- 3 Big Scoops

- Posts

- 🗞 Palantir Smashes Q4 Estimates

🗞 Palantir Smashes Q4 Estimates

PLUS: Trump pauses trade tariffs

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

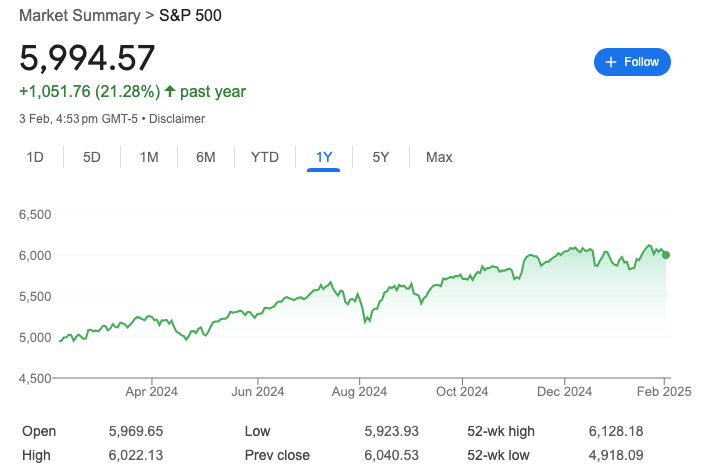

S&P 500 @ 5,994.57 ( ⬇️ 0.76%)

Nasdaq Composite @ 19,391.96 ( ⬇️ 1.20%)

Bitcoin @ $98,849.22 ( ⬆️ 4.21%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter today?

👉 Palantir stuns Wall Street

👉 Vanguard lowers its ETF fees

👉 Donald Trump makes a U-turn

So, let’s go 🚀

Market Wrap

Hey, Scoopers!

In a day that felt like a financial roller coaster, Wall Street showed resilience as markets recovered from what initially looked like a devastating plunge.

After dropping a heart-stopping 665 points, the Dow Jones managed to steady itself, closing 123 points down at 44,421.91.

What's Moving Markets?

The drama began when President Trump dropped a weekend bombshell, imposing a 25% tariff on Canadian and Mexican imports and a 10% levy on Chinese goods.

But a diplomatic breakthrough with Mexico's President Sheinbaum turned the tide! After a "friendly conversation," Mexico agreed to deploy 10,000 soldiers at the border, earning a one-month tariff pause.

Canada followed suit, securing its 30-day reprieve.

Smart Money Says...

"Call us deluded, but permanent tariffs on U.S. allies won't stick," says Macquarie's Thierry Wizman, suggesting these moves are more negotiating tactics than permanent policy.

Meanwhile, Baird's Ross Mayfield offers this gem: "We're in a bull market fueled by a strong U.S. consumer. Until something cracks with this narrative, dips are buyable."

Read The Daily Upside. Stay Ahead of the Markets. Invest Smarter.

Most financial news is full of noise. The Daily Upside delivers real insights—clear, concise, and free. No clickbait, no fear-mongering. Just expert analysis that helps you make smarter investing decisions.

Trending Stocks 🔥

Kyndryl Holdings - The IT infrastructure company slipped 2% after it reported revenue of $3.74 billion in fiscal Q3, below estimates of $3.81 billion.

Tyson Foods - The poultry and beef giant ticked higher after posting earnings of $1.14 per share vs. estimates of $0.90 per share. Sales rose by 2.3%, which was led by growth in the beef category.

Triumph - Shares rallied upon the news that affiliates of Warburg Pincus and Berkshire Partners would acquire the aerospace services supplier. Triumph shareholders will receive $26 per share in cash, making the deal worth around $3 billion.

Palantir’s AI Revolution Drives Record Growth!

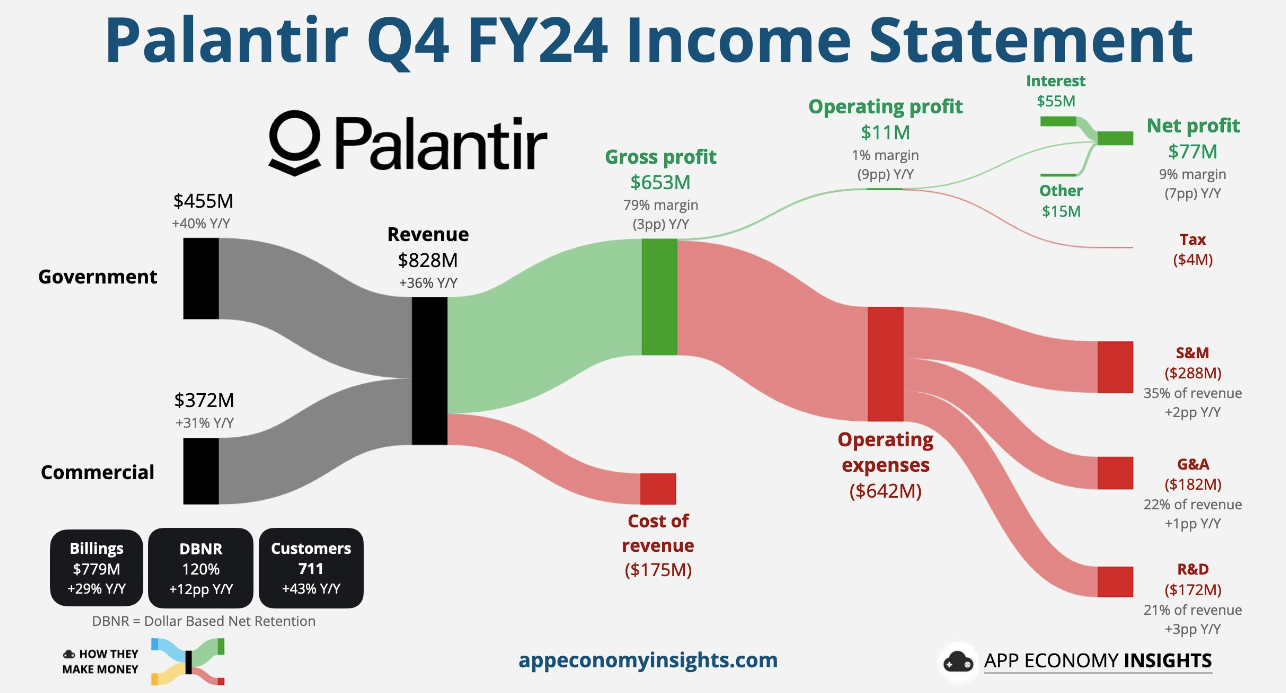

Palantir Technologies blasted through Wall Street's expectations, rocketing 22% in after-hours trading. The AI-powered defense tech giant didn't beat estimates – it crushed them!

By the Numbers:

The company posted a stellar $828 million in revenue (smashing the expected $776M) and delivered $0.14 per share in earnings (beating the $0.11 per share forecast).

But here's the real kicker: U.S. commercial revenue skyrocketed 64% to $214 million, while government contracts surged 45% to $343 million.

Looking Forward:

CEO Alex Karp isn't optimistic – he's electric about Palantir's future. "Our business results continue to astound," he declared, positioning the company at the heart of the AI revolution.

With projected 2025 revenues of $3.74-$3.76 billion, Palantir is betting on America's future in AI.

The Bigger Picture:

Fresh off joining both the S&P 500 and Nasdaq 100, Palantir's 340% stock surge in 2024 proves one thing: in the AI gold rush, selling picks and shovels (or, in this case, sophisticated AI solutions) might be the most innovative play of all.

Remember: As Karp says, we're just in "the first act of a revolution that will play out over years and decades." Stay tuned! 🤖📈

Vanguard Slashes Fund Fees

In a move making waves across Wall Street, investment giant Vanguard announced its most aggressive fee reduction in history!

This isn't a tiny trim—but a massive overhaul that will affect 87 funds and save investors an estimated $350 million in 2025.

The Big Numbers:

Average fee cut: 20% per share class

Funds affected: 87

Total share classes: 168

Estimated annual savings: $350 million

What's Getting Cheaper?

Everything from stock ETFs to bond funds is getting a makeover. Some standouts include:

Russell 1000 Value ETF: Now 0.07% (down from 0.08%)

International High Dividend Yield ETF: Slashed to 0.17% (from 0.22%)

Emerging Markets Bond ETF: Reduced to 0.15% (from 0.20%)

Why It Matters:

Under new CEO Salim Ramji's leadership, Vanguard is doubling down on founder Jack Bogle's mission to make investing cheaper for everyone.

With active fixed-income funds now averaging just 0.10% (versus the industry's 0.53%), the message is clear: the race to zero fees is far from over!

Trump Unveils Sovereign Wealth Fund Plan

President Trump has signed an executive order to create America's first-ever sovereign wealth fund in a bold move that raises eyebrows from Wall Street to Washington.

Think of it as a national investment portfolio with some uniquely American twists!

The Big Vision:

Treasury Secretary Scott Bessent promises to "monetize the asset side of the U.S. balance sheet for the American people" within 12 months.

The fund aims to tackle everything from upgrading airports to potentially acquiring stakes in companies like TikTok (yes, you read that right!).

How Big Are We Talking?

While the U.S. is just getting started, it's joining an elite club:

Norway's fund: $1.7 trillion

China Investment Corp: $1.3 trillion

U.S. fund: Size TBD (but with big ambitions!)

What's Different?

Unlike traditional sovereign funds backed by oil wealth or trade surpluses, America's version would be unique. It would launch despite budget deficits, and the administration suggests tariff revenues could help fuel it.

What's Next?

Commerce nominee Howard Lutnick and Secretary Bessent have 90 days to craft the blueprint. Wall Street's watching this one closely, folks! 🦅💰

Stay tuned for more updates on this unprecedented financial experiment!

Headlines You Can't Miss!

China retaliates with additional tariffs on certain U.S. imports

UBS reports $770 million in net profits

Asia tech stocks rise as Trump pauses tariffs

China to launch anti-trust probe against Google

MicroStrategy holds over 470k BTC

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.