- 3 Big Scoops

- Posts

- Amazon: Q1 Earnings Preview

Amazon: Q1 Earnings Preview

Will Amazon beat estimates in Q1?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,051.41 ( ⬇️ 0.21%)

Nasdaq Composite @ 15,865.25 ( ⬇️ 0.12%)

Bitcoin @ $63,602.67 ( ⬇️ 0.97%)

Hey Scoopers,

Happy Wednesday. Midweek milestone achieved!

In today’s issue, we examine the consensus estimates for Amazon’s upcoming earnings and dive deeper to analyze the e-commerce giant’s business model and fundamentals.

So, let’s go 🚀

What to Expect from Amazon in Q1?

After a stellar performance amid the COVID-19 pandemic, Amazon stock fell by more than 50% from $184 in November 2021 to $84 in December 2022.

Since the start of 2023, AMZN stock has returned 118% and currently trades near all-time highs. Valued at a market cap of $1.9 trillion, Amazon is among the largest companies in the world today.

The next major driver of the company’s stock price will be its upcoming earnings report. Amazon is scheduled to report its Q1 of 2024 (ended in March) results on April 30, 2024.

So, let’s see what Wall Street expects from AMZN in Q1.

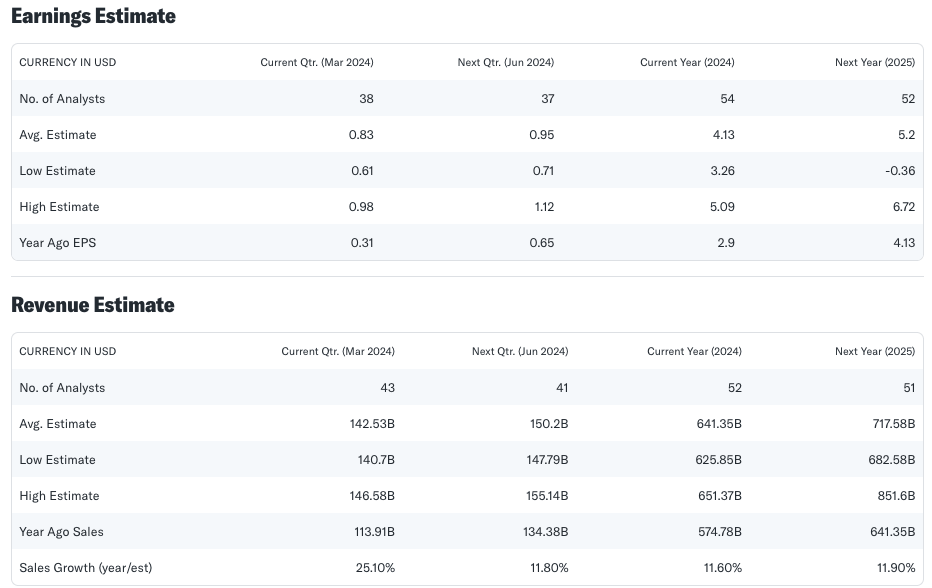

Amazon’s Earnings and Revenue Estimates

Q1 Earnings forecast at $0.83 per share

Analysts covering Amazon expect:

👉 Sales to rise by 25% to $142.53 billion

👉 Earnings to rise by 168% to $0.83 per share

In the year-ago period, Amazon reported revenue of $113.9 billion and earnings of $0.31 per share.

Amazon- A Game Changer!

Investors aim to pick winning stocks that can help them deliver inflation-beating returns over time. In the last two decades, companies part of the tech and internet sectors have been a hotbed for such opportunities.

For instance, Amazon went public in May 1997 and has since returned an emphatic 190,000% to shareholders. It means a $1,000 investment in AMZN stock soon after its IPO would be worth close to $2 million today.

Let’s see how this “Magnificent Seven” stock has become one of the largest companies in the world.

Amazon was founded by Jeff Bezos back in 1994 as an online book-selling company and was listed on the public markets three years later. In 1997, Amazon generated $148 million in sales and was valued at a market cap of $1.4 billion.

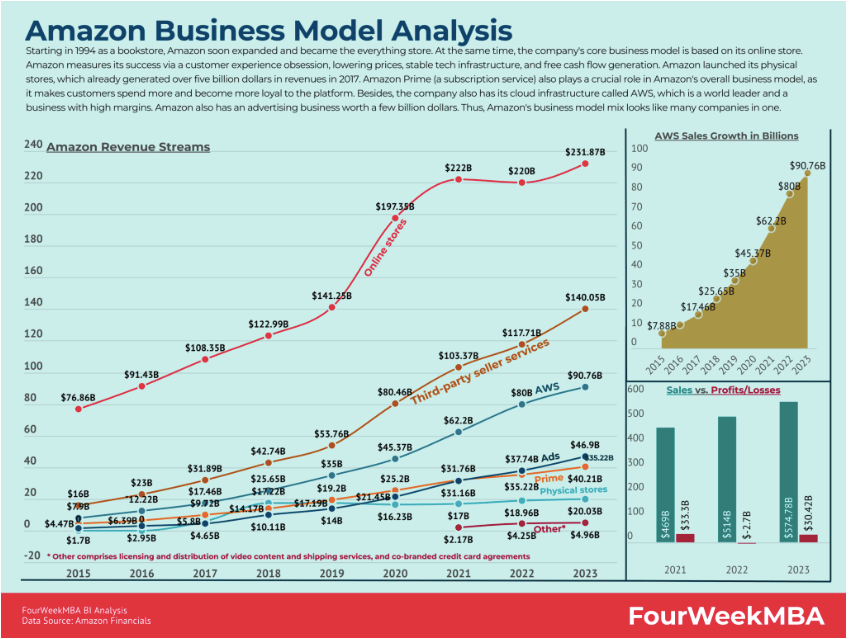

In the last 27 years, it has grown to become one of the most prominent success stories on Wall Street, raking in $574 billion in sales in 2023.

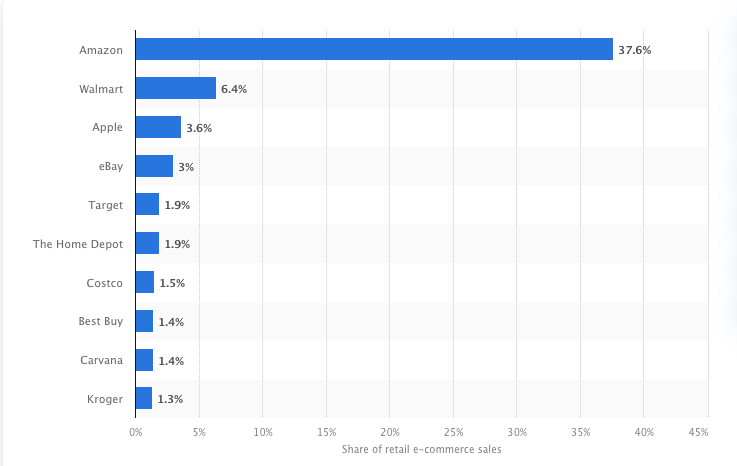

Over the years, Amazon transitioned from an online bookstore to an e-commerce behemoth, selling millions of items across product categories. The website drew 4.3 billion visitors in March and accounts for 38% of online spending in the U.S.

Amazon’s e-commerce Market Share in 2023 (U.S.)

Source: Statista

Amazon invested heavily in building its logistics infrastructure, allowing it to provide fast shipping at a competitive cost. In fact, it is now a platform on which many direct-to-consumer companies have grown their operations at scale.

Focus on Diversification

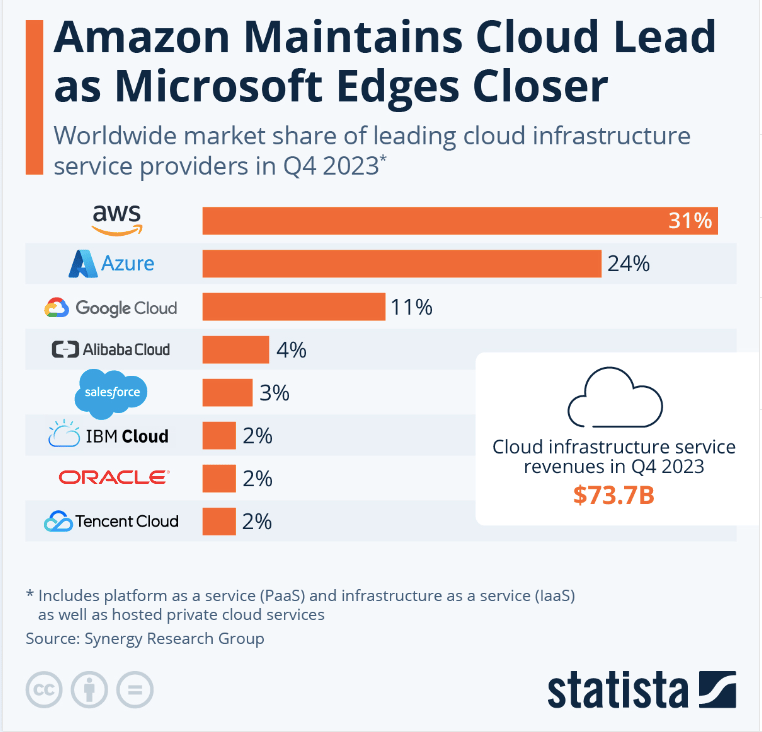

Amazon has diversified into several other business segments in the last two decades. For instance, Amazon Web Services, or AWS, is now the largest public cloud infrastructure company in the world.

In 2023, AWS reported sales of $91 billion and an operating income of $25 billion, accounting for a majority of company profits.

In addition to online shopping and cloud, Amazon is among the largest streaming platforms globally with Prime Video.

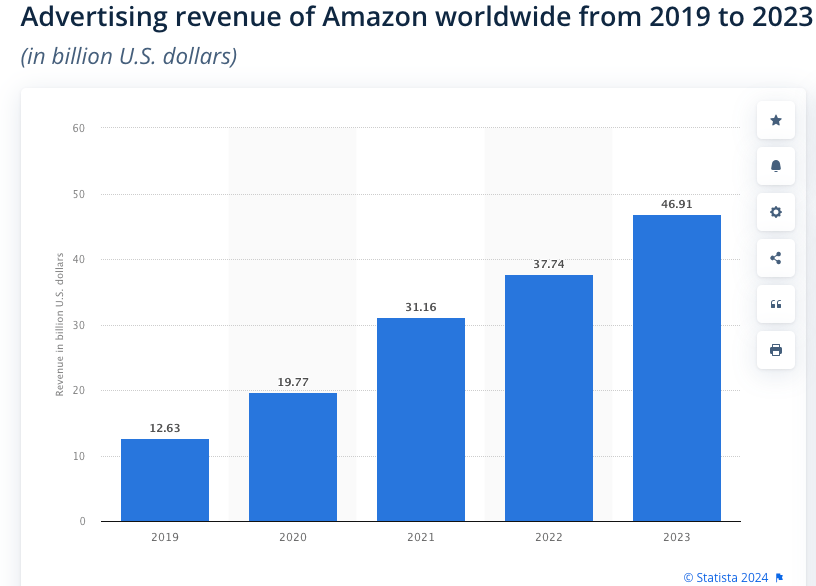

Now, what most investors don’t know is that Amazon is also the third-largest digital ad platform after Google and Meta. In 2022, Amazon’s digital ad market share stood at 7.3% and might surpass 15% by 2024.

Advertisers are shifting to Amazon ads as it is the most effective and cheapest way to advertise online. According to a 2023 Feedvisor report, 36% of brands emphasized that Amazon generates the highest return on media spend.

Additionally, 59% of brands on Amazon’s e-commerce marketplace say it drives the highest return on media spending.

Basically, Amazon is a behemoth that is firing on all cylinders. In the U.S. it ended 2023 with:

👉 A 38% market share in e-commerce

👉 A 31% share in public cloud and

👉 A 15.2% share in digital ad spending

Amazon’s Growth Story is Not Over

Amazon is positioned to benefit from secular tailwinds and an expanding addressable market. For example, the e-commerce market in the U.S. accounts for just 15% of total retail, indicating trillions of dollars of consumer spending is yet to come online.

The highly disruptive AI capabilities offered by leading tech organizations would drive demand for new data center investments and cloud computing.

Analysts expect the public cloud market to surpass $1.5 trillion by 2030. If Amazon can maintain its market share, AWS should generate $465 billion in annual sales by the end of the decade.

What is the Target Price for AMZN Stock?

Analysts tracking Amazon expect the company to increase sales by 11.6% to $641.4 billion in 2024 and by 11.9% to $717.6 billion in 2025. Its adjusted earnings are forecast to expand from $2.9 per share in 2023 to $4.13 per share in 2024 and $5.2 per share in 2025.

AMZN stock might seem expensive, priced at 44.3x forward earnings. But its earnings are on track to grow by 30.5% annually in the next five years.

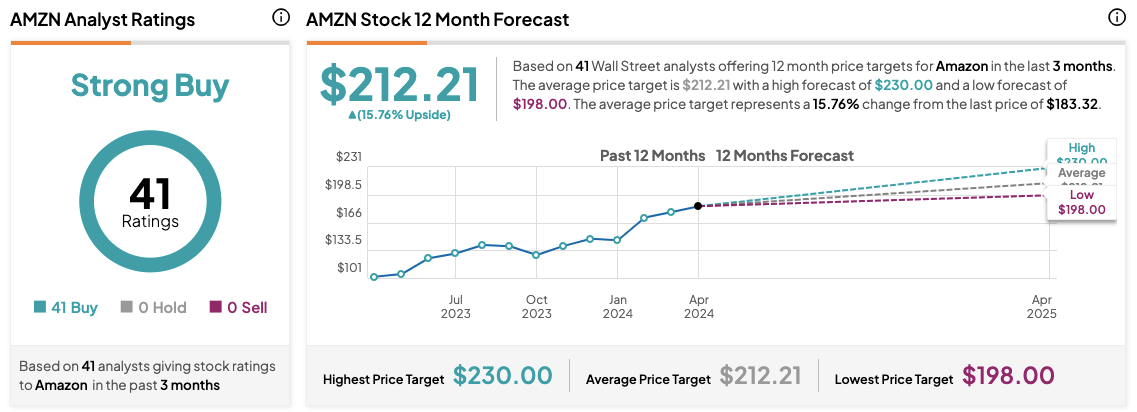

Source: TipRanks

Each of the 41 analysts tracking AMZN stock recommends a “buy.” The average target price for AMZN stock is $212.21, which is 16% above the current trading price.

The Takeaway

Investors shouldn’t expect Amazon to replicate its historical gains going forward due to the company’s scale, market cap, and revenue base.

However, Amazon has multiple growth opportunities that should allow it to continue outpacing the broader market in the upcoming decade.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.