- 3 Big Scoops

- Posts

- 🗞 Amazon On Cloud Nine

🗞 Amazon On Cloud Nine

while Apple Services drives growth

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

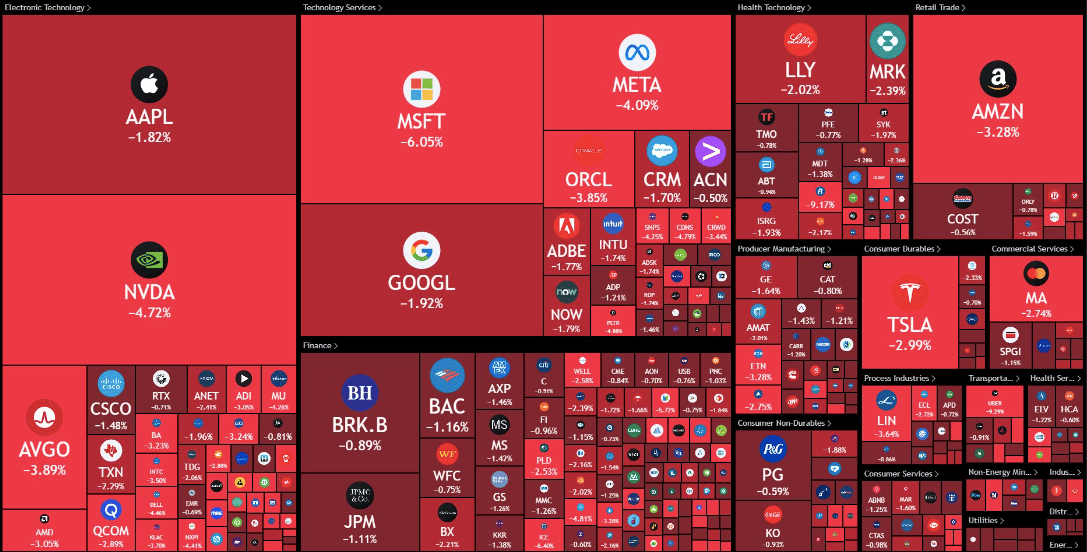

S&P 500 @ 5,705.45 ( ⬇️ 1.86%)

Nasdaq Composite @ 18,095.15 ( ⬇️ 2.76%)

Bitcoin @ $70,047.18 ( ⬇️ 2.88%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter today?

👉 Amazon crushes Wall Street estimates

👉 Apple surprises in fiscal Q4

👉 Chevron is on the move

So, let’s go 🚀

Market Wrap

Stocks slid on Thursday as Wall Street digested discouraging quarterly reports from megacap tech names and awaited further results.

Microsoft shares tumbled 6% after its revenue guidance disappointed investors and overshadowed a quarterly earnings beat. Meta Platforms slipped over 4% as the social media giant missed estimates for user growth and warned of rising capital expenditures in 2025.

Thursday also marked the end of a losing trading month, a negative mark amid a strong year. The Dow led the slide with 1.3%, while the S&P 500 and Nasdaq shed 1% and 0.5% respectively.

The latest personal consumption expenditure price index showed that 12-month inflation rose at a rate of 2.1% in September, which is in line with estimates and moving closer to the Fed’s 2% target. The PCE reading is the Fed’s preferred inflation gauge.

The PCE reading, October’s payroll report, and unemployment data will inform the Fed’s interest rate decision next week.

Trending Stocks 🔥

Peloton - Shares surged over 27% after posting better-than-expected results in fiscal Q1. It also announced Ford executive Peter Stern as its next CEO and reported a free cash flow in the last quarter.

Intel - The chip maker has advanced over 7% in pre-market on better-than-expected Q3 revenue.

BJ’s Restaurants - The restaurant stock is down 6% in pre-market after reporting a loss in Q3 of 2024.

Amazon Stock Rallies 7%

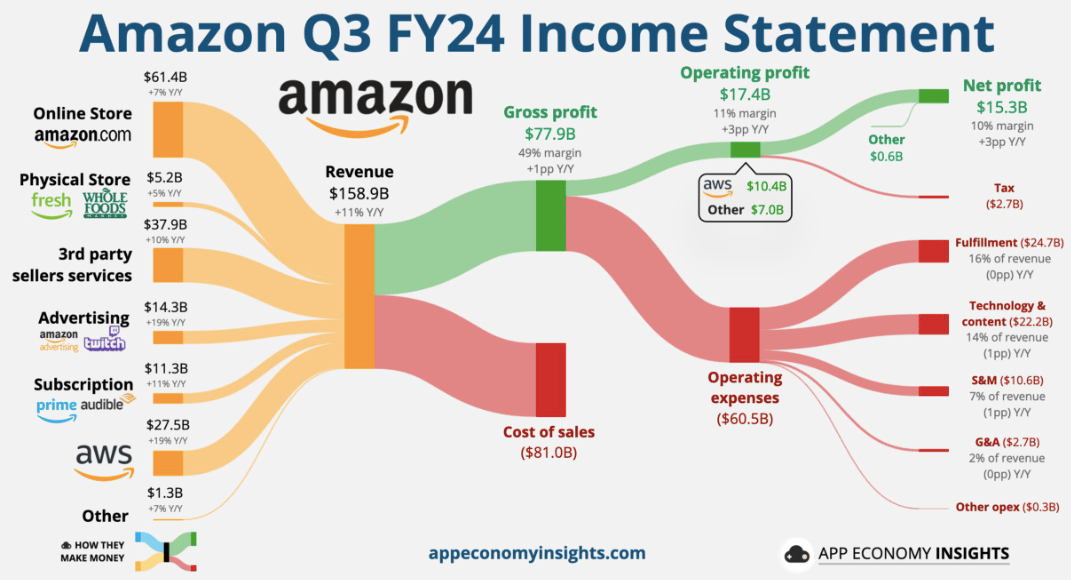

Amazon reported better-than-expected earnings and revenue for Q3, driven by growth in its cloud computing and ad businesses, pushing the stock higher by 7% in pre-market.

In the September quarter, Amazon reported:

👉 Revenue of $158.88 billion vs. $157.2 billion

👉 Earnings per share of $1.43 vs. estimates of $1.14

👉 Amazon Web Services sales of $27.4 billion vs. estimates of $27.5 billion

👉 Ad sales of $14.3 billion, in line with estimates

While AWS sales were marginally below estimates, they grew faster than last year. The cloud business rose 19% yearly, higher than 12% last year. However, this was still lower than Microsoft’s Azure growth of 33% and Google Cloud’s growth of 35%.

The tech giant continues to invest heavily in data centers to power AI products, increasing capital expenditures by 81% to $22.62 billion. Notably, it expects to spend $75 billion on capex this year.

Its operating income rose by 56% to $17.4 billion as the company focused on cost efficiency, having cut more than 27,000 jobs since 2022.

Ad revenue was up 19%, outpacing its core retail business. Meta’s ad business rose by 15%, while Google and Snap saw a 15% bump in ad revenue in Q3.

At the midpoint estimates, Amazon expects Q4 sales to rise by 9% to $185 billion, below estimates of $186.2 billion.

Apple Q4 Beat

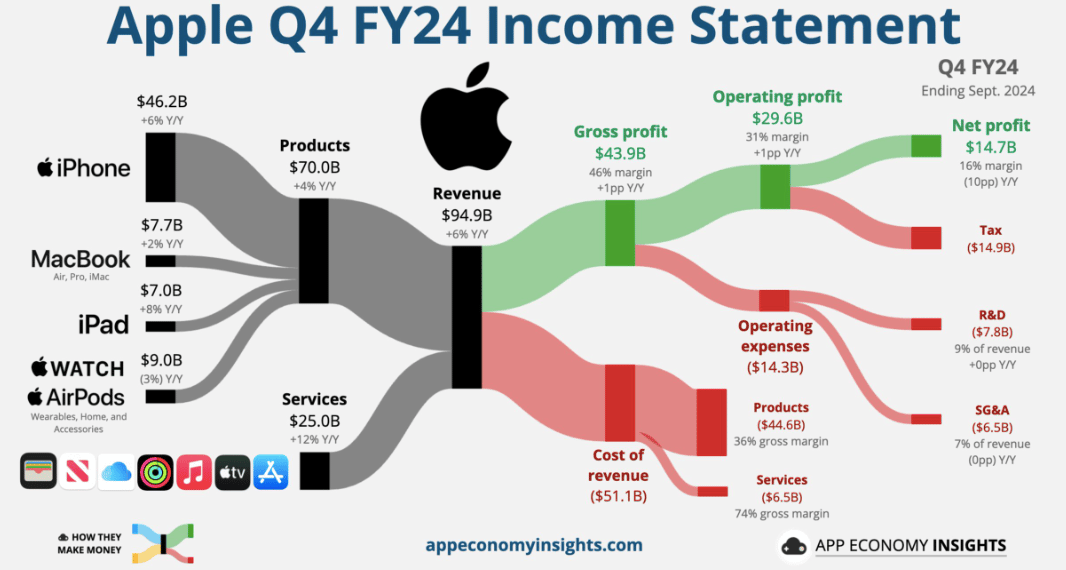

Apple’s fiscal Q4 results beat Wall Street estimates for revenue and earnings as it reported:

Revenue of $94.93 billion vs. estimates of $94.58 billion

Earnings per share of $1.64 vs. estimates of $1.60

iPhone revenue of $46.22 billion vs. estimates of $45.47 billion

Services revenue of $24.97 billion vs. estimates of $25.28 billion

iPhone sales rose 6% and accounted for 49% of total revenue. Apple’s latest iPhone was launched in September, while the tech behemoth unveiled its AI system this week.

Apple’s iPad business led hardware sales, growing 8% to $6.95 billion, while Mac sales rose 2% to $&.74 billion.

Its adjusted earnings per share rose by 12%, ending the quarter with $156.65 billion in cash. In the current quarter, Apple expects low to mid-single-digit sales growth while projecting Service growth to be similar to last year, which stood at 12.87%.

The higher-margin Services business grew by 12% to almost $25 billion, while wearables sales fell by 3% to $9.04 billion.

The Services business reported a gross margin of 74%, compared to an overall margin of 46.2%. The business includes licensing revenue from Google, cloud subscription services such as iCloud, content subscriptions such as Apple TV+ and Apple Music, and more.

In Q4 of 2014, Apple’s Services revenue stood at $4.8 billion. Today, as a standalone entity, the segment would be as big as the 40th largest Fortune 500 company.

Chevron Ticks Higher

Chevron beat Q3 earnings and revenue estimates, as it reported:

👉 Revenue of $50.67 billion vs. estimates of $48.99 billion

👉 Earnings per share of $2.51 vs. estimates of $2.43

However, Chevron’s net income declined significantly year over year due to lower margins on refined product sales and lower commodity prices.

The energy heavyweight aims to streamline its portfolio with asset sales in Canada, Congo, and Alaska, which are expected to close in the current quarter. It is also targeting cost reductions between $2 billion and $3 billion which will be completed over the next two years.

The oil major returned a record $7.7 billion to shareholders in Q3, including $4.7 billion in buybacks and $2.9 billion in dividends.

Chevron produced 3.36 million oil-equivalent barrels per day, an increase of 7% due to record output in the Permian basin.

CVX stock is flat year-to-date, underperforming the S&P 500 energy sector, which has gained over 6%. Shares have struggled to gain pace as uncertainty looms over its $53 billion acquisition of Hess.

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

Headlines You Can't Miss!

China’s Zeekr almost doubles EV deliveries in October

Intel stock jumps on earnings beat

Byd’s outlook in Q4 surpasses Tesla

China’s manufacturing output expands in October

Tether reports $2.5 billion profit in Q3 of 2024

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.