- 3 Big Scoops

- Posts

- Qualcomm Might Acquire Intel

Qualcomm Might Acquire Intel

PLUS: FedEx Disappoints Wall Street

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

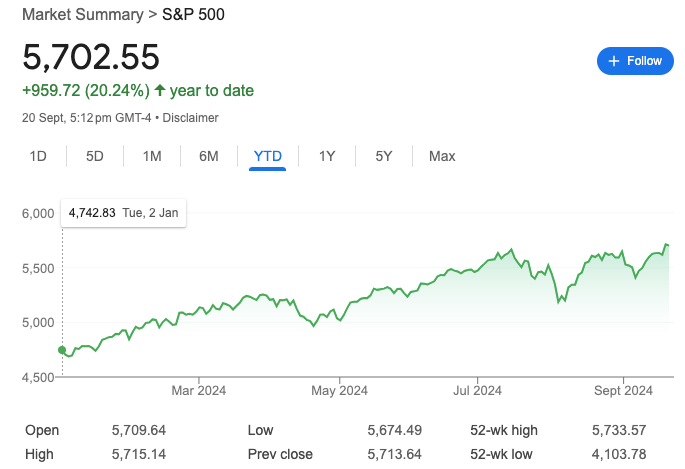

S&P 500 @ 5,702.55 ( ⬇️ 0.19%)

Nasdaq Composite @ 17,948.32 ( ⬇️ 0.36%)

Bitcoin @ $63,573.90 ( ⬆️ 0.33%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today:

👉 Qualcomm eyes Intel

👉 FedEx stock tanks post earnings

👉 Constellation Energy soars to fresh all-time highs

So, let’s go 🚀

Market Wrap

All three major indices notched weekly gains as the S&P 500 rose 1.36%, posting its fifth positive week over the past six weeks. The flagship index is now up 20% in 2024. Meanwhile, the tech-heavy Nasdaq index advanced 1.49%, while the Dow Jones Index rose 1.6% last week.

The Fed effectively convinced investors that its 0.50% rate cut is a proactive measure to sustain economic momentum rather than a reactive measure to stabilize it.

According to FactSet, earnings for S&P 500 companies are forecast to grow by 4.6% year over year in the September quarter, expanding for the fifth consecutive quarter.

Until now, 60 S&P 500 companies have shared negative earnings per share guidance, and 50 have announced positive guidance for Q3.

The forward price-to-earnings multiple for the S&P 500 index stands at 21.4x, based on corporate earnings estimates for the next 12 months. It is above the five-year average of 19.5x and the 10-year average of 18x.

Trending Stocks 🔥

Novo Nordisk - Shares of the helathcare giant tumbled over 5% after data from its weight-loss drug showed patients lost 5.8% of their body weight after 16 weeks of treatment, below estimates of a 15% reducton.

Centessa Pharmacueticals - Morgan Stanley upgraded the clincial-stage pharma company as it could be at the forefront of a leading nacrolepsy treatment. The investment bank has a 12-month target price of $26, up from $15. Centessa Pharma stock rose over 4% following its upgrade.

Chewy - The pet products retailer lost over 4% after announcing a $500 million public offering.

The 32,481% Boom: First Disruption to $martphones in 15 Years

Mode saw 32,481% revenue growth from 2019 to 2022, ranking them the #1 overall software company, on this year's Deloitte 500 fastest-growing companies list. Mode is on a mission to disrupt the entire industry with their “EarnPhone”, a budget smartphone that’s helped consumers earn and save $325M for activities like listening to music, playing games, and… even charging their devices?!

Mode has over $60M in revenue - this is your chance to invest in a $1T+ market opportunity!

This is a paid advertisement for Mode Mobile Reg A offering. Please read the offering statement at https://invest.modemobile.com/.

Will Qualcomm Acquire Intel?

According to CNBC, Qualcomm recently approached struggling chipmaker Intel about a takeover. It's still unclear if Intel has engaged in conversations with Qualcomm or what the terms of the acquisition could be.

Intel stock popped over 3%, while Qualcomm shed 2.9% following this news. If the acquisition goes through, it would be one of the largest technology mergers ever, as Intel has a market cap of $90 billion.

While Intel is among the largest chipmakers globally, the stock has trailed the broader markets by a wide margin. It is down over 50% this year and experienced its biggest one-day drop in 50 years following its disappointing Q2 earnings.

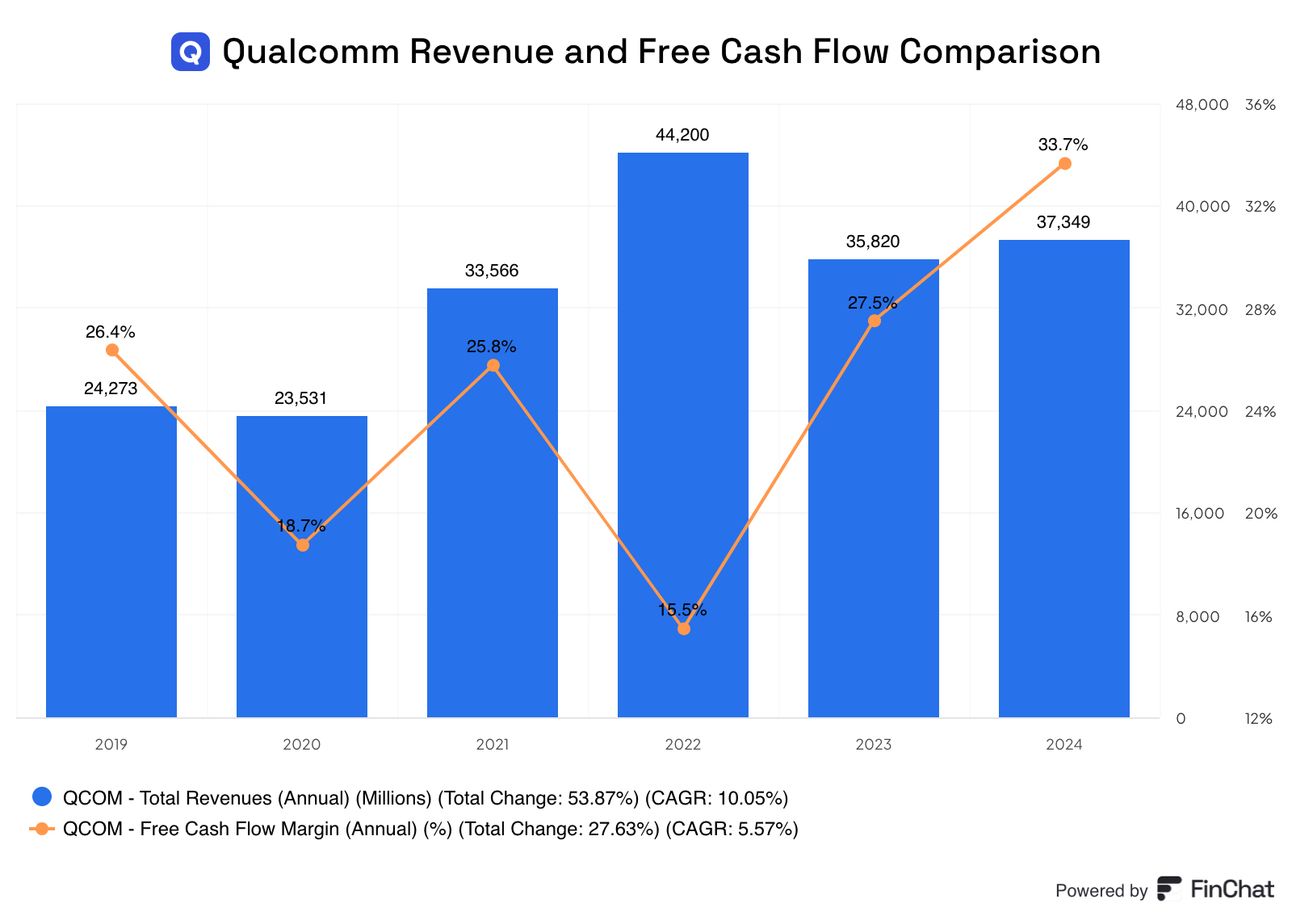

Qualcomm and Intel compete in several markets such as PC and laptop chips. However, unlike Intel, Qualcomm does not manufacture its own chips and relies on companies such as Taiwan Semiconductor Manufacturing and Samsung to handle production.

Intel, meanwhile, continues to invest heavily in its foundry business that could cost $100 billion over the next five years.

Additionally, Intel has missed out on the artificial intelligence boom. For instance, most of the advanced AI programs run on Nvidia’s graphics processors, instead of Intel’s central processors. Nvidia is estimated to own a 80% share in this fast-growing market.

In fiscal 2023, Qualcomm reported sales of $35.8 billion, lower than Intel’s sales of more than $50 billion. Antitrust and national security matters would impact the potential acquisition as both companies have a sizeable business in China.

FedEx Tumbles 15%

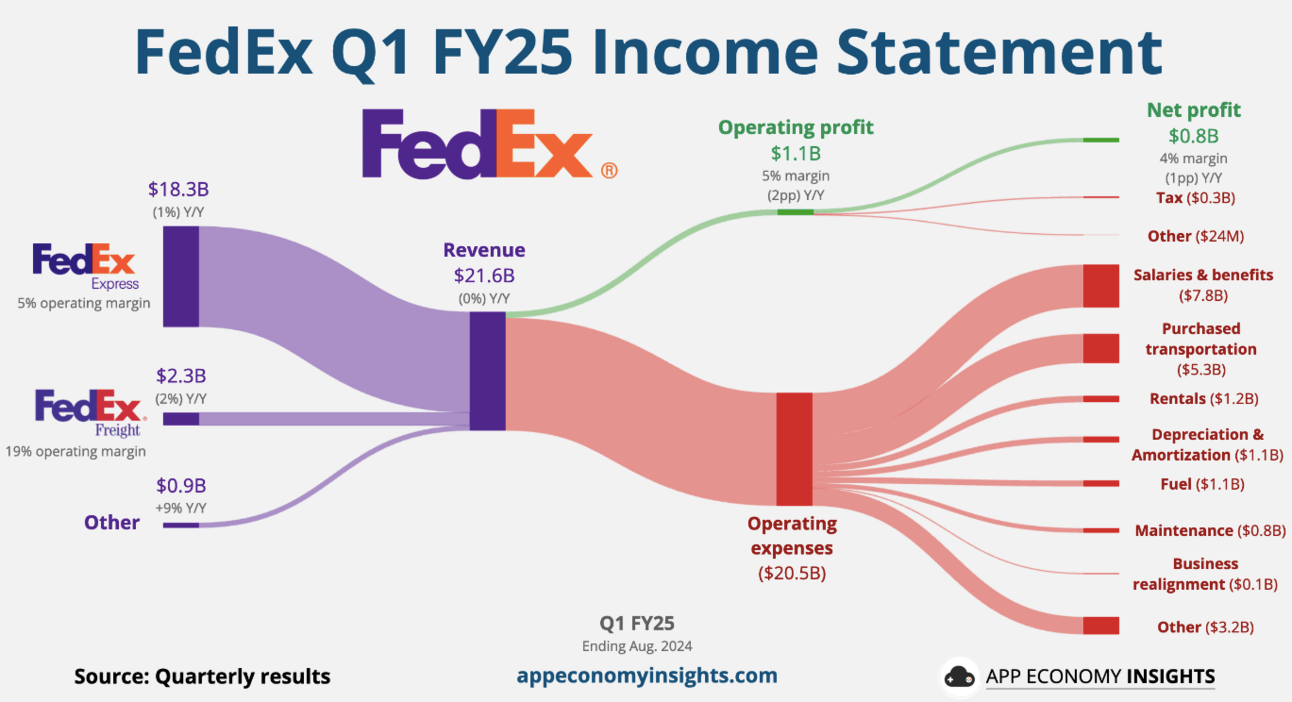

Delivery giant FedEx reported a steep drop in quarterly profits and lowered its full-year revenue forecast after its customers continues to trade down from speedy, pricey delivery options to cheaper, slower options.

The shift to lower margin packages is squeezing profits at FedEx, in addition to a drop in priority shipments between businesses.

Shipments between manufacturers and other companies are the most profitable for FedEx and CEO Raj Subramaniam emphasized that industrial demand was softer than expected.

Subramaniam is also leading a complex restructuring at FedEx that involves slashing overhead costs and merging its separate Ground and Express delivery units.

However, these costs failed to offset the drag from weak demand for lucrative priority services as the comany’s adjusted earnings fell from $4.55 per share to $3.60 per share in the last 12 months.

FedEx now expects revenue in fiscal 2025 to grow by low single-digit percentages. It lowered its midpoint earnings 2025 guidance to $20.5 per share, from its earlier forecast of $21 per share.

The logistics heavyweight is also winding down a contract with the United States Postal Service, its largest customer, and expects a $500 million headwind from this development in fiscal 2025.

Finally, executives are assessing whether to spin off or sell its FedEx Freight business.

Constellation Energy Stock Soars Over 22%

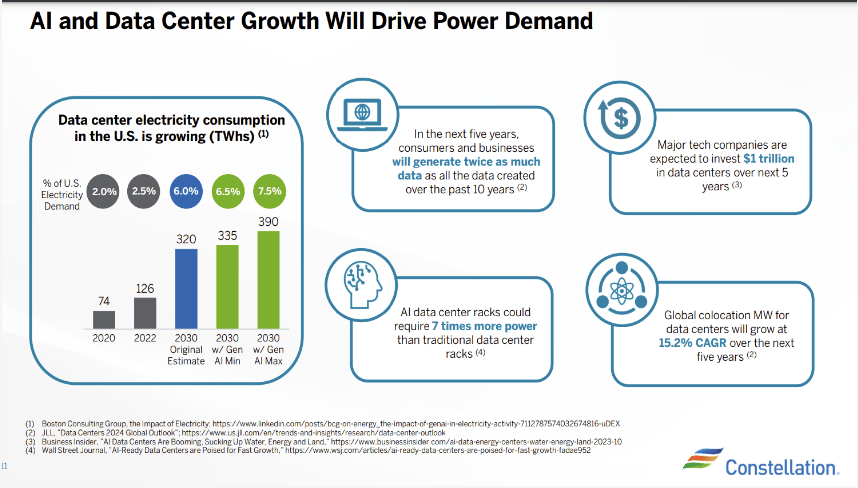

Constellation Energy stock jumped over 22% after it announced plans to restart the Three Mile Island nuclear plant and sell the power to Microsoft, showcasing the energy demands of the tech sector as they build out data centers to support AI.

Constellation expects the reactor to come online in 2028 and has plans to extend plant operations through 2054.

Microsoft will purchase electricity from the plant in a 20-year agreement to match the energy requirements of its data centers. In fact, Constellation’s agreement with Microsoft is the largest power purchase deal the nuclear plant operator has ever signed. Contellation will spend $1.6 billion in restartting the plant through 2028.

Energy demand from data centers is expected to surge in the upcoming decade as the tech sector ramps up AI spending. According to Goldman Sachs, data centers will consume 8% of the total U.S. electricity demand by 2030, up from 3% right now.

Power demand is also surging due to the expansion of domestic manufacturing and adoption of EVs. For instance, data center and EVs could add 290 terawatt hours of electricity demand by the end of 2030, which is the equivalent to the entire consumption of the nation of Turkey.

Headlines You Can't Miss!

UniCredit raises its stake in Commerzbank

TSMC and Samsung to build chip factories in UAE

China’s youth unemployment hits fresh high amid economic slowdown

The SEC wants to sanction Elon Musk

Crypto investment products see inflows of $321 million

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.