- 3 Big Scoops

- Posts

- 🗞 Apple Turns Intelligent

🗞 Apple Turns Intelligent

PLUS: Bitcoin tops $70k (again!)

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,823.52 ( ⬆️ 0.27%)

Nasdaq Composite @ 18,567.19 ( ⬆️ 0.26%)

Bitcoin @ $71,157.11 ( ⬆️ 6.33%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Apple unveils AI features

👉 Pfizer’s stock gains post Q3 results

👉 Bitcoin is on the move

So, let’s go 🚀

Market Wrap

Stocks jumped on Monday as investors look for a batch of megacap technology earnings to keep driving the Nasdaq Composite index to new heights this week. A cooling geopolitical situation also aided risk sentiment.

Weekend airstrikes by Israel against Iran did not target oil or nuclear facilities as was feared, and oil futures sold off on the day. U.S. crude futures were down 6%, along with international benchmark Brent.

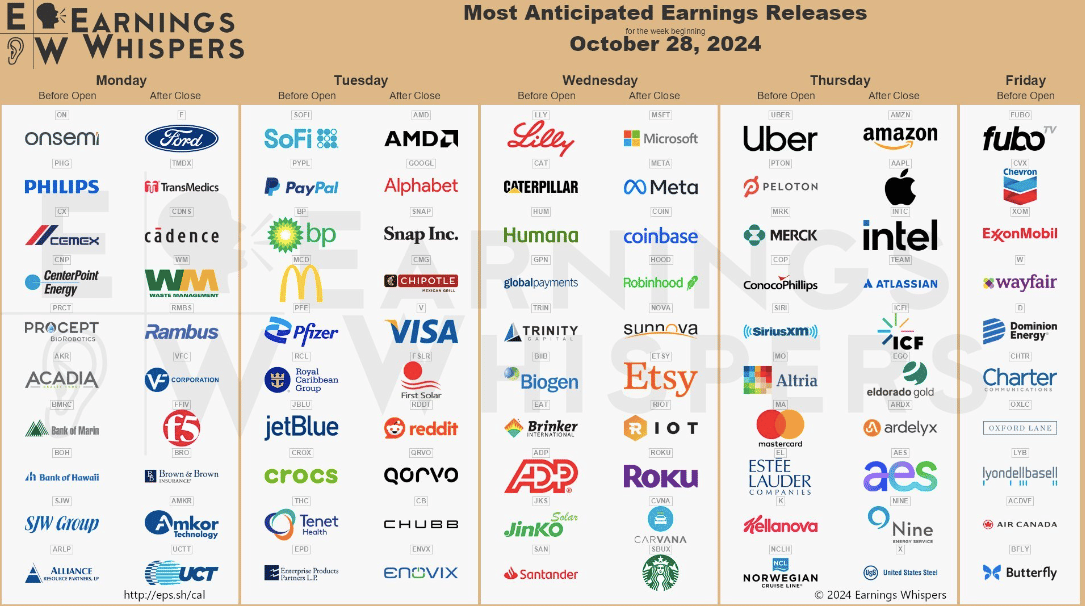

The ongoing week is the busiest one in the Q3 earnings reporting season. It’s also the last week before the U.S. presidential election and the Fed Reserve’s policy decision.

Five Magnificent Seven companies—Alphabet, Microsoft, Meta, Amazon, and Apple—are scheduled to report their latest financial results this week.

Given the steep valuations in the equity market, the focus will be on whether big tech can continue to grow steadily.

Traders are also monitoring a slew of key economic data this week, including a preliminary reading on Q3 gross domestic product tomorrow, the PCE index on Thursday, and the October jobs report due Friday.

Trending Stocks 🔥

Spotify - The music platform rose 1.4% after Wells Fargo named Spotify as a top stock pick. The investment is bullish on its rising margins, strong product mix, and evolving record label partnerships.

Robinhood - Shares rose 3% after the retail investing company announced users can trade a Kamala Harris or Donald Trump contract ahead of the presidential election.

Boeing - The aircraft maker slipped 2.8% after it launched a stock offering that could raise $19 billion. The move should shore up company financials, as a worker strike and a slew of production and safety issues hit Boeing.

Apple Intelligence is Here

Yesterday, Apple released an update that includes Apple Intelligence for the iPhone 16 and iPhone 15 Pro. It also released software updates for iPad and Mac with Apple Intelligence.

The release is a critical milestone for Apple, as it is relying on the feature launch to power its marketing campaign for the iPhone 16 lineup released in September.

It is also Apple’s answer to Wall Street’s questions about its AI strategy. Apple has taken a different path with its device-based AI than its megacap rivals, which are focused on cloud-based AI systems powered by billions of dollars of Nvidia chips.

The initial Apple Intelligence features include writing tools that can proofread or rewrite text and a feature that can summarize a stack of notifications into a single message.

The release includes improvements to Siri, which can now answer questions about Apple products, including troubleshooting.

Investors expect Apple Intelligence to drive a major upgrade cycle and cement the iPhone maker as the leader in the daily usage of cutting-edge AI.

You need an iPhone 15 Pro Max or any iPhone 16 model to use Apple Intelligence. The service primarily uses the iPhone’s chip, which is why it does not work on earlier phones, though Apple's servers will handle some more complicated queries.

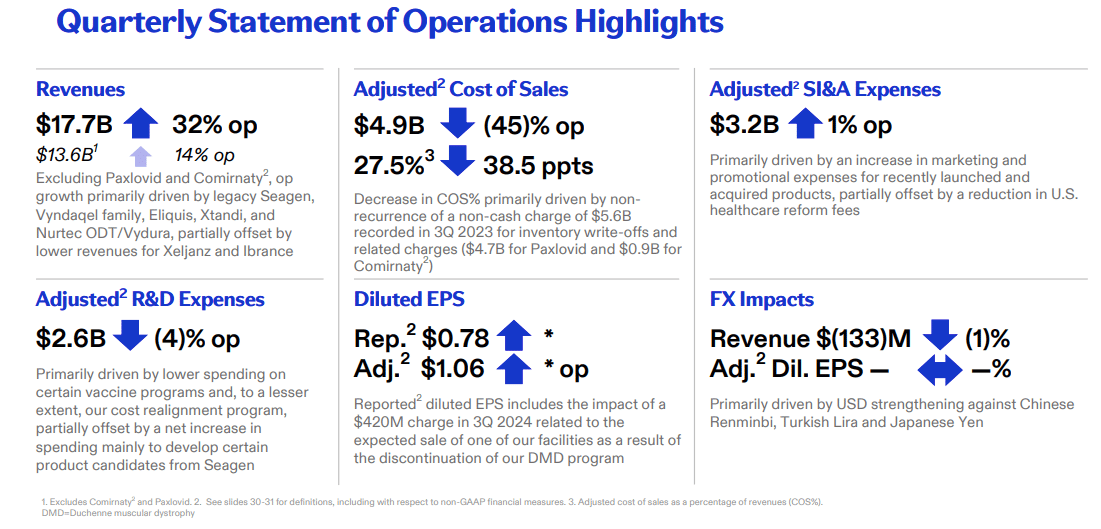

Pfizer Crushes Analyst Estimates

Pfizer just reported its Q3 revenue and earnings that blew past estimates as its Covid vaccine and antiviral pill Paxlovid helped boost sales.

In the September quarter, Pfizer reported:

👉 Revenue of $17.7 billion vs. estimates of $14.95 billion

👉 Earnings per share of $1.06 vs. estimates of $0.62

The pharma giant hiked its full-year outlook. It expects to book adjusted earnings per share of $2.85, higher than its previous guidance of $2.55. It forecast 2024 sales at $62.5 billion, up from its earlier forecast of $61 billion.

The earnings report was crucial for Pfizer, which is cutting costs to recover from the rapid decline of its COVID business and share price in the last two years. The healthcare stock is down 50% from all-time highs and is valued at $163 billion by market cap.

It is also wrestling with a proxy battle waged by the activist investor Starboard Value, which has a roughly $1 billion stake in the pharmaceutical company.

Starboard managing member Jeff Smith contends that Pfizer failed to capitalize on the windfall earned from its COVID products and destroyed tens of billions of dollars in market value.

Meanwhile, Pfizer previously said it is on track to deliver at least $4 billion in savings by the end of the year. The company announced a multiyear plan to slash costs in May, with the first phase of the effort slated to deliver $1.5 billion in savings by 2027.

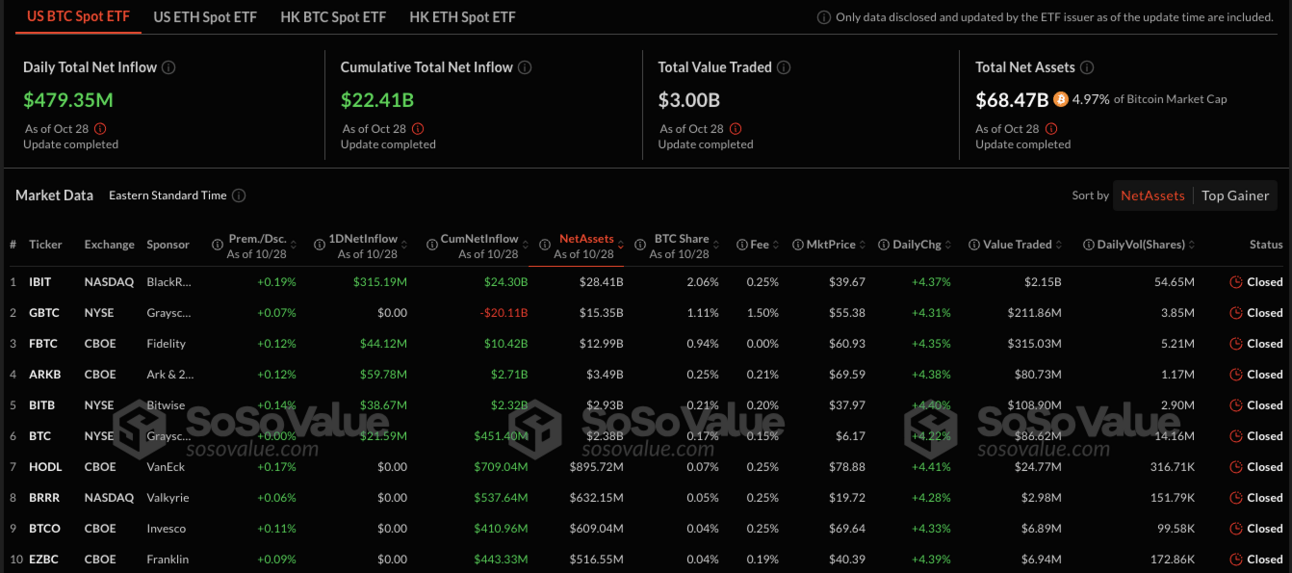

Bitcoin Tops $71,000

Bitcoin prices have surged over $71,000, rising more than 6% in the last 24 hours. The world’s largest cryptocurrency has more than doubled in the last year, rising 62% in 2024.

U.S. spot Bitcoin exchange-traded funds recorded net inflows of $479.35 million yesterday, the largest in two weeks. BlackRock’s IBIT, the largest Bitcoin ETF by net assets, led inflows with $315.19 million, extending the fund’s streak of positive inflows to 11 days.

The total daily trading volume for 12 ETFs reached $3 billion on Monday, up from $2.9 billion on Friday.

Meanwhile, spot Ethereum ETFs in the U.S. saw $1.14 million in net outflows on Monday, compared to $19.16 million on Friday.

ETH prices are up 46% in the last 12 months.

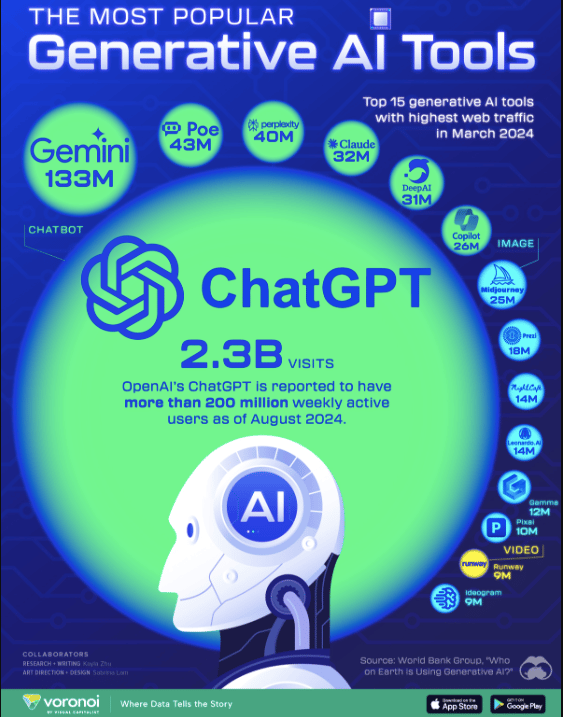

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Headlines You Can't Miss!

Sin taxes could play a role in Britain’s upcoming budget

BP posts weakest quarterly earnings in four years

McDonald’s beats Q3 revenue and earnings estimate

Chinese IPO listings in the U.S. set to increase

MicroStrategy benefits from big Bitcoin bet

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.