- 3 Big Scoops

- Posts

- Dividend Investing: 101

Dividend Investing: 101

Passive income at a low cost

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,622.44 ( ⬆️ 0.39%)

Nasdaq Composite @ 14,432.49 ( ⬆️ 0.20%)

Bitcoin @ $41,870.45 ( ⬇️ 0.58%)

Hey Scoopers,

Happy Tuesday!!

Today, we look at how investing in quality dividend stocks can help you earn a steady stream of passive income and generate outsized gains over time.

Passive income can accelerate your retirement goals and help you achieve financial independence sooner than you think.

While most passive income sources require significant investments, dividend stocks can help you create a recurring income stream with just a few dollars.

So, let’s go 🚀

What Are Dividend Stocks?

Dividend investing has gained widespread acceptance globally as it enables individuals to create an alternate source of income.

Here, you buy shares of companies that distribute a portion of their profits to investors as dividends. Further, over the long term, investors can also benefit from capital gains.

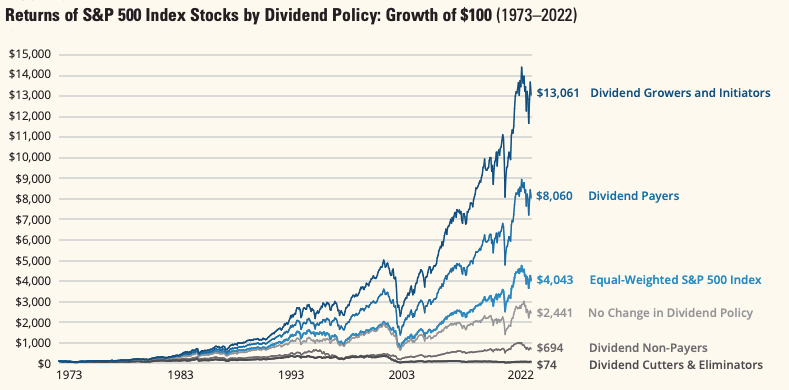

Source: Hartford Funds

You can either choose to withdraw the dividends or reinvest the payouts to benefit from compounded gains.

Dividend-paying companies need to generate consistent profits to sustain their payouts. Generally, these companies are part of mature industries, allowing them to generate cash flows across various business cycles.

But not every stock that pays a dividend may turn out to be a good investment. So, it's advisable to look at various other metrics to help you make an investment decision.

Identifying the Best Dividend Stocks

As is the case with most other investments, there are certain risks associated with dividend stocks. Therefore, creating a portfolio of dividend stocks is essential to help you derive substantial gains over the long term.

Let's look at some metrics you can analyze to identify quality dividend stocks. These metrics will help you recognize potential red flags associated with dividend-paying stocks.

Dividend Yield

The most attractive metric for income-seeking equity investors is the dividend yield. Also known as the forward yield, the metric is a function of the company's stock price.

So, if you purchase 100 shares of Chevron (NYSE: CVX), you will have to invest around $14,435, given each stock is priced at $144.35 at the time of writing. Chevron pays investors dividends of $6.04 per share each year, so you will generate $604 in annual dividends.

Chevron has a dividend yield of 4.18% at the current stock price (Annual dividends/Total Investment*100). So, if Chevron's stock falls to $100, its dividend yield will increase to 6.04%.

Alternatively, the yield will drop to 3.02% if the stock price increases to $200. A high dividend yield may be attractive, but it is also a red flag as the company’s stock price may be depressed due to poor fundamentals.

Payout ratio

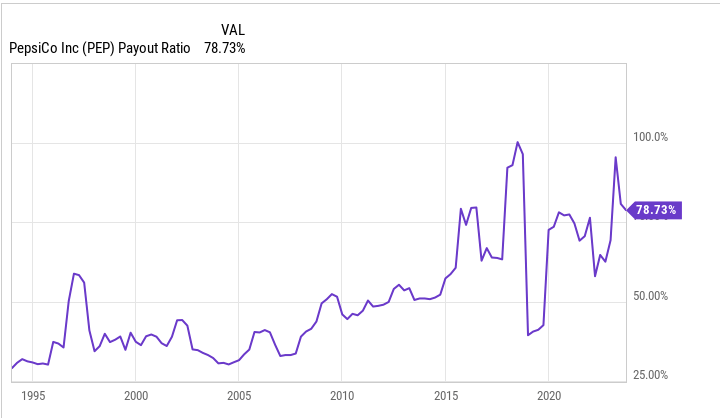

A company's payout ratio is another crucial metric investors should watch out for while evaluating dividend stocks. This ratio or multiple is calculated as a percentage of a company's earnings.

For example, Pepsi pays investors a dividend of $4.95 per share, translating to a dividend yield of 2.95%. In the last year, Pepsi reported adjusted earnings of $6.79 per share, indicating a payout ratio of 73%.

A lower payout ratio suggests the company has enough room to utilize profits to lower debt, reinvest in capital expenditures, or even increase dividend payouts.

Pepsi's payout ratio is sustainable, given it has increased dividend payments yearly for 50 consecutive years.

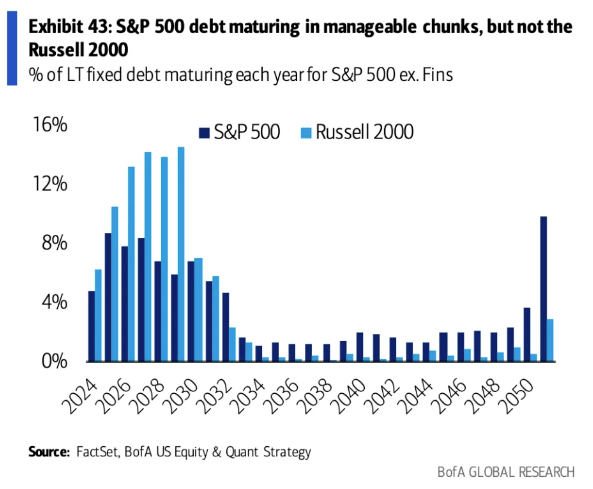

Focus on liquidity and debt

Investors need to consider the amount of debt a company has on its balance sheet. The company needs to generate enough cash flows to make interest payments and consistently lower its debt while paying shareholders dividends.

In case macroeconomic conditions turn challenging, it should also have enough cash on its books to support temporary losses or a decline in revenue.

Economic cycles are inevitable, and a robust balance sheet will help a company tide over an uncertain and volatile environment.

Avoid the dividend yield trap

Investors who have just begun investing in the stock market might associate high dividend-paying stocks as attractive investment opportunities.

While you can use the dividend yield as a prominent filter, it's advisable to look at the reasons for the high payout.

We know the dividend yield is inversely related to a company's stock price. So, investors should investigate the reasons behind the decline in share prices and evaluate if the sell-off is related to weak fundamentals or market-wide factors.

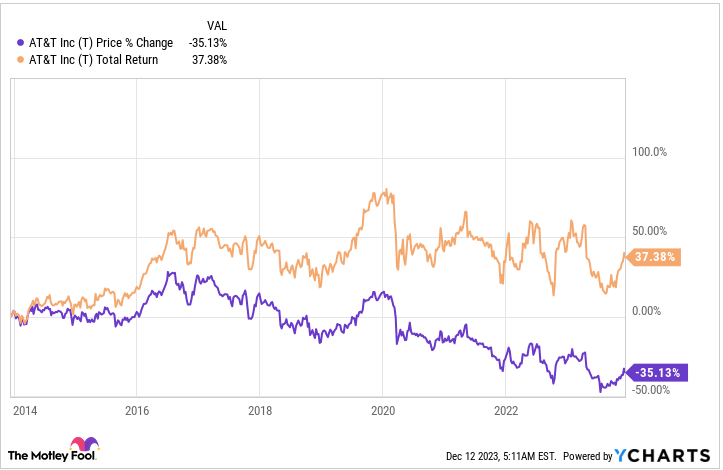

Telecom heavyweight AT&T pays investors a tasty forward yield of 6.68%, given its annual dividends of $1.11 per share. But AT&T's stock has declined by 35% in the last ten years.

Even after accounting for dividend reinvestments, its total returns stand at just 37%, trailing the S&P 500 index by a significant margin.

Investors should avoid buying stocks just based on a high yield. A company with a significantly higher yield than peers may be a red flag. It's imperative to analyze other factors, such as the payout ratio, earnings expansion, and the strength of the financial statements.

It's safer to place your bets on companies with a lower dividend yield, but that have also increased these payouts consistently, reflecting the strength of their business model.

There is also a chance for companies with high yields to roll back or suspend dividend payouts if markets turn volatile.

Dividend Payouts Are Not Guaranteed

Investors should note that, unlike interest payments, dividends are not an obligation and can be suspended at any time.

When a company starts dividend payments, it is rewarded by the equity market. Alternatively, share prices are decimated if these payouts are suspended or reduced.

👉 During the bear market of 2020, several oil-producing companies, such as Schlumberger, cut dividends by 75%.

👉 The COVID-19 pandemic also impacted companies such as Bed Bath & Beyond and General Motors, which suspended dividend payments indefinitely.

👉 Several debt-heavy companies, including Algonquin Power & Utilities, slashed dividends by over 50% due to rising interest rates in the past two years.

Dividends are paid only if a company can generate profits. So, those wrestling with a higher cost structure, negative profit margins, or falling revenue growth might choose to stop dividend payments until their fundamentals improve.

Considering these factors, let’s see where dividend investors should invest for a recurring stream of dividend income.

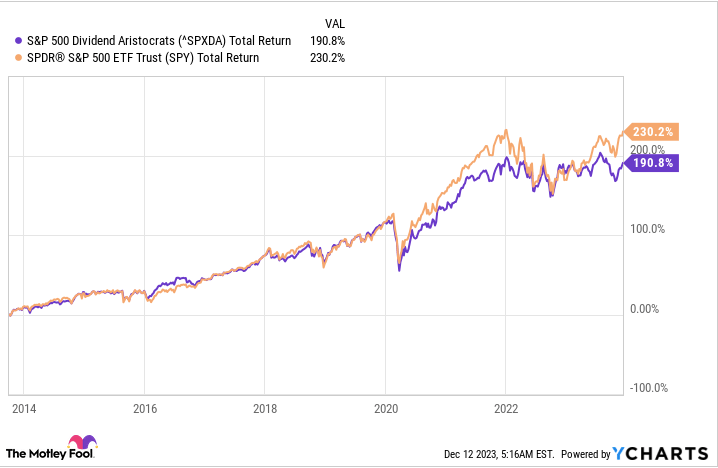

Invest In Dividend Aristocrats

Dividend Aristocrats are companies that have raised dividends each year for at least 25 consecutive years. It indicates these companies generate cash flows across market cycles and are armed with strong fundamentals.

Some of the dividend aristocrats part of the S&P 500 include Pepsi, Coca-Cola, Colgate-Palmolive, 3M, and Walmart.

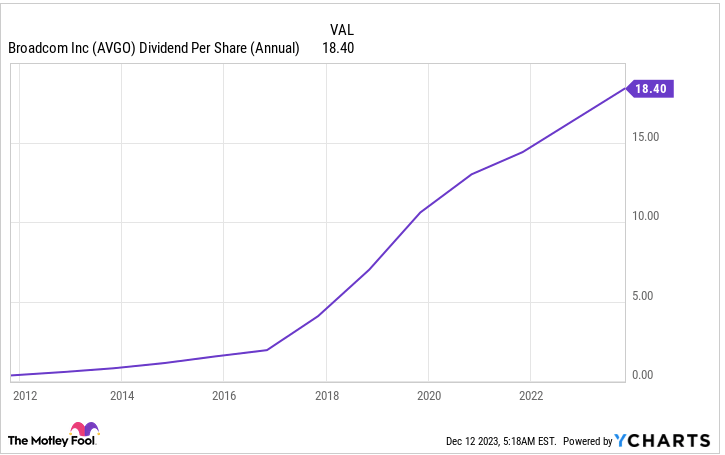

Invest in Dividend Growth Companies

Another strategy can be investing in dividend growth companies, which have grown their payouts at a significant rate over time.

One such company is Broadcom, a semiconductor giant that has increased dividends by 40% annually in the past 12 years, enhancing the effective yield significantly.

If you bought 100 shares Broadcom shares back in December 2011 for $3,061, you would have earned $40 in dividends in the following 12 months. Today, 100 shares would help you earn $1,840 in annual dividends.

Other dividend growth companies include Brookfield Infrastructure and American Tower.

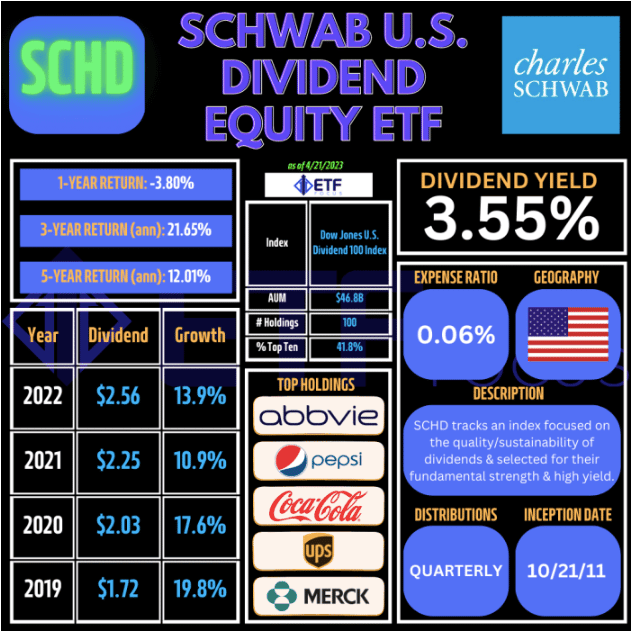

Invest in ETFs such as the SCHD

Investors who don't want the hassle of identifying individual stocks can consider investing in ETFs such as the Schwab U.S. Dividend Equity ETF (NYSE:SCHD).

The ETF holds a basket of blue-chip stocks and offers you a forward yield of 3.62%. The payouts have risen by 16% annually in the past 12 years.

The SCHD ETF offers you exposure to stocks such as Verizon, Broadcom, Home Depot, AbbVie, and much more.

While building a portfolio of dividend stocks, it's advisable to pick companies across sectors to diversify your investments and lower overall risks.

Remember, when you include dividend payouts with capital gains, total returns are compounded, allowing you to outpace the broader markets comfortably.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.