- 3 Big Scoops

- Posts

- 🗞 Microsoft, Meta Disappoint

🗞 Microsoft, Meta Disappoint

while Reddit stuns Wall Street

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

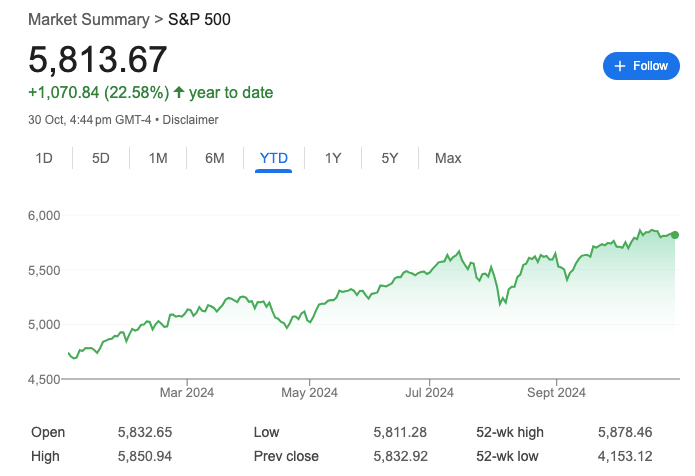

S&P 500 @ 5,813.67 ( ⬇️ 0.33%)

Nasdaq Composite @ 18,607.93 ( ⬇️ 0.56%)

Bitcoin @ $72,430.21 ( ⬆️ 1.22%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter today?

👉 Microsoft’s guidance falls short

👉 Meta warns of high AI spending

👉 Reddit turns profitable

So, let’s go 🚀

Market Wrap

Stocks slipped on Wednesday as investors digested a deluge of earnings reports and looked toward more results from megacap tech companies.

Alphabet kicked off a major week for megacap tech earnings. The Google parent crushed consensus estimates due to strong revenue growth from its cloud business, driving the stock higher by 3%.

Other major market movers included:

👉 AMD that shed over 10% as Q4 revenue guidance failed to impress investors.

👉 Super Micro Computer, which plunged over 30% after the company’s departing auditor raised concerns over its financial statements.

Elsewhere, the latest numbers pointed to a mixed backdrop. The U.S. economy grew slower than expected in Q3 as GDP rose by 2.8% annually, compared to estimates of 3.1%.

However, payroll data on Wednesday pointed to a stronger-than-expected labor market, as private job creation jumped to its highest level in more than a year.

Today, investors await the personal consumption price index for September, which is the Fed’s preferred inflation indicator. Economists expect the PCE to rise by 2.1% from the year-ago period.

Trending Stocks 🔥

Booking Holdings - Shares of the online reservation company are up 6% in pre-market after it reported earnings of $83.39 per share and revenue of $7.99 billion, compared to estimates of $77.52 per share and $7.63 billion, respectively.

Starbucks - Shares ticked lower after the coffee chain said its same-store sales dropped 7% in fiscal Q4 due to sluggish demand in the U.S. and China. It reported revenue of $9.07 billion and earnings of $0.80 per share, vs. estimates of $9.36 billion and $1.03 per share, respectively.

Garmin - The stock rallied to a fresh 52-week high after it posted revenue of $1.59 billion and earnings of $1.99 per share in Q3 vs. estimates of $1.44 billion and $1.45 per share, respectively.

Microsoft Stock Falls Over 4%

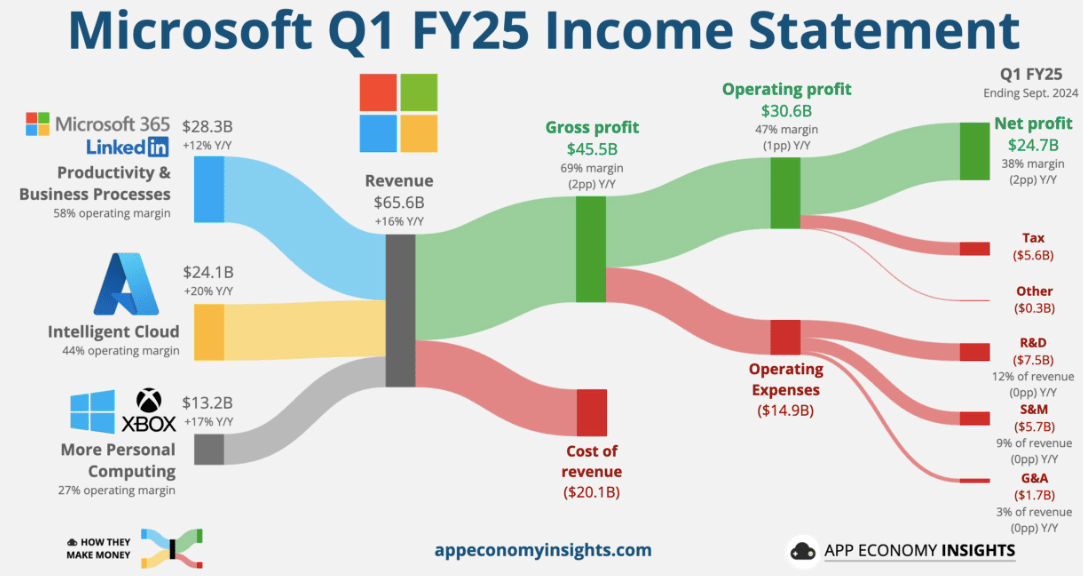

Shares of Microsoft are down over 4% in pre-market after the company reported an earnings and revenue beat in fiscal Q1 of 2025 (ended in September). In Q1, it reported:

👉 Revenue of $65.59 billion vs. estimates of $64.51 billion

👉 Earnings per share of $3.30 vs. estimates of $3.10

It forecast sales between $68.1 billion and $69.1 billion in the current quarter, indicating a 10.6% YoY growth at the midpoint. Comparatively, analysts were looking for $69.83 billion in revenue.

Microsoft claimed that suppliers are late in delivering data center infrastructure, which means it won’t be able to meet demand in fiscal Q2.

Revenue from productivity and business processes rose 12% to $28.3 billion in Q2, above estimates of $27.9 billion.

Its intelligent cloud segment rose by 20% to $24.09 billion, above estimates of $24.04 billion. Notably, Google reported a 35% annual growth in its cloud business in the September quarter.

Its personal computing business rose by 17% to $13.18 billion, above estimates of $12.56 billion.

Its AI infrastructure is a major focus for investors as Microsoft continues to ramp up chip spending to handle bigger workloads. In Q1, Microsoft’s property and equipment spending grew by 50% to $14.92 billion, above estimates of $14.58 billion.

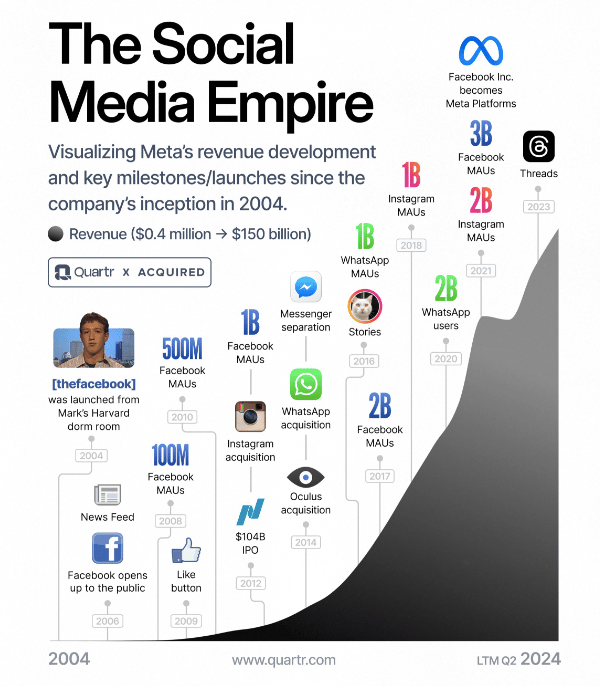

Meta Platforms Stock Moves Lower

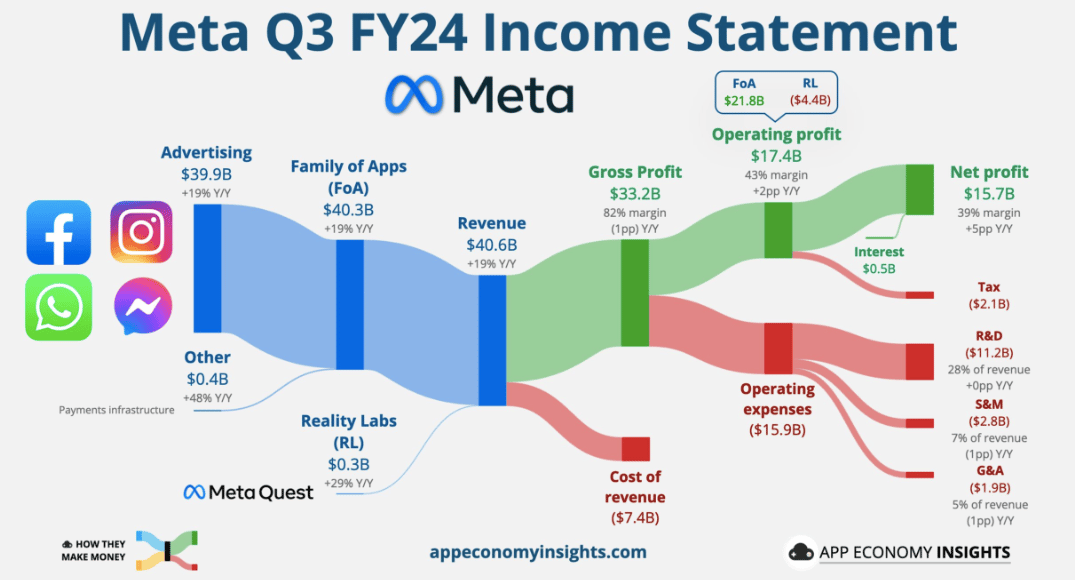

Meta reported weaker-than-expected user numbers and warned of an acceleration in infrastructure expenses in 2025, driving the stock lower by 3.5% in pre-market.

In Q3 of 2024, Meta reported:

👉 Revenue of $40.59 billion vs. estimates of $40.29 billion

👉 Earnings per share of $6.03 vs. estimates of $5.25

Meta’s Q3 sales rose by 19% while net income grew 35% to $15.7 billion, up from $11.6 billion in the year-ago period. It was Meta’s slowest YoY net income growth since Q2 of 2023.

At the midpoint estimate, Meta forecast Q4 sales at $46.5 billion, above estimates of $46.3 billion.

It reported 3.29 billion daily active users for Q3, up 5% year over year and below estimates of 3.31 billion.

The social media giant also raised its capital expenditures guidance for 2024 to $39 billion, above its earlier forecast of $38.5 billion. Due to an acceleration in infrastructure expenses, it expects capital expenditures to grow significantly in 2025.

Meta reported ad revenue of $39.9 billion, up 18.7% year over year. Ad sales accounted for 98.3% of total revenue in Q3.

Its Reality Labs hardware unit posted an operating loss of $4.4 billion, narrower than estimates of a $4.68 billion loss. Sales in the segment rose by 29% to $270 million, below estimates of $310.4 million.

Meta’s Reality Labs unit has recorded an operating loss of over $58 billion since the start of 2020.

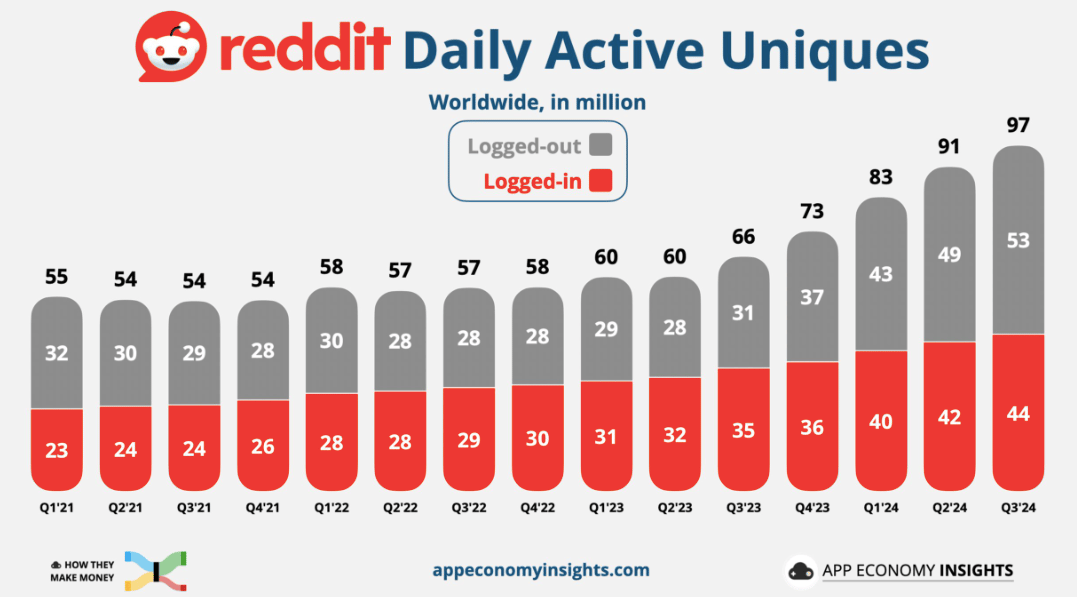

Reddit Rallies To Record High

Reddit shares rallied over 40% yesterday after the social media company reported Q3 results, topping analyst estimates. In Q3, it reported:

👉 Revenue of $348.4 million vs. estimates of $312.8 million

👉 Earnings per share of $0.16 vs. estimates of a loss of $0.07

It forecast sales in Q4 between $385 million and $400 million, above estimates of $358 million. Its adjusted earnings for Q4 are estimated between $110 million and $125 million, higher than estimates of $85.2 million.

Revenue in Q3 rose 68%, allowing Reddit to report a net income of $29.9 million, compared to a loss of $7.4 million in the year-ago quarter. Its daily active users were up 47% to 97.2 million, bettering estimates of 96.5 million.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Headlines You Can't Miss!

Euro Zone inflation tops 2%, higher than estimates

Shell posts $6 billion profit beat

Stellantis posts 27% drop in sales

Microsoft is launching an index tied to sports teams

MicroStrategy announces plan to raise $42 billion to buy Bitcoin

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.