- 3 Big Scoops

- Posts

- Netflix: Q1 Earnings Preview

Netflix: Q1 Earnings Preview

Will Netflix beat estimates in Q1?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,209.91 ( ⬆️ 0.14%)

Nasdaq Composite @ 16,306.64 ( ⬆️ 0.32%)

Bitcoin @ $68.865.67 ( ⬇️ 2.97%)

Hey Scoopers,

Happy Wednesday. Midweek milestone achieved!

In today’s issue, we examine the consensus estimates for Netflix’s upcoming earnings and dive deeper to analyze the streaming giant’s business model and fundamentals.

So, let’s go 🚀

What to Expect from Netflix in Q1

After a stellar performance amid the COVID-19 pandemic, Netflix has trailed the broader markets since touching all-time highs in October 2021. Today, Netflix stock is down 11% from record levels despite rising 82% in the last 12 months.

Valued at a market cap of more than $265 billion, Netflix is the largest streaming company in the world.

The next major driver of the company’s stock price will be its upcoming earnings report. Netflix is set to report its Q1 of 2024 (ended in March) results on April 18, 2024.

Let’s see what Wall Street expects from NFLX in Q2.

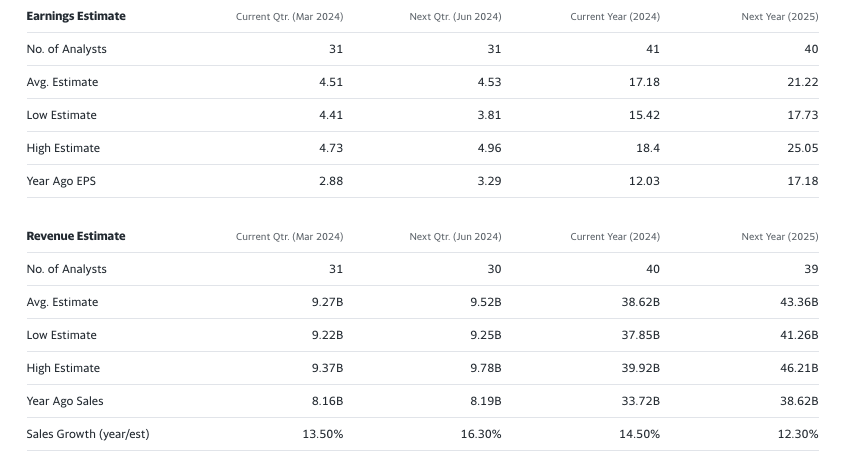

Netflix’s Earnings and Revenue Estimates

Source: Yahoo Finance

Analysts covering Netflix expect:

👉 Sales to rise by 13.5% to $9.27 billion

👉 Earnings to rise by 56.6% to $4.51 per share

In the year-ago period, Netflix reported revenue of $8.16 billion and earnings of $2.88 per share.

Did You Binge Invest In Netflix?

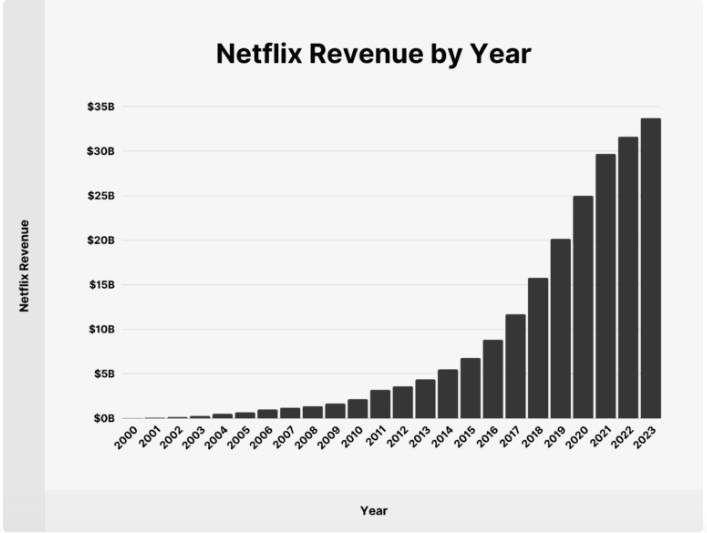

Despite the drawdown in share prices since 2021, Netflix stock has crushed broader market returns, rising over 1,130% in the last decade. The key factor driving NFLX stock higher is its growth trajectory.

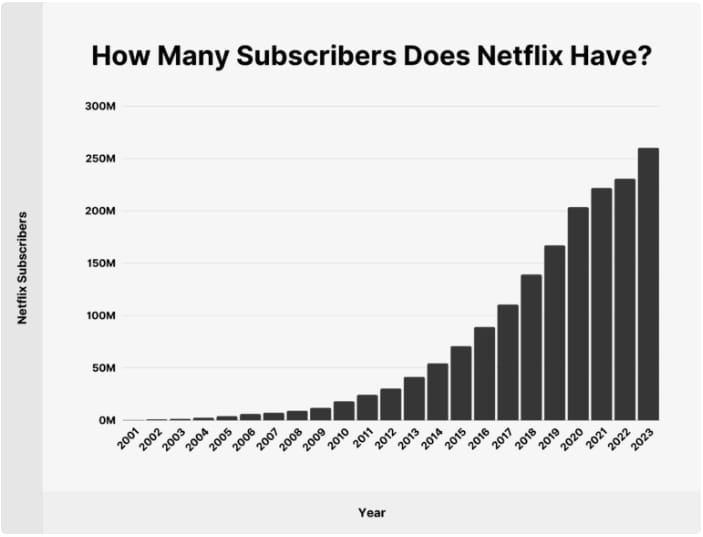

Netflix ended 2023 with 260 million subscribers in 190 countries, much higher than the 44 million subscribers at the end of 2013. The streaming heavyweight could scale at an enviable pace due to secular tailwinds such as rising broadband internet penetration and the cord-cutting phenomenon.

Source: Netflix

Netflix’s growth story is far from over, given there are one billion broadband-enabled households globally, excluding China.

Netflix has a simple business model. It creates and acquires content, which is then distributed on its streaming platform for a monthly subscription fee.

In the last year, it has introduced an ad-supported tier and cracked down on password sharing, a move that has boosted subscriber numbers. For instance, Netflix increased its subscriber base by 13.1 million in Q4 of 2023.

Source: Backlinko

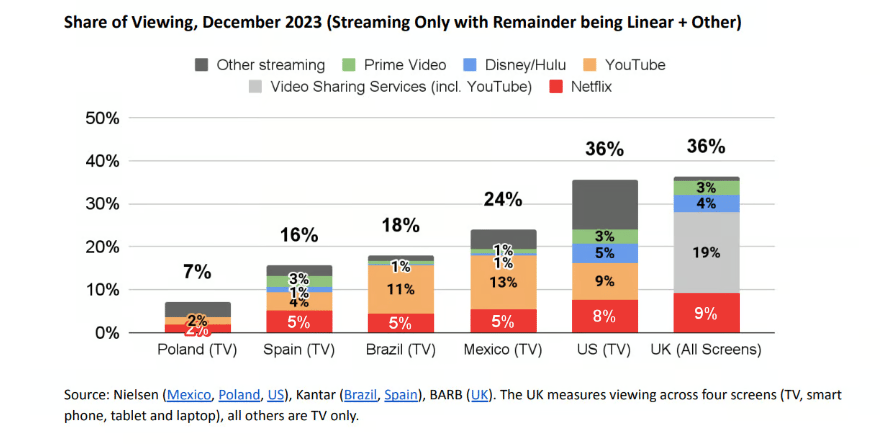

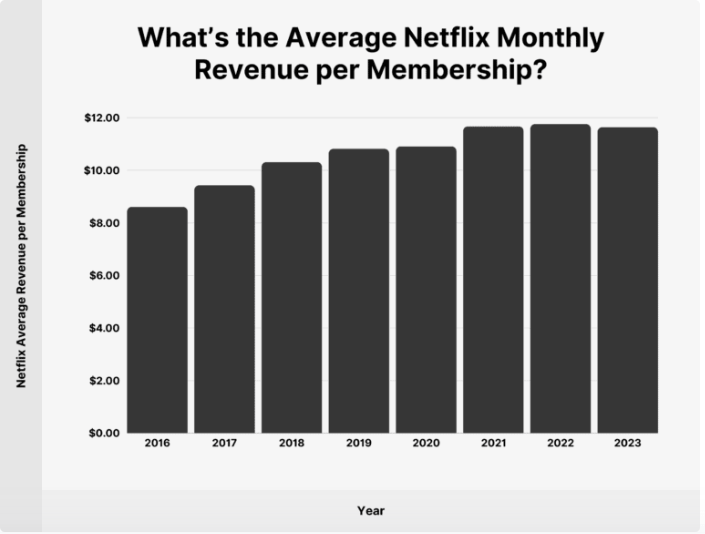

Netflix runs a borderless media empire, while traditional TV businesses in the U.S. are confined to limited markets. Its first-mover advantage provides Netflix with a competitive moat, while investments in content production offer it strong customer engagement rates and pricing power.

Netflix Reports Consistent Profits

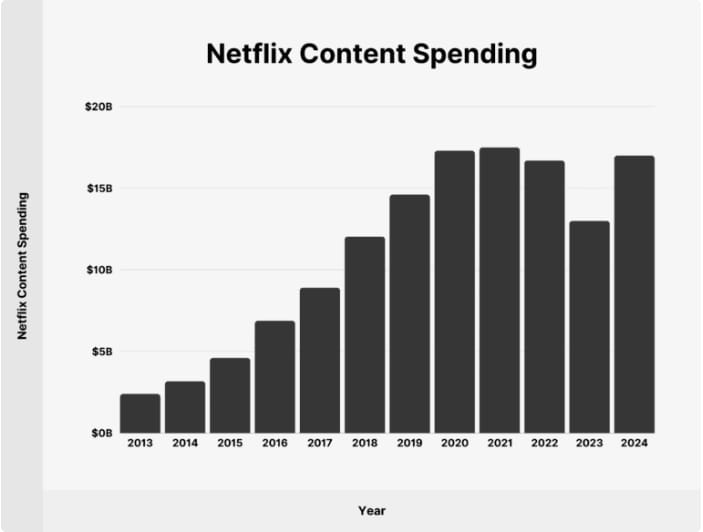

A few years back, the bears were convinced Netflix would never stop burning cash as it spent billions of dollars creating and acquiring content.

In 2023, Netflix reported revenue of $34 billion and a free cash flow of $6.9 billion in 2023, up from $1.6 billion in 2022. In 2024, it expects free cash flow at $6 billion.

Source: Backlinko

Due to consistent profits, Netflix will no longer have to depend on capital markets to fund its operations, even as it has allocated $17 billion towards content development in 2024.

Basically, Netflix can easily spread its fixed cost over a larger subscriber base than its peers, providing it with an advantage in the industry.

Due to a widening earnings base, Netflix has the flexibility to return capital to shareholders. In the last 12 months, Netflix repurchased shares worth $6 billion, with another $8.4 billion left under the current authorization.

Analysts Are Bullish on NFLX Stock

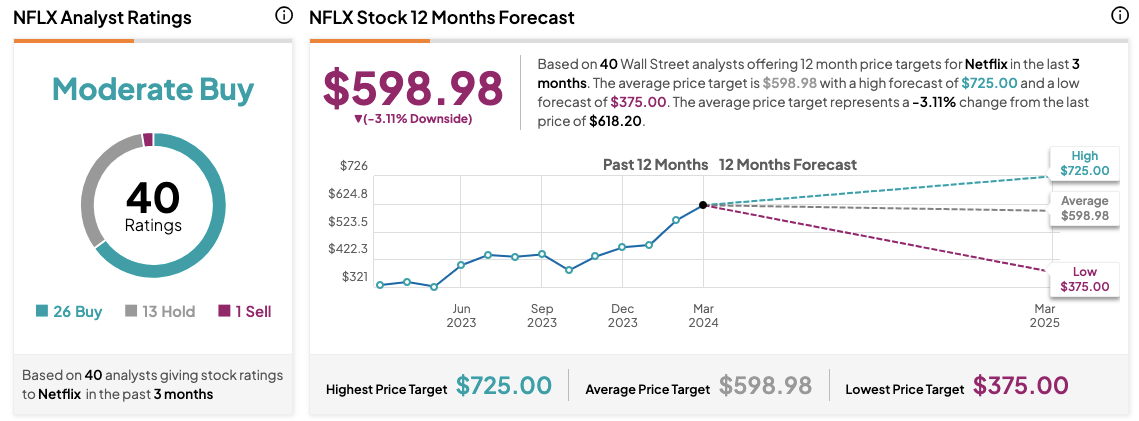

In recent months, analysts such as Oppenheimer and Jeffries raised price targets for NFLX stock.

Oppenheimer analyst Jason Helfstein increased the 12-month target price for the tech stock from $615 to $725 due to:

👉 Improving monetization for the ad-supported tier and

👉 Crackdown on password-sharing

Both these initiatives have unlocked additional revenue streams for Netflix. Moreover, a subscription rate increase in October should boost average revenue per user by 4% in 2024, up from 2.5% in 2023.

Source: Backlinko

Jeffries analyst Andrew Uerkwitz lifted the price target on Netflix from $580 to $700. The analysts adjusted subscriber estimates higher due to the weak competitive landscape and healthy engagement despite password-sharing measures introduced in 2023.

Several streaming peers, such as Disney, have been cutting streaming costs amid a challenging macro environment. Comparatively, Netflix is cutting huge checks for high-profile movies and shows.

It is diversifying into live sports and entertainment, inking a deal for the distribution of WWE’s Raw and the streaming rights for the Mike Tyson and Jake Paul fight later this year.

Is Netflix Stock Undervalued?

The world is a large place, and Netflix estimates its share of global screen time is still at a single-digit percentage. Its ad-supported tier, rising subscriber base, and higher subscription costs should translate to revenue growth in the near term.

Source: Backlinko

Netflix is positioned for success despite the rise in competition. In the last five years, several new and legacy players have entered the streaming space but have struggled to displace Netflix from its pole position.

Analysts tracking Netflix expect the company to increase sales by 14.5% to $38.6 billion in 2024 and by 12.3% to $43.4 billion in 2025. Its adjusted earnings are forecast to expand from $12 per share in 2023 to $17.2 per share in 2024 and $21.4 per share in 2024.

Priced at 36x forward earnings, NFLX stock might seem expensive. But its earnings are on track to grow by 25% annually in the next five years.

Source: TipRanks

Out of the 40 analysts tracking NFLX stock, 26 recommend “buy,” 13 recommend “hold,” and one recommends “sell.” The average target price for NFLX stock is $600, which is 3% below the current trading price.

The Takeaway

Despite its volatile stock price, Netflix’s historical performance has been spectacular. However, it's safe to assume that Netflix will not be able to replicate these gains going forward.

The company is wrestling with market saturation in mature geographies such as the U.S. and Canada, resulting in decelerating top-line growth.

Those looking to gain exposure to the tech stock can do so by investing in exchange-traded funds that track indices such as the S&P 500 and Nasdaq Composite.

Netflix accounts for 0.6% of the S&P 500 index and 2% of the Nasdaq Composite index.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.