- 3 Big Scoops

- Posts

- Buying vs. Renting a House

Buying vs. Renting a House

PLUS: Canada's housing market may crash

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Tuesday!!

Today, we provide a simple calculation to help you decide whether to own a house or rent an apartment.

We also analyze the Canadian housing market to see why it’s poised for a crash.

Let’s go 🚀.

Should You Own a House or Stay on Rent?

A penthouse in London, a beach house in Malibu, or a log cabin in Europe: everyone’s got a dream home. But figuring out how to turn the dream into reality is quite challenging.

We all need a roof over our heads, and choosing whether to buy or rent a house can confound even the brightest minds.

Here, I try to provide a simple calculation to see if you should buy a home or delay the inevitable purchase by a few years.

First, we calculate the cost of home ownership, which includes:

👉 Interest and principal payments

👉 Maintenance and

👉 Taxes

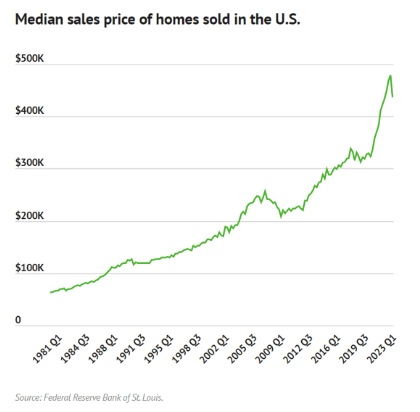

Let’s assume you want to buy a house worth $450,000, marginally higher than the average home price in the U.S., which is $431,000.

Source: The Motley Fool

Average property taxes in the U.S. are 1.1% so you will pay an annual property tax of $4,950. You may also have to allocate 1% toward yearly maintenance costs, which amounts to $4,500.

Cost of capital

Next, we calculate the cost of capital, which includes a 20% downpayment of $90,000 and a 30-year mortgage of $360,000.

In the last 20 years, the S&P 500 index has returned 7.2% annually, on average, after adjusting for inflation. Comparatively, home prices have appreciated by 2% each year in this period.

So, the difference in outperformance is about 5%. It indicates the $90,000 downpayment allocated to purchase a house could earn an additional 5% if invested in the stock market. The annual outperformance difference is $4,500 ($90,000×5%).

Now, we calculate the debt cost, including your $360,000 loan at 7% interest. It means your annual interest expenses will be $25,200 ($360,000×7%).

The total cost of debt is $4,500 + $25,200 = $29,700. It accounts for 6.6% of the entire home amount of $450,000.

The last step is to add the cost of capital and home ownership costs, such as maintenance and taxes.

The total cost increases to $39,150 ($29,700 + $4,500 + $4,950), 8.70% of $450,000.

It suggests the cost of home ownership each year is $360,000 × 8.70% = 31,320, while the cost of owning a home each month is $2,610 ($31,320/12).

What does this mean?

If your current rent is below $2,600, you should continue to rent the property. But if the monthly rental is over $2,600, it might make more sense to start looking out for your own home.

Cons of this model

This model is quite simple and easy to understand. However, there are a few cons or assumptions associated with the calculations.

For instance, generally, all mortgage loans have an amortization schedule. It means initial mortgage payments will have a higher portion of interest component, which reduces with each additional payment.

There are tax benefits associated with owning a home. You may deduct up to $14,000 each year in mortgage payments.

While mortgage payments may be fixed for a few years, rent prices change yearly.

The fulfillment of owning a home cant be calculated

The pros of renting

It offers you flexibility

There are no annual costs such as taxes or maintenance

You may get access to facilities such as gyms and pools in specific apartments

The bottom line

You need to think about a few things: the varying costs of renting vs. buying, the advantages of being able to move, the changing needs of future you, and whether you want the security – but also the responsibility – of having a place of your own.

If you’re based somewhere you plan to live long-term, have savings piling up, and like the idea of a place of your own – you should be looking to buy. But if you ever plan to motor West, live paycheck to paycheck, and value flexibility – you should probably rent for now instead.

For many people, the right answer is a combination of the two: renting when you’re younger and buying when you’re older.

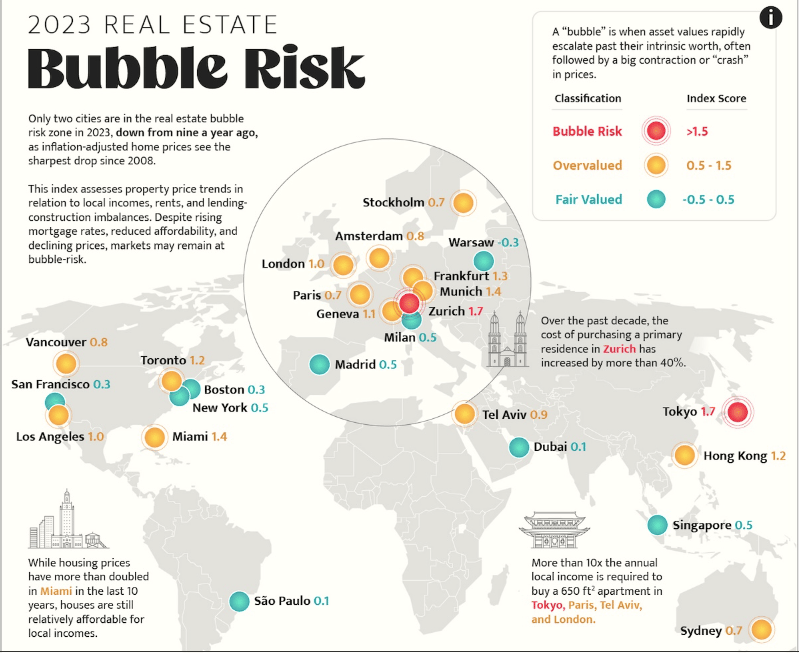

Canada’s Housing Market is Heating Up

Soon after the financial crisis in 2009, home prices in the U.S. fell by 20%. Comparatively, home prices declined by “just” 9.2% in Canada.

While it took ten years for the U.S. home prices to recover, Canadian home prices surged to all-time highs within three years.

Canada’s robust but conservative banking industry helped the country avert a major housing crash.

Mortgage loans in the U.S. were astonishingly risky back in 2008, leading to the collapses of several large banks. Comparatively, the balance sheets of Canadian banks were well-capitalized, allowing most of them to maintain their dividend payments amid a challenging macro environment.

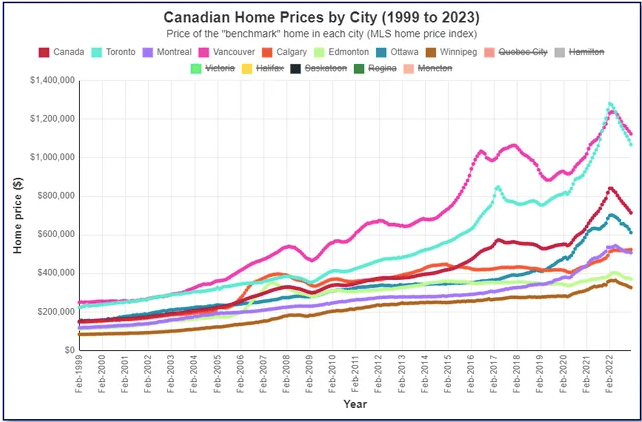

While the pullback in the U.S. made home ownership affordable, home prices in Canada have more than doubled compared to 2008.

Source: Visual Capitalist

Canadian homes are unaffordable

The average home price in Canada is close to CA$660,000. According to experts, the average household income in Canada should be close to CA$180,000 to fund the mortgage comfortably. However, the median household income is around CA$120,000.

Lower interest rates in the past decade allowed individuals access to debt capital at a low cost. Several Canadians viewed lower interest rates as an opportunity to buy properties as an investment, making the housing market quite speculative and inflated.

As interest rates have spiked, demand is expected to come to a screeching halt. A housing crash may have multiple ripple effects. It will reduce consumer spending and impact other sectors like banking and construction.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research