- 3 Big Scoops

- Posts

- Amazon's Massive EV Bet

Amazon's Massive EV Bet

PLUS: A soft landing is here (almost!)

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

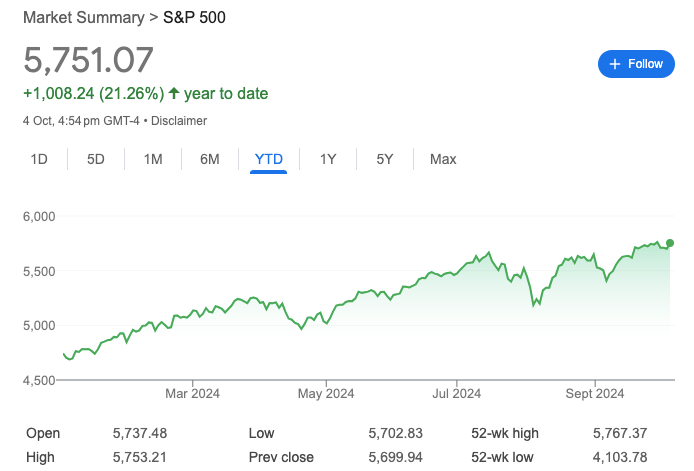

S&P 500 @ 5,751.01 ( ⬆️ 0.90%)

Nasdaq Composite @ 18,137.85 ( ⬆️ 1.22%)

Bitcoin @ $63,543.20 ( ⬆️ 2.37%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Amazon can save big as EVs gain traction

👉 Is a soft landing inevitable?

👉 Will the Bitcoin bull run begin?

So, let’s go 🚀

Market Wrap

Equities advanced on Friday after an expectation-defying jobs report increased investor confidence around the economy’s health. Nonfarm payrolls in September grew by 254,000, far outpacing the 150,000 gain forecast by economists. The unemployment rate ticked down to 4.1% despite estimates for it to hold steady at 4.2%.

Tesla, Amazon, and Netflix were among the mega cap tech names that moved higher on Friday, while financials was the top-performing sector in the S&P 500 during the session, rising 1.6%, driven by gains in JPMorgan Chase and Wells Fargo.

Friday’s bounce erased early-week losses, as mounting geopolitical tensions in the Middle East gave way to a shaky start in October, a turn after the market posted an unusually strong nine months of the year.

Crude oil prices rose again on Friday, bringing the weekly gain to 9%. Energy stocks rose in tandem as the sector gained 7%, its best week in two years.

Key releases in the week ahead include Thursday's consumer price index report. Meanwhile, earnings season will heat up with results from Delta Air Lines, JPMorgan Chase, and Pepsi.

Trending Stocks 🔥

Abercrombie & Fitch - Shares of the teen apparel retailer jumped 9% after JPMorgan added it to its positive catalyst watch list.

Spirit Airlines - The ultra-low-cost carrier plunged over 26%, following a report that it is potentially filing for bankruptcy after a failed merger with JetBlue.

Rivian Automotive - The EV maker slipped 8% after cutting annual production guidance for 2024, citing a supply shortage.

The Biggest Disruption to $martphones Since iPhone

Mode saw 32,481% revenue growth from 2019 to 2022, ranking them the #1 overall software company, on this year's Deloitte 500 fastest-growing companies list.

Mode has over $60M in revenue - this is your chance to invest in a $1T+ market opportunity!

This is a paid advertisement for Mode Mobile Reg A offering. Please read the offering statement at https://invest.modemobile.com/.

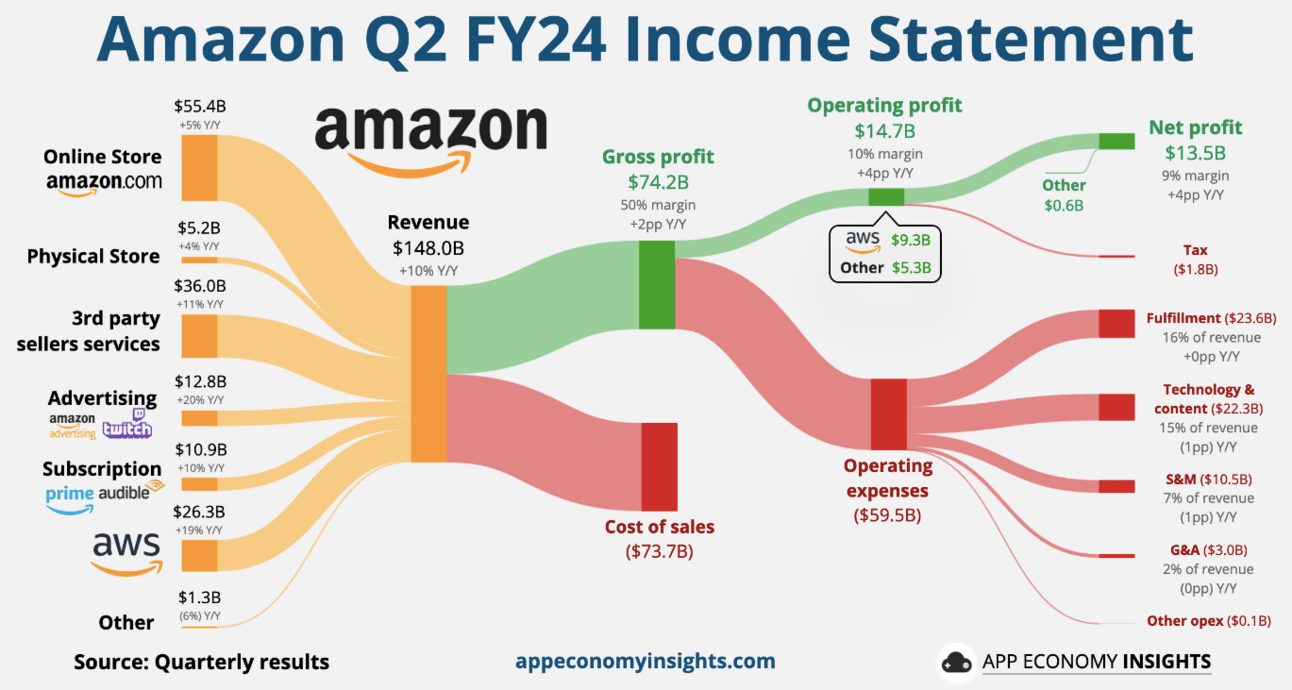

How Can Amazon Save $20 Billion a Year

Amazon can save more than $20 billion annually by deploying autonomous technology with electric Rivian vans and ditching the internal combustion engine vans for middle-mile transport.

Amazon has a 15.7% stake in Rivian, while the e-commerce giant acquired Zoox in 2020, aiming to enhance its capabilities in the autonomous vehicle space.

Fuel accounts for about 25% to 20% of the per-mile costs in middle and last-mile delivery. Now, EVs can cut per-mile energy costs by 50%, and wages and benefits account for more than 40% of the cost per mile.

According to a report from JMP Securities, Amazon can reduce shipping costs by 20% globally or $20 billion over time by utilizing autonomous driving technology for the middle mile and deploying electric vehicles for last-mile delivery.

In the near term, JMP expects Amazon to save $7 billion in annual savings as it converts its last-mile fleet to Rivian vans by the end of 2030.

Amazon is among the largest companies in the world, valued at $2 trillion by market cap. Despite its massive size, it continues to grow at an enviable pace while shoring up its profit margins.

For instance:

Operating margin for its North American business has improved to 5.6% from 3.9% in the past year

High-margin ad sales grew 20% annually in Q2 of 2024

Amazon Web Services sales rose by 19%, while the business reported an operating margin of 3%

The cloud computing market is forecast to touch $1.44 trillion by 2030

Its free cash flow has risen from $32 billion in 2023 to $48 billion in the last 12 months

Has the Fed Avoided a Recession?

September’s outsized payrolls boost lifted the U.S. economy out of the shadows of a recession and gave the Fed an open glide path to a soft landing, even with lingering inflation concerns straining consumer spending.

Nonfarm payrolls in September totaled 254,000, reversing a trend that started in April of decelerating job numbers and rising concern for a broader slowdown.

Analysts expect a 25 basis point interest rate in December, followed by eight similar cuts in 2025. This means that interest rates will fall by another 2.75 percentage points by the end of next year.

Falling interest rates should act as a tailwind for corporate earnings as companies can access debt at a lower rate to fuel their expansion plans.

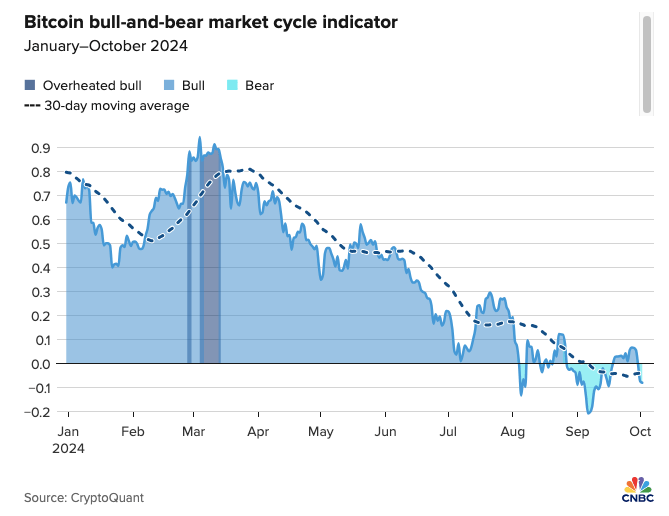

Bitcoin Trades 18% Below Record Highs

While Bitcoin touched a fresh all-time high in early 2024, the digital asset trades more than 15% below record levels. However, analysts are confident that the cryptocurrency can reach new records by the end of 2024.

A recent reawakening of demand for bitcoin ETFs is a positive sign for the price in the medium term, but according to CryptoQuant, demand for the cryptocurrency that backs those funds is stagnant and badly needs a boost if bitcoin is going to hit new records.

BTC is currently 18% off its March all-time high. The data firm said it could reach between $85,000 and $100,000 this quarter.

The fourth quarter of a bitcoin bull cycle tends to see huge gains, especially in a halving year. In the fourth quarters of 2012, 2016, and 2020 — the previous Bitcoin halving years — bitcoin prices rose by 9%, 59%, and 171%, respectively.

The most recent halving — the supply-cutting event that takes place every four years — happened this April.

After the September jobs report, Bitcoin rose nearly 2% on Friday. The digital asset is up 43% in 2024 and 127% in the last 12 months.

Headlines You Can't Miss!

Activist Starboard Value has a 1% stake in Pfizer

Mining giant Rio Tinto to acquire lithium producer Acardium

‘Joker’ rakes in $40 million on domestic debut

China’s stimulus plan could boost retailers such as Nike

New Ethereum proposal aims to increase throughput by 50%

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.