- 3 Big Scoops

- Posts

- 🗞 Netflix Crushes Q3 Estimates

🗞 Netflix Crushes Q3 Estimates

PLUS: TSMC surges 10%

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

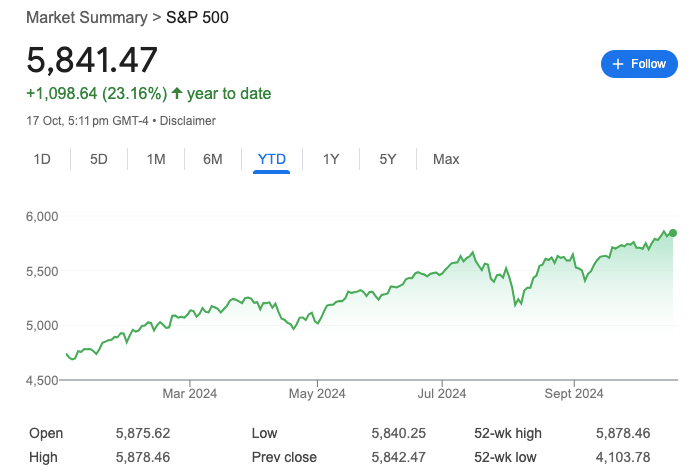

S&P 500 @ 5,841.47 ( ⬇️ 0.017%)

Nasdaq Composite @ 18,373.61 ( ⬆️ 0.036%)

Bitcoin @ $67,749.53 ( ⬆️ 0.41%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter?

👉 Netflix beats consensus estimates

👉 TSMC benefits from AI boom

👉 Travelers spikes 9%

So, let’s go 🚀

Market Wrap

The Dow Jones Industrial Average rallied to a new record high after strong economic data eased lingering fears of a potential recession.

Retail sales figures for September showed that monthly customer spending rose 0.4%, above estimates of 0.3%. Sales excluding autos rose 0.5%, higher than the 0.1% forecast. Moreover, jobless claims for the week that ended Oct 12 were lower than expected.

While stocks have been volatile this week, the utilities sector has led gains, rising 3.4% in the last four trading sessions. Sectors such as financials and real estate are also up over 2%, while the energy sector is down close to 3% week-to-date.

Investors will closely watch housing starts and building permit data today. Furthermore, S&P 500 companies such as American Express and Procter & Gamble will report earnings before the morning bell.

Trending Stocks 🔥

Blackstone - Shares jumped over 6% after the alternative asset manager reported earnings of $1.01 per share and revenue of $2.43 billion in Q3, compared to estimates of $0.92 per share and $2.41 billion, respectively.

CSX - The stock shed more than 5% after it reported revenue of $3.62 billion and earnings of $0.46 per share in Q3, compared to estimates of $3.67 billion and $0.48 per share respectively.

Walgreens Boots Alliance - Shares slid close to 5%, paring some of the 15.8% it gained in the prior session. Earlier this week Walgreens posted an earnings beat and announced plans to close about 1,200 stores over the next three years.

Whiskey: A Hedge Against Market Volatility

Looking to protect your portfolio from the next recession?

Consider investing in rare spirits like whiskey.

Whiskey investing provides a proven hedge against stock market dips driven by inflation and other factors.

With Vinovest, you can invest in high-growth segments such as American Single Malt, emerging Scotch, Bourbon, and Irish whiskey. Thanks to established industry relationships, Vinovest overcomes industry barriers that have made historically whiskey investing expensive and opaque. As a result, you can enjoy high-quality inventory that boosts your portfolio value and enhances liquidity.

Netflix Surges Over 5%

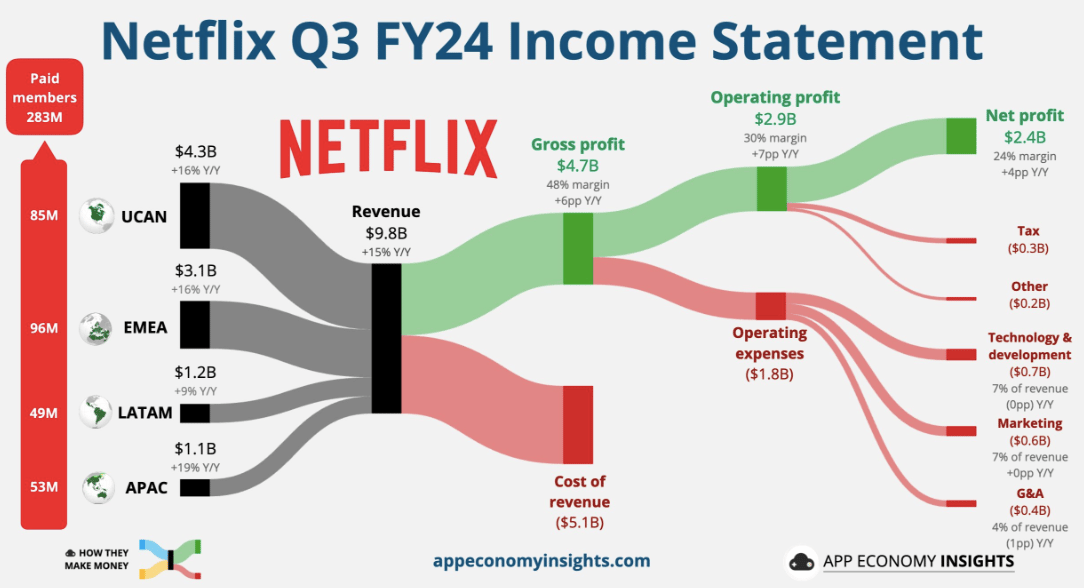

Netflix shares are up over 5% in pre-market trading after the streaming giant beat Q3 revenue and earnings estimates, as its ad business continued to grow.

Netflix's ad-tier memberships rose 35% quarter over quarter. The company also stated that it is on track to launch the service in Canada in the current quarter and in other international markets in 2025.

However, Netflix said it does not expect advertising to be a key growth driver until 2026. It was noted that the ad-tier accounted for over 50% of sign-ups in Q3 in countries where it is available.

In Q3 of 2024, Netflix reported:

👉 Revenue of $9.83 billion vs. estimates of $9.77 billion

👉 Earnings per share of $5.40 vs. estimates of $5.12

👉 Paid memberships of 282.7 million vs. estimates of 282.15 million

While revenue rose 15% year over year, net income grew by over 40% to $2.36 billion in the September quarter. It also forecast Q4 sales at $10.13 billion with adjusted earnings of $4.23 per share.

In 2025, the company expects revenue between $43 billion and $44 billion as it improves core series and film offerings while ramping up investments in new initiatives such as ads and gaming.

Netflix added 5.1 million subscribers in Q3, above the estimated 4.5 million. It ended Q3 with a total of 282.7 million memberships across pricing tiers.

Taiwan Semiconductor Gains Big

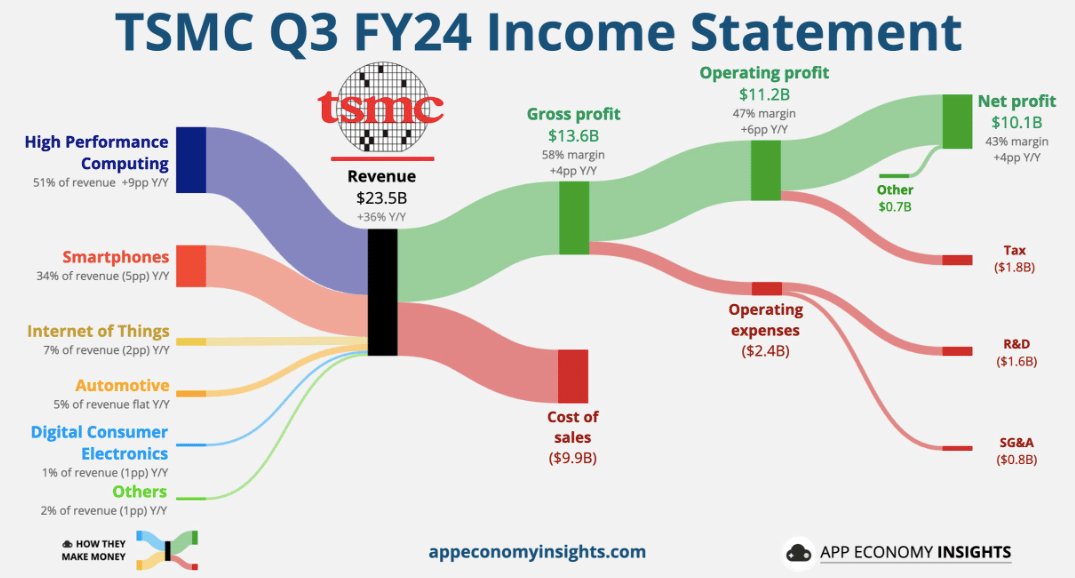

Shares of Taiwan Semiconductor Manufacturing, the world’s largest producer of advanced chips, serving clients such as Apple and Nvidia, jumped 10% after the company reported a 54% hike in Q3 net income.

In Q3 of 2024, TSMC reported a net income of $10.1 billion, almost 10% higher than estimates. Its net sales stood at $23.5 billion, up 36% year over year. The company reported a gross margin of 57.8% in Q3, up from 54.3% in the year-ago period.

In the current quarter, it has forecast Q4 sales between $26.1 billion and $26.9 billion, indicating a 35% annual increase at the midpoint.

TSMC said its business was supported by strong smartphone and AI-related demand for its industry-leading 3nm and 5nm technologies.

TSMC expects capital expenditure to range around $30 billion in 2024, as it spent $6.4 billion in Q3.

Travelers Companies Beats Q3 Estimates

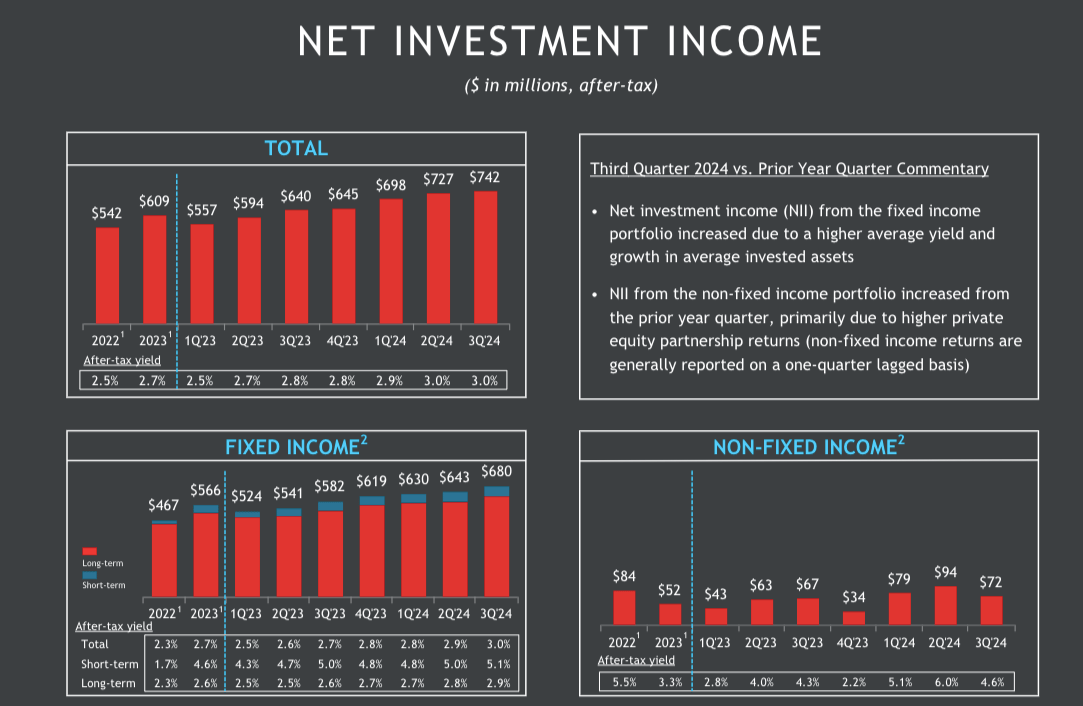

Travelers Companies beat Q3 estimates as higher underwriting gains and investment income offset steep catastrophe losses, sending the stock higher by 9%.

Individuals and businesses have increased insurance spending, allowing insurers to attract and retain clients despite higher prices for some policies such as auto and property.

The company’s core income surged almost 3x to $1.22 billion or $5.24 per share, smashing estimates of $3.55 per share.

Its net written premiums rose 8% while underwriting gains climbed to $685 million, compared to a loss of $136 million last year. Notably, net investment income rose 18% due to strong fixed-income returns and growth in fixed-maturity investments.

Travelers reported a combined ratio of 85.6%, compared to 90.6% last year. A ratio of below 100% means the insurer earned more in premiums than it paid in claims.

Headlines You Can't Miss!

China reports Q3 GDP growth of 4.6%, beats estimates

Intel seeks billions for minority stake in Altera

Teen tobacco use falls to 25-year low

China’s robotaxi firm Pony Ai files for U.S. IPO

U.S. crypto voting bloc forecast at 26 million

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.