- 3 Big Scoops

- Posts

- Home Depot Acquires SRS

Home Depot Acquires SRS

PLUS: Amazon builds stake in Anthropic

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,248.59 ( ⬆️ 0.86%)

Nasdaq Composite @ 16,399.52 ( ⬆️ 0.51%)

Bitcoin @ $69,643.37 ( ⬇️ 0.11%)

Hey Scoopers,

Happy Thursday! The long weekend is here 🎉

Let’s see what’s moving the markets 👇

👉 Home Depot acquires SRS

👉 Robinhood launches a credit card

👉 BlackRock bullish on Bitcoin

So, let’s go 🚀

Market Wrap 📉

The S&P 500 rose yesterday, closing at a record as the index heads for its best Q1 in five years. Investors witnessed a broader market rally as all 11 sectors of the index registered gains.

Capital-intensive sectors led the gains, with utilities rising 2.8%, followed by real estate at 2.4% and industrials at 1.6%.

The major indices are poised to end Q1 on a strong note, with the S&P 500 on track for a 10% advance. The Dow Jones index is up 5.5%, while the tech-heavy Nasdaq added 9.3%.

Later this week, investors will watch data on jobless claims, gross domestic product, and consumer sentiment.

While the market is closed tomorrow, attention will be on data releases tied to personal income, consumer spending, and personal consumption expenditures.

Trending Stocks 🔥

GameStop - The video game retailer shed roughly 15% after it reported lower Q4 revenue compared to the year-ago period.

Merck - Shares of the healthcare giant popped 4% after the U.S. Food and Drug Administration approved its drug to treat a life-threatening lung condition.

Carnival - The stock slipped 2% after the cruise operator reported Q1 revenue of $5.41 billion, below estimates of $5.43 billion.

Home Depot Announces Big Ticket Deal

Today, Home Depot announced its intention to acquire SRS Distribution for $18.25 billion, showcasing the company’s plans to gain traction among contractors, professionals, and businesses.

Source: CNBC

The home improvement giant expects to close the deal within the next 10 months and will finance the acquisition via a combination of cash and debt.

SRS Distribution sells supplies to professionals in the landscaping, pool, and roofing business. The Texas-based company has 760 branches in 47 states and a fleet of 4,000 delivery trucks.

Home Depot expects the deal to increase its total addressable market by $50 billion.

Amazon Invests $2.75 Billion in Anthropic

Amazon just made its largest outsized investment in its 30-year history as it looks to take a lead in the artificial intelligence race. The tech giant will invest $2.75 billion in Antrhopic, an AI-based start-up operating in the generative AI space.

Last September, Amazon invested $4 billion in the high-flying start-up, maintaining a minority stake in the company.

Anthropic is valued at $18.4 billion and is a direct competitor to OpenAI’s ChatGPT.

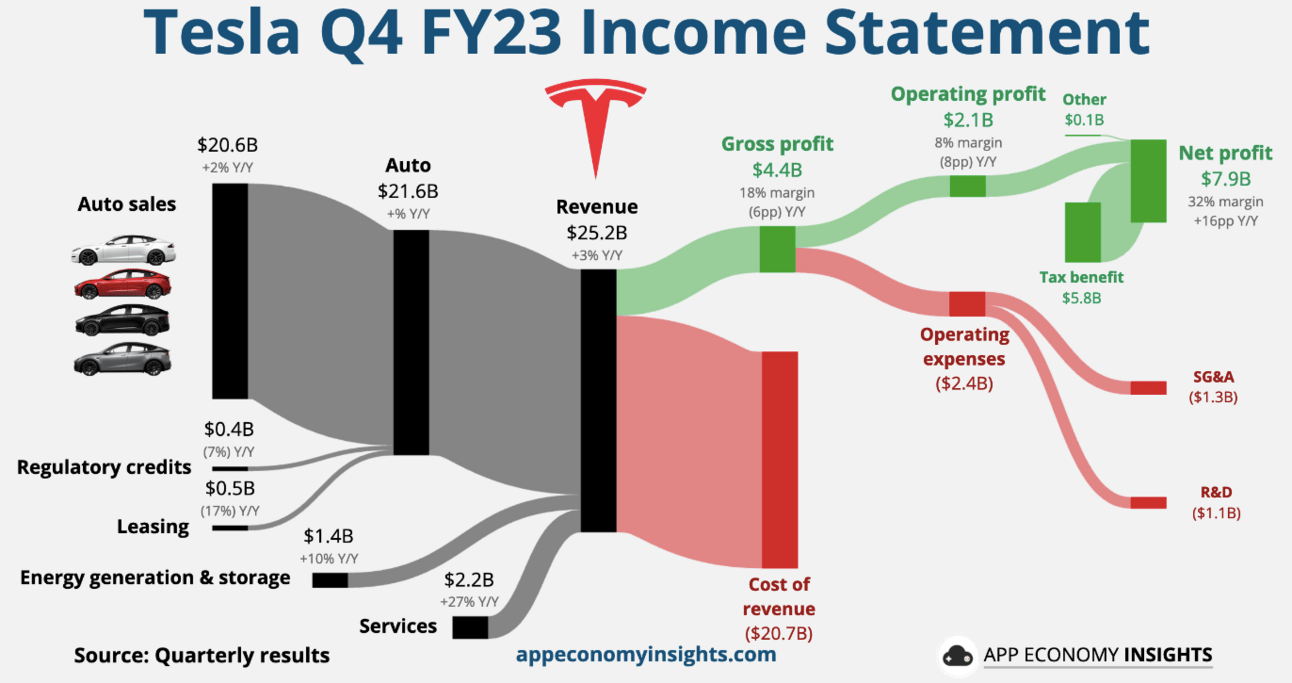

Morgan Stanley Cuts Tesla’s Delivery Forecast

Morgan Stanley’s head of global auto and shared mobility research, Adam Jonas, cut his forecast for Tesla’s vehicle deliveries.

Jonas expects Tesla’s vehicle deliveries in Q1 at 425,400, 9% lower than his previous forecast of 469,400. The new forecast indicates a yearly growth of just 0.6%.

Moreover, full-year delivery estimates stand at 1.95 million, implying a growth of 8% year over year.

Tesla has been wrestling with sluggish consumer spending and a volatile macro environment in the last 18 months, dragging shares of the EV giant lower by 56% from all-time highs.

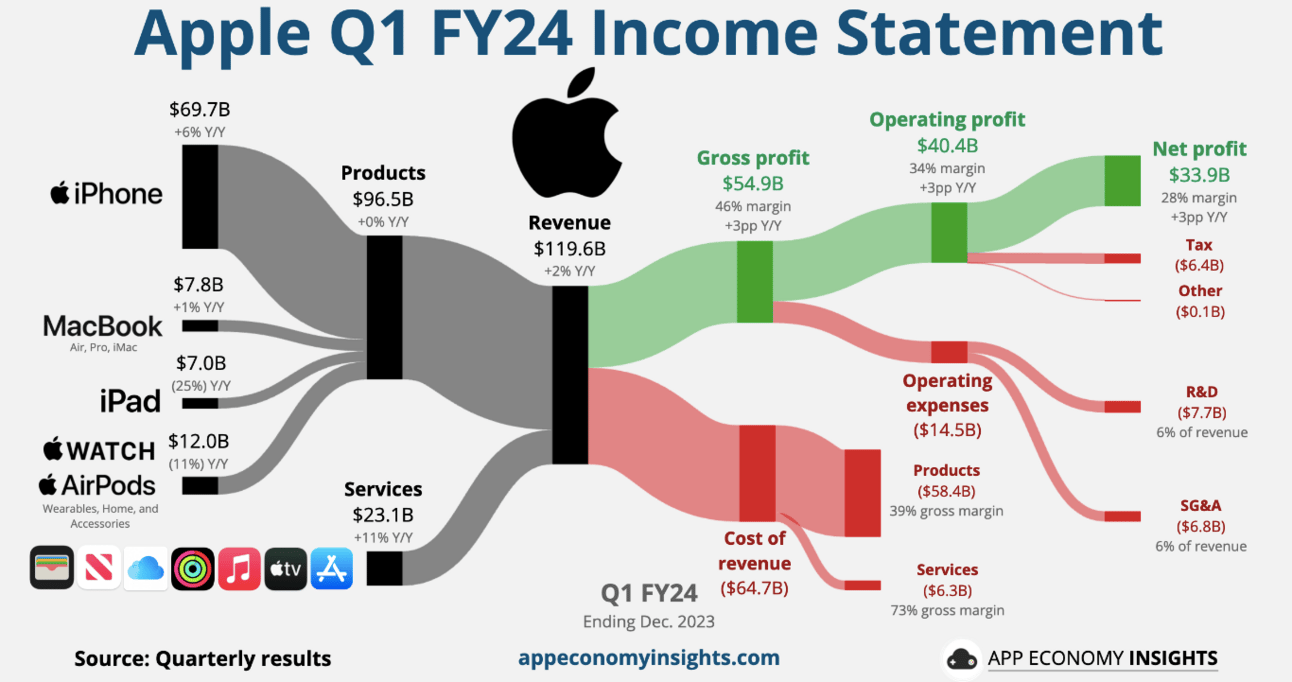

Apple Continues to Trail the S&P 500

Slowing sales in China and the lack of a clear artificial intelligence story have hampered Apple stock in 2024.

The tech giant soared 48% in 2023 but retreated around 12% in Q1 of 2024. Apple's 200-day outperformance spread versus the S&P 500 index is the widest in almost 11 years.

A market rally without Apple’s contribution is quite rare. In fact, the S&P 500 index has lost 9.3% on average when Apple stock has declined over a 200-day trading window.

Robinhood, Equities, and EVs

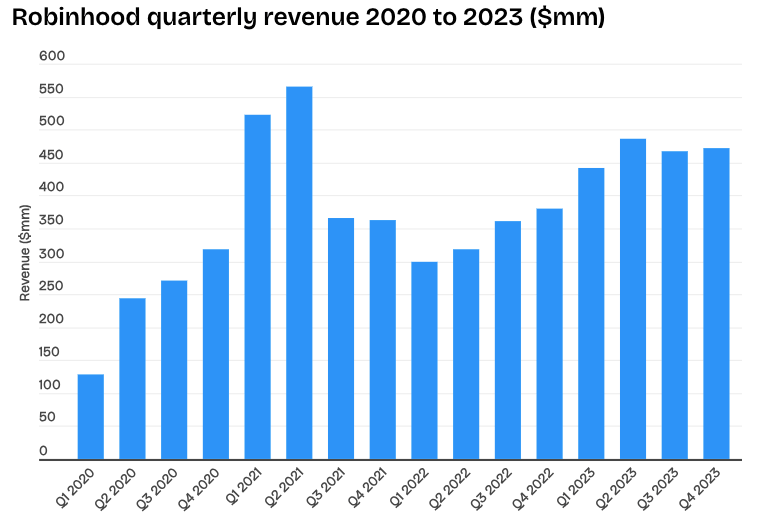

Shares of Robinhood gained around 4% after the brokerage platform disclosed plans to launch a credit card as it looks to expand its suite of financial services.

Robinhood said the card will be available to premier Robinhood Gold customers.

It will have no annual fees and zero foreign transaction fees while offering customers 3% cash back in the form of reward points.

Moreover, bookings made via the company’s new travel portal will attract a 5% cash back.

Source: BusinessofApps

Robinhood’s credit card launch comes two years after it launched a debit card. According to the discount broker, a 3% cash back is well above industry norms and should appeal to existing customers as well as expand its user base.

Robinhood ended February with $80.9 billion in equity trading volume, up 36% compared to the year-ago period. Its customer base has risen to 23.6 million.

After trailing the broader markets significantly in 2022, the stock has more than doubled in the last 12 months.

GE Vernova and Solventume to join the S&P 500 index

GE Vernova and Solventum are set to join the S&P 500 index next week. Solventum is 3M’s healthcare business, which will spin off from the conglomerate and trade under the ticker symbol SOLV.

Similarly, GE Vernova is part of General Electric’s power business and will spin off on April 2, trading under the ticker GEV.

The S&P index will drop V.F. Corp and Dentsply Sirona from the broad market index, with the latter joining the S&P Midcap 400.

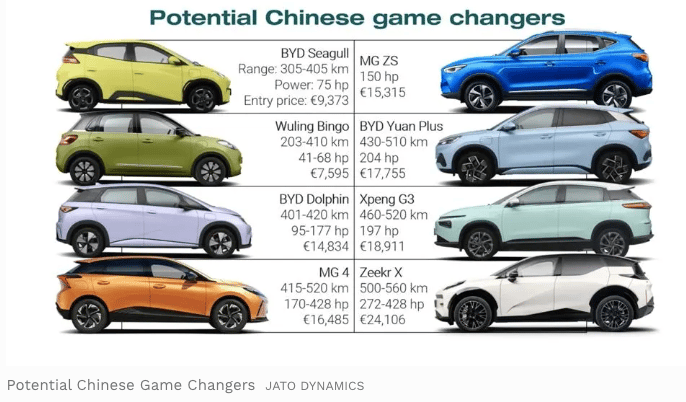

China-based EVs Gain Traction in Europe

Electric vehicles manufactured in China will account for over 25% of EV sales in Europe in 2024, up from 19.5% last year. Around a third of the EVs shipped from China are delivered to France and Spain.

Most of the EVs sold in the European Union are from Western brands such as Tesla, which has a manufacturing facility in China. Comparatively, Chinese brands are forecast to account for 11% of EU’s market share in 2024, and this number might touch 20% by 2027.

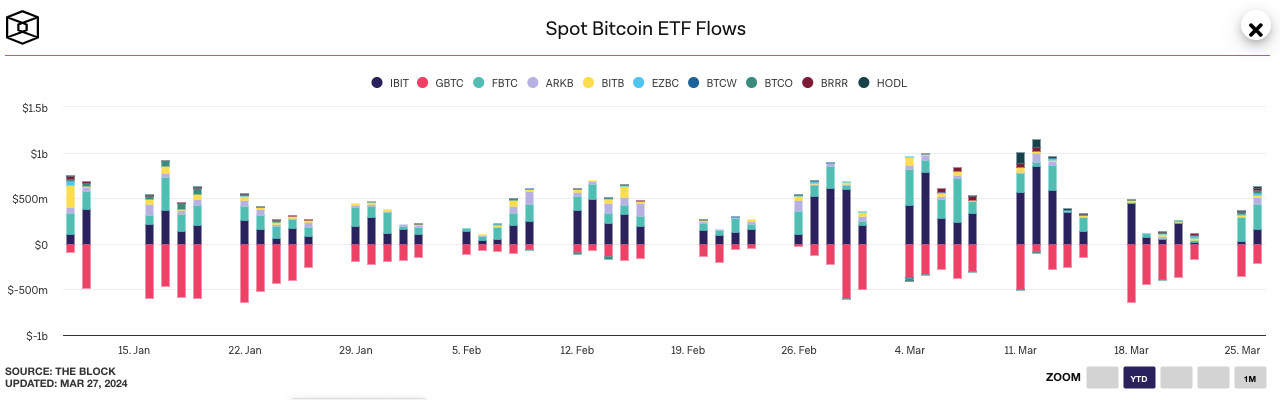

BlackRock ETFs Hold $17 billion In BTC

In an interview with Fox Business, BlackRock CEO Larry Fink emphasized he is pleasantly surprised by the performance of the company’s first spot Bitcoin ETF (exchange-traded fund).

Fink claimed the IBIT ETF is the fastest-growing ETF ever, attracting $13.5 billion in total inflows in the first 11 weeks. Inflows touched a record high of $849 million on March 12, and the IBIT averages $260 million in inflows every day.

Today, the IBIT holds BTC worth $17.1 billion, taking two months to attract inflows worth $10 billion, a milestone that took the first gold ETF almost two years to reach.

Headlines You Can't Miss!

U.S. equities have limited upside, says Godman Sachs

China’s economy is on track for strong March performance

Hyundai may manufacture hybrid vehicles at $7.6 billion Georgia plant

Around 50% of Americans back a TikTok ban

Over $1 billion in U.S. Treasuries have been tokenized on-chain

Chart of The Day

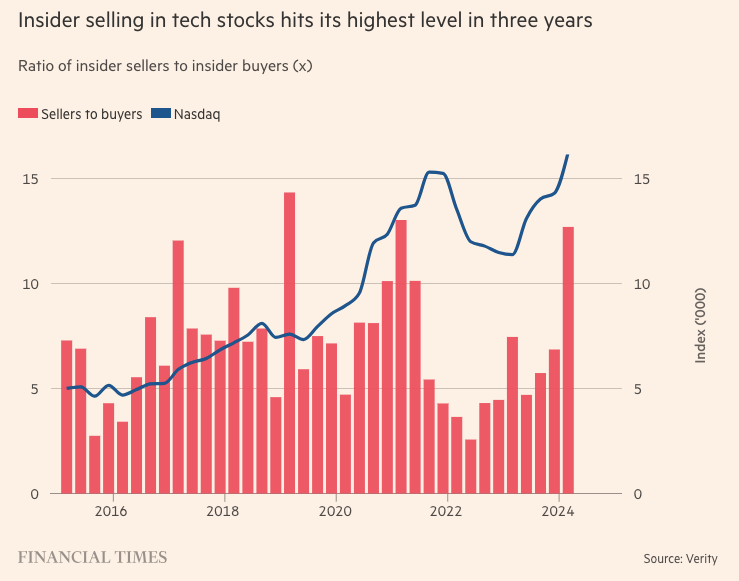

Billionaires such as Jeff Bezos and Mark Zuckerberg have sold millions of dollars of their company shares in Q1 of 2024, which might indicate valuations are elevated and a pullback is on the cards.

With the equity markets trading at all-time highs, the ratio of corporate insider selling to insider buying is at the highest level since Q1 of 2021, according to a Financial Times report.

Sales have been driven by tech executives, including Peter Theil, the co-founder of Palantir, who sold $175 million in March.

In February, Meta’s CEO, Mark Zuckerberg, sold $135 million worth of stock, his first sale since November 2021. He still owns 13.5% of Meta and is the company’s largest shareholder.

Last month, Amazon founder Jeff Bezos sold 50 million shares of the e-commerce giant for a whopping $8.5 billion.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.De