- 3 Big Scoops

- Posts

- 🗞 Perplexity AI Seeks $9B Valuation

🗞 Perplexity AI Seeks $9B Valuation

while Bitcoin inches towards $70k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

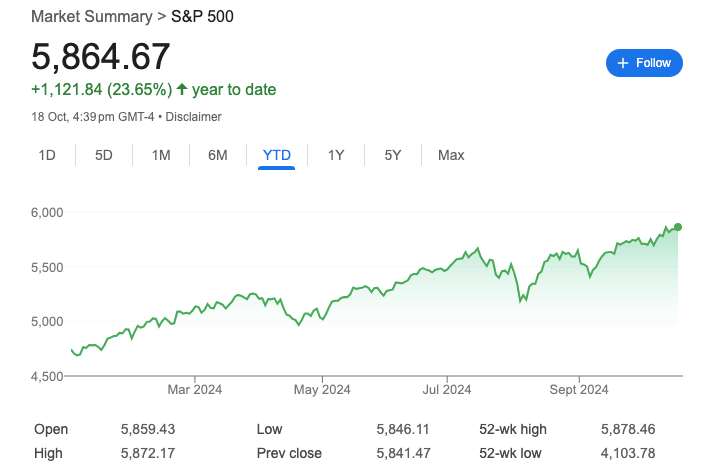

S&P 500 @ 5,864.67 ( ⬆️ 0.40%)

Nasdaq Composite @ 18,489.55 ( ⬆️ 0.63%)

Bitcoin @ $68,619.59 ( ⬆️ 0.51%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Perplexity AI is raising money

👉 American Express tanks post Q3 results

👉 Bitcoin is on the move

So, let’s go 🚀

Market Wrap

On Friday, equity indices such as the S&P 500 and the Dow Jones Industrial Average surged to fresh record highs. In fact, all three major averages clinched their sixth straight positive week, the longest streak of weekly advances in 2024.

The recent rally in the stock market can be tied to solid earnings results. Over 70 companies in the S&P 500 index have reported earnings this season, 75% of which have beaten consensus estimates.

Despite increased market volatility leading up to the election, stocks may continue to rally through November.

In 2024, the S&P 500 index is up 23.6%, while the DJIA and Nasdaq indices surged by 14.7% and 25%, respectively.

Trending Stocks 🔥

Netflix - Shares rallied over 10% after the streaming giant reported revenue of $9.83 billion and adjusted earnings per share of $5.40, compared to estimates of $9.77 billion and $5.12 per share, respectively.

CVS Health - The stock tumbled over 5% after the pharmacy chain replaced its longtime CEO, David Joyner. Moreover, it projected adjusted earnings between $1.05 and $1.10 per share for the current quarter, lower than estimates of $1.69 per share.

Lamb Weston - The stock surged over 10% after activist investors Jana Partners disclosed it has built a stake in the frozen french fries maker as it plans to push the company into exploring a sale.

Perplexity AI Takes on Google

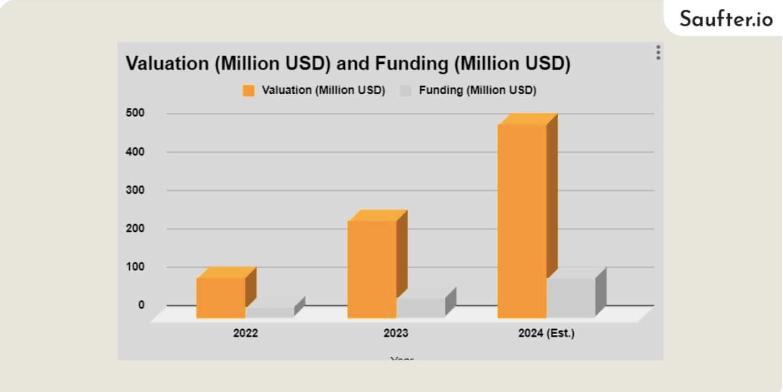

Perplexity AI, one of the world's most popular artificial intelligence platforms, aims to chip away at Google’s dominance as it seeks to more than double its valuation to $9 billion in the next funding round.

According to a Wall Street Journal report, Perplexity was last valued at $3 billion in June 2024 and now seeks to raise $500 million.

As seen in the above chart, at the start of the year, Perplexity was valued at $500 million and continues to attract investor interest alongside the bigger boom in generative AI, raising three funding rounds in 2024.

It is among several AI startups, led by OpenAI's ChatGPT, competing for a slice of the buzzy generative AI market. A few days back, OpenA raised $6 billion, which valued the company at $150 billion.

Despite the AI hype, Perplexity has been mired in controversy, facing plagiarism accusations from media outlets such as the New York Times, which accused the AI platform of scraping its content to generate its answers.

American Express Pulls Back

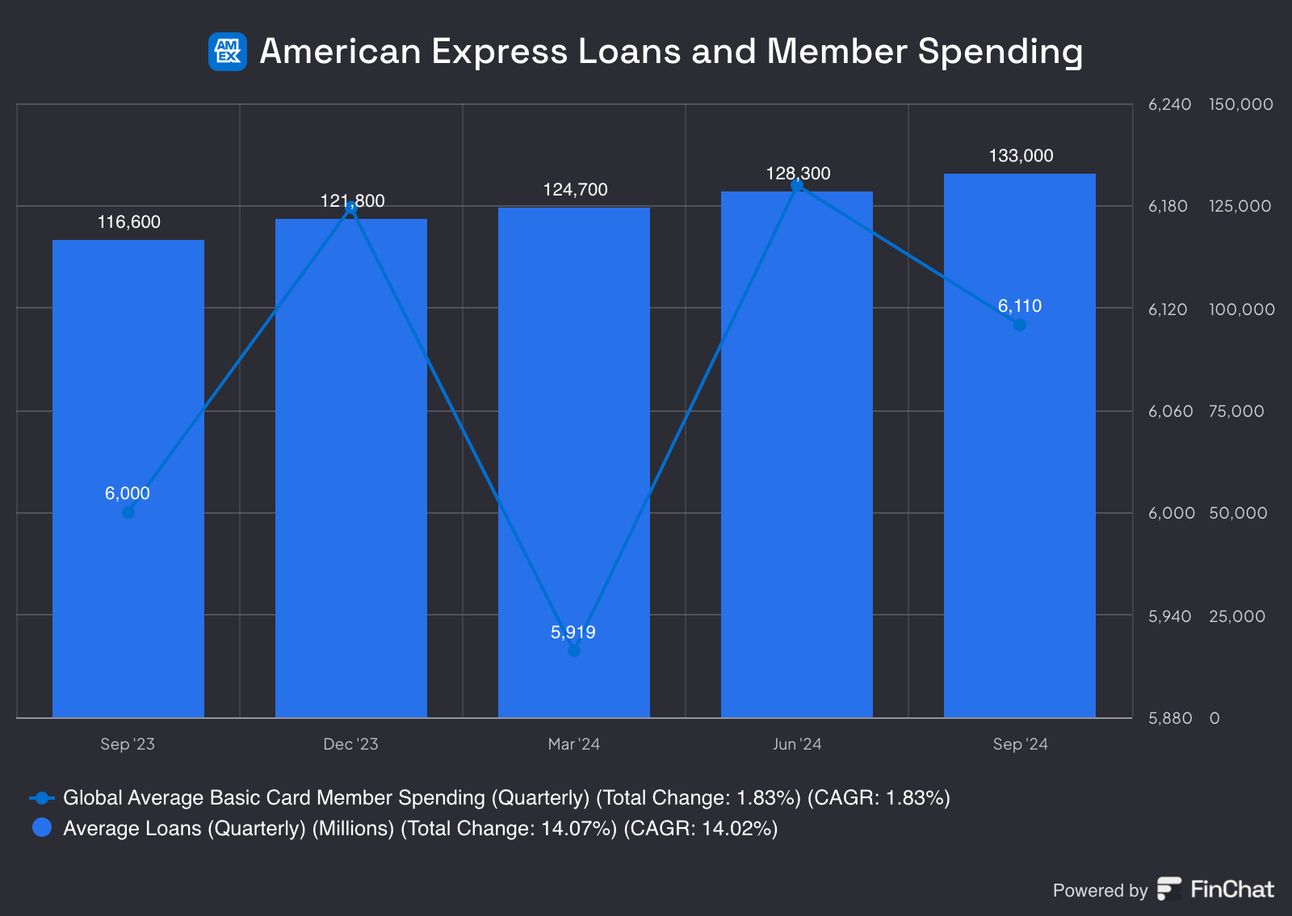

Shares of American Express fell over 3% on Friday, even though it reported Q3 profits above consensus estimates. The financial services giant explained that it benefitted from disciplined expense management, which helped cushion a blow from softer spending.

High-income customers have enabled American Express to maintain relatively smaller provisions for credit losses than peers that serve a broader spectrum of customers.

The credit card giant kept a lid on incentives, rewards, and other expenses, allowing it to surpass earnings estimates amid a deceleration in revenue growth.

In the September quarter, American Express reported:

👉 Revenue of $16.64 billion vs. estimates of $16.67 billion

👉 Earnings per share of $3.49 vs. estimates of $3.28

American Express increased its sales by 8% year over year. The company forecasts EPS between $13.75 and $14.05 in 2024, higher than its earlier forecast of $13.30 and $13.90.

American Express emphasized that its asset-light model can help it grow EPS by mid-teen percentages amid slower revenue growth. Conversely, analysts are worried about the company’s reliance on cost-cutting to drive the bottom line.

Bitcoin Attracts Investments

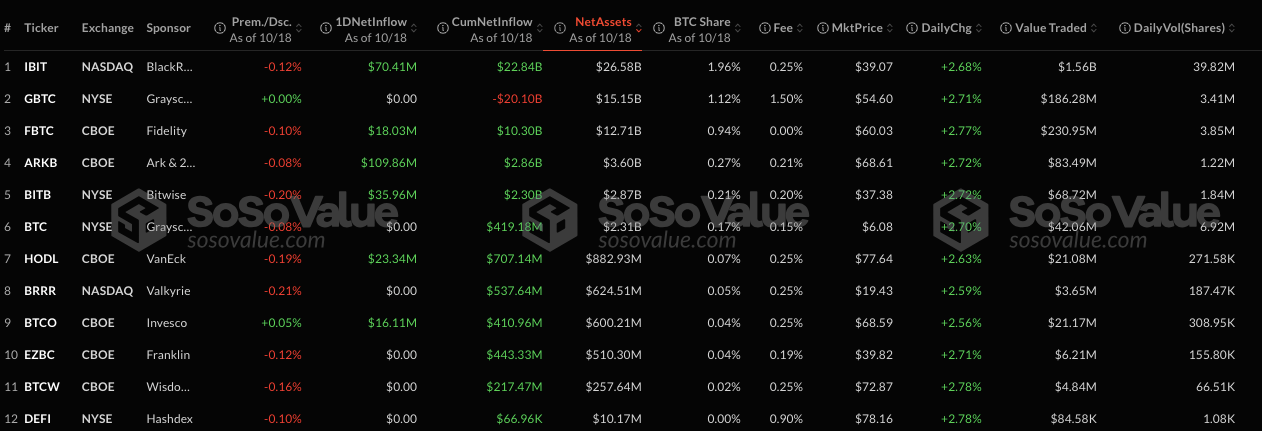

The 12 U.S.-based Bitcoin spot exchange-traded funds have set a new record, logging the highest total net asset value since they launched in January 2024.

The funds hold more than $66.1 billion worth of BTC, surpassing the previous record of $62.6 billion set in early June. The value held across the ETFs represents almost 5% of Bitcoin’s total market cap.

The ETFs had their best trading week for inflows since early March, recording more than $2 billion.

At the time of writing, BTC prices are hovering around $68,600, up almost 30% since early September. This rally meant that the value of BTC held by the funds rose by $11 billion in the last week.

BlackRock’s IBIT ETF was the largest individual gainer, which accrued $3 billion in asset value last week.

VaultCraft V2 secures $100M+ BTC from Matrixport

VaultCraft launches V2 in partnership with Safe, lands $100M+ in Bitcoin

Matrixport entrusts VaultCraft with $100M+ Bitcoin

OKX Web3 rolls out Safe Smart Vaults with $250K+ rewards

Headlines You Can't Miss!

China tightens export controls for military-use tech and goods

UBS sells its 50% Swisscar stake to American Express

10-Year Treasury yield rises above 4.1%

China cuts benchmark lending rates by 0.25%

Crypto stocks rally as Bitcoin gains pace

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.