- 3 Big Scoops

- Posts

- 🗞 Costco's Gold Rush

🗞 Costco's Gold Rush

Costco, Super Micro and Samsung

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

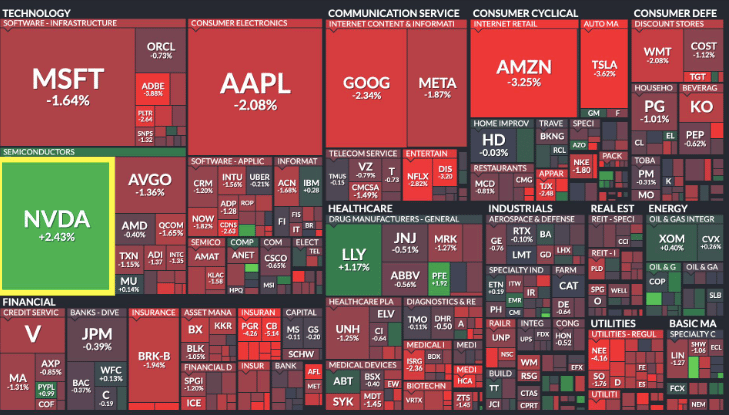

S&P 500 @ 5,695.94 ( ⬇️ 0.96%)

Nasdaq Composite @ 17,923.90 ( ⬇️ 1.18%)

Bitcoin @ $63,126.12 ( ⬇️ 0.23%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Costco’s gold bars are popular

👉 Super Micro gains big

👉 Samsung disappoints investors

So, let’s go 🚀

Market Wrap

Stocks struggled on Monday as rising oil prices and higher Treasury yields weighed on market sentiment.

The 10-year Treasury yield rose to 4.02%, the first time it topped 4% since August. U.S. crude oil climbed 3% to settle at $77 per barrel amid tensions in the Middle East.

According to investment bank JPMorgan, U.S. equities look stretched after a strong recent rally, which could contribute to higher concentration risk and momentum reversal.

JPMorgan explains that U.S. equities are trading at an expensive multiple, and the region’s profitability versus the rest of the world might be peaking as well.

Meanwhile, Sam Stovall, the chief investment strategist at CFRA Research, pointed to a pullback in Q3 earnings estimates as a source of market weakness.

Stovall theorized that the revisions could be due to management teams tempering expectations so they could beat forecasts once again. Notably, actual results have exceeded end-of-quarter estimates in 60 of the past 62 quarters.

Trending Stocks 🔥

Generac Holdings - Shares of the power generator manufacturer surged over 8% as Hurricane Milton intensified into a Category 5 storm.

Amazon - The e-commerce giant lost 3% after Wells Fargo downgraded shares to “equal weight” from “overweight” and cut its price target, citing slowing growth and competition from Walmart.

Scholar Rock - The biopharma stock rallied 360% after a phase three study for patients with spinal muscular atrophy had met its primary endpoint.

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

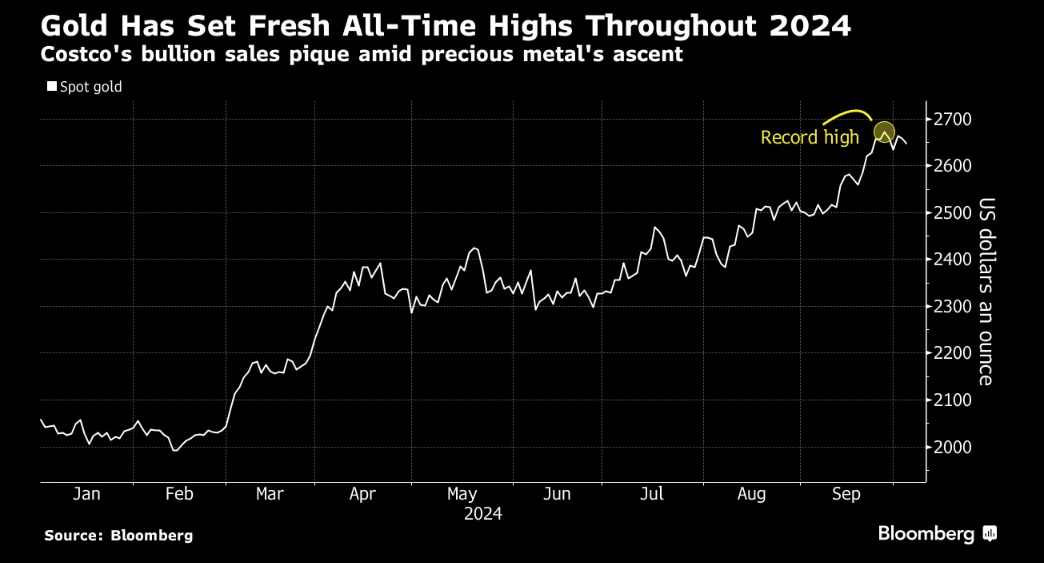

Costco’s Gold Bars Sell Out

Gold’s breathtaking rally in 2024 hasn’t stopped bullion from flying off shelves at Costco stores in the U.S. Costco is a big-box discount wholesaler that started selling the precious metal in U.S. stores and on its website in June 2023.

During its earnings call in September 2023, Costco claimed it sold more than $100 million in gold bars, which, based on average gold prices in that period, equals 51,740 ounces.

Costco’s one-stop shopping convenience brings gold buying to the masses by offering prices that undercut traditional precious metal dealers while providing additional rewards to its loyal customers.

For example, Costco offers 2% cash rewards for using an affiliated Citi credit card. Shoppers also get a 2% reward on purchases with an executive membership that costs $130 a year.

Historically, gold has demonstrated an ability to deliver inflation-beating returns, making it a store of value. Additionally, the safe-haven asset thrives during periods of economic turmoil, offering portfolio diversification.

While Costco doesn’t disclose much about its gold sales, 77% of surveyed Costco outlets said that bullion bars were sold out in the first week of October.

Spot gold has jumped 30% in 2024, making it one of the best-performing commodities globally. Last month, it surpassed $2,600 an ounce, bolstered by the Fed’s decision to cut interest rates.

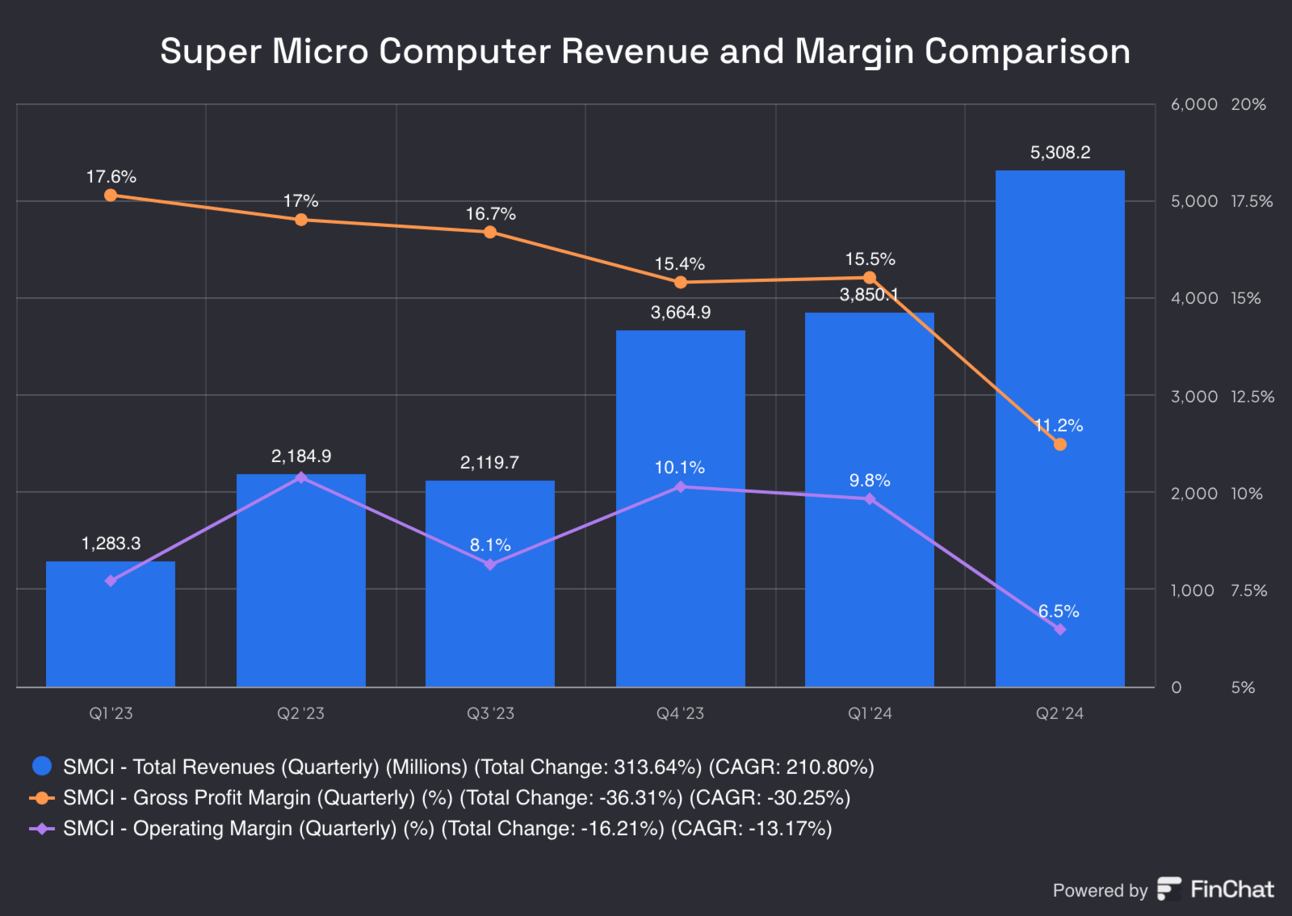

Super Micro Stock Surges Over 15%

Shares of Super Micro Computer surged close to 16% yesterday after the server company said it’s shipping more than 100,000 graphics processing units for AI, each quarter.

This should translate into several billions of dollars of orders, given that the average price of a GPU is around $30,000.

Super Micro is one of the biggest beneficiaries of the AI boom. The company makes computers that its enterprise customers use as servers for data storage, training AI models, and more. Further, its new cooling product enables data centers to reduce hardware costs and cooling infrastructure for servers.

Recently, Super Micro said it deployed more than 100,000 GPUs with liquid cooling solutions for some of the largest AI factories ever built and other cloud service providers.

While SMCI stock has surged over 2,400% in the last five years, it trades 60% below all-time highs after a report from Hindenburg Research accused the server maker of accounting manipulation.

Samsung Lowers Q3 Profit Estimates

Source: CNBC

South Korean tech giant Samsung said it will report worse-than-expected profit for Q3 of 2024. The memory chip maker said operating profit in Q3 is forecast at 9.10 trillion won, an increase of 274% year over year. However, it was below consensus estimates of 11.456 trillion won ($7.7 billion).

Samsung explained that the performance of its memory business decreased due to one-time costs, which include inventory adjustments by mobile customers and increased supply of legacy products by Chinese memory companies.

Samsung manufactures memory chips that power devices such as laptops and servers. It is also the world’s largest player in the smartphone market. Notably, demand for legacy chips used in PCs and smartphones is not picking up globally.

Last month, Reuters reported that Samsung had instructed its subsidiaries to reduce 30% of staff in some divisions.

Headlines You Can't Miss!

China rally loses steam as Hang Seng index tanks 6%

Apple might enter the smart ring market

Samsung issues apology after Q3 results

Foxconn expects AI investment boom to continue

FTX creditors will make money on bankruptcy

Chart of The Day

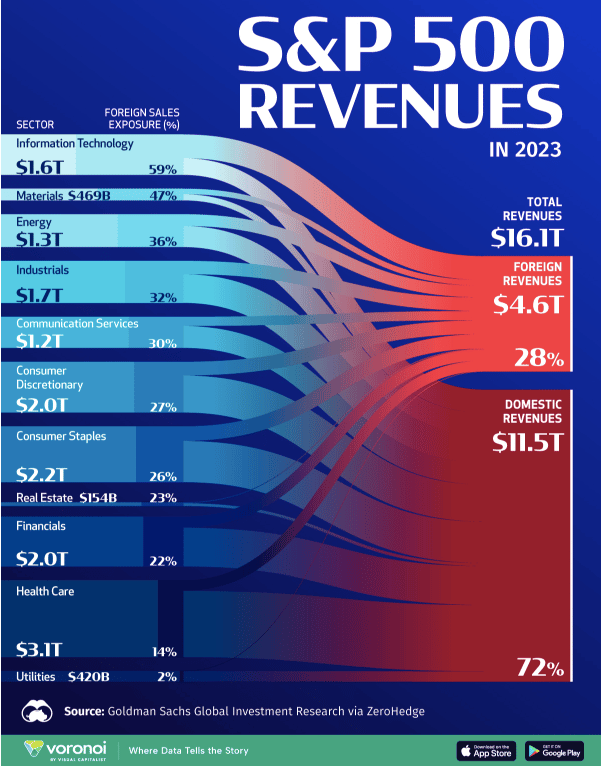

The 500 largest companies in the U.S. generated $16.1 trillion in total revenue last year. Domestic sales accounted for 72% of revenue, while international sales stood at 28%.

However, the information technology sector had the largest exposure to foreign sales, with 59% of revenue coming from international markets, more than double the index average.

The IT sector includes tech giants like Apple, Microsoft, Amazon, and Nvidia. The asset-light nature of tech businesses allows for the easy distribution of digital products and services globally.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.