+ BTC from Matrixport

VaultCraft launches V2 in partnership with Safe, lands $100M+ in Bitcoin

Matrixport entrusts VaultCraft with $100M+ Bitcoin

OKX Web3 rolls out Safe Smart Vaults with $250K+ rewards

Headlines You Can't Miss!

Donald Trump aims to replace income tax with tariffs

China’s industrial profits plunge at the fastest pace since the pandemic

Oil prices slide over 4% as Israel attacks Iran

TSMC suspends shipments to Chinese firm

Hong Kong eyes tax breaks for crypto

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.