- 3 Big Scoops

- Posts

- 🗞 Big Banks Deliver in Q3

🗞 Big Banks Deliver in Q3

while Delta Air Lines disappoints

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,815.03 ( ⬆️ 0.61%)

Nasdaq Composite @ 18,342.94 ( ⬆️ 0.33%)

Bitcoin @ $62,638.99 ( ⬆️ 2.72%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 JPMorgan shines in Q3

👉 Wells Fargo crushes estimates

👉 Delta Air Lines misses estimates

So, let’s go 🚀

Market Wrap

The S&P 500 and Dow Jones Industrial Average powered to new highs on Friday and capped off a winning week as banking behemoths ushered in a promising start to the earnings season in Q3.

Wall Street tends to view the banking sector as a barometer for the health of the economy, setting the tone for the remainder of the earnings season.

All three major averages registered a fifth straight week of gains, with each index gaining over 1%.

Stocks gained pace from data that alleviated fears that inflation was not cooling off quickly enough. It included a cooler-than-expected producer price index reading after the CPI increased more than expected.

The FedWatch tool indicates a 90% likelihood that the Federal Reserve will dial back interest rates by 0.25 percentage points next month.

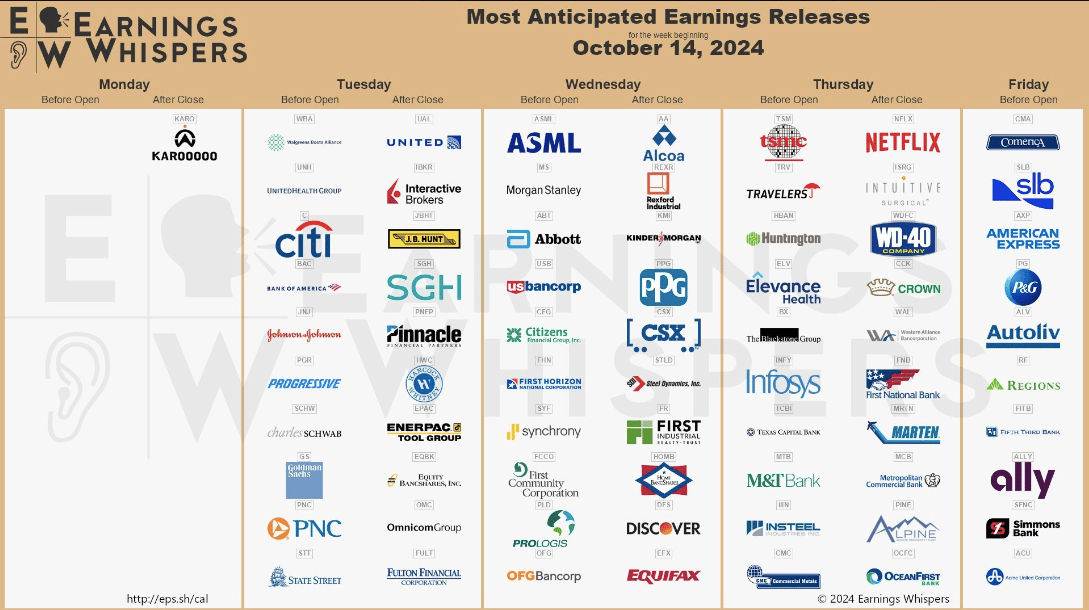

Trending Stocks 🔥

Stellantis - Shares fell over 2% after the automaker announced major management changes, including removing its finance chief.

Tesla - The EV giant shed close to 9% following an underwhelming robotaxi event last week.

BlackRock - The asset manager gained 3.6% after reporting revenue of $5.20 billion and earnings of $11.46 per share in Q3, above estimates of $5.01 billion and $10.33 per share, respectively. It ended Q3 with $11.5 trillion in assets under management, up $2.4 trillion in the past year.

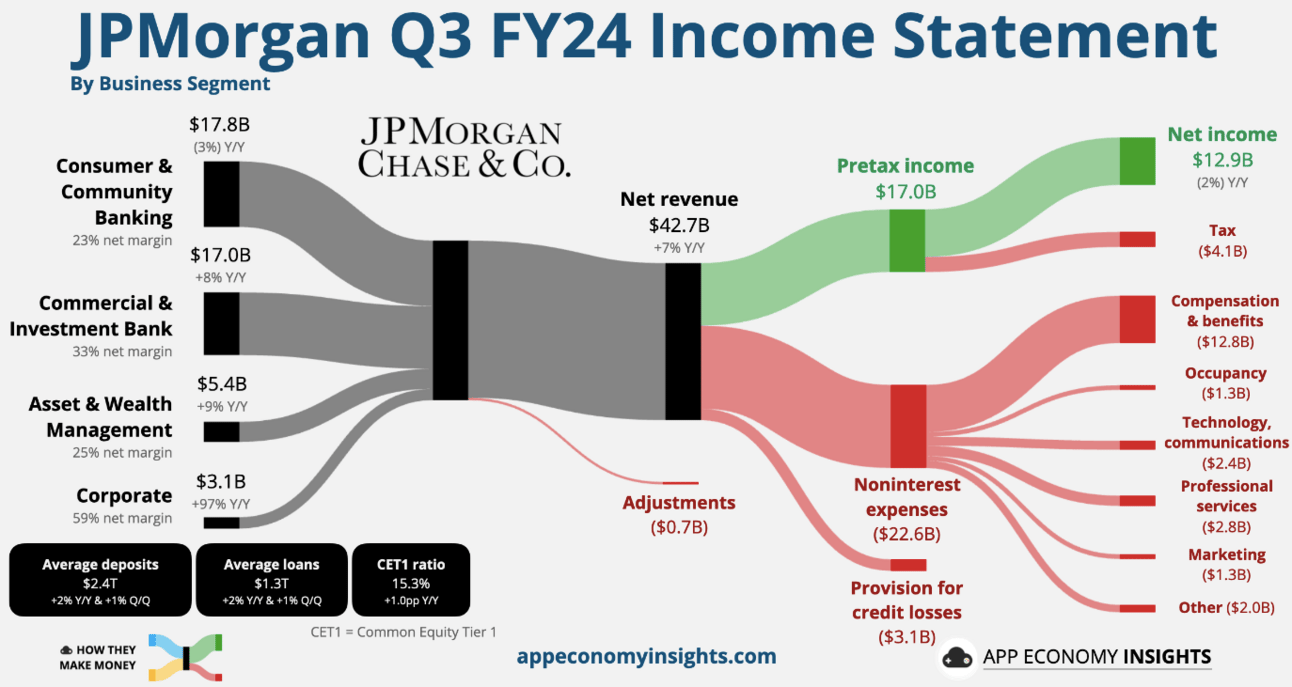

In Q3 of 2024, JPMorgan reported:

👉 Revenue of $43.32 billion vs. estimates of $41.63 billion

👉 Earnings per share of $4.37 vs. estimates of $4.01

While sales rose 6%, net income was down 2% year over year. The company’s net interest income rose 3% to $23.5 billion, higher than estimates of $22.73 billion, due to gains from investments in securities and loan growth in the credit card business.

Here are some key numbers for the banking giant 👇

Investment banking fees rose by 31% to $2.27 billion in Q3, significantly higher than estimates of $2.02 billion.

Fixed-income trading sales were unchanged at $4.5 billion but higher than estimates of $4.38 billion

Equities trading sales rose 27% to $2.6 billion, higher than estimates of $2.41 billion

Its provision for credit losses stood at $3.1 billion, worse than estimates of $2.91 billion

It forecast $2.1 billion in charge-offs and built reserves for future losses by $1 billion

JPMorgan emphasized that consumers are on strong footing and the increase in reserves was due to a growing book of credit card loans.

The company also raised its 2024 guidance for net interest income and expects the metric to be $92.5 billion, above its initial guidance of $91 billion. Annual expenses are expected at $91.5 billion, lower than the earlier forecast of $92 billion.

JPMorgan has thrived in a rising interest rate environment, posting record net income figures since the Fed started hiking rates in 2022. With multiple rate cuts on the horizon, JPMorgan has dialed back net interest income estimates for 2025.

JPM stock rose over 4% on Friday and is up 29% in 2024.

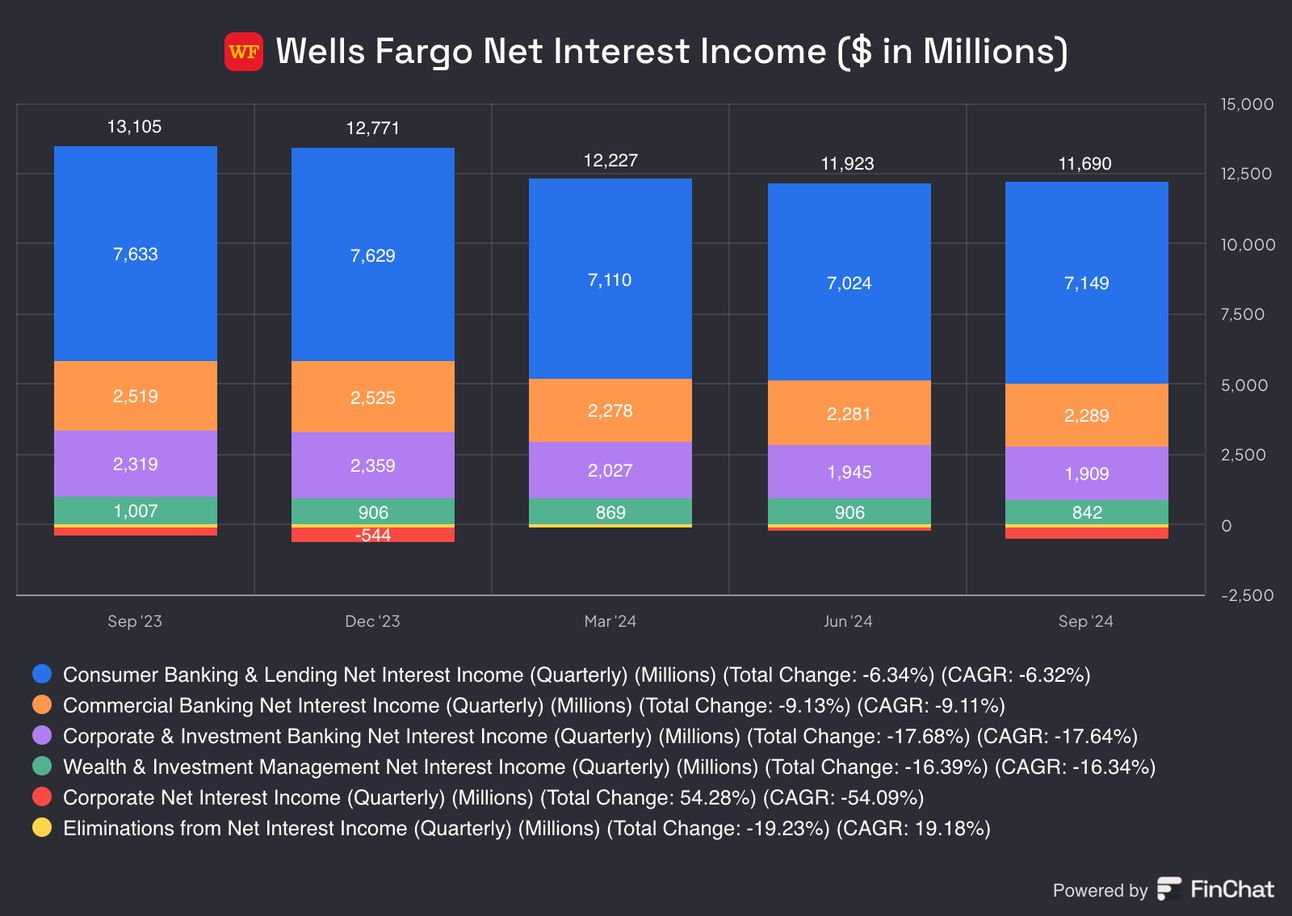

Wells Fargo Stock Surges Over 5%

In Q3 of 2024, Wells Fargo reported:

👉 Revenue of $20.37 billion vs. estimates of $20.42 billion

👉 Earnings per share of $1.52 vs. estimates of $1.28

Notably, the earnings beat came amid a sizeable decline in net interest income, which measures a bank's profit from lending.

Higher funding costs and the shift towards higher-yielding deposit products caused the lender to post a net interest income of $11.69 billion, down 11% year over year.

Wells Faro explained that a diversified revenue base allowed it to offset net interest income headwinds as fee-based sales grew by 16% in Q3.

Its net income fell to $5.11 billion in Q3 from $5.77 billion in the year-ago period. This includes $447 million in losses on debt securities. The financial heavyweight also set aside $1.07 billion as a provision for credit losses compared to $1.20 billion last year.

Wells Fargo repurchased $3.5 billion of common stock in Q3, bringing its total to over $15 billion in 2024. Meanwhile, the stock is up 17% this year, lagging behind the S&P 500 index.

Delta Air Lines Fails to Take Off

While Delta Air Lines expects to grow earnings in Q4 due to resilient travel demand and strong bookings for year-end holidays, the carrier missed consensus estimates in the September quarter, reporting:

👉 Revenue of $1.49 billion vs. estimates of $14.67 billion

👉 Earnings per share of $1.50 vs. estimates of $1.52

In Q3, Delta stated that the CrowdStrike outage amounted to a $0.45 hit to adjusted earnings. The event took thousands of Microsoft Windows machines offline, forcing the airline to cancel thousands of flights, impacting revenue by almost $400 million.

The Atlanta-based carrier forecast Q4 earnings at $1.72 per share (at the midpoint), higher than estimates of $1.71 per share, and above year-ago earnings of $1.28 per share.

Revenue is on track to rise between 2% and 4%, compared with estimates of a 4.1% increase. The carrier warned it expects a 1-point revenue hit from lower demand before and after the upcoming U.S. presidential elections.

Headlines You Can't Miss!

With a stagnant PPI, the Fed is at the finish line

China hints at increasing deficit to boost the economy

Boeing to cut 17,000 jobs as losses deepen amid strikes

China’s car sales snap five-month decline

Bitcoin to have “crazy decade” as adoption widens

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.