- 3 Big Scoops

- Posts

- Nvidia Triples Revenue

Nvidia Triples Revenue

PLUS: Changpeng Zhao exits Binance

Bulls, Bitcoin, and Beyond

Hello Folks,

Buckle up for a wild Wednesday as we bring you some of the juiciest stories from the world of finance. Here’s what’s brewing this morning.

👉 Nvidia beat estimates

👉 Binance is fined $4 billion

👉 Morgan Stanley’s investment thesis

So, let’s go 🚀.

Nvidia Crushes Wall Street Estimates

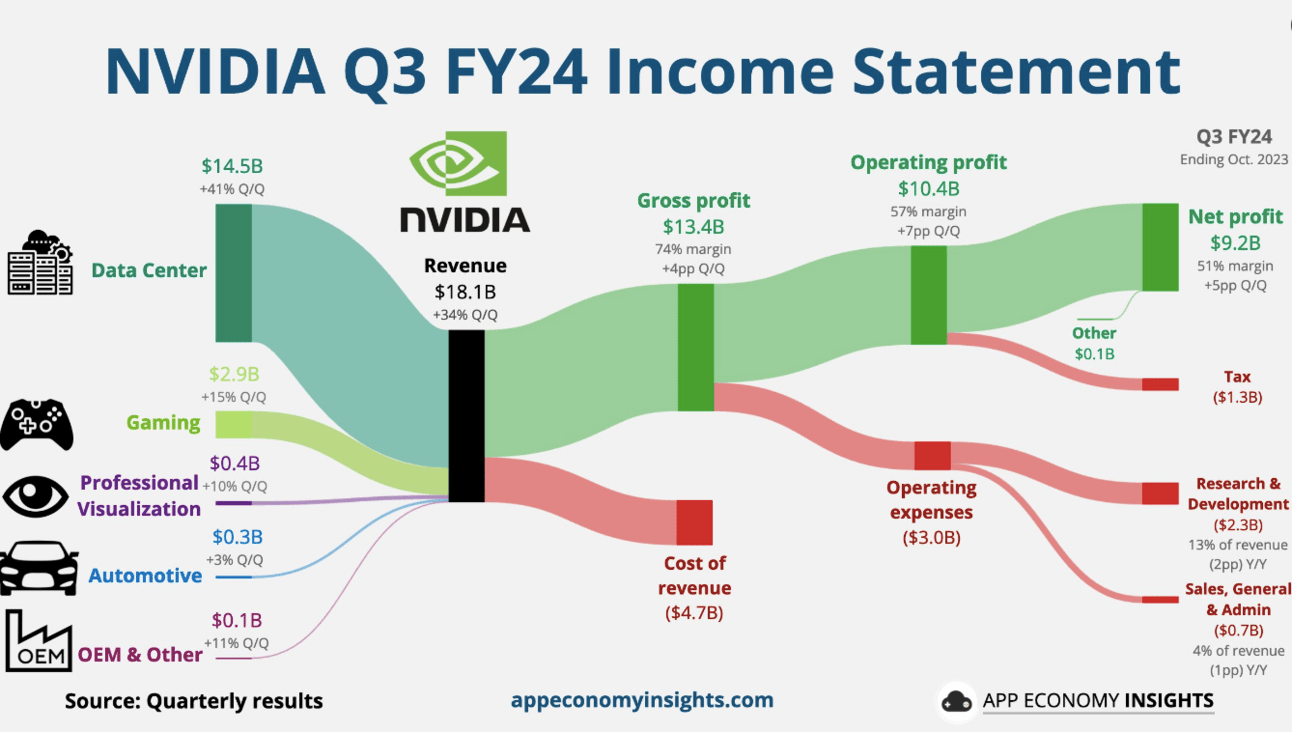

Semiconductor giant Nvidia surpassed Wall Street estimates in fiscal Q3 of 2024 (ended in October). The company reported:

Revenue of $18.12 billion vs. estimates of $16.18 billion

Earnings of $4.02 per share vs. estimates of $3.37 per share

Despite its earnings and revenue beat, Nvidia stock is down almost 2% in pre-market trading as Nvidia expects export restrictions to specific companies in China to impact sales in Q4.

Nvidia grew sales by a whopping 206% year over year while net income surged to $9.24 billion or $3.71 per share, up from $680 million or $0.27 per share in the year-ago period.

Here’s what drove Q3 sales for Nvidia

Data center revenue grew 279% to $14.5 billion vs. estimates of $12.97 billion

Gaming sales were up 81% at $2.86 billion vs. estimates of $2.68 billion

Around 50% of data center sales came from public cloud infrastructure companies such as Amazon and Microsoft.

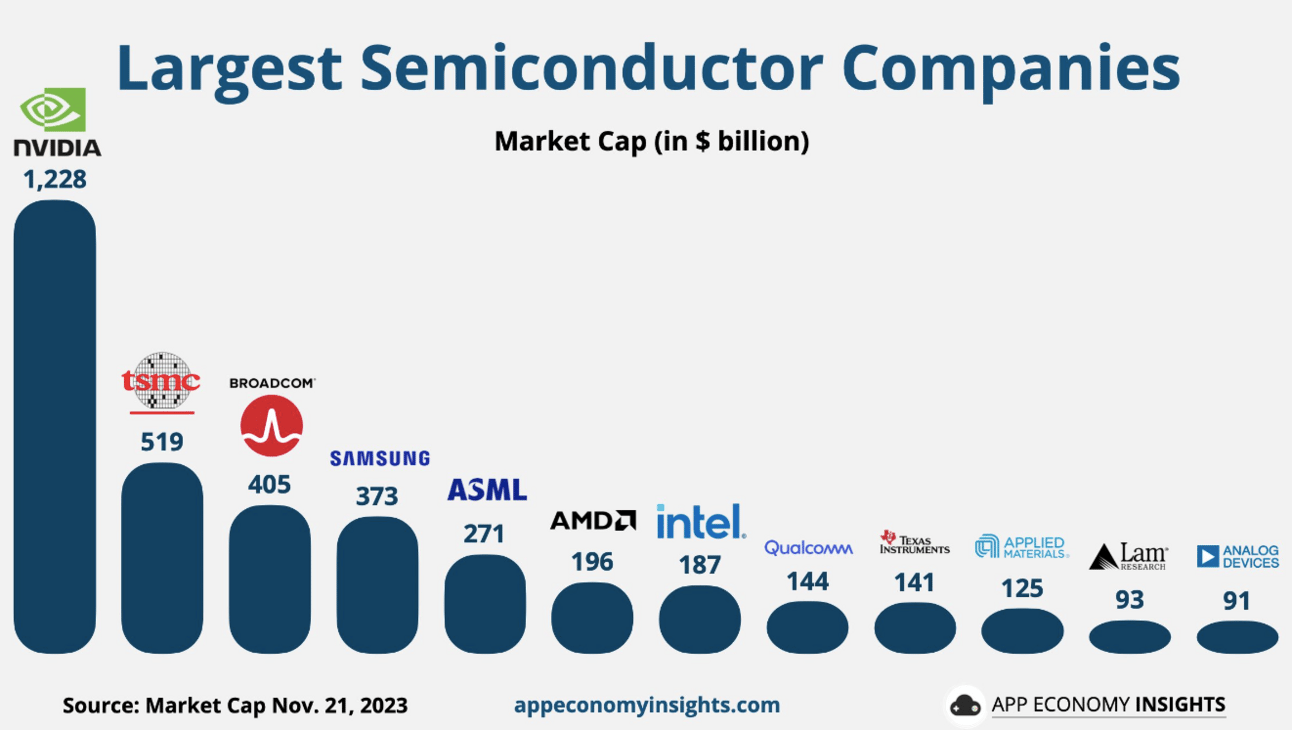

Nvidia expects Q4 sales to grow 231% to $20 billion. Valued at $1.23 trillion by market cap, Nvidia stock has gained 240% in 2023.

Where is Morgan Stanley Investing?

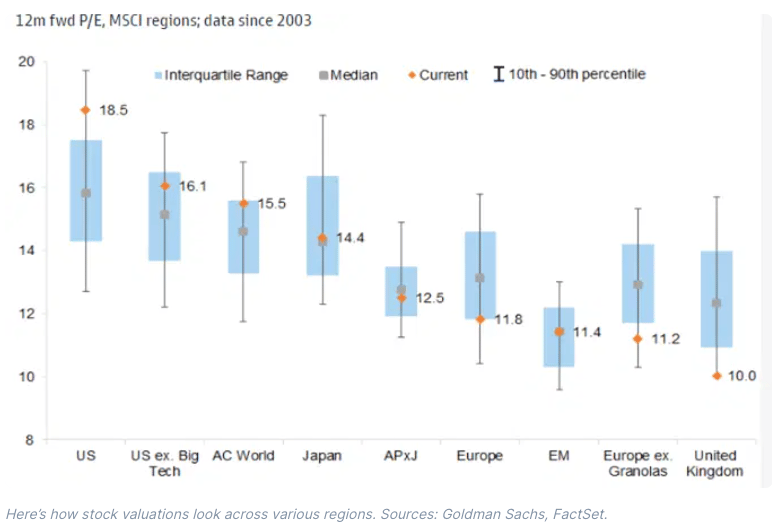

Morgan Stanley says you should consider these investment options if U.S. stocks significantly dominate your portfolio.

Japanese stocks

Morgan Stanley expects the Tokyo Stock Price Index to surge 13% in 2024, much higher than its forecasts of a 5% growth for the S&P 500, due to:

👉 A revved-up economy

👉 Corporate reforms

👉 Rising foreign investments

👉 Higher return on equity

Moreover, Japan is sheltered from Asian growth hiccups and geopolitical drama.

Industrial and healthcare stocks

Defensive sectors such as healthcare and industrials are appealing, given the macro environment remains uncertain and challenging.

Historically, healthcare stocks have outpaced the broader markets, particularly in late business cycle stages and periods of above-average inflation.

The industrial sector, which includes aerospace, defense, and machinery, thrives in late-cycle markets and is positioned to benefit from multiple trends such as automation and clean tech.

Both sectors are seeing a positive growth in earnings revisions and offer attractive valuations.

India and Mexico

Morgan Stanley is cautious about emerging markets due to a strong U.S. dollar, higher financing costs, and geopolitical tensions.

But it remains bullish on India and Mexico. First, Mexico’s proximity to the U.S. allows it to benefit from nearshoring, where a growing wave of businesses are moving closer to home.

Second, India is rising high on structural reforms, rising foreign direct investments, and robust GDP growth.

Diversify with bonds

Interest rates have more than doubled in the past two years, causing a slump in longer-dated Treasury bonds.

Why? Coz bond prices and yields are inversely related. Bonds are currently trading at an attractive price as investors have factored in challenges, including:

👉 A surge in Treasury supply

👉 A period of elevated interest rates

👉 Expansive fiscal spending

As the U.S. economy cools down and inflation reduces, the future looks bright for U.S. 30-year Treasury bonds.

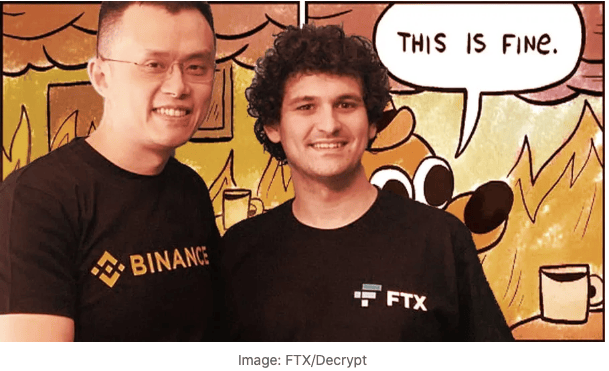

Binance Slapped With $4 Billion Fine

Binance CEO Changpeng Zhao just stepped down as part of a $4 billion settlement with regulatory agencies in the U.S.

In a post on X, Zhao stated he made “mistakes” and is taking responsibility by stepping down. The CEO was accused of anti-money laundering and sanctions violations and has pleaded guilty to these charges.

In June, SEC Chair Gary Gensler suspected Binance of operating an unregistered exchange and misleading investors by inflating trading volumes on the Binance U.S. platform.

Gensler had then stated, “Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.”

Yesterday, Binance emphasized it did not have adequate compliance and control when it was first launched. It seems the world’s largest crypto exchange turned a blind eye to its legal obligations in pursuit of profits.

With a $4 billion fine, Binance has paid one of the largest corporate penalties in U.S. history.

Headlines You Can’t Miss!

OpenAI reinstates Sam Altman as CEO

AI is giving Big Tech more power?

Goldman Sachs is bullish on China

Investors wary about geopolitical tensions

SEC recently met with Grayscale for a spot Bitcoin ETF listing

Chart of the Day

Inflation and a difficult macro environment are catching up with individuals and households.

According to a survey by McKinsey, consumers are less inclined to splurge this holiday season compared to last year.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.