- 3 Big Scoops

- Posts

- Passive Income: 101

Passive Income: 101

Stock, bonds, crypto and more!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,569.78 ( ⬇️ 0.54%)

Nasdaq Composite @ 14,185.49 ( ⬇️ 0.84%)

Bitcoin @ 41,460 ( ⬇️ 1.27%)

Hey Scoopers,

Happy Tuesday!!

Today, we look at a few passive income strategies to help you create a reliable and recurring income stream. Why?

Coz passive income can accelerate your retirement goals and help you achieve financial independence sooner than you think.

While most passive income sources require some type of investment in time or money, surpassing the initial hurdle is totally worth it.

Once you get a passive income stream rolling and have a source of cash that’s not tied to your employment, it can snowball into something massive over time.

Here, we analyze different asset classes that offer you the opportunity to generate passive income (hopefully for life!!!).

So, let’s go 🚀

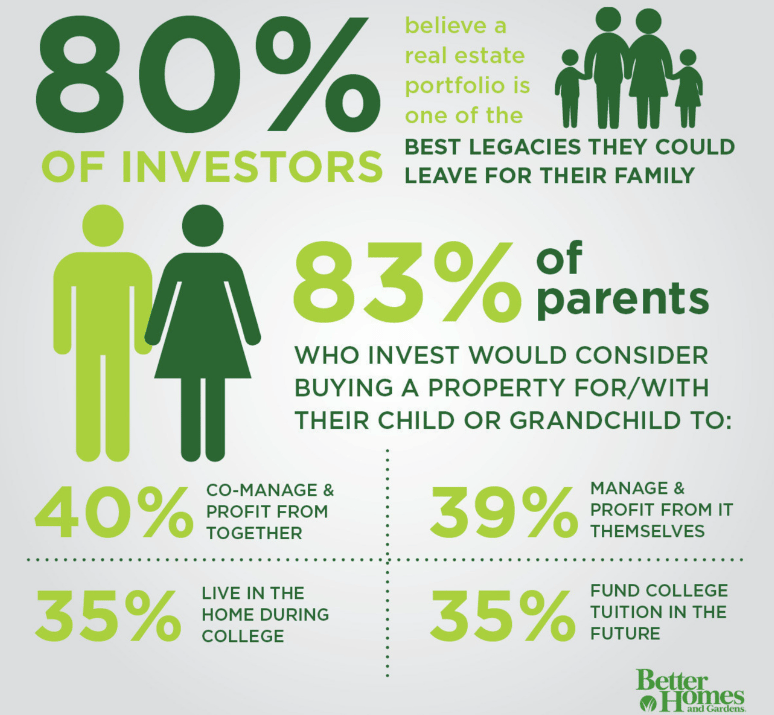

Investing in Real Estate

Among the most common forms of generating passive income is by investing in real estate.

Here, you buy a property and rent it out to tenants, creating a stream of rental income. However, purchasing a property is very expensive and will most likely be funded by debt for most investors.

The average home price in the U.S. is over $425,000, and interest rates are currently hovering around 7%, which is quite steep.

Moreover, you also need to account for maintenance, vacancy periods, taxes, and other expenses that lower overall returns.

Dividend Stocks

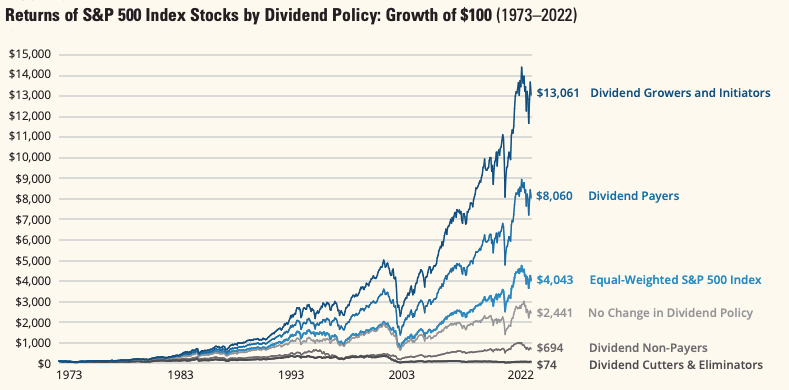

Investing in quality dividend-paying stocks is a low-cost way to generate a passive income stream, and this strategy is quickly gaining popularity on Wall Street.

Generally, dividend-paying companies distribute a portion of their profits to shareholders through dividends.

Source: Hartford Funds

A company growing its cash flows consistently will also hike its dividends each year, enhancing the effective yield over time.

Dividends are not guaranteed and can be suspended anytime, especially if a company’s financials deteriorate.

So, you need to identify companies with stable and growing cash flows, a sustainable payout ratio, and a strong balance sheet.

Historically, dividend stocks have outpaced the broader markets, making them ideal for those with a low capital base. It would be best if you focused on diversifying your dividend portfolio by purchasing shares of companies across sectors.

If you have $25,000 invested in dividend stocks with an average yield of 3%, your annual dividend payout will be $750. If the companies increase dividends by 7% each year, your payout will double to $1,500 in 10 years.

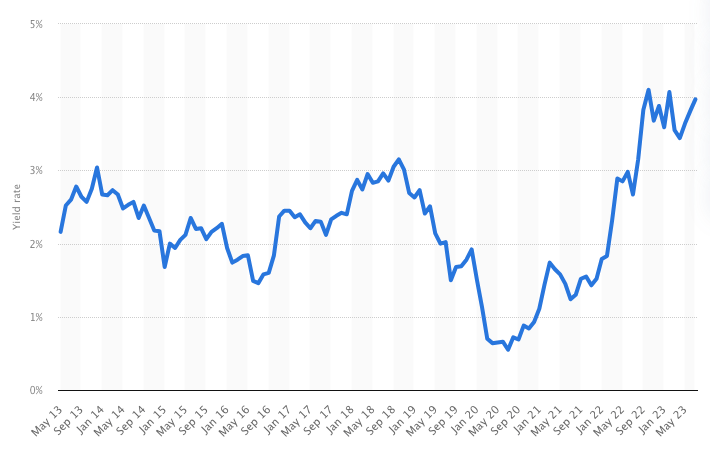

Investing In Bonds

Bonds are fixed-income instruments and are less risky than stocks. By investing in bonds, you provide loans to corporations or government entities and are paid an interest on these funds.

U.S. 10-Year Treasury Bond Rate Comparison

Source: Statista

Recent interest rate hikes have made bonds quite attractive, as several bank accounts offer you a yield of more than 5%.

Here, too, you need to diversify your bond holdings and lower overall risk.

Staking Your Cryptocurrency

With staking, you can put your digital assets to work and earn passive income. Staking is similar to depositing cash in a high-yield savings account.

Here, you lock crypto assets on a platform for a specific period and support the operations of the particular blockchain. In return, you will receive an annual percentage yield as you provide the blockchain with liquidity.

Investors can consider staking their digital assets on platforms such as Coinbase, which offers you a yield of over 3% for Ethereum deposits.

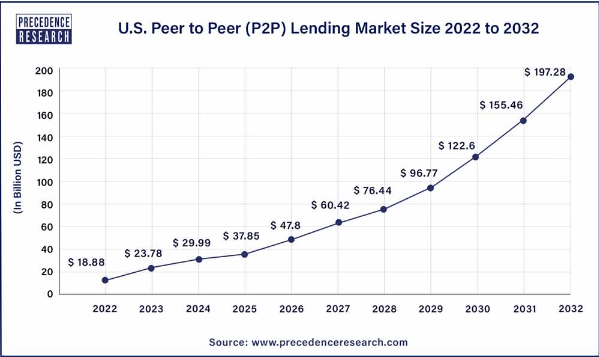

Peer-to-Peer Lending

Investors looking for a higher interest rate than bonds can consider allocating capital to peer-to-peer lending platforms such as LendingClub and Prosper.

These platforms manage money transfers. and repayments while you may be free to choose the borrowers and lending timeline.

However, the risk of default may be high, and loans are not backed by any collateral. Here, you can mitigate risks by diversifying funds across multiple small loans.

Online Passive Income Ideas

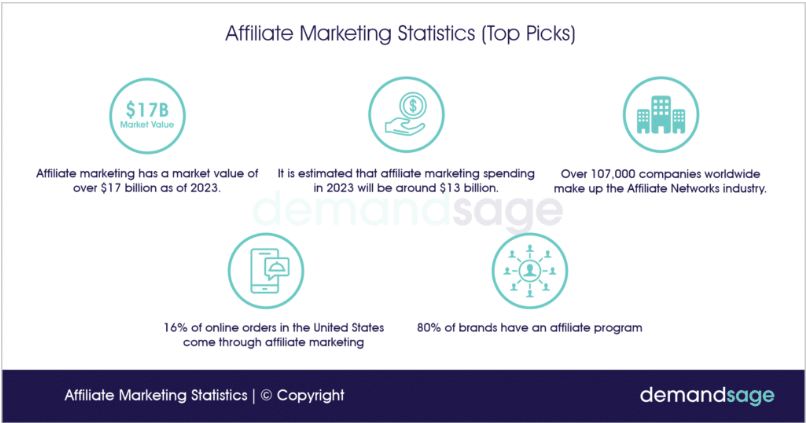

You can consider affiliate marketing and earn commissions for referring people to online products or services. Referrals are tracked through links you publish on your website or social media posts.

When someone clicks the link and makes a purchase, you will be credited for the transaction.

The commission rates for affiliate marketing are pretty low, usually between 1% and 5% of the sale amount, and may not be enough to generate a solid revenue stream.

Another way to earn income online is by dropshipping, where you sell products online without having a warehouse full of inventory.

You need to set up an online store, and your product catalog would include items you can purchase from wholesalers.

When an order is placed, you collect funds and order the product directly from the wholesaler at a lower price. The wholesaler ships the product to the customer directly.

Similar to affiliate marketing, the challenge with dropshipping is generating traffic and sales. Another risk is fraudulent transactions. So, if you fund the purchase with the wholesaler, but the payment from the customer fails, you will be liable.

Make Passive Income Work for You

The profit potential of any passive income idea generally correlates to the size of the up-front investment in terms of time and money.

For instance, dividend stocks can generate thousands of dollars over time but will require a more significant cash outlay to start.

The key to building a passive income stream is to remain disciplined and focus on diversification across asset classes.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.