- 3 Big Scoops

- Posts

- Oracle Stuns Wall Street

Oracle Stuns Wall Street

PLUS: Bitcoin rips through $72k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

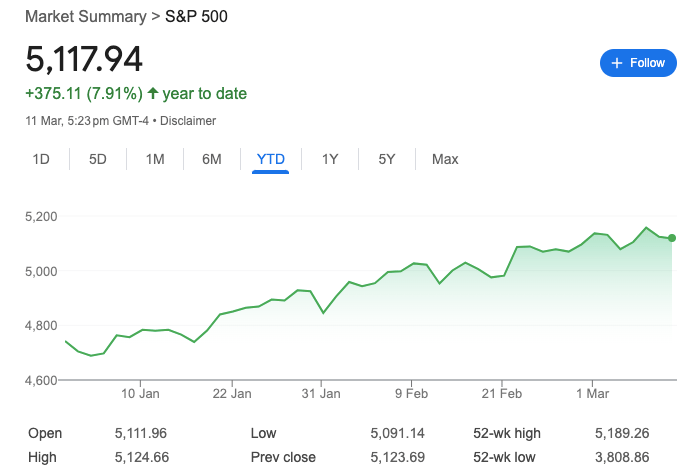

S&P 500 @ 5,117.94 (⬇️ 0.11%)

Nasdaq Composite @ 16,019.27 ( ⬇️ 0.41%)

Bitcoin @ 72,011.74 ( ⬆️ 4.1%)

Hey Scoopers,

Fasten your seatbelts. Here’s today’s breakdown:

👉 Oracle’s blockbuster earnings

👉 All eyes on inflation

👉 Bitcoin marches on

So, let’s go 🚀

Market Wrap 📉

Major stock market indices pulled back on Monday as the rally that brought them to all-time highs cooled off.

The sell-off was driven by tech stocks in the AI (artificial intelligence) sector, as investors were worried about the lofty valuations surrounding these companies.

“At the end of the day, markets are probably still too optimistic about the Fed’s ability to cut rates significantly in 2024,” said Lara Rhame, chief U.S. economist at FS Investments, in an interview with CNBC.

Rhame further added, “I think the February inflation data will be another reminder that the Fed needs to tread cautiously.”

Trending Stocks 🔥

Bally’s - Shares of the casino operator soared over 25% after hedge fund Standard General made a buyout proposal valuing the company at $15 per share, 41% higher than where the stock finished last week.

Nvidia - The semiconductor giant fell over 1% on Monday, extending its losses from Friday’s session when it tanked over 5%.

Meta - Shares of the social media giant slumped 4.4%, primarily due to the broader market sell-off.

Oracle Beats Wall Street Estimates

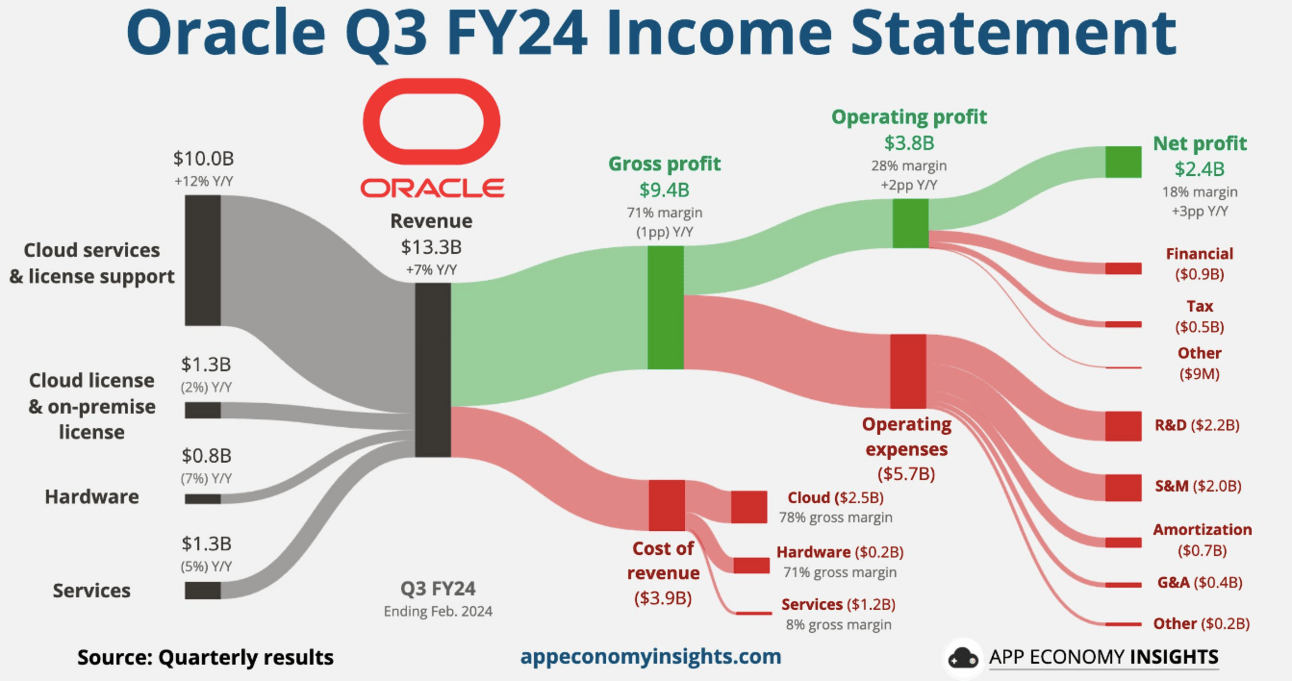

Oracle reported its quarterly earnings yesterday and exceeded Wall Street’s estimates. The tech stock is now up over 13% in pre-market trading.

In fiscal Q3 of 2024 (ended in February), Oracle reported:

👉 Revenue of $13.28 billion vs. estimates of $13.3 billion

👉 Earnings per share of $1.41 vs. estimates of $1.38

Oracle expects earnings between $1.62 and $1.66 per share in Q4, compared to estimates of $1.64 per share. It forecasts revenue growth between 4% and 6% in Q4, or at $14.5 billion, below estimates of $14.7 billion.

Oracle emphasized it remains committed to hitting annual sales of $65 billion by fiscal 2026.

In Q3, its revenue rose by 7% while net income grew 27% year over year. Oracle's largest business, its cloud services and license support segment, saw revenue rise by 12% to $9.96 billion due to robust demand for AI servers.

Oracle added several large new cloud infrastructure contracts in Q3, as cloud sales surged 25% to $5.1 billion.

Inflation Forecast at 3.1%

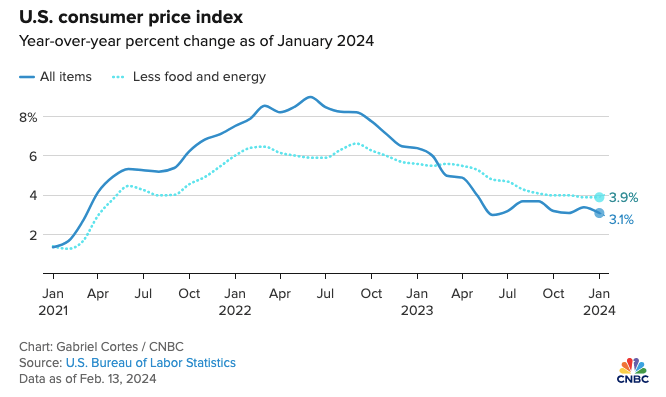

Rising gasoline prices likely drove inflation in February, potentially reinforcing the Fed’s decision to take a conservative approach with interest rate cuts.

According to estimates, headline inflation is expected to show a 3.1% gain year over year, while core inflation is expected at 3.7%. Compared to January, inflation is forecast at 0.4%.

While inflation has cooled down in recent months after touching multi-decade highs in 2022, it continues to remain resilient due to strong employment rates.

It suggests there will be no interest rate cuts at least in the next three months. Equity markets were rattled in January when CPI data came in higher than expected.

Bitcoin Continues to Surge

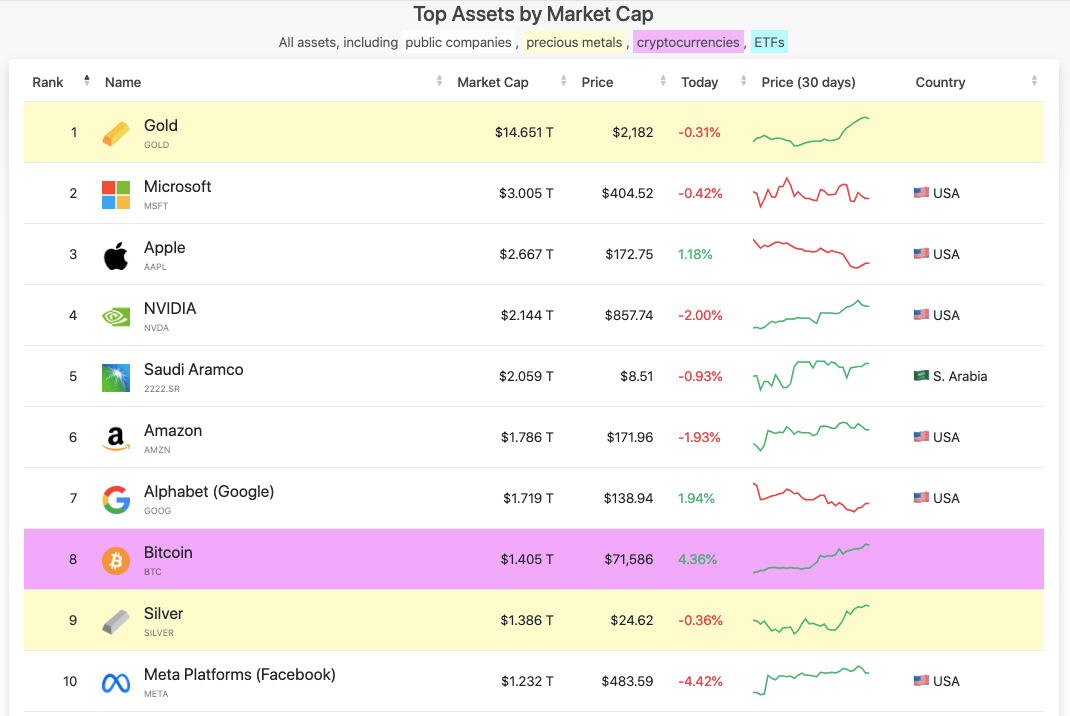

Bitcoin prices just topped $72,000 on the back of demand from spot Bitcoin ETFs or exchange-traded funds.

Source: CompaniesMarketCap

Bitcoin is currently the eighth-largest asset in terms of market cap. Valued at $1.4 trillion, BTC overtook silver (in terms of market cap) as the digital asset has more than tripled returns in the last 12 months.

While Bitcoin might pull back from record levels, the upcoming halving event will act as a catalyst for the world’s leading cryptocurrency.

Headlines You Can't Miss!

China’s stock valuations are “way too low”

Alcoa to acquire Alumina for $2.2 billion

Ikea is cutting prices as inflation cools

OpenAI denies Elon Musk's lawsuit claim about founding agreement

BlackRock and Fidelity dominate the Bitcoin ETF market

Chart of The Day

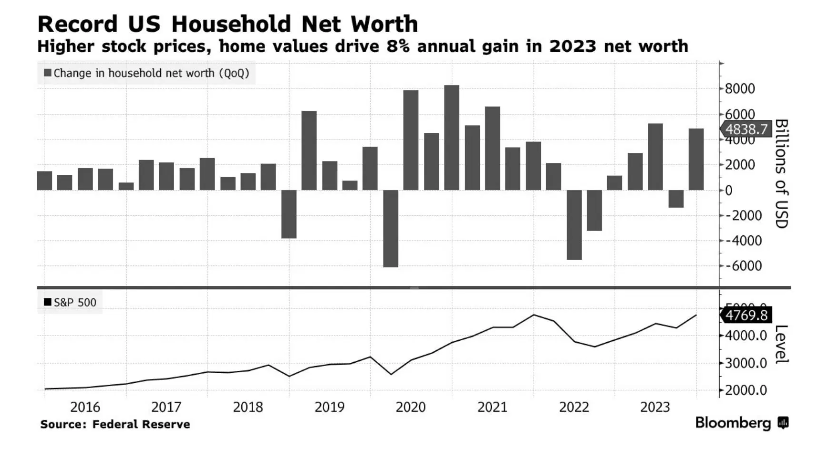

What’s going on here?

The wealth owned by US households hit an all-time high last year, potentially signaling the start of an AI-fueled financial utopia.

What does this mean?

U.S. households racked up 8% more wealth last year to reach a total of $156 trillion, according to the Federal Reserve. That doesn’t mean there’s more cash in everyone’s pockets, though.

Most of that increase came from stocks, which ended up being worth $7.8 trillion more than the year before. Plus, with high interest rates turning affordable mortgages into a pipe dream, more Americans stuck to their homes instead of upgrading.

That’s capped the number of homes on the market, forcing buyers to bid more and keeping house prices high. In fact, the real estate market was worth some $2 trillion more by the end of the year—a win for homeowners.

Why should I care?

Zooming out: What goes up can come down.

The opposite of accumulating wealth is losing a job, and that’s a real risk for an increasing number of Americans. There were 9% more layoffs this February than at the same time last year, making it the worst month for new redundancies since the global financial crisis.

Although, with the count of monthly jobless claims staying fairly steady, it seems that freshly unemployed Americans are finding new jobs lickety-split.

The bigger picture: Everything is AI’s fault.

AI’s effect on the US stock market is far from tailing off: the S&P 500 index is already up another 9% this year. There are worries, though, that automatic processes could start replacing human work, exacerbating the rate of layoffs over time.

Dystopia isn’t the only option, of course, and AI tools could be used to enhance human productivity and company profits across the board, raising stock prices and making most Americans richer in the long run.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.