- 3 Big Scoops

- Posts

- Ulta Beauty Nosedives

Ulta Beauty Nosedives

Ulta Beauty, Disney, and Intel

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

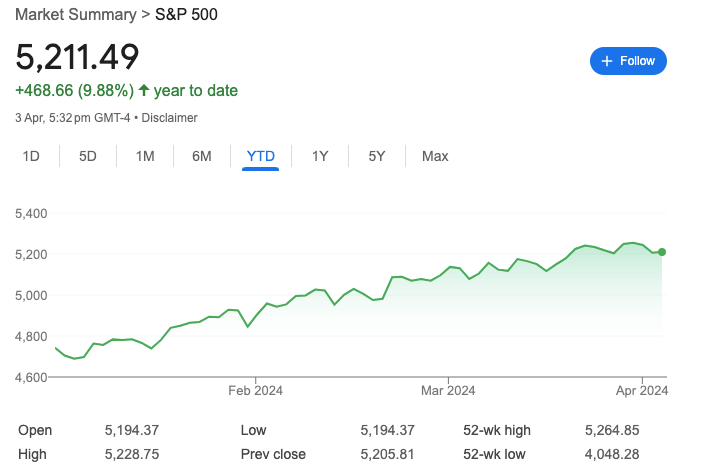

S&P 500 @ 5,211.49 ( ⬆️ 0.11%)

Nasdaq Composite @ 16,277.46 ( ⬆️ 0.23%)

Bitcoin @ $65,577.30 ( ⬇️ 0.62%)

Hey Scoopers,

Happy Thursday! We have a great newsletter for you today 👇

👉 Ulta Beauty warns of slowing growth

👉 Oil prices may weigh on inflation

👉 Crypto’s Q1 narratives

So, let’s go 🚀

Market Wrap 📉

The Dow Jones Industrial Average ended modestly lower yesterday as the legacy index failed to shake off its second-quarter malaise.

The 30-stock Dow has now fallen for the third consecutive day even as the S&P 500 and Nasdaq indices inched higher.

Elevated interest rates continue to weigh on investor sentiment. Moreover, ADP released data that showed private payrolls grew more than expected in March, indicating the economy remains resilient.

Additionally, Fed officials are unlikely to slash interest rates in a hurry. In fact, the Atlanta Fed President stated he only sees one interest cut in 2024.

Meanwhile, Fed Chair Jerome Powell emphasized that the central bank must see enough evidence that inflation has cooled down before embarking on rate cuts.

The probability of a rate cut in June has fallen to 62.3%, down from 70.1% last week.

Trending Stocks 🔥

Spotify - Shares of the music streaming company popped over 5% after Bloomberg reported it is raising prices for premium subscription services in multiple markets.

Tesla - Shares of the EV giant gained over 1% even though Guggenheim and Deutsche Bank slashed the price target on the stock following its weaker-than-expected delivery numbers.

Paramount Global - Shares added close to 15% after a New York Times report said the company could enter into sale discussions with media company Skydance.

Ulta Beauty Tumbles

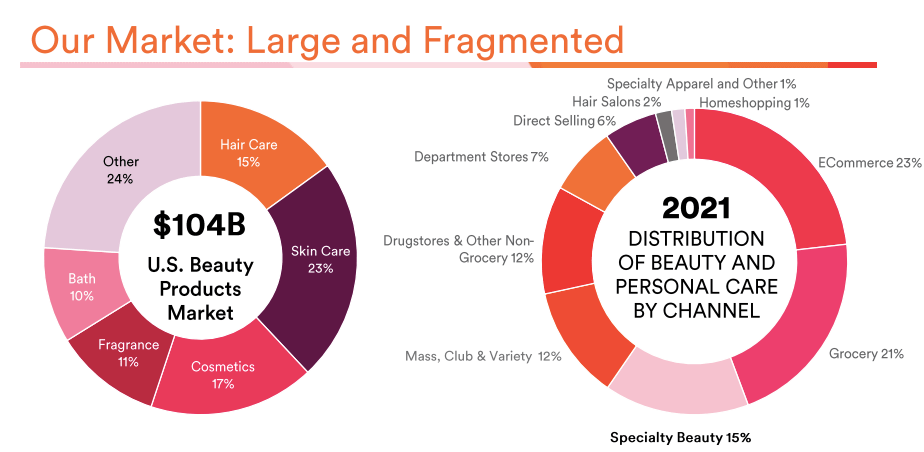

Shares of Ulta Beauty fell over 15% as the company warned about a slowdown in consumer demand. Other stocks in the segment, such as E.L.F. Beauty, Estee Lauder, and Coty, also tumbled yesterday.

Ulta expects sales to grow in the mid-single digits this year and claimed the slowdown has been “a bit earlier and bit bigger than we thought.”

Sluggish demand forced Ulta to cut price points across categories, including haircare and makeup.

Source: Ulta Beauty

The beauty industry has been among the hottest categories in retail even as consumers look to limit spending on discretionary items. The strength of the category inspired several retailers to place large bets on Ulta Beauty and its peers.

Target, one of the largest big-box retailers globally has opened several Ulta Beauty shops at its stores. Kohl’s plans to open Sephora outlets at its locations, while Macy’s is also expanding its beauty chain.

During its earnings call in March, Ulta forecast sales to range between $11.7 billion and $11.8 billion in fiscal 2024, higher than the $11.2 billion sales in 2023.

Ulta expects comparable sales to rise between 4% and 5% in 2024, slower than the growth of 5.7% in 2023 and 15.6% in 2022.

The retail stock touched an all-time high of $574 in March and is down 10% year-to-date.

Intel Stock Slumps 8%

Intel shares fell over 8% after it revealed widening operating losses in its semiconductor manufacturing business. It reported an operating loss of $7 billion in the foundry business in 2023, wider than its $5.2 billion loss in 2022.

Comparatively, sales in the segment fell from $27.5 billion to $18.9 billion in the last year.

Intel disclosed these numbers in a regulatory filing and expects foundry losses to peak in 2024.

Intel stock is down roughly 15% year-to-date after it surged over 90% in 2023.

Disney wins proxy fight

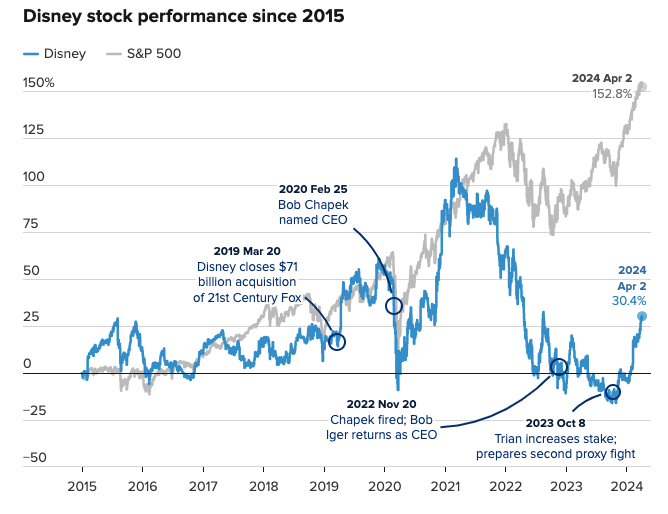

Shares of Disney shed over 3% as investors reacted to news that the entertainment heavyweight won its proxy fight against Nelson Peltz’s Trian Partners.

Preliminary results suggest that shareholders reelected Disney’s full board, marking the end of a months-long battle.

It seems activists failed to convince shareholders that they had a meaningful plan to fix issues at the House of Mouse.

Source: CNBC

Alternatively, Disney continues to face multiple challenges. For example, ESPN has lost subscribers for several years, raising questions about how it can compete effectively with streaming platforms.

Moreover, Disney’s streaming business has invested billions to expand its subscriber base and remains unprofitable as it tries to catch up with Netflix.

Disney stock is up over 30% year-to-date, comfortably outpacing the broader markets.

Oil, Payroll Data, and All-time Highs

The rally in crude oil prices would make it difficult for the Fed to cut interest rates, states Bank of America.

U.S. crude oil futures prices have surged close to 20% in 2024 due to steady demand, lower inventory levels, and a slowdown in production by OPEC+.

An oil run may easily cap the ability of central banks to lower rates, given that services inflation remains sticky. Energy prices are expected to rise in the near term as the global market slips into a supply deficit of 450,000 barrels per day.

BoA expects Brent to peak at $95 a barrel, up from its current price of $89, and will be a key driver of headline inflation.

Further, according to ADP data, companies added more workers than expected in March, indicating that the economy will remain strong.

Private payrolls increased by 184,000 in March, much higher than estimates of 155,000. It marked the fastest pace of growth since July 2023.

A resilient economy has translated to stock market gains in 2024. Yesterday, 30 stocks in the S&P 500 hit new 52-week highs.

A few of the names that hit the milestone include Micron, Domino’s Pizza, Kinder Morgan, Progressive, and Caterpillar.

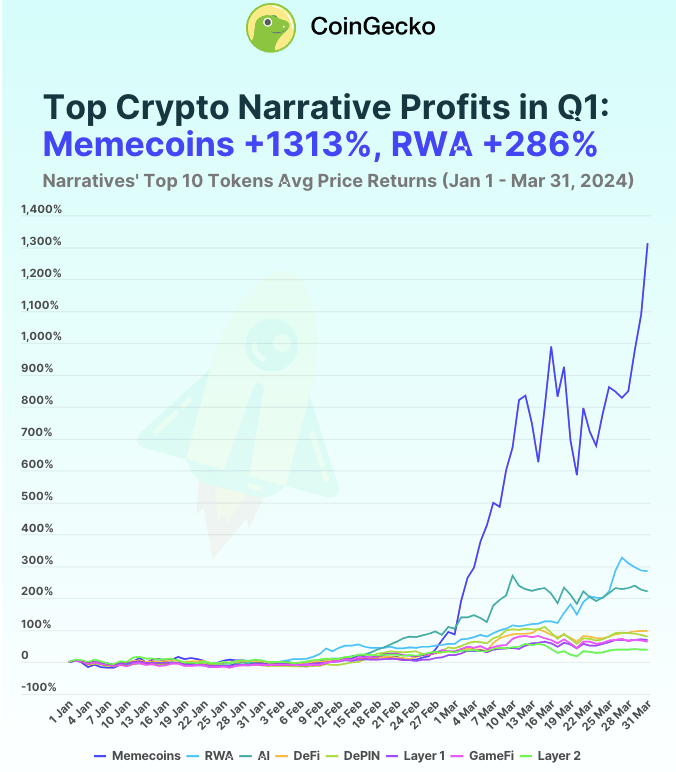

The Best Performing Crypto Narratives in Q1

According to a CoinGecko report, here are the top crypto narratives in Q1:

Memecoins

👉 On average, the top 10 memecoins gained 1,312% in Q1

👉 Three of the top 10 best-performing memecoins are less than a month old

👉 Memcoins were 4.6x more profitable than the next best-performing narrative

Real World Asset Tokens

👉 On average, the top 10 Real World Tokens gained 286% in Q1

👉 Just one RWA token called $XDC had negative returns

👉 RWA’s were briefly the most profitable crypto narrative before the memecoin mania took over

AI Tokens

👉 Just not stocks; even AI tokens are gaining pace. The top 10 AI tokens rose by 222% in Q1

👉 All AI tokens were in the green in Q1

👉 The lowest AI gainer (TRAC) returned close to 75%

Headlines You Can't Miss!

Tesla is exploring locations in India to set up a $3 billion factory

Amazon cuts jobs in its cloud business

SK Hynix plans to invest $3.9 billion in a chip factory in the U.S.

Is Apple exploring the personal home robots category?

Bitcoin futures signals buying opportunity

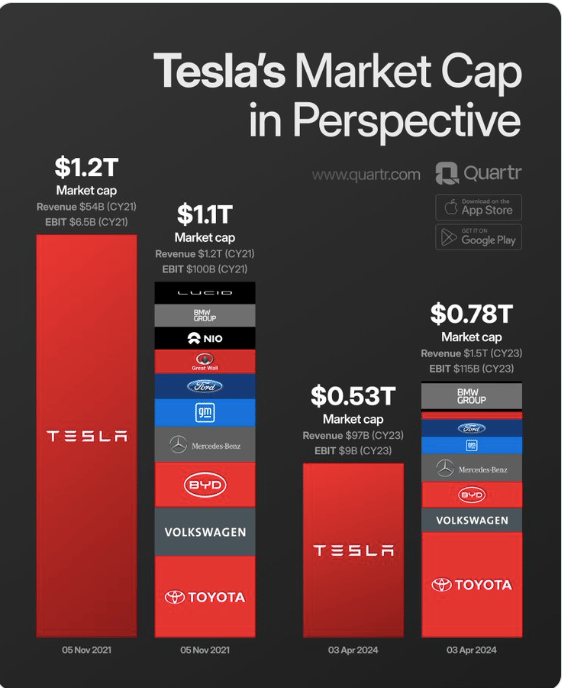

Chart of The Day

Tesla stock is down over 60% from all-time highs as it wrestles with multiple headwinds, including rising competition, a challenging macro backdrop, interest rates, inflation, and slower demand.

In 2021, Tesla stock was valued at $1.2 trillion by market cap. It has since trailed the broader markets by a wide margin.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.