- 3 Big Scoops

- Posts

- An IPO Boom In 2024?

An IPO Boom In 2024?

PLUS: Robinhood plans to enter U.K. (Again!)

Bulls, Bitcoin, and Beyond

Hello Folks,

Let’s jump straight into today’s exciting news lineup

👉 Upcoming big-ticket IPOs in 2024

👉 Robinhood’s expansion plans

👉 Cristiano Ronaldo faces lawsuit for Binance promotion

So, let’s go 🚀

An IPO Revival in 2024

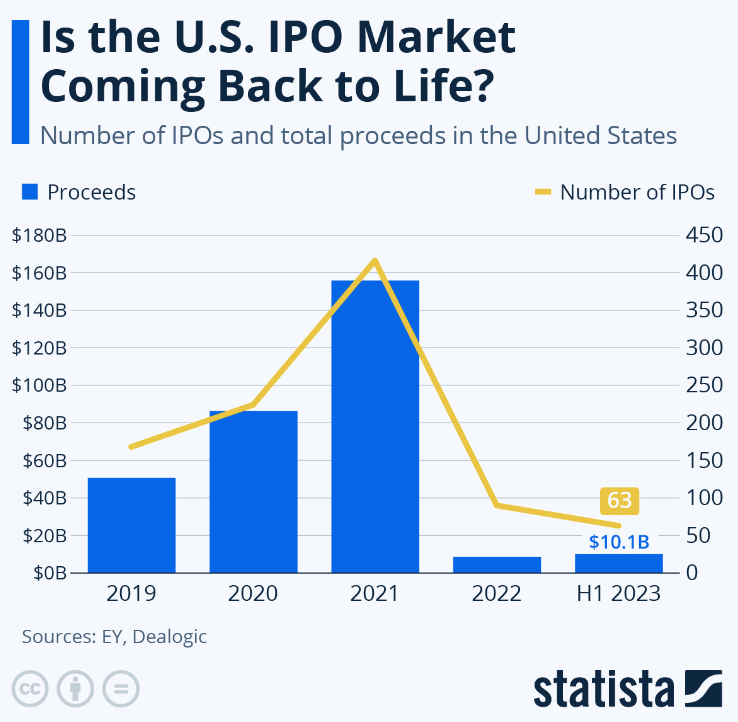

After a lull in the last 18 months, IPO (initial public offering) activity in the U.S. may spring back to life in 2024.

Investors should brace for significant developments in IPO land as several companies are considering going public next year. The list includes:

Skims- Kim Kardashian’s lingerie brand currently valued at $4 billion

Reddit- A popular social media platform

Rubrik- A cloud and data security company backed by Microsoft

Shein- A retail giant valued at $66 billion

The IPO gold rush fizzled out in 2022, and this trend was replicated this year, too.

On average, the IPO markets in the U.S. raise $50 billion each year. However, companies raised just $7.7 billion in 2022, while 96 companies raised $18.8 billion in 2023.

Companies generally delay IPO plans when market sentiment turns bearish, as they may be forced to settle for a lower valuation.

Robinhood Plans to Launch in the U.K.

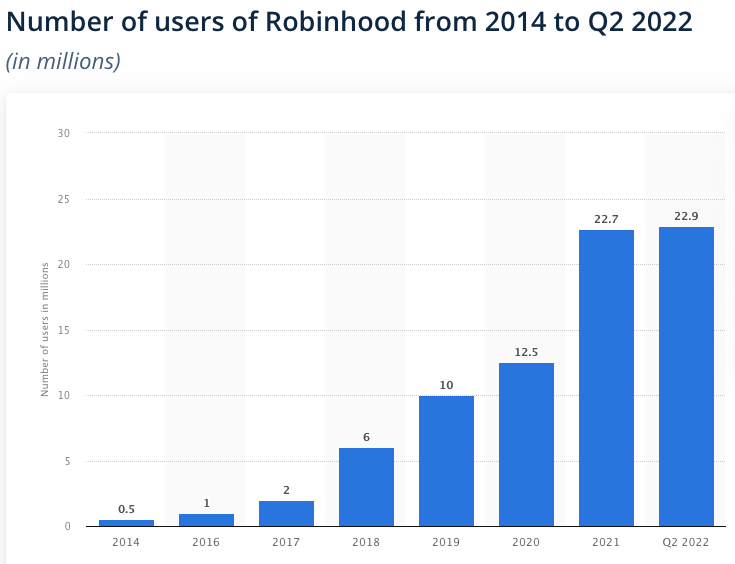

Online brokerage platform Robinhood announced plans to launch in the U.K. in early 2024. It will be the company’s third attempt at expanding into international markets.

Source: Statista

Robinhood will let investors in the U.K. choose from a basket of 6,000 U.S. stocks and offer them a 24-hour trading window five days a week.

Robinhood emphasized it won’t offer U.K. stocks initially but will add them as it gains traction in this region. The U.K. app version will not include sophisticated products such as options and derivatives at launch, either.

Jordan Sinclair, Robinhood’s U.K. chief, said he expects 24-hour trading to be popular, as it will let users trade on market-moving news.

“You wake up in the morning, you read the news headlines, and then you have to wait,” Sinclair said. “Customers actually can make a trade and choose their investment strategy and actually act on that market news.”

According to CNBC, Robinhood has already tried to launch in the U.K. twice. Around 300,000 people signed up for its waiting list in 2019, but Robinhood shelved its expansion plans as demand soared amid the COVID-19 pandemic.

Last year, it disclosed plans to acquire Ziglu, a U.K.-based crypto trading application, but the deal soon faltered. Moreover, Robinhood was forced to write off $12 million via impairment charges.

Will it be third time lucky for Robinhood in the U.K.?

What does this mean for Robinhood?

Robinhood experienced massive growth in 2020 due to a spike in retail trading. For instance, Robinhood’s user base more than doubled from 10 million in 2019 to 22.7 million in 2021. It moved marginally higher to 22.9 million in 2022.

Its expansion plan in the U.K. should allow the brokerage platform to widen its user base again.

Cristiano Ronaldo Sued for Binance Link

Football legend Cristiano Ronaldo is facing a class-action lawsuit for promoting crypto exchange Binance, which is wrestling with legal troubles in the U.S.

The lawsuit was filed on November 27 with a District Court in Florida and claims Ronaldo “promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance.”

The plaintiffs claim they suffered losses from Ronaldo’s association and promotion of Binance and are seeking damages for the same.

Binance and Ronaldo entered into a multi-year agreement in 2022 to promote NFTs (non-fungible tokens) featuring the footballer.

According to the lawsuit, users who signed up for the NFTs were more likely to use the Binance platform for investing cryptocurrencies, a majority of which have been classified as unregistered securities.

It includes Binance’s BNB token and crypto yield programs offered on the crypto exchange.

Headlines You Can’t Miss!

Elon Musk says advertisers are blackmailing him

Microsoft secures a non-voting board seat at Open AI

China’s factory activity shrinks again in November

Singapore tops the most-expensive cities list

Bitcoin’s first halving event took place 11 years back

Chart of the Day

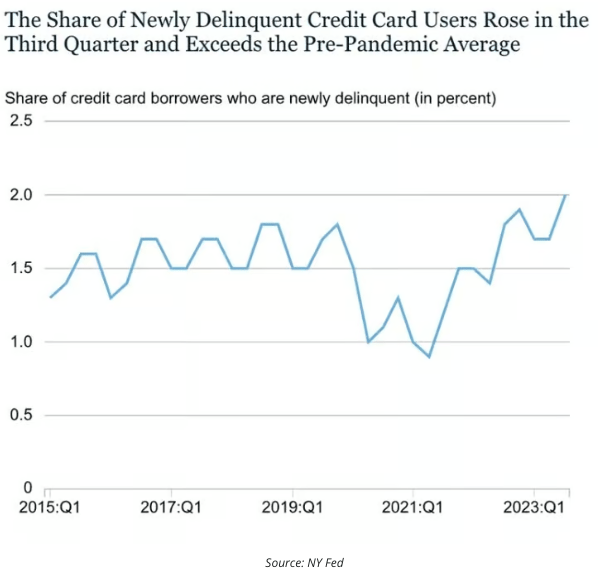

Data from the New York Fed suggests credit card debt has surged to $1.08 trillion, and this number excludes balances from retail credit cards, which account for an additional $530 billion.

Delinquency rates for credit cardholders have exceeded pre-pandemic levels due to rising interest rates, high inflation, and a sluggish economy, all of which have translated to lower household savings.

Further, it was the eighth consecutive quarter of year-over-year credit card balance growth.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.