- 3 Big Scoops

- Posts

- S&P 500 Ends Q3 at Record High

S&P 500 Ends Q3 at Record High

Tesla, Vistra, PayPal and more

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,762.48 ( ⬆️ 0.42%)

Nasdaq Composite @ 18,189.17 ( ⬆️ 0.38%)

Bitcoin @ $63,742.77 ( ⬇️ 0.92%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Tesla gains pace

👉 Real estate and utilities outperform

👉 Bitcoin and gold rally

So, let’s go 🚀

Market Wrap

The S&P 500 index rose to a record close on Monday, concluding a winning month and quarter. Stocks rallied into the close, erasing losses after Fed Chair Jerome Powell stated that more interest rate cuts are on the horizon if the economy moves as expected.

Stocks struggled at multiple points in Q3, which also saw the global market rout on August 5th when the Dow shed over 1,000 points.

However, investors were able to scale those walls of worry as the Dow rose more than 8% in Q3, followed by the S&P 500 at 5.5% and the tech-heavy Nasdaq at 2.6%.

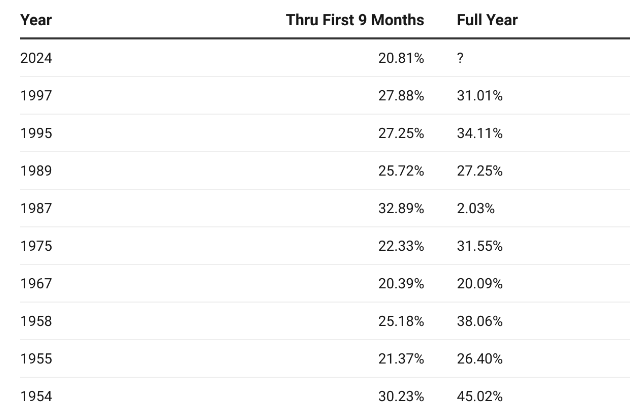

S&P 500 Gains of 20% or More In First Three Quarters

Source: CNBC

It was the first positive September for the S&P 500 since 2019. The flagship index has risen for four consecutive quarters for the first time since the seven straight quarters of gains ended in Q4 of 2021.

The S&P 500 index is up more than 20% in 2024. It is the first time since 1997 that the index has gained 20% or more in the first nine months of the year.

Trending Stocks 🔥

EchoStar - The satellite communications stock declined 11.5% after DirecTV agreed to buy the company’s satellite television business.

CVS Health - Shares rose over 2% on news that hedge fund Glenview Capital intends to meet with CVS executives to boost the struggling business.

Stellantis - The stock tumbled 12% and hit a 52-week low following the automaker’s full-year profit warning.

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

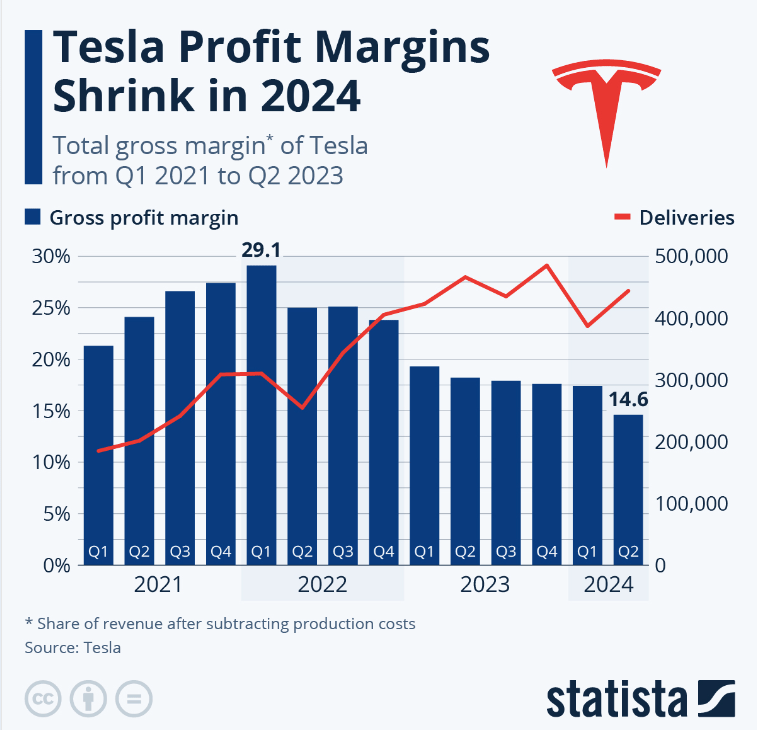

Tesla Gains Over 30% in Q3

Tesla staged a spectacular turnaround in Q3, gaining 32% in the last three months. Investors have been piling into the electric vehicle company ahead of its robotaxi event on October 10 and its Q3 delivery report expected tomorrow.

However, investors should remain skeptical that the event will yield something that will add to the company’s bottom line anytime soon and justify the stock’s recent rally.

For instance, Elon Musk has promised a full self-driving vehicle since 2017 and has failed to deliver on his lofty promises. Meanwhile, Tesla’s revenue and earnings growth remain under pressure amid sluggish consumer demand and rising competition.

Elsewhere, Nvidia posted its first losing quarter since 2022 after the AI darling captured investor attention since the start of 2023. Despite the pullback, NVDA stock has returned close to 140% in 2024.

Vistra shares moved higher yesterday, making it the best performer in the S&P 500 in September. Vistra stock surged close to 40% last month, eight percentage points higher than Constellation Energy.

Vistra is also the best-performing stock in 2024, more than tripling investor returns this year.

PayPal Leads the Nasdaq Index

Fintech giant PayPal and electric vehicle maker Tesla led the Nasdaq-100 to another winning quarter, rising 34% and 31%, respectively. The two stocks were the biggest winners in Q3, followed by DoorDash and Constellation Energy, which soared nearly 29%.

Other notable winners include Illumina, Starbucks, and Fortinet, which rallied over 20%.

3M and IBM Drive Dow Jones Higher

The Dow ended Q3 of 2024 with gains of 8%, outpacing the other two major indices. Shares of 3M surged 33%, leading the blue-chip average. It was the best quarter for 3M since the early 1970s.

Comparatively, IBM rose over 27%, its biggest quarterly gain since 2022.

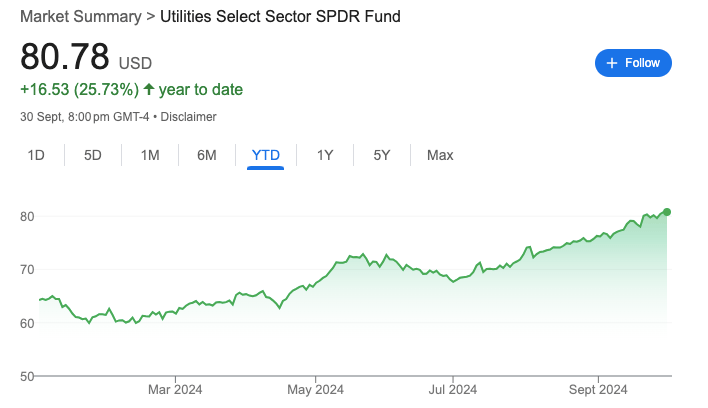

Utilities and Real Estate Impress in Q3

The utilities sector added 18% in Q3, making it the best-performing sector in the S&P 500. It is on track to notch its biggest quarterly gain since 2003. The sector is up 27% in 2024 and is on track to see its largest yearly advance since 2000.

After a rough start to the year, real estate stocks have staged a turnaround, rising 16% in Q3. Real estate investment trusts that offer attractive yields have suffered amid elevated interest rates, but they are expected to outperform with multiple rate cuts on the horizon.

The real estate sector is up 11% in 2024 after being down 5% at the end of Q2 of 2024.

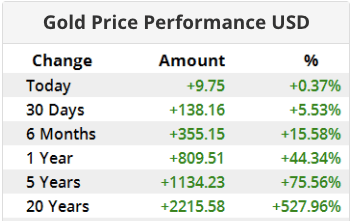

Gold Gains 6% in September

Gold prices surged 6% last month, adding to multiple record highs in 2024 and notching its best quarter in more than eight years.

Source: Goldprice.org

The precious metal traded at a fresh all-time high last week, touching $2,685.42 per ounce. Gold has rallied after larger-than-expected interest rate cuts, escalating tensions in the Middle East, and China’s efforts to stimulate the economy.

Bitcoin, also called digital gold, retreated on the final trading day of September following a rally last week. The flagship digital asset gained 8% last month, historically the worst month for cryptocurrencies.

Bitcoin has gained 45% in 2024 and is up 129% in the last 12 months.

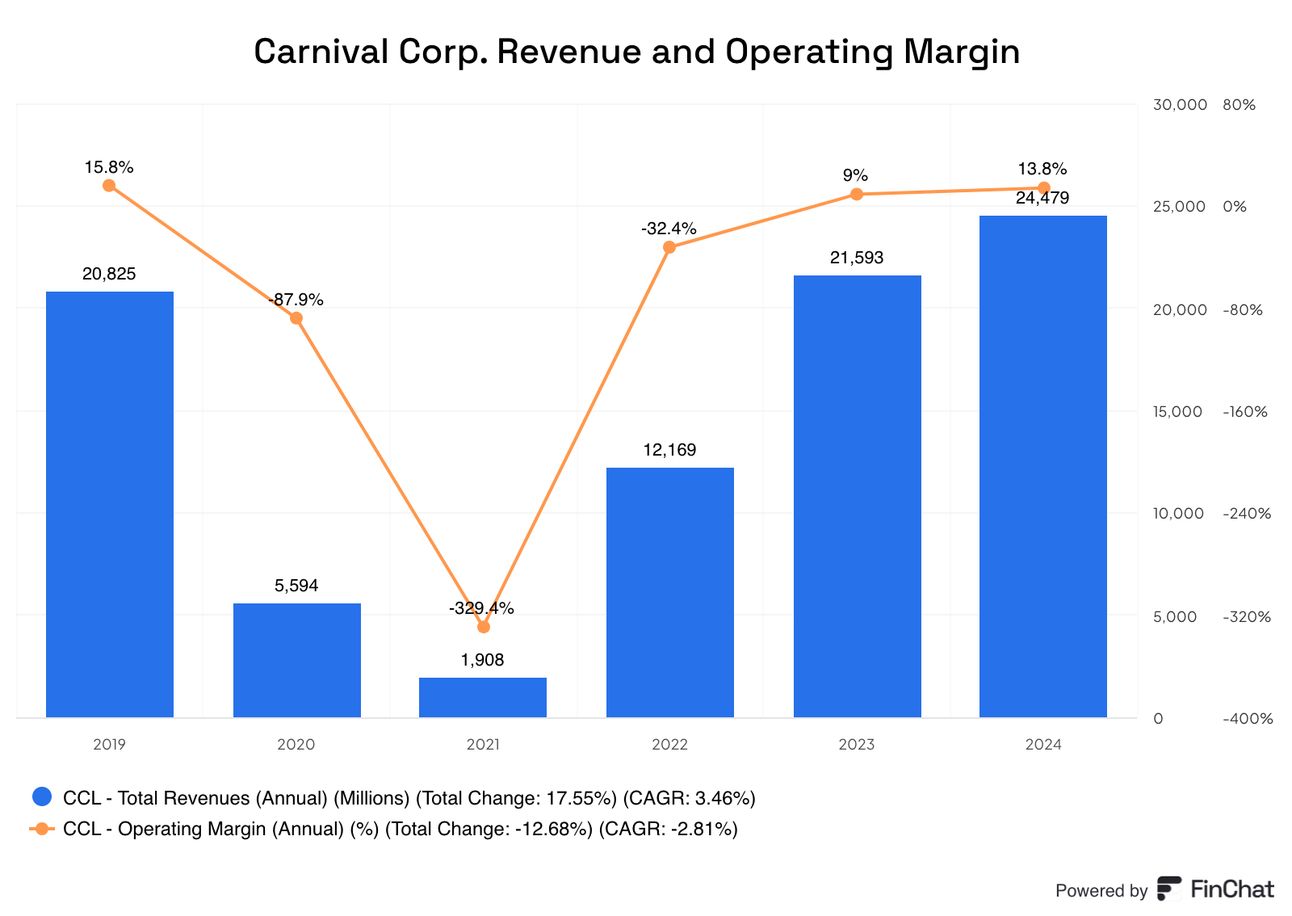

Carnival Moves Lower Post Fiscal Q3 Results

Shares of Carnival moved marginally lower after the cruise line offered weaker-than-expected guidance. It forecast adjusted earnings at $0.05 per share in the current quarter, lower than consensus estimates of $0.07 per share.

In fiscal Q3, it reported:

👉 Revenue of $7.9 billion vs. estimates of $7.83 billion

👉 Earnings per share of $1.27 vs. estimates of $1.16

Its quarterly sales rose by 15.2% year over year while operating income grew by 34% to $2.2 billion.

In the current quarter, it expects adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.14 billion, up 20% year over year.

Headlines You Can't Miss!

Robinhood launches crypto transfers in Europe

Chinese EV makers report record deliveries in September

CVS is working with advisors for strategic review

AI chipmaker Cerebras files for IPO

Hive Digital expands into AI data centers

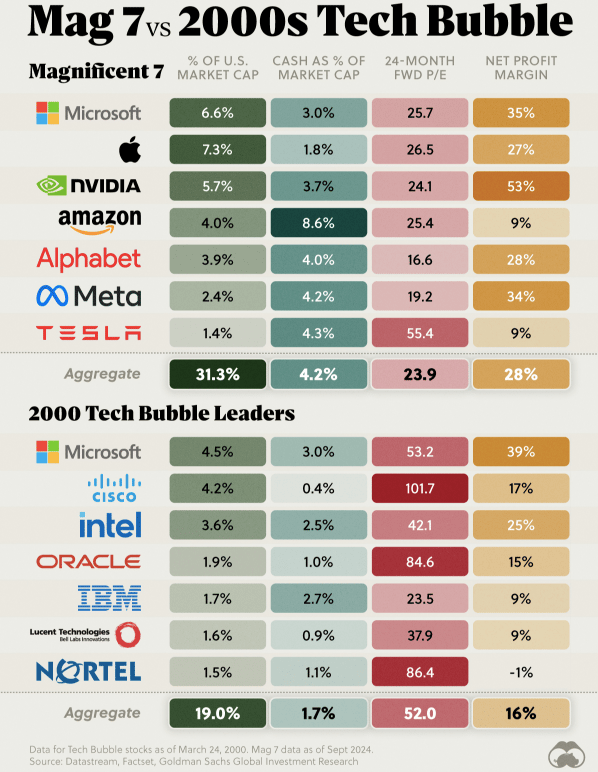

Chart of The Day

Source: Visual Capitalist

Meme of the Day

Source: WallStreetBets

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.