- 3 Big Scoops

- Posts

- EV Stocks Are on Fire 🔥

EV Stocks Are on Fire 🔥

Tesla, Lucid, and Fisker

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

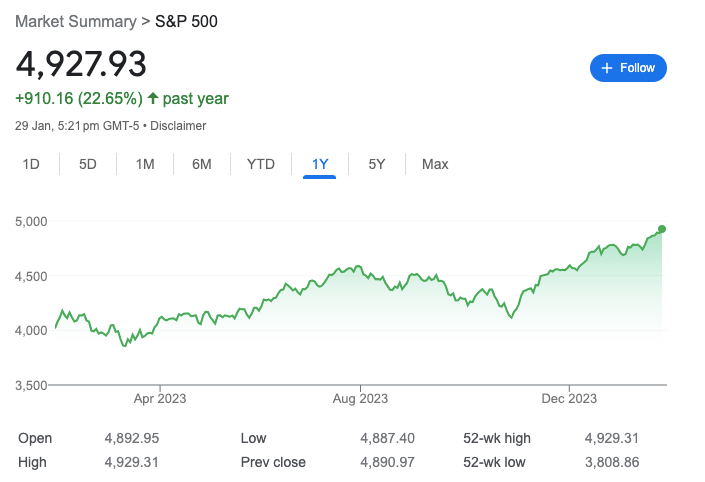

S&P 500 @ 4,927.93 ( ⬆️ 0.76%)

Nasdaq Composite @ 15,628.04 ( ⬆️ 1.12%)

Bitcoin @ $43,438.60 ( ⬆️ 0.31%)

Hey Scoopers,

Fasten your seatbelts! Here’s Tuesday’s breakdown:

👉 EV stocks gain big

👉 S&P 500 surges to all-time highs

👉 Fidelity Bitcoin ETF rakes in $208 million

Lucid Group Surges Over 27%

Electric vehicle stocks gained massive traction yesterday as shares of:

👉 Lucid Group surged 27%

👉 Fisker rose 13.5%

👉 Tesla increased 4.2%

Lucid announced it signed a three-year agreement with a Saudi-based company to provide aluminum panels for its manufacturing plants.

Fisker, on the other hand, emphasized it remains committed to its dealership strategy, while Nikola claimed it is experiencing a surge in interest around its hydrogen-powered business model.

Tesla had no company-specific news as the EV giant added billions of dollars to its market cap in a single trading session.

In the last few months, EV stocks have been battered due to sluggish consumer demand, rising interest rates, and an uncertain macro environment.

Despite the uptick in share prices, Lucid and Fisker are down over 90% from all-time highs, while Tesla has shed 53% since touching a record high in 2021.

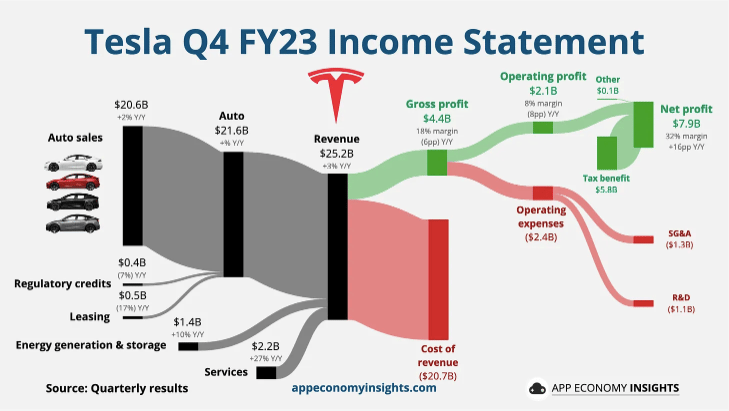

To offset lower demand, EV manufacturers have reduced vehicle selling prices, impacting profit margins in the process. Tesla recently reported its Q4 results and missed Wall Street estimates on earnings and sales.

Our Take

The recent gains in EV stocks may suggest that the drawdown in the last six months may have been exaggerated. However, investors should remain cautious as EV companies wrestle with multiple headwinds.

In addition to tepid demand, EV stocks must allocate significant resources to expand their manufacturing capabilities while fighting off competition from legacy players such as Ford and General Motors.

Yes, the EV market will expand at a rapid pace in the next two decades. But not every company in this market will be a winning investment.

Big Tech Earnings On the Cards

The S&P 500 index closed at a fresh record high yesterday as Wall Street looks forward to earnings from mega-cap tech giants and the Fed’s rate policy decision.

The ongoing week marks the busiest slate of the Q4 earnings season as 19% of the S&P 500 companies report their results. It includes big-tech companies such as Microsoft, Meta, Apple, Amazon, and Alphabet, a core group of tech stocks that have driven the index rally in the past year.

Investors will closely watch other large-cap companies that are part of the Dow Jones index, including Boeing and Merck, which will report earnings this week.

Meanwhile, the FOMC (Federal Open Market Committee) will begin its two-day policy meeting today. Investors are almost certain the Fed will keep interest rates steady and have assigned a 97% probability that the committee will not cut rates.

Bitcoin On the Move

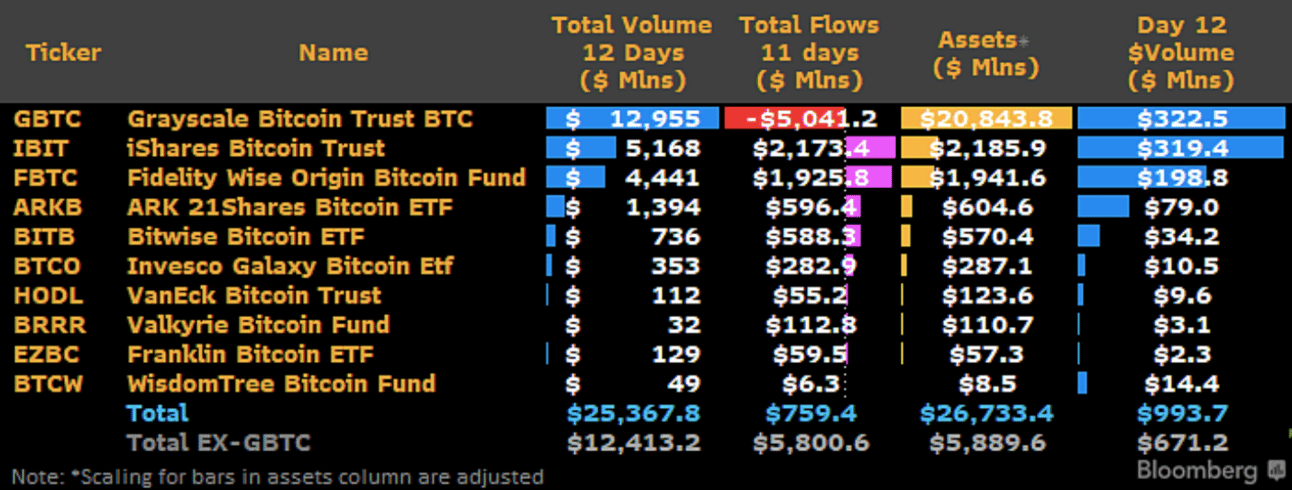

Fidelity’s spot Bitcoin exchange-traded fund (ETF) attracted $208 million in daily inflows yesterday, outpacing outflows from the Grayscale Bitcoin Trust (GBTC) for the first time since the ETF was launched.

According to Farside investors, the Fidelity Bitcoin ETF raked in $208 million in inflows on Jan. 29, compared to outflows of $192 million from GBTC.

The latest GBTC outflows indicate a 25% drop from $255 million on Jan. 26 and a 70% drop from the peak daily outflow of $641 million on Jan. 22.

Bitcoin prices fell over 20% after touching two-year highs, soon after the spot Bitcoin ETFs were approved earlier this month. According to analysts, the outflows from GBTC caused downward price pressure on BTC in the last two weeks.

Bitcoin currently trades at over $43,200, rising roughly 10% in the last four days.

Headlines You Can’t Miss!

Saudi Aramco halts plan to increase production capacity

Retail return fraud is on the rise

Amazon terminates deal with iRobot

General Motors to report Q4 earnings today

73% of Europeans are bullish on crypto

Chart of The Day

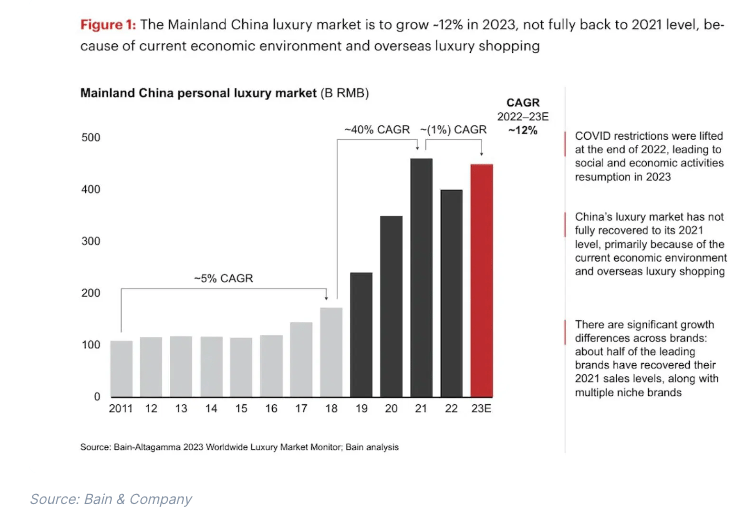

China’s drab economy might not be much to look at, but its glimmering luxury market proved it can still grab shoppers’ attention.

What does this mean?

China’s everyday shoppers haven’t been biting, even as retailers continue to pull their prices lower. After all, the wobbling housing market has undermined confidence in their single biggest asset.

International trade partners have also been more cautious with their cash, bringing in less money than China’s export industry made the year before last.

But one group is still spending big: the country’s luxury market made 12% more money last year than the one before, according to Bain & Company.

That’s partly because the well-to-do haven’t been jetting off to Paris, London, and New York as much, so they’re stocking up on thousand-dollar neckerchiefs and cashmere socks within China’s borders instead.

LVMH reported that sales in China were 30% higher in December than the previous year.

Not just that, but the French luxury firm told investors that there are now twice as many Chinese shoppers with a penchant for the finer things than there were in 2019. That’s a lot of pent-up demand waiting to be released, and it could line LVMH and other high-end peers’ pockets.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.