- 3 Big Scoops

- Posts

- The Magnificent 7 Are Invincible

The Magnificent 7 Are Invincible

And here are their secrets 💰

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,117.09 ( ⬇️ 0.65%)

Nasdaq Composite @ 15,973.17 ( ⬇️ 0.96%)

Bitcoin @ $66,319.70 ( ⬇️ 3.76%)

Hey Scoopers,

Monday magic unleashed! Today, we analyze the massive outperformance surrounding the Magnificent 7.

So, let’s go 🚀

What are the Magnificent 7?

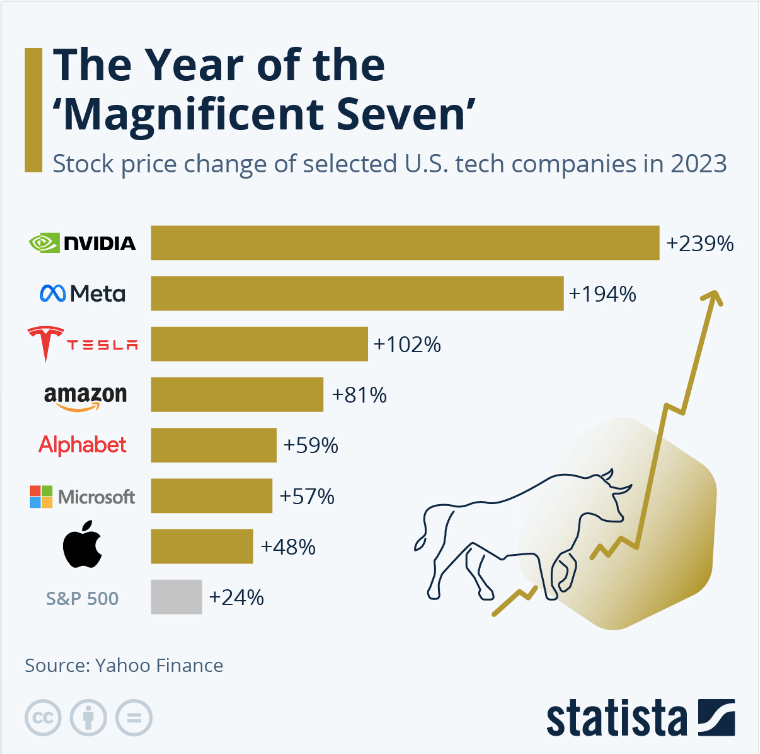

The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market. These companies include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

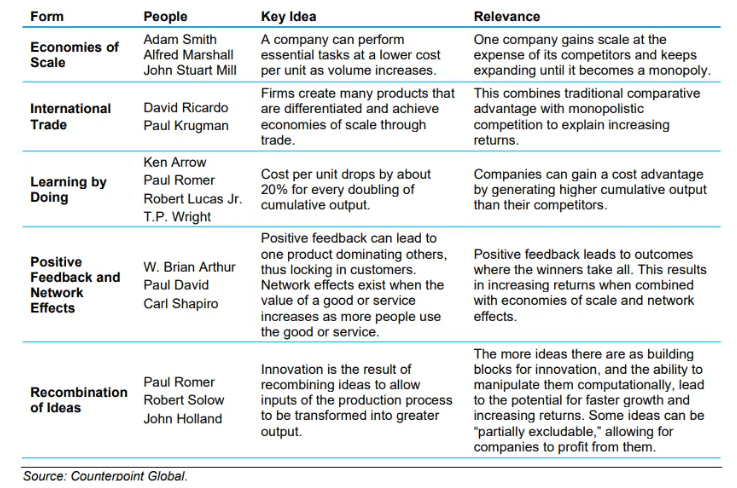

If you’ve ever wondered how behemoth firms like the Magnificent Seven manage to not just withstand increased competition in their space but actually thrive alongside it, well, the “increasing returns” theory can explain a lot of that.

It’s how these leading firms become stronger and more dominant, even when it seems like they should be threatened. Here’s what you need to know about the theory and the seeming invincibility that cloaks these giants.

What’s This “Increasing Returns” Theory?

Classic economic theory tells us there’s an invisible force pulling companies back to reality when they’re making the big bucks, ensuring everyone eventually plays on a level field.

Imagine a bustling cafe in a newly trendy neighborhood. Its popularity would naturally attract more competitors to the street, each trying to outdo the other with unique coffee blends, better service, or cheaper prices.

That rivalry would ultimately spread the customers and profits more evenly across all cafes, demonstrating how traditional theory sees market equilibrium being restored as success invites competition.

Or, at least, that’s how it’s supposed to go.

But Wall Street strategist and author Michael Mauboussin – building on the research of others – says this old-school view doesn’t hold up in all industries anymore.

Nowadays, some businesses instead ride a wave of increasing returns, meaning the more they succeed, the more they keep on winning, leaving their rivals in the dust.

It’s not about balance but about gaining a snowballing advantage that allows them to not only preserve or even grow their above-average profitability but also lock down the whole market, just for them.

And they do this – defying gravity – in five different ways 👇

Economies of Scale

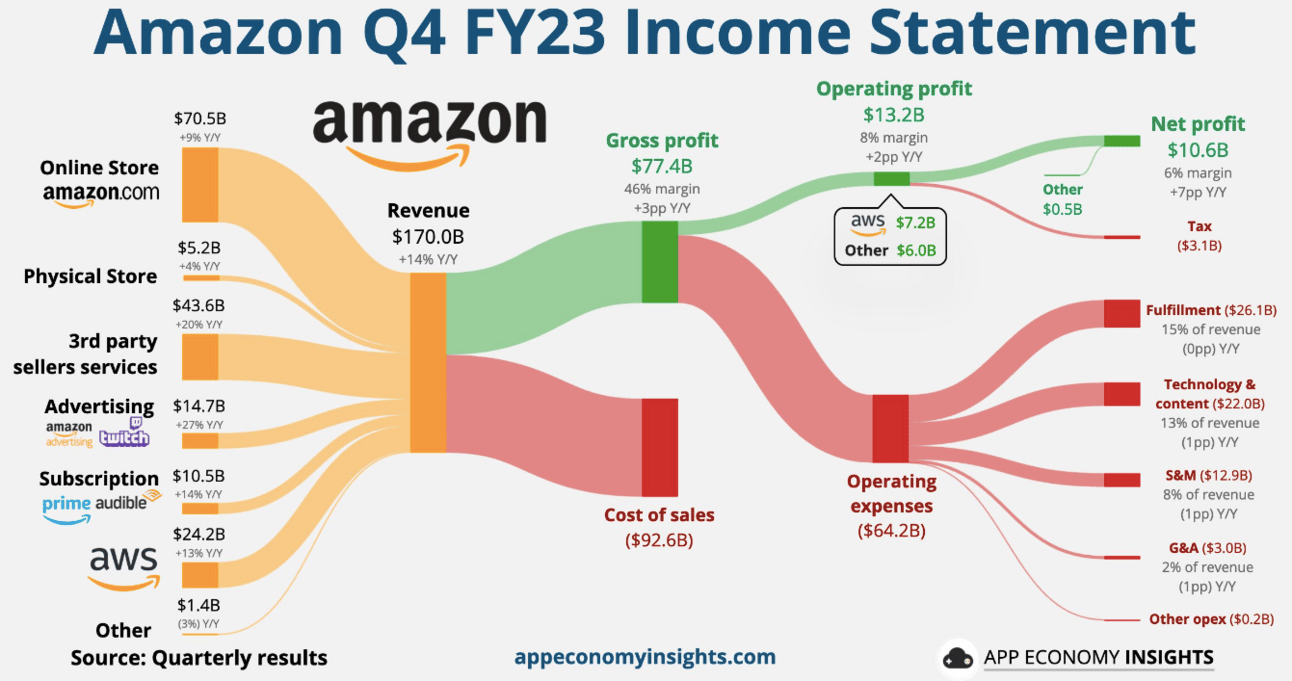

When a company grows, it can produce its goods or services at a lower cost per unit, giving it a competitive edge. Amazon’s success story is a textbook case.

As Amazon grew, it was able to buy things (books, at first) in bulk and streamline logistics, significantly lowering per-item costs and passing these savings to consumers in the form of lower prices and faster shipping.

This scale advantage has allowed Amazon to dominate a wider range of retail categories, making it challenging for smaller retailers to compete on price or delivery speed.

The company’s massive scale benefits (not just in cost savings but also in attracting sellers and buyers) ultimately created a comprehensive marketplace that’s hard to rival.

International Trade

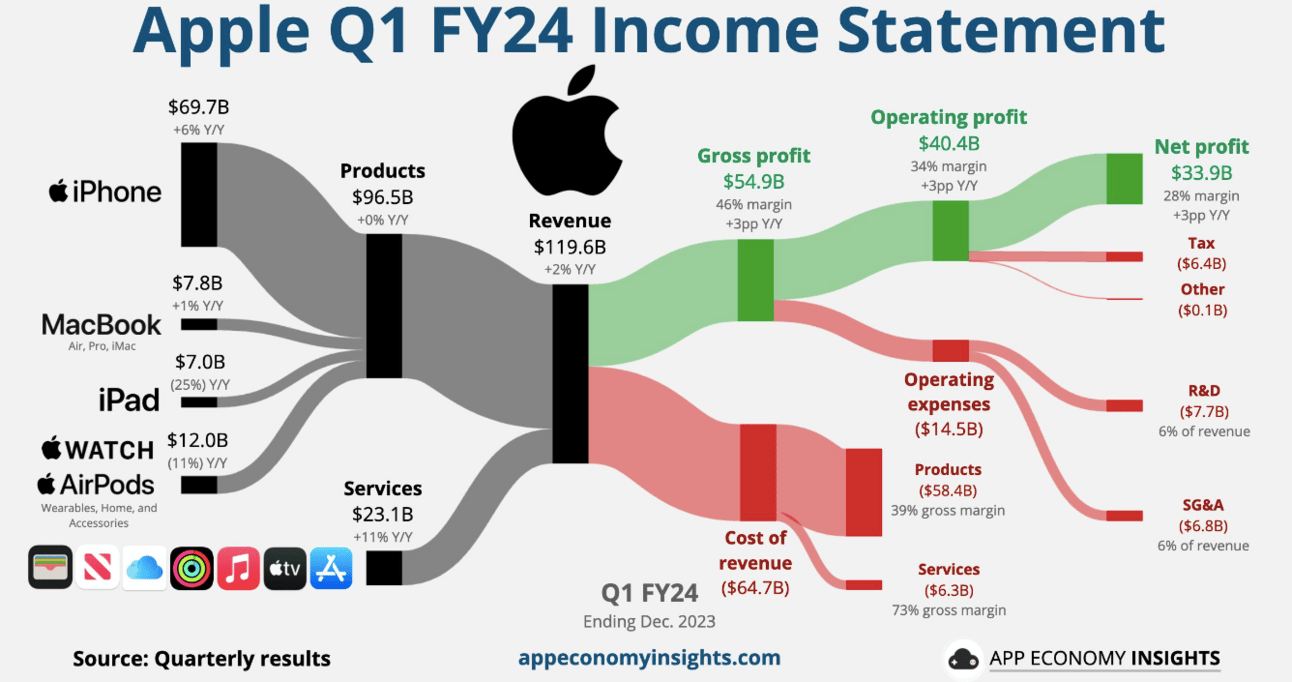

The rise of brands like Apple demonstrates the power of international trade, leveraging global supply chains to optimize production costs and access new markets. By manufacturing in countries with lower labor costs and selling in markets with higher purchasing power, Apple maximizes its profits and its overall footprint.

This strategy allows companies to specialize in what they do best and trade for the rest, resulting in more efficient worldwide production and distribution networks.

Cross-border trade enables firms to achieve economies of scale beyond domestic markets, reinforcing their competitive advantage on a planet-spanning scale.

Learning by Doing

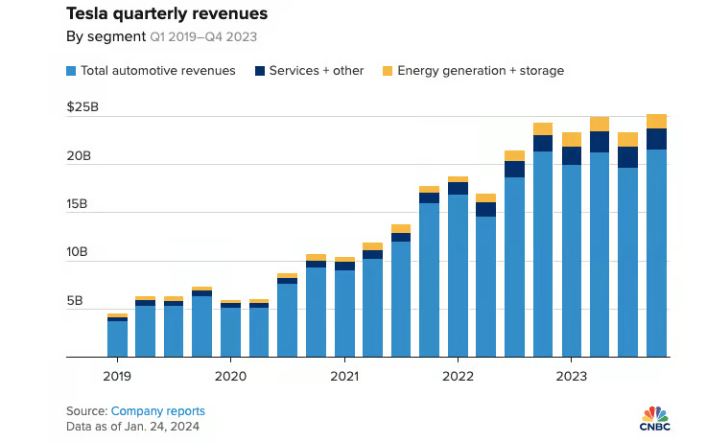

Tesla’s journey in electric vehicle production underscores the concept of learning by doing. Each car manufactured and every mile driven by its fleet feeds data back to the company, enabling continuous improvement in vehicle design, battery efficiency, and software algorithms.

This iterative process of manufacturing and refinement has allowed Tesla to shrink costs, improve the performance of its vehicles, and stay ahead of competitors. It showcases how accumulated experience can lead to superior products and a more entrenched market position.

Wright’s law of cumulative production supports this, stating that labor hours needed per unit fall by 20% every time total production doubles, showing how experience translates into efficiency and stronger market presence.

Positive feedback and network effects

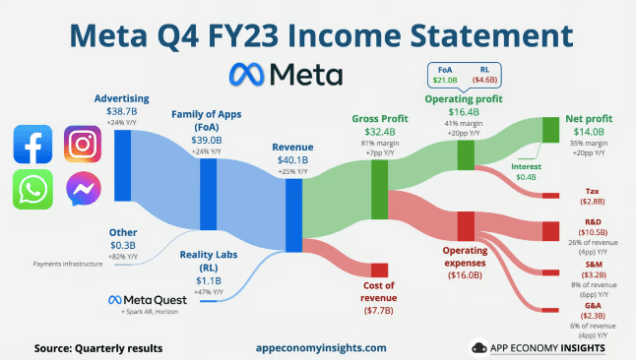

Facebook’s ascent illustrates the combined power of network effects and positive feedback loops. Each new user makes Meta’s original platform more valuable by increasing potential social connections and interactions, which in turn attracts more users.

This growth cycle is amplified by personalized content and advertisements that improve as more data is collected, making the platform increasingly engaging for users and more valuable for advertisers.

The intertwining of network effects with positive feedback loops creates a dominant social media platform that becomes increasingly indispensable to users and advertisers alike, cementing Facebook’s market leadership.

Recombination of Ideas

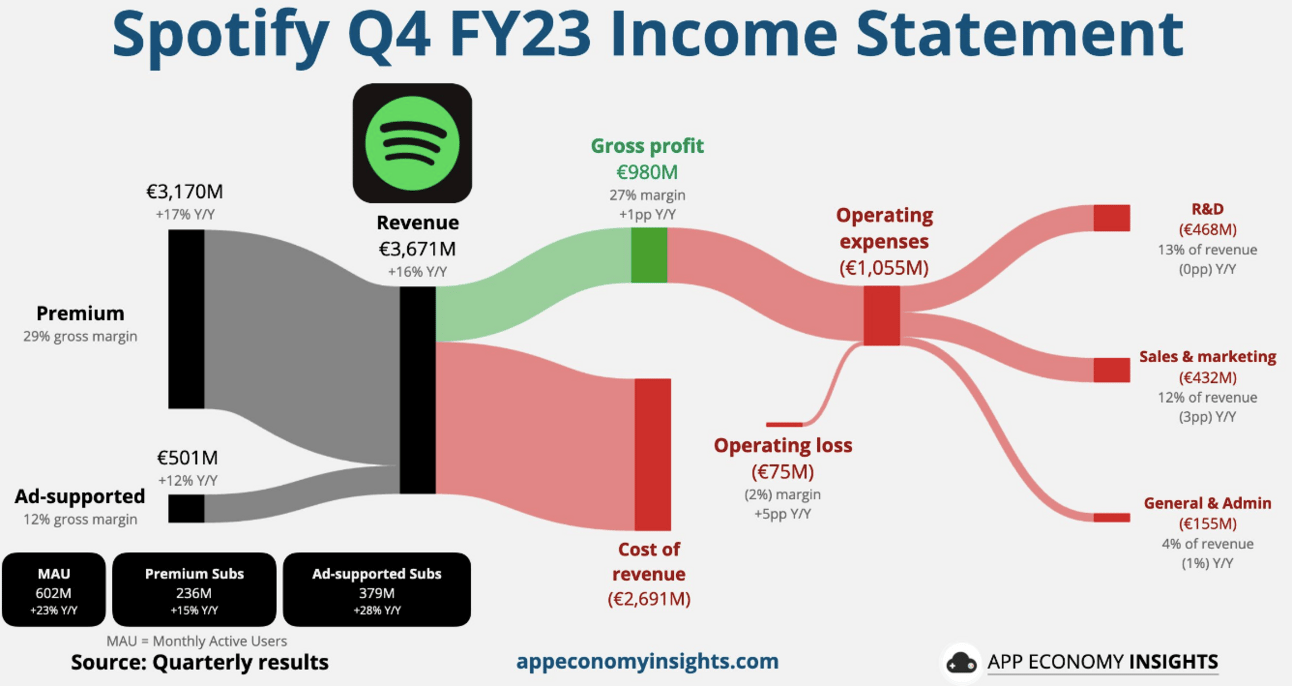

Spotify transformed music listening by merging the vast library of streaming music with personalized playlists and algorithmic recommendations.

This recombination of ideas created a new music experience that caters to individual tastes while providing unlimited access to music.

By leveraging the cloud for storage and algorithms for personalization, Spotify has made discovering and enjoying music easier, changing consumer habits and expectations around music consumption.

This innovative approach to combining existing technologies and ideas has established Spotify as a leader in the music streaming industry. It illustrates the transformative potential of recombining existing concepts in novel ways.

What’s the Opportunity in All This?

These giants have created a kind of members-only club, with a sea of firms facing a brutal churn of competition. But the regulatory spotlight is intensifying, questioning the societal cost of the meteoric rise of some titans.

And history whispers a word of caution – with tales of yesteryear’s giants like Nokia, Blackberry, or AOL serving as stark reminders that today’s leaders could be tomorrow’s relics.

That said, if you dive into the world of increasing returns, you’ll find a treasure map to understanding why some tech behemoths keep on winning and why they’ve come to dominate the overall stock market.

This concept also explains why companies like Apple have continued to smash expectations year after year and why high-quality, mega-big businesses have persistently outshined the rest.

This isn’t simply about explaining the past. Dive into the heart of a company’s success—like Meta’s power of network effects or Microsoft’s knack for learning and mixing ideas—and you’ll get a taste of its competitive edge and a whiff of how sustainable it might be.

This insight can be your guide to spotting which companies have a grip on their throne and which could become the next Blackberry.

If you’re ready to get your hands dirty, use this framework as a tool to uncover the next big things out there – those under-the-radar firms that are just beginning to ride the increasing returns wave.

By dissecting each element – from economies of scale to idea recombination – you can pinpoint companies poised for explosive growth, sturdy competitive edges, and, hopefully, strong stock gains.

Or, if you want to take just one simple lesson from all this, it might be to cut your losers short and let your “increasing returns” winners run.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research