- 3 Big Scoops

- Posts

- 🗞 Trump's Trade Wars Begin

🗞 Trump's Trade Wars Begin

as chaos grips Wall Street

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 6,040.53 ( ⬇️ 0.50%)

Nasdaq Composite @ 19,627.44 ( ⬇️ 0.28%)

Bitcoin @ $94,194.99 ( ⬇️ 3.61%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter today?

👉 Donald Trump levies tariffs

👉 Apple Services rakes in $100B

👉 Nvidia leads tech sell-off

So, let’s go 🚀

Market Wrap

Hey, Scoopers!

Hold onto your coffee cups! Wall Street's starting February with a bang – and not the good kind.

Futures are taking a nosedive faster than your New Year's resolutions, with the Dow dropping a whopping 546 points. Why, you ask?

The U.S. Commander-in-Chief dropped a trade policy bombshell, shaking markets like a maraca!

President Trump has imposed new tariffs on Canada, Mexico, and China (apparently, good fences and tariffs make good neighbors?).

We're talking about a 25% tax on Mexican and Canadian goods, plus a 10% "friendship fee" on Chinese imports.

But wait, there's more! These trading partners aren't exactly sending thank-you notes. Canada is responding with tariffs, Mexico is plotting revenge, and China is lawyering up at the WTO.

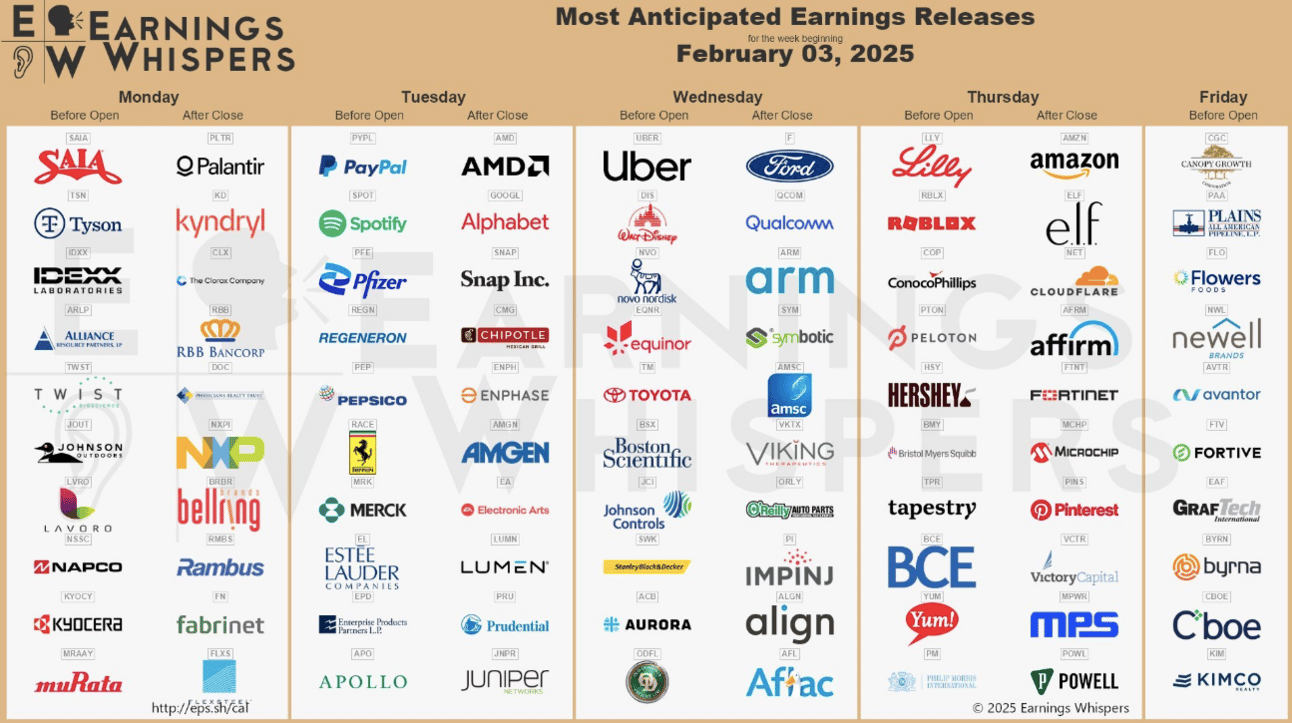

Meanwhile, tech earnings will gain pace this week, so prepare for a parade of heavy hitters, including Alphabet, Amazon, and Palantir.

Stay tuned, keep your sense of humor, and maybe keep some antacids handy!

Add a piece of the energy sector to your portfolio.

Access to 300 million barrels of recoverable oil reserves

Royalty-based investment model reducing operational risks

Projected 25+ years of potential royalty income

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.klondikeroyalties.com.

Trending Stocks 🔥

Colgate-Palmolive - Shares slipped over 4% after the household products company reported Q4 revenue that missed analyst estimates and forecast weak 2025 sales, given negative effects from FX rates.

Vertex Pharmaceuticals - The biotech stock jumped over 5% after the U.S. Food and Drug Administration approved its non-opioid painkiller pill. It is the first drugmaker in decades to get U.S. approval for a new type of pain medicine.

Atlassian - The stock rose 15% after the software company posted better-than-expected fiscal Q2 results. It reported revenue of $1.29 billion with adjusted earnings of $0.96 per share vs. estimates of $1.24 billion and $0.76 per share, respectively.

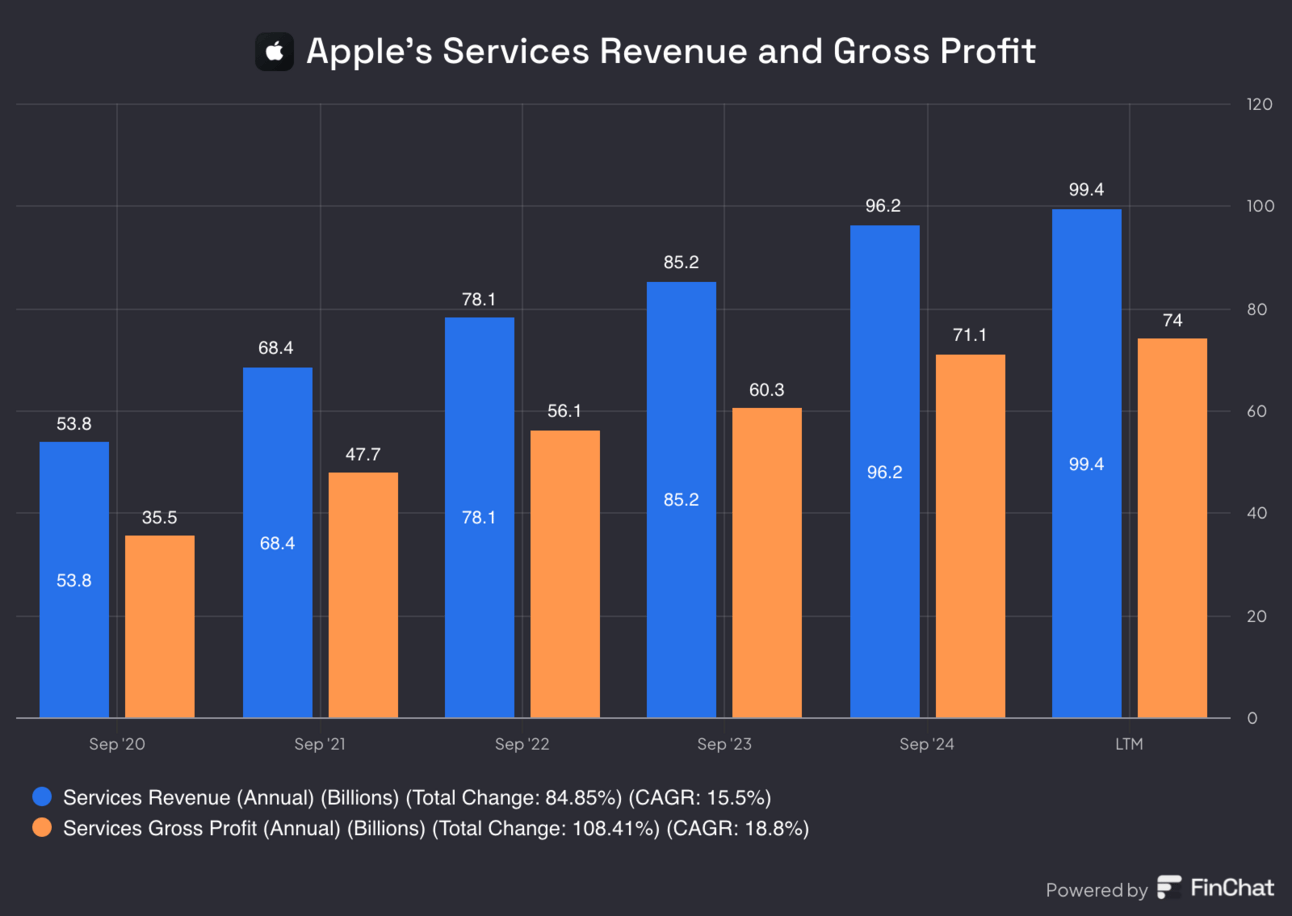

Apple’s Services Business Is Massive

While iPhone sales might be doing the limbo (how low can they go?), Apple's Services division is partying like it's 1999!

The tech titan from Cupertino dropped some numbers that would make any Wall Street analyst's spreadsheet tingle with joy.

🏆 The Highlight Reel:

Services revenue hit a jaw-dropping $26.3 billion (That's a billion with a B!)

Nearly $100 billion in services revenue over the past year (Tim Cook's piggy bank must be enormous)

Over 1 BILLION subscriptions across their services (Someone's been busy!)

But wait, there's drama in paradise! The regulatory wolves are howling at Apple's door, and investors are curious about how new regulations might shake up this cash cow.

When asked about it, Apple's CFO made the classic "Look at these shiny numbers instead!" move while Tim Cook mastered the art of strategic silence.

Meanwhile, Epic Games' legal battle with Apple ended with a plot twist worthy of a Netflix series: Apple is not a monopoly, but it does have to let developers add their payment links.

It's like being told you're not the boss, but you still get to keep your corner office!

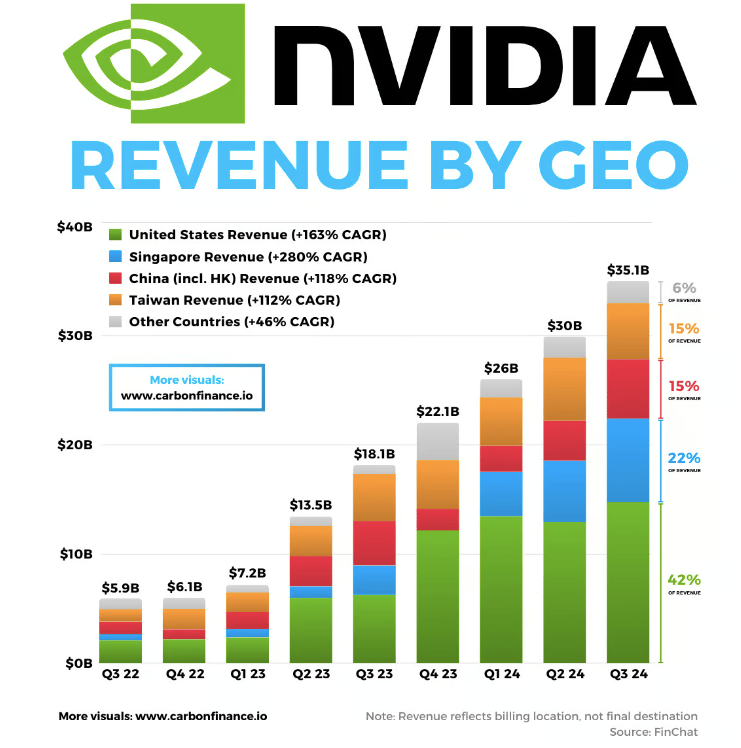

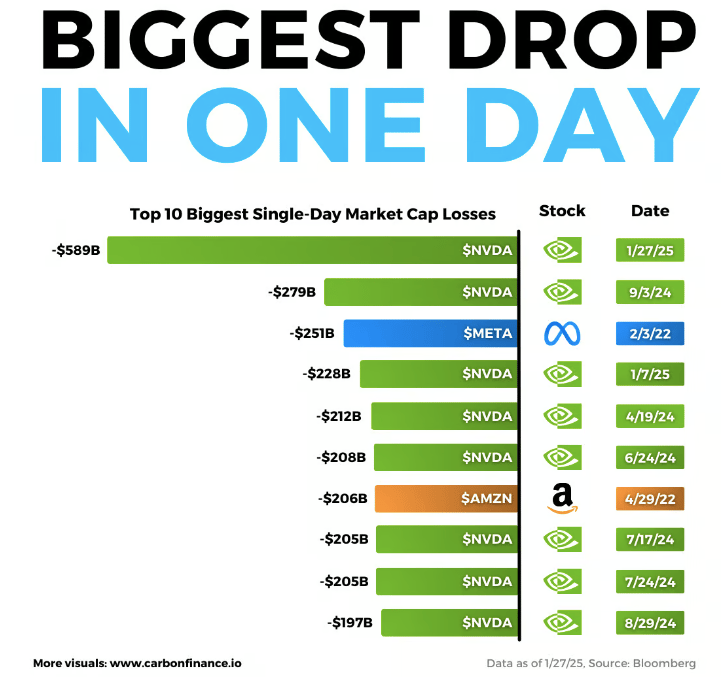

Nvidia Stock Is Under Pressure

Grab your popcorn as we break down the chaos that sent Nvidia's stock on a rollercoaster ride that would make Six Flags jealous.

🎢 The DeepSeek Drama

Picture this: A Chinese startup releases a free AI model that performs like a champion and is cheaper than a cup of coffee (okay, maybe several cups).

The claim of training it for just $5.6M sent Nvidia's stock plunging faster than a skydiver without a parachute – we're talking a 17% nosedive that had billionaires checking their couch cushions for spare change.

The world's 500 wealthiest people lost a cool $108B, while short sellers were popping champagne over $6B in profits.

But wait! Enter our cast of tech celebrities:

Elon Musk and Scale AI's CEO suggested DeepSeek might be playing fast and loose with their math

Microsoft's Satya Nadella dropped some economic wisdom with Jevons' paradox

Alibaba crashed the party with their own AI model (because why not?)

Here's where it gets juicy: Singapore's suddenly becoming Nvidia's hottest market, growing faster than a tech startup's burn rate (280% CAGR!).

But is it the final destination for all those precious chips? The U.S. government would love to know!

The week ended with Nvidia's Jensen Huang having a brief tête-à-tête with President Trump about DeepSeek and chip exports.

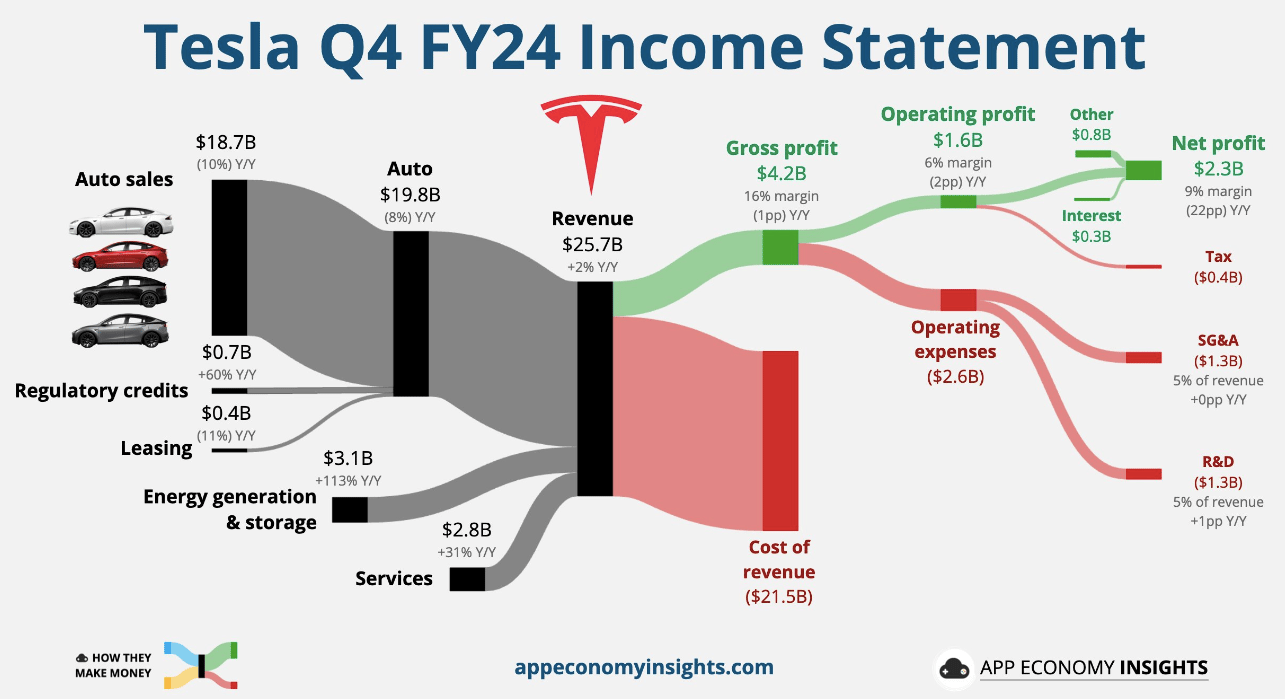

Tesla Misses Estimates

Hold onto your charging cables! Tesla dropped its Q4 numbers last week, so let's plug into the details:

Revenue: $25.71B (analysts wanted $27.26B - oops!)

EPS: $0.73 per share (missed the $0.76 per share target)

Operating margin: Shrunk to 6.2% (like a battery in cold weather)

Remember when Tesla couldn't make cars fast enough? Now they're playing the discount game harder than a Black Friday sale:

Auto revenue in Q4 was down 8% to $19.8B

Tesla reported its first annual delivery decline in history

"Affordability" is the new buzzword (Tesla owners, clutch your pearls!)

Musk is back with more autonomy promises (because the third time's the charm?):

Unsupervised FSD launching in Austin this June

Plans for widespread U.S. rollout by year-end

"It's a self-driving wolf!" (His words, not ours!)

Tesla’s energy division is the unexpected star:

Revenue up 113% to $3.06B

Proving there's more to Tesla than cars

The Politics Plot

Musk's new White House role raising eyebrows

Brand value took a $15B hit in 2024

Shareholders getting chatty about Musk's political adventures

Headlines You Can't Miss!

Eurozone inflation rises to 2.5%

Global auto stocks plunge on trade war concerns

SoftBank commits to JV with OpenAI

Crypto stocks plunge as Bitcoin dips to three-week low

Ethereum leads crypto liquidations

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.