- 3 Big Scoops

- Posts

- Google Pays Apple $20 Billion Each Year

Google Pays Apple $20 Billion Each Year

PLUS: Sam Altman moves to Microsoft

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Monday!!

Here’s what’s on the menu for today:

👉 Apple’s $20 billion payout

👉 Goldman Sachs’ forecast for 2024

👉 Disney NFTs

So, let’s go 🚀

Why does Alphabet Pay Apple $20B Each Year?

Google is on trial for using underhand tactics to ensure it is the #1 search engine in the world.

The U.S. Department of Justice (DOJ) claims Google, which owns a 90% market share in online search, paid enormous sums to companies such as Apple. Why? So Google is the default search engine on iPhones.

And it seems the DOJ’s anti-competitive-behavior case against Alphabet (Google's parent company) might have just gotten stronger.

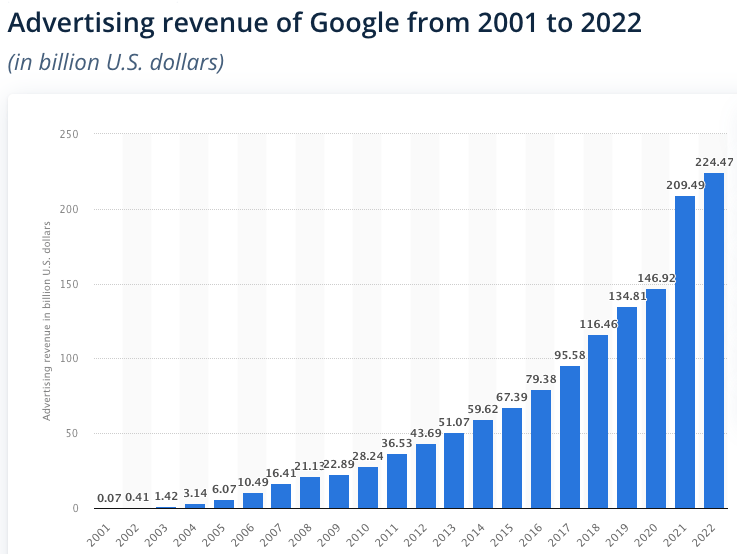

Source: Statista

A witness disclosed that Google-parent Alphabet funnels a whopping 36% of the money it makes (roughly $20 billion) from search advertising straight into Apple’s pockets.

According to the DOJ, a $20 billion payout is enough to price out competitors, strengthening its case against Big Tech.

This $20 billion annual check is massive for Apple too, as it accounts for 30% of Apple Services sales, the company’s fastest-growing business.

Will the DOJ win the lawsuit against Alphabet? Find out here soon.

Sam Altman Is Fired, Then Hired

Microsoft just hired OpenAI CEO Sam Altman to lead a new advanced AI research team. Over the weekend, Altman was fired as the CEO of OpenAI, the company behind ChatGPT.

The firing of Silicon Valley’s tech superstar made global headlines, leaving everyone stunned. According to multiple reports, OpenAI’s board of directors forced Altman to leave the company.

The board members want to proceed cautiously with the expansion of OpenAI, given the potential risks associated with this disruptive technology. It’s possible they were alarmed by Altman’s fast-paced approach to monetizing the ChatGPT platform.

Top OpenAI investors, including Microsoft, were left in the lurch, after which the tech giant tried to get Altman to return. The tech community, too, rallied behind Altman, increasing the pressure on OpenAI’s board.

Microsoft has invested over $13 billion in OpenAI and wasn’t about to let Sam just walk out.

An interesting turn of events in the last two days!!!!

Goldman Sachs Expects Stocks to Surge

Goldman Sachs is among the most prominent investment banks in the world. So, let’s see what the financial heavyweight predicts for investors in 2024.

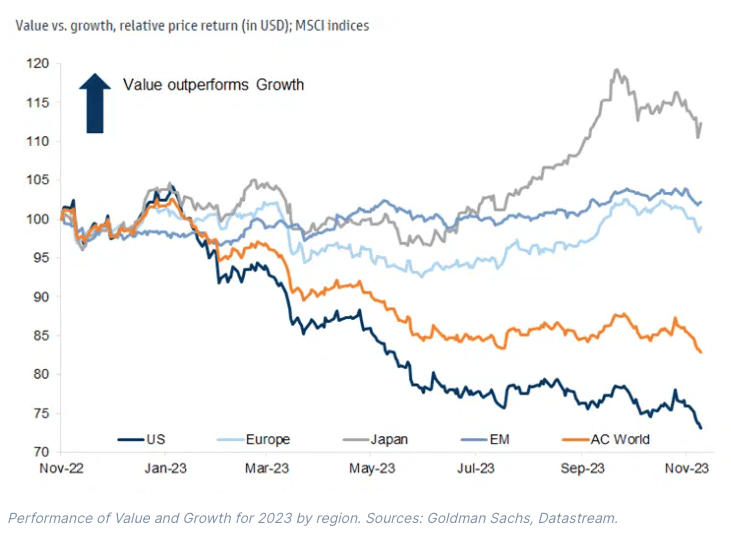

Goldman Sachs expects all major stock indexes in the U.S., Europe, Japan, and Asia to move higher in the next 12 months. It expects global stocks to deliver cumulative returns of 10% (including dividends and buybacks) in 2024.

Goldman emphasized interest rates and inflation have peaked, which should improve the macro environment in 2024.

Earnings growth in Japan is projected to rise by double-digit percentages in 2024, making it the fastest-growing region globally.

Goldman also expects the U.S. economy to experience a soft landing, meaning interest rate hikes will bring down inflation without crashing the economy.

While a soft landing is a positive outcome for stocks, steep valuations surrounding the U.S. market may limit the upside potential for investors.

Goldman further claimed the AI megatrend is not a bubble and expects tech giants with strong balance sheets and cash flows to perform well despite sky-high multiples.

So, here’s where you may invest right now.

👉 The iShares MSCI World ETF (expense ratio of 0.24%)

👉 The Invesco QQQ Trust Series ETF (expense ratio 0.2%)

👉 The iShares MSCI Japan ETF (expense ratio 0.5%)

Disney Launches NFT Marketplace

There’s a new NFT marketplace in town- Disney Pinnacle.

Disney is partnering with Dapper Labs to launch an NFT trading platform. Dapper Labs is the creator of NBA Top Shot.

The trading platform will be built on the Flow blockchain. Moreover, Disney is creating digital pins (similar to their physical ones) that can be traded.

The digital pins will include popular Disney characters such as Buzz Lightyear and Darth Vader.

The Disney Pinnacle platform might go live on the mobile app stores by the end of 2023. So, why is this a big deal?

The marketplace is mobile-friendly, resulting in higher accessibility for everyday users.

Disney is keeping it simple. It hasn’t mentioned NFTs or blockchains. All users will see in the mobile app is a Digital Pin.

Disney first released physical pins back in 1999, which have become a valuable collector’s item.

Headlines You Can’t Miss!

Who is OpenAI’s new CEO?

Treasury yields rise as investors weigh economic outlook

Japan should shun its loose monetary policy, says Deutsche Bank

Mastercard bets on AI to tackle crypto fraud

SEC delays Ruling on Spot Bitcoin ETFs from Franklin Templeton

Chart of the Day

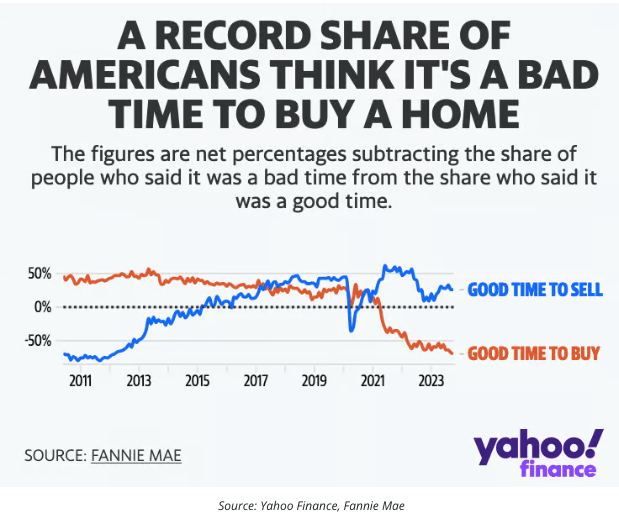

A record share of Americans think it’s a bad time to buy a home!

The Federal Reserve embarked on its second-most aggressive cycle of interest rate hikes in early 2022 to offset inflation.

However, higher interest rates increase the cost of debt for individuals, households, and corporations, leading to a tepid lending environment.

With average mortgage rates near 7.5% (yes, they have more than doubled in the past two years), we can see why a majority of people think it’s not a good time to buy a home.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.