- 3 Big Scoops

- Posts

- 🗞 Nvidia Zooms to Record High

🗞 Nvidia Zooms to Record High

PLUS: Goldman Sachs provides S&P 500 forecast

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,853.98 ( ⬇️ 0.18%)

Nasdaq Composite @ 18,540.01 ( ⬆️ 0.27%)

Bitcoin @ $67,524.49 ( ⬇️ 0.24%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Nvidia continues to rally

👉 Goldman Sachs remains cautious

👉 BoA is bullish on AppLovin

So, let’s go 🚀

Market Wrap

Indices such as the S&P 500 and the Dow Jones Industrial Average fell on Monday, reversing some of the strong gains from last week.

Consumer and homebuilder stocks were among the biggest losers as fears about higher-for-longer interest rates increased. Shares of Target, Builders FirstSource, and Lennar moved lower by 3.8%, 5.2%, and 4.4%, respectively.

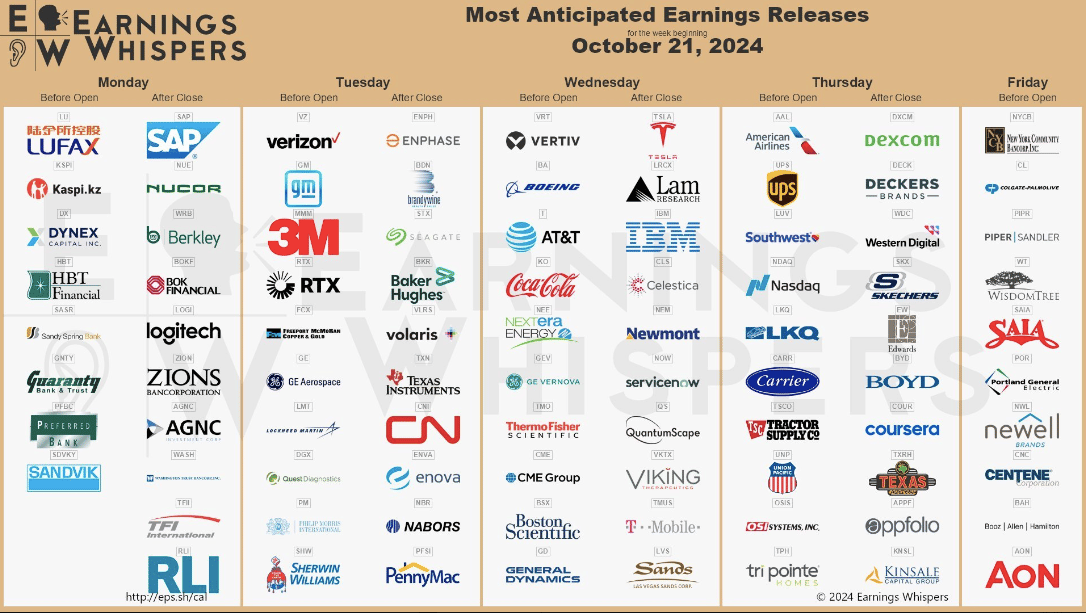

Earnings will be key this week, with 100 companies in the S&P 500 set to report quarterly results. Large-cap giants such as Tesla, Coca-Cola, and GE Aerospace will report earnings over the next few days.

Around 14% of S&P 500 companies have posted Q3 results, 70% of which have beaten consensus estimates. Notably, analysts have significantly downgraded earnings estimates for the quarter in recent months.

Elsewhere, the yield on the 10-year Treasury yield jumped, rising 12 basis points to 4.19%

Trending Stocks 🔥

Boeing - The stock climbed over 3% after the aircraft maker reached a new contract proposal with the machinists’ union, which could end a months-long strike.

Warby Parker - The eyeglass maker and retailer gained almost 10% after Goldman Sachs upgraded shares to a “buy” from “neutral,” saying its margin growth potential and solid fundamentals support its “somewhat elevated” valuation.

Cigna - The insurer’s stock slid over 4% after a Bloomberg report stated that the company had reignited merger discussions with Humana.

Nvidia Stock Has Almost Tripled In 2024

Nvidia shares surged to a fresh record high on Monday, just a week after the company set a previous record. The chipmaker’s stock gained more than 4% and has almost tripled in value this year as demand for its AI chips remains solid.

Despite its meteoric rise, analysts expect the stock to climb further. Last week, Bank of America raised its price target for Nvidia to $190 from $165, calling it a top AI pick. Investment research firm CFRA also raised its price target for NVDA to $160 from $139.

In addition to the AI megatrend, Nvidia’s enterprise partnerships with giants such as Microsoft and Accenture are a major contributor to its higher price target. Nvidia is now the partner of choice for enterprise AI hardware and software.

Wedbush analyst Dan Ives expects the AI infrastructure market to expand 10x through 2027, with companies spending $1 trillion on AI-related capital expenditures in this period.

A report from International Business Strategies projects the AI chip market to grow by 99% in 2024 and by 74% in 2025. Nvidia produces AI chips that Big Tech companies use in data centers to power generative artificial intelligence software such as ChatGPT.

Given Nvidia’s lofty valuation even a slight slowdown in growth could send the stock lower. In fiscal Q3 of 2025 (ending in October), analysts expect revenue to rise by 83% to $33.1 billion, with EPS of $0.74, up 84% year over year.

Goldman Sachs Sounds the Alarm Bell

The S&P 500 is on a record run in 2024, posting its strongest year-to-date performance since 1997. However, Goldman Sachs forecasts the flagship index to return just 3% annually in the next decade, down from an annual return of 13% in the past ten years.

Goldman’s forecast is well below consensus estimates as Wall Street expects the index to gain 6% annually on average in this period.

Goldman argues that the index's concentration is at its highest level in 100 years, making it reliant on the earnings growth of its largest constituents.

The ten largest S&P 500 stocks account for 36% of the index, higher than any other time in the last 40 years. Notably, Big tech giants have swelled in size due to exceptional earnings growth in the last two years.

It isn’t easy to sustain earnings growth at the same clip. For instance, just 11% of the S&P 500 companies since 1980 have maintained double-digit sales growth for 10+ years.

Earnings growth for the Magnificent 7 (Apple, Nvidia, Microsoft, Amazon, Meta, Alphabet, and Tesla) have begun to decline in recent months. However, the other 493 companies are forecast to report double-digit earnings growth over the next five quarters, narrowing the gap between the Mag Seven and the rest.

AppLovin Remains a Top Investment

Shares of marketing technology software provider AppLovin gained close to 10% yesterday due to a bullish Bank of America report. BoA analyst Omar Dessouky raised the price target of the tech stock to $210 from $120, indicating an upside potential of over 30% from current levels.

The investment bank explained that AppLovin is “joining the pantheon of at-scale MarTech, AI, and growth stocks,” and the stock’s valuation is too low for a core business that is “growing 20% sustainably.”

AppLovin launched its AI engine in Q2 of 2023, ushering in a growth and profitability transformation that has yet to be recognized by the markets, stated Dessouky.

BoA raised its software revenue estimate for AppLovin by six percentage points for 2025 and by three percentage points for 2026.

Valued at a market cap of $53 billion, AppLovin has increased its sales in the last 12 months to $3.95 billion, up from $994 million in 2019. The stock went public in April 2021 and has since returned 160% to shareholders.

Unique Investment Opportunity: Whiskey Casks

Here’s an investment opportunity you didn’t know you were missing - whiskey casks.

But where to start?

Try Vinovest.

Vinovest differentiates its whiskey investing platform through strategic sourcing and market analysis. With Vinovest, you can invest in Scotch, American, and Irish whiskey casks, providing diverse and flexible exit options.

Vinovest team targets high-growth markets and caters to a range of buyers, from collectors to brands using casks for cocktails. This approach not only enhances your liquidity but also increases your portfolio’s resilience against market fluctuations. Discover how Vinovest’s innovative strategy sets it apart from competitors.

Headlines You Can't Miss!

U.S. proposal to curb AI chip investment in China under review

Hyundai Motor India’s shares drop 5% in trading debut

Economists expect the UK to cut rates substantially

What to expect from General Motors in Q3 of 2024?

Ethereum trails Bitcoin due to weak institutional demand

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.