- 3 Big Scoops

- Posts

- 🗞 TSMC Benefits From AI Boom

🗞 TSMC Benefits From AI Boom

PLUS: DoJ takes aim at Google

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

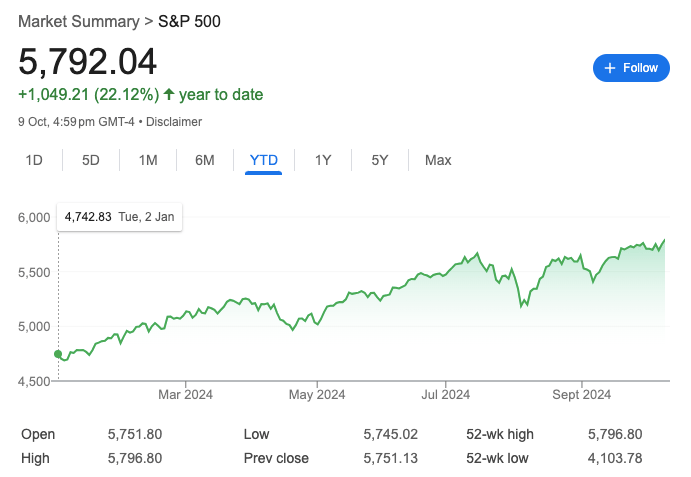

S&P 500 @ 5,792.04 ( ⬆️ 0.71%)

Nasdaq Composite @ 18,291.62 ( ⬆️ 0.60%)

Bitcoin @ $63,126.50 ( ⬇️ 0.03%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 TSMC stuns Wall Street

👉 Will Google break up?

👉 Tech stocks continue to rally

So, let’s go 🚀

Market Wrap

Stocks rose for a second straight session on Wednesday with the S&P 500 and Dow Jones Industrial Average closing at records, as tech stocks powered higher and investors shook off geopolitical concerns.

Tech giants such as Amazon and Apple gained over 1%, while server maker Super Micro Computer rallied 4%, pushing the major averages into positive territory for the month.

Today, investors will closely watch September’s CPI report, which is forecast to advance 2.3% year over year and 0.1% compared to October.

The CPI report will indicate the Fed’s next policy steps at its November meeting. According to the FedWatch tool, there is a 70% chance of a quarter-point cut next month.

Trending Stocks 🔥

Astera Labs - Shares gained almost 16% as the data connectivity chip company launched new fabric switches for AI.

Norwegian Cruise Line - Shares popped 11% on the heels of a Citi upgrade to “buy” from “neutral.” The investment firm said the cruise line company should see significant earnings growth and margin expansion going forward.

Bayer - The life sciences stock fell over 5% after the U.S. Supreme Court said it would review a case against the company that alleges that several people at the Sky Valley Education Center in Washington state were harmed from exposure to products made by its Monsanto unit.

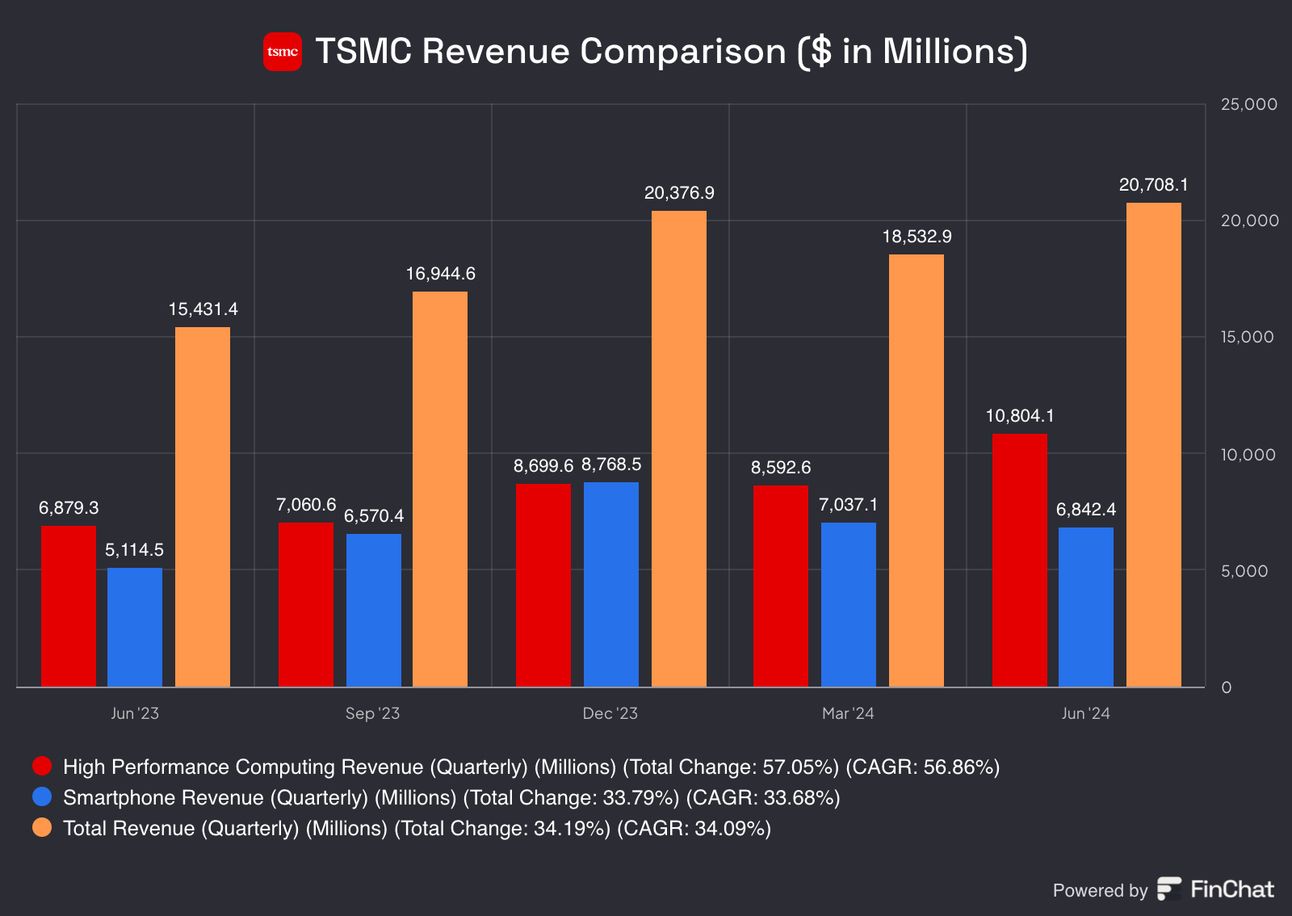

TSMC Sales Rise 39%

Semiconductor giant Taiwan Semiconductor posted a 39% rise in Q3 sales, assuaging concerns that AI hardware spending is beginning to taper off.

TSMC owns and operates the world’s largest chip foundry, manufacturing products for big tech giants such as Nvidia and Apple. It reported revenue of $23.6 billion in Q3, above year-ago sales of $17.07 billion.

Meanwhile, Wall Street forecast the company to report sales of $23 billion in Q3.

Its better-than-expected performance reinforces the view that AI spending will remain elevated as companies seek an early-mover advantage.

TSMC is at the epicenter of the AI boom, manufacturing cutting-edge chips to train AI platforms such as ChatGPT.

With gross margins of over 54% and an operating margin that exceeds 40%, TSMC is expected to grow sales by 7% sequentially in Q4, according to consensus estimates.

Shares of the chip maker have more than doubled since the launch of ChatGPT and briefly crossed the $1 trillion market cap threshold in July.

TSMC expects AI spending to remain high as several start-ups and established companies, such as Microsoft and Baidu, are splurging on AI infrastructure in a race to develop applications.

TSMC generates over 50% of its sales from high-performance computing, a segment driven by AI demand.

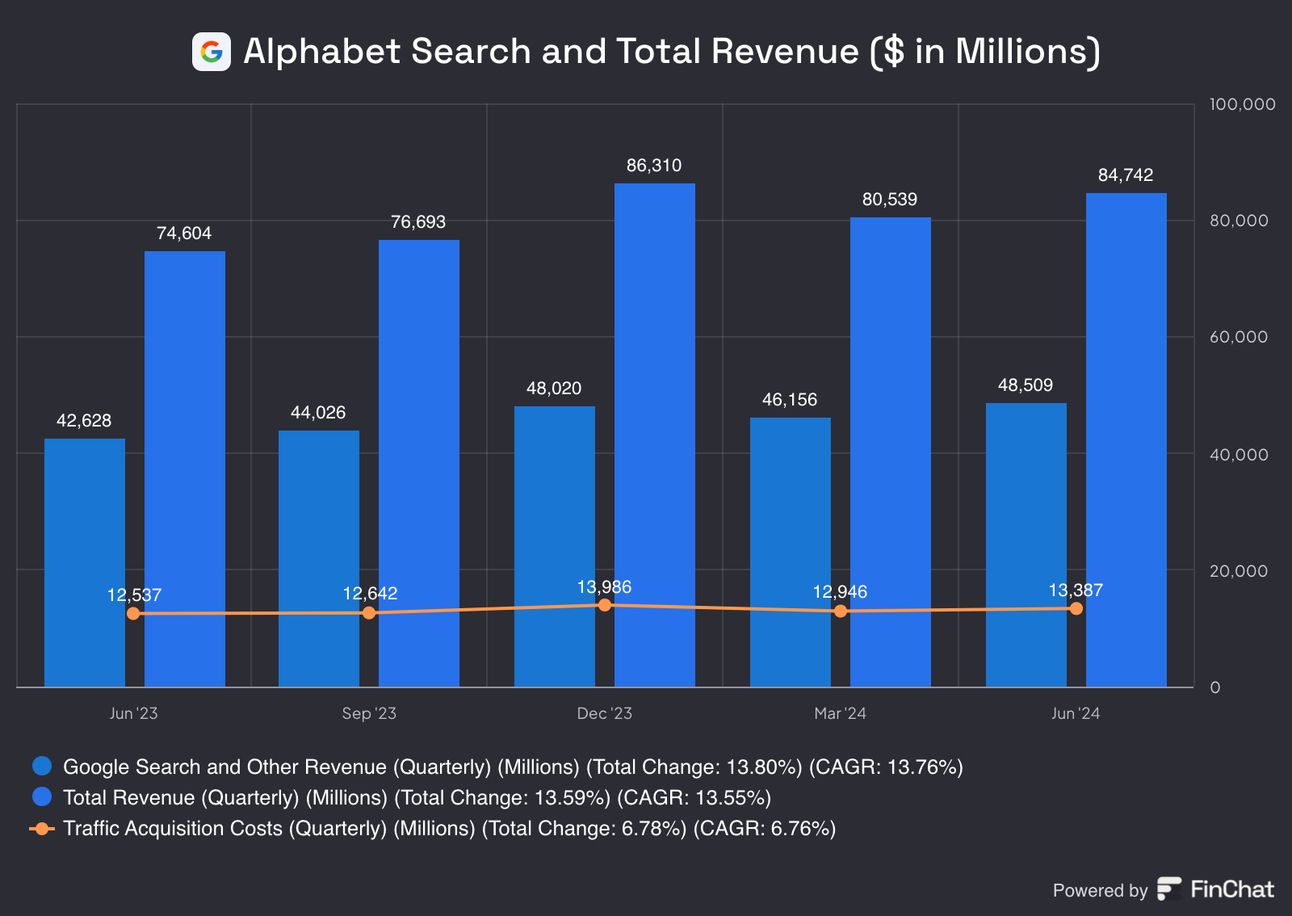

Google’s Monopoly Is Under Threat

The U.S. Department of Justice made recommendations for Google’s search engine business practices, indicating it was considering a possible breakup of the tech giant as an antitrust remedy.

The DoJ explained the remedies are necessary to prevent and restrain monopoly maintenance and could include contract requirements and prohibitions as well as data and interoperability requirements.

The regulator also said it considered remedies to prevent Google from using products such as Google Chrome and Android to advantage Google search and related platforms.

Finally, the DoJ suggested limiting revenue-sharing agreements related to search products. This includes Google’s search position agreements with Apple’s iPhone and Samsung devices, which cost the company billions of dollars a year in payouts.

In August, a U.S. judge ruled that Google holds a monopoly in the search market, while another ruling in 2020 alleged the company has kept its share by creating strong entry barriers and a feedback loop that sustained its dominance.

Legal experts believe the most likely outcome is for Google to shelve certain exclusive agreements like the one with Apple. The court may also suggest that Google make it easier for users to try other search engines, and a breakup seems likely.

In Q2, Google’s search business generated $48.5 billion in sales, or 57% of total revenue. The company holds a 90% share of the online search market.

In another antitrust case this week, a U.S. judge issued a permanent injunction that will force Google to offer alternatives to its Google Play store for downloading apps on Android phones.

GOOGL stock fell 1.5% yesterday and is up 17% in 2024, trailing the broader markets this year.

IT Stocks Surge 30% in 2024

Recent advances have propelled the S&P 500 information technology sector’s gain above the 30% mark in 2024. The sector is up 2% this year, bringing its YTD rally to 31%, compared to the 21% gains of the S&P 500 index.

This year, Nvidia and Palantir have driven the outperformance, with the stocks rallying over 160% and 140%, respectively. Other top gainers include Fair Isaac and Arista Networks, both of which have rallied 70% in 2024.

Alternatively, several stocks in the sector have bucked the trend. Intel is the worst performer of the group, with a drop of 50% in 2024. Adobe and On Semiconductor were also among the top names tracking for losses this year.

Headlines You Can't Miss!

Tributes pour in for India’s Ratan Tata

Nvidia trades near an all-time high

AI startup Writer launches new model to compete with OpenAI

U.S. crude oil drifts lower, falls below $74 per barrel

Solana has over 100 million wallets, but most are empty

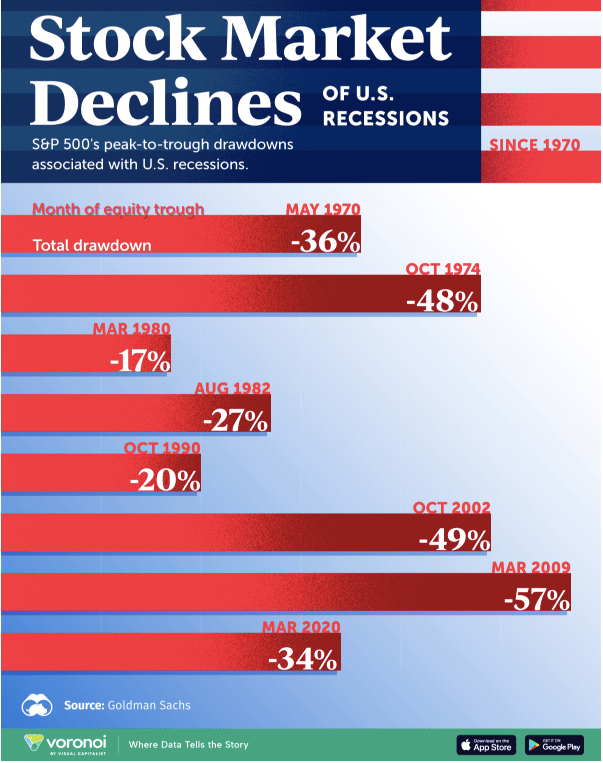

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.