- 3 Big Scoops

- Posts

- Nike CEO Steps Down

Nike CEO Steps Down

PLUS: Tech stocks push Nasdaq higher

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

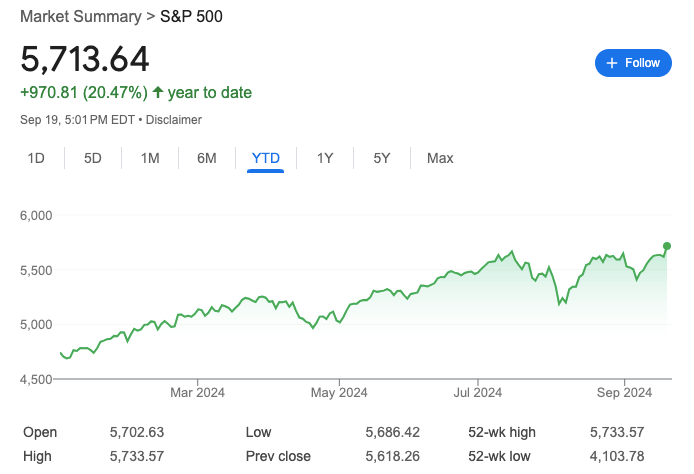

S&P 500 @ 5,713.64 ( ⬆️ 1.70%)

Nasdaq Composite @ 18,013.98 ( ⬆️ 2.51%)

Bitcoin @ $63,432.61 ( ⬆️ 1.82%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter?

👉 Nike CEO steps down

👉 Nvidia and Broadcom rally

👉 BMO raises S&P 500 forecast

So, let’s go 🚀

Market Wrap

Equities jumped higher on Thursday, with the Dow Jones Industrial Average and S&P 500 rising to fresh all-time highs, as Wall Street cheered the Fed’s decision to lower interest rates by 0.50%.

Moreover, traders received some validation that the Fed was engineering a soft landing for the economy, as weekly jobless claims fell by 12,000 to 219,000, which was below estimates.

Tech stocks rallied as the rate cut spurred investors to return to a risk-on mood. Chip stocks such as Nvidia, AMD, and Broadcom added 4%, 5.7%, and 3.9%, respectively.

Other big tech stocks, such as Meta Platforms and Alphabet, advanced by 3.9% and 1.5%, respectively.

Stocks leveraged to lower rates, spurring the economy, also jumped, with JPMorgan rising 1.4%, while Caterpillar and Home Depot added 3.9% and 1.5%, respectively.

While the broad index rose 1.5%, eight of the 11 sectors in the S&P 500 ended on a positive note. Utilities was the worst-performing sector, slipping 0.6%, while real estate and consumer staples also inched lower.

Trending Stocks 🔥

Edgewise Therapeutics - Shares soared almost 55% after the biopharmaceutical company announced positive top-line trial data for a heart disease treatment.

Mobileye Global - The tech stock gained close to 2% after Intel said it has no plans to divest its majority stake in the company.

Progyny - The stock tumbled 33% after the fertility benefits company disclosed it is losing a significant client.

Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

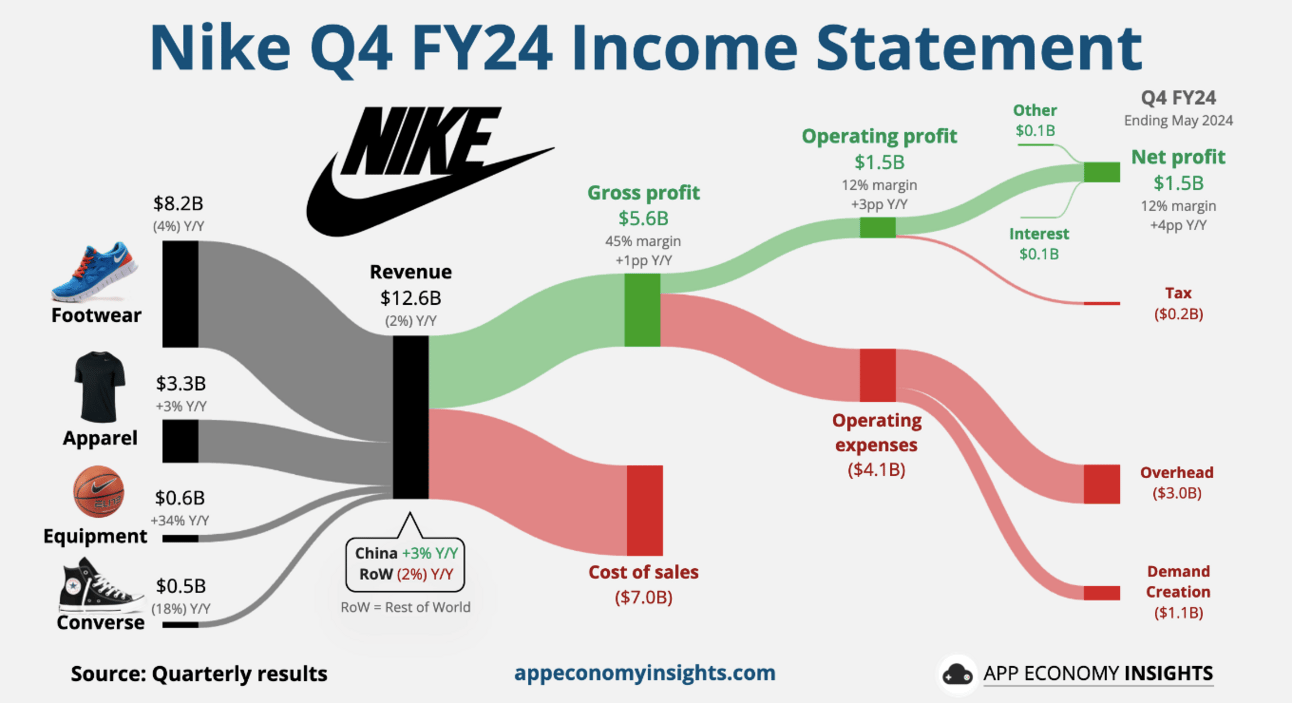

Nike CEO Jon Donahoe Announces Retirement

Yesterday, Nike announced its CEO John Donahoe is stepping down and company veteran Elliott Hill is coming out of retirement to take the helm of the sneaker giant. Donahoe was Nike’s CEO since January 2020 and will retire on October 13th. The stock is up over 6% in pre-market today after falling 25% in 2024.

Nike is in the midst of a broader restructuring after it shifted its strategy to sell directly to consumers. In late June, it forecast sales to fall by 10% in the current quarter (ending in August) due to soft demand in China.

Nike then posted its worst trading day in history, fueling speculations about a CEO change.

Under Donahue, Nike grew its annual sales from $39.1 billion in fiscal 2019 to $51.4 billion in fiscal 2024. While online sales boomed amid COVID-19, Nike’s strategy of cutting off its wholesale partners allowed competitors such as On Running and Hoka to take over the crucial shelf space and gain market share.

In 2024, Donahoe acknowledged that Nike went too far in its efforts to move away from its wholesale partners and explained that the company was fixing it.

Last December, Nike announced a broad restructuring plan to reduce costs by $2 billion over the next three years. It announced a 2% cut in its workforce to invest in growth areas such as running, the women’s category, and the Jordan brand.

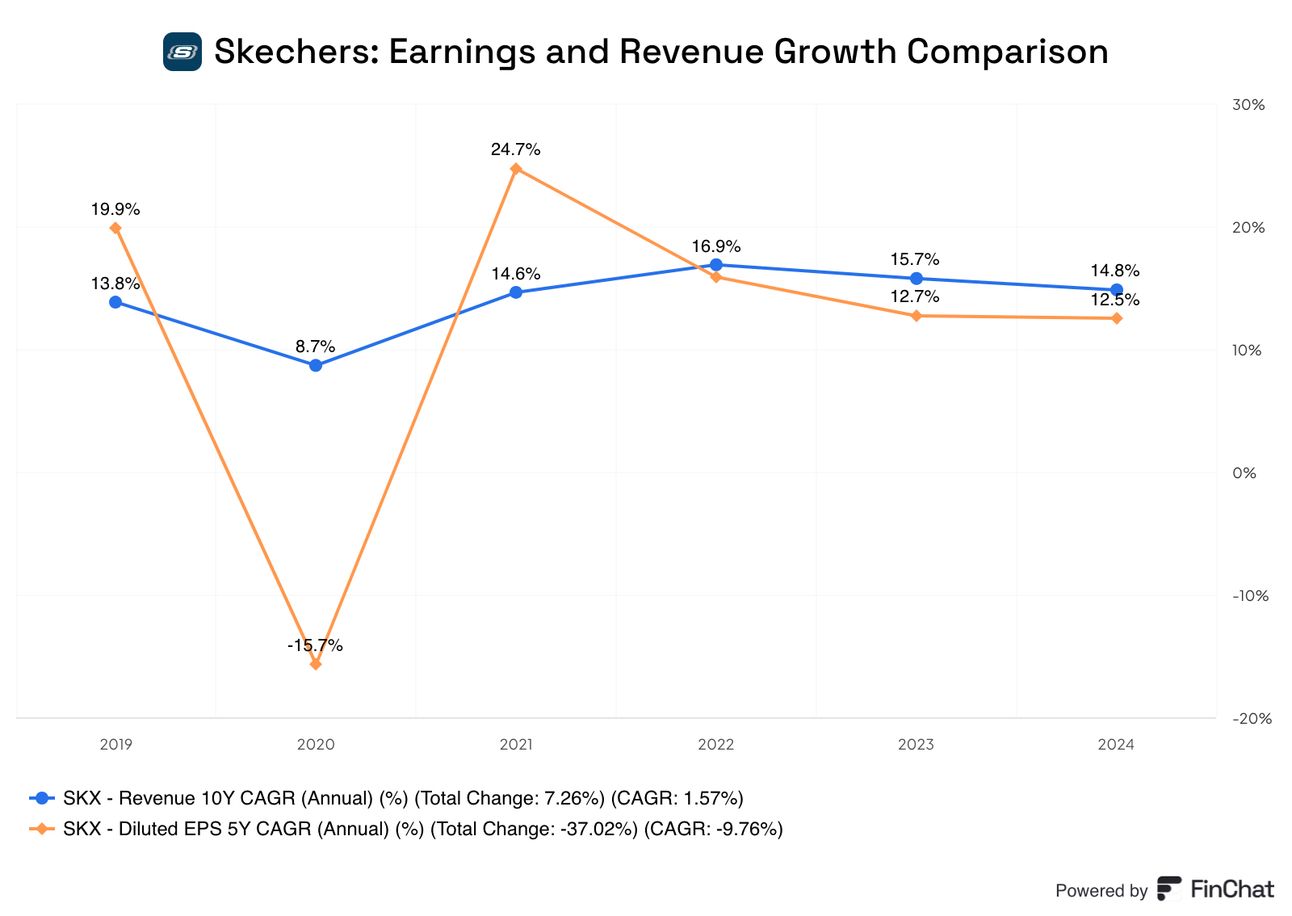

Skechers Tanks Over 9%

Shares of footwear company Skechers tumbled almost 10% after the sneaker maker revealed that its China business was experiencing severe consumer discretionary pressures.

“We’ve definitely seen worse conditions unfold in China than we expected for the back half of the year, so I would expect the back of the year’s going to be more disappointing than what we had originally thought,” said Skechers CFO John Vandemore at the Wells Fargo Consumer Conference. “I think that’s a market that’s still re-forming itself post Covid.”

China is a key market for global retailers, and concerns about the strength of the domestic consumer have been under the radar for the last few years.

The Asia-Pacific region accounted for more than 25% of the top-line for Skechers in 2023.

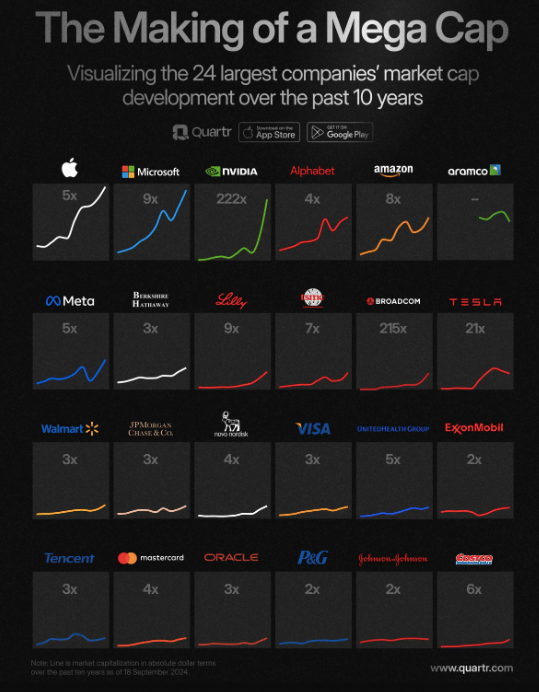

BMO is Bullish on Stocks

Investment bank BMO Capital Markets hiked its year-end target for the S&P 500 to a Wall Street high of 6,100, up from its previous forecast of 5,600. The new forecast suggests the S&P 500 can climb close to 7% from yesterday’s close.

BMO’s chief investment strategist Brian Belski stated, “Much like our last target increase in May, we continue to be surprised by the strength of market gains and decided yet again that something more than an incremental adjustment was warranted.”

Elsewhere, Wells Fargo claimed that the catch-up rally for utility stocks is about to run out of steam, downgrading the sector from “overweight” to “neutral.”

An investor note explained, “The excessively negative sentiment and oversold technicals from late-2023 have eased. The group is a top performer YTD, indicating event-risk uncertainty is well reflected.”

The utility sector is up more than 21% in 2024, outpacing the S&P 500 and Nasdaq Composite.

Headlines You Can't Miss!

Bank of Japan keeps interest rates steady

EU tariffs unlikely to impact Chinese EVs

Disney to ditch Slack following July data breach

UAW warns of strikes at Ford and Stellantis

Crypto exchange Bing X faces $43 million exploit

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.