- 3 Big Scoops

- Posts

- 🗞 McDonald's: Not Lovin' It

🗞 McDonald's: Not Lovin' It

PLUS: Starbucks continues to disappoint

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

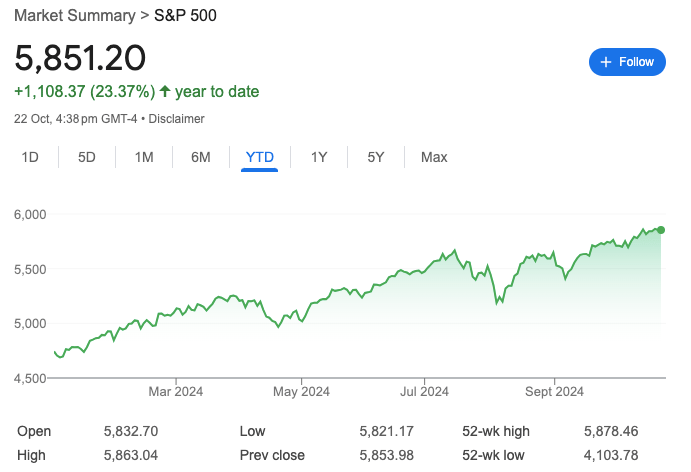

S&P 500 @ 5,851.20 ( ⬇️ 0.047%)

Nasdaq Composite @ 18,573.13 ( ⬆️ 0.18%)

Bitcoin @ $66,842.17 ( ⬇️ 1.98%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 E.coli looms over McDonald’s

👉 Starbucks tumbles post preliminary results

👉 General Motors stuns Wall Street

So, let’s go 🚀

Market Wrap

The S&P 500 and Dow Jones Industrial Average ended marginally lower on Tuesday as investors grappled with concerns about an uptick in interest rates and digested the week’s latest earnings reports.

However, according to the CME FedWatch tool, traders see a 91% chance of a 0.25% cut at the Fed’s next meeting in November.

Homebuilding stocks, including Lennar and D.R. Horton, lost over 3% on persistent higher-for-longer interest rate concerns.

Wall Street is now eyeing a fresh slate of earnings reports set to come out this week, including Tesla and Coca-Cola today.

Around a fifth of companies in the S&P 500 have reported results, with the majority topping earnings estimates.

Trending Stocks 🔥

Texas Instruments - The semiconductor company is up close to 4% in pre-market after it reported revenue of $4.15 billion and earnings of $1.47 per share, compared to estimates of $4.12 billion and $1.38 per share, respectively.

Seagate Technology - The data storage company tumbled 5% in pre-market despite topping analyst estimates for revenue and earnings in fiscal Q1.

Manhattan Associates - The supply chain software company is down over 3% after forecasting full-year sales at $1.039 billion to $1.041 billion, compared to estimates of $1.04 billion.

McDonald’s Stock Is Down 6%

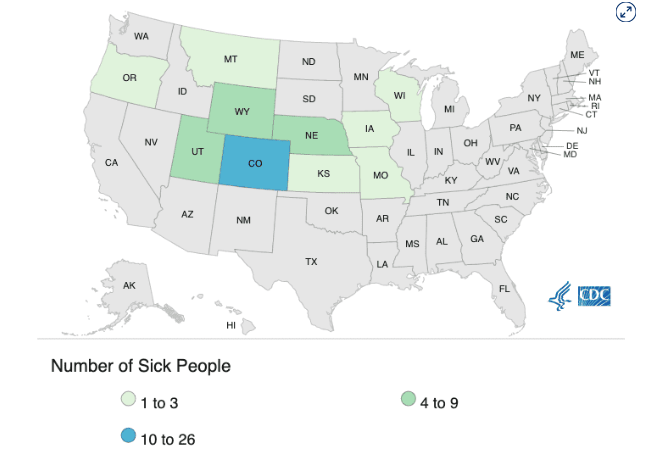

McDonald’s shares are down close to 6% in pre-market trading after the U.S. Center for Disease Control and Prevention said an E.coli outbreak linked to the company’s Quarter Pounder burgers led to 10 hospitalizations and one death.

The agency said 49 cases were reported in 10 states between Sept. 27 and Oct. 11, with most illnesses in Colorado and Nebraska. Moreover, the CDC said the number of cases affected by the outbreak is “much higher” than reported cases.

E. coli is a group of bacteria found in the guts of nearly all people and animals. However, some strains of the bacteria can cause mild to severe illness if a person eats contaminated food or drinks polluted water.

Several past cases of E. coli have been reported at McDonald’s restaurants. In 2022, at least six children developed symptoms consistent with E. coli poisoning after eating McDonald’s’ Chicken McNuggets Happy Meals in Ashland, Alabama.

Four of the six children were admitted to a hospital after experiencing severe adverse effects.

McDonald’s emphasized taking swift and divisive action following the E. coli outbreak. Its Quarter Pounder hamburger will be temporarily unavailable in several Western States, such as Colorado, Kansas, Utah, and Wyoming.

These hamburgers are a core menu item for McDonald’s, raking in billions of dollars annually.

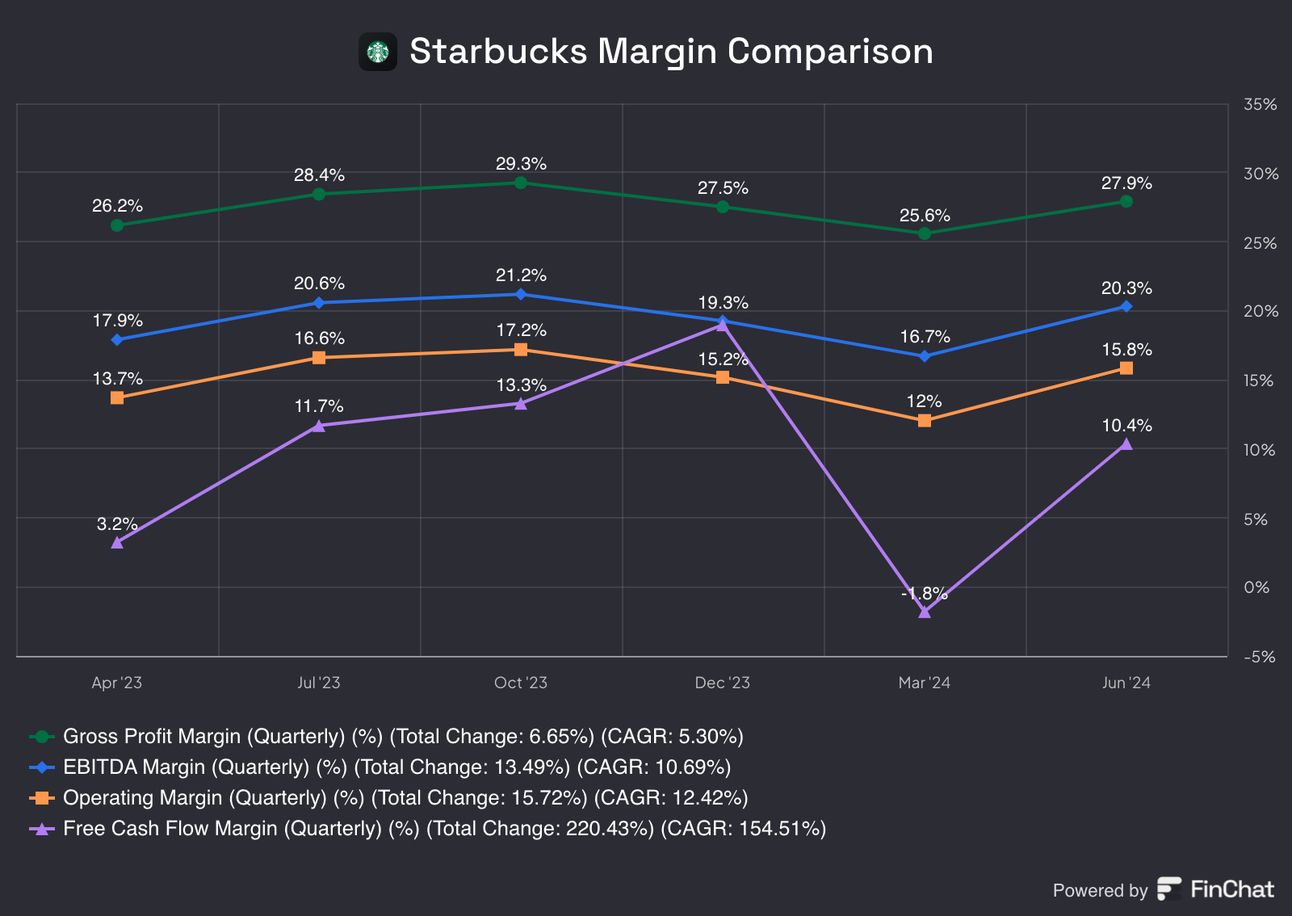

Starbucks Stock Is Down 5%

Yesterday, Starbucks posted preliminary quarterly results, showing that its sales fell as the coffee chain tries to execute a turnaround, dragging the stock lower by 5% in pre-market trading.

Brian Niccol, Starbucks’ new CEO, aims to reverse slowing demand for its drinks, starting with the U.S. For instance, Starbucks is fundamentally changing its marketing by focusing on all customers rather than just loyalty program members.

In fiscal Q4 of 2024, Starbucks reported net sales of $9.1 billion, down 3% year over year, with adjusted earnings per share of $0.80. Analysts expected Q4 sales at $9.38 billion with earnings per share of $1.03.

Its same-store sales were down 7% in Q4, falling for the third consecutive quarter and reporting its steepest drop since the COVID-19 pandemic. Starbucks blamed its soft sales on weaker demand in North America.

In the U.S., same-store sales fell by 6% while traffic was down 10%, despite more frequent mobile app promotions and expanded product offerings. China, its second-largest market, saw same-store sales decline by 14% due to rising competition and changing consumer behavior.

Starbucks also suspended its fiscal 2025 outlook. However, it raised dividends from $0.57 per share to $0.61 per share.

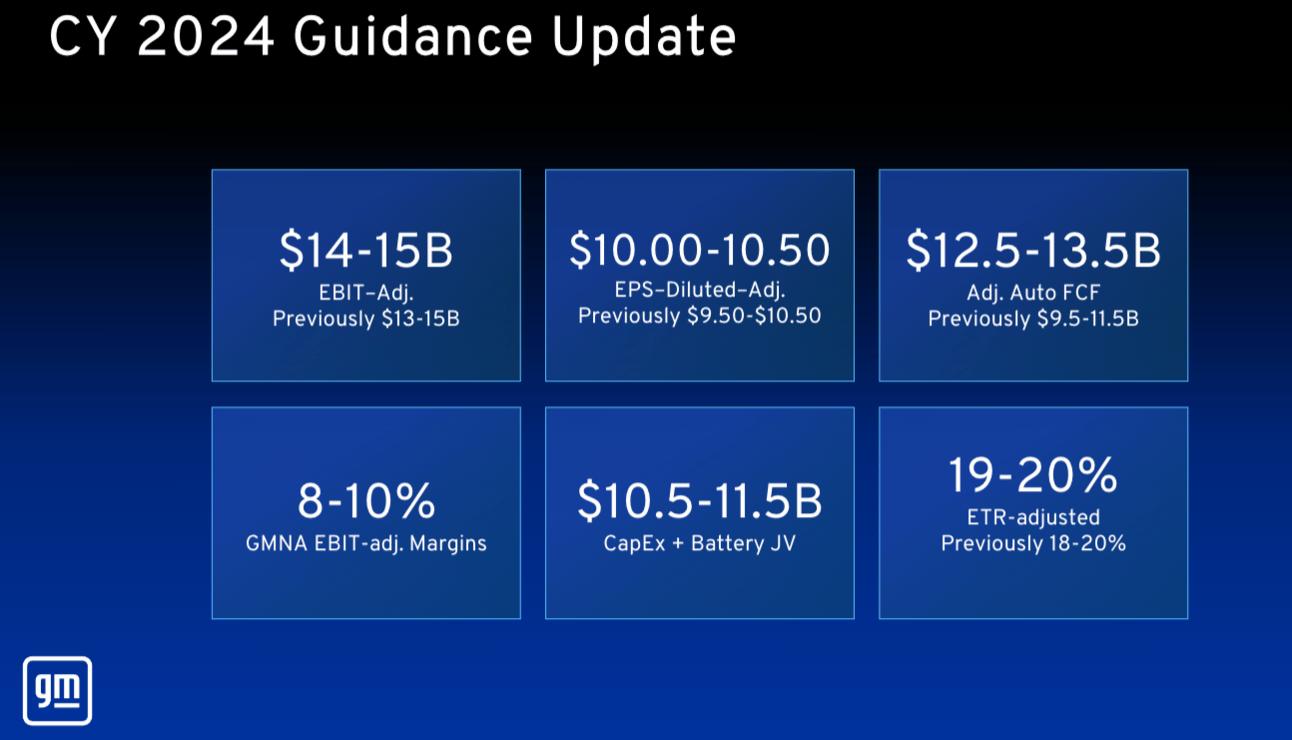

General Motors Stock Surges

Shares of General Motors saw their largest daily increase since March 2020 yesterday after topping earnings estimates in Q3 and increasing its guidance for 2024.

In Q3 of 2024, GM reported:

👉 Revenue of $48.76 billion vs. estimates of $44.59 billion

👉 Earnings per share of $2.96 vs. estimates of $2.43

It is the third time this year that GM has updated its guidance after beating consensus estimates, led by its North American operations.

In 2024, GM expects:

Earnings before interest and taxes between $14 billion and $15 billion, up from between $13 billion and $15 billion

Adjusted automotive free cash flow between $12.5 billion and $13.5 billion, up from $9.5 billion and $11.5 billion

Net income between $10.4 billion and $11.1 billion, compared to $10 billion and $11.4 billion

The Detroit-based automaker warned that Q4 earnings would be lower due to the timing of truck production, lower wholesale volumes, vehicle mix, seasonality, and the rising sale of EVs.

The automobile giant has topped EPS estimates for nine consecutive quarters and revenue for eight straight quarters. Its sales in Q3 rose 10.5% year over year from $44 billion in the year-ago period.

Here are some critical numbers for GM in Q3 of 2024:

Its North American operations reported adjusted EBIT of $4 billion, up 12.9% year over year

It reported a $137 million loss in China, where it is restructuring operations

Adjusted earnings in other international markets fell by 88% to $42 million

Its financing arm reported a 7.3% decline in earnings to $687 million

The Cruise autonomous vehicle unit lost $1.3 billion through September

The 32,481% Boom: First Disruption to $martphones in 15 Years

Mode saw 32,481% revenue growth from 2019 to 2022, ranking them the #1 overall software company, on this year's Deloitte 500 fastest-growing companies list. Mode is on a mission to disrupt the entire industry with their “EarnPhone”, a budget smartphone that’s helped consumers earn and save $325M for activities like listening to music, playing games, and… even charging their devices?!

Mode has over $60M in revenue - this is your chance to invest in a $1T+ market opportunity!

This is a paid advertisement for Mode Mobile Reg A offering. Please read the offering statement at https://invest.modemobile.com/.

Headlines You Can't Miss!

Qualcomm tumbles after Arm threatens to scrap key license

Deutsche Bank shed 3% after Q3 earnings miss

Tokyo Metro shares surge 45% on trading debut

Global fight against inflation almost over, says IMF

Approval of BTC options ETF will increase volatility

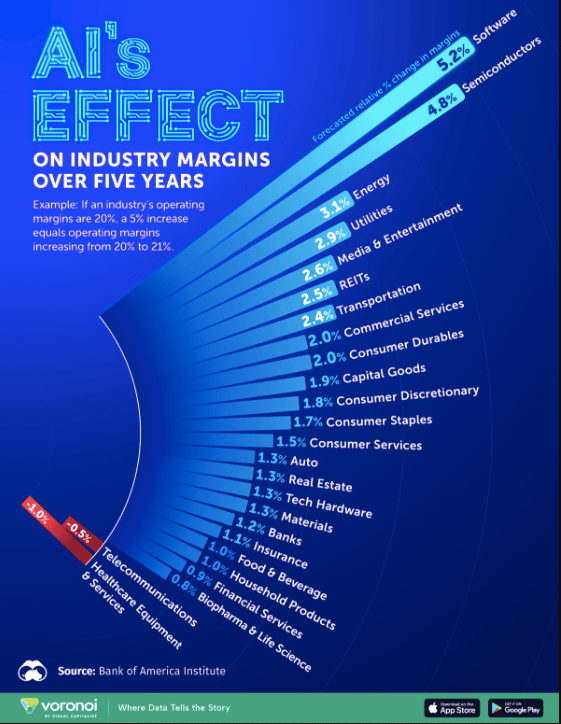

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.