- 3 Big Scoops

- Posts

- Energy Stocks Are Rallying

Energy Stocks Are Rallying

Big oil, Tesla, and GE Vernova

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

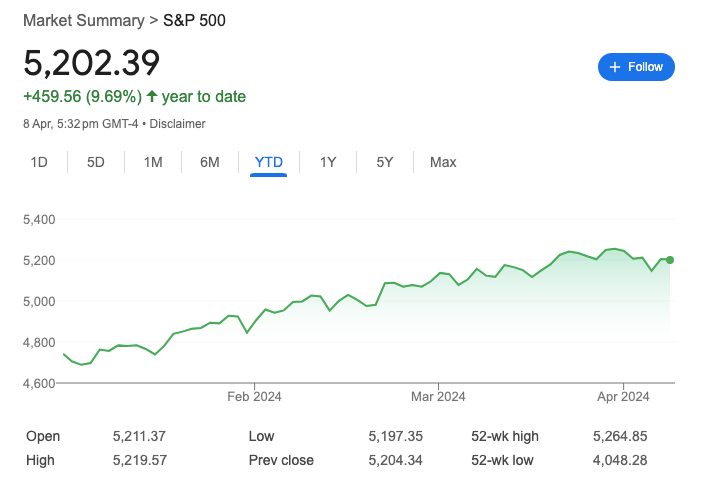

S&P 500 @ 5,202.39 ( ⬇️ 0.037%)

Nasdaq Composite @ 16,253.96 ( ⬇️ 0.033%)

Bitcoin @ $71,176.62 ( ⬇️ 0.62%)

Hey Scoopers,

Happy Tuesday! Let’s see what’s moving the markets 👇

👉 Oil prices push energy stocks higher

👉 Inflation may rise again

👉 Crypto inflows soar past all-time highs

So, let’s go 🚀

Market Wrap 📉

Stocks moved marginally lower on Monday as an uptick in Treasury yields kept investors from making big moves ahead of key U.S. inflation data. The rate of the benchmark 10-year Treasury note climbed to 4.42%.

Investors are awaiting the consumer and producer price indexes (for March), which will be published later this week. The consumer price index for March is closely watched to analyze when the Fed will begin to lower interest rates. Economists expect the CPI number to increase 0.3% in March.

The 30-stock Dow Jones index posted its worst weekly performance since March 2023 last week. Comparatively, the S&P 500 index pulled back 1%, its biggest weekly loss since January.

Trending Stocks 🔥

Ulta Beauty - The retail giant gained 1.8% following an upgrade by Loop Capital, as the analyst expects shares to rebound in the next 12 months.

BJ’s Wholesale - Shares of the warehouse club added 1% following an upgrade by Goldman Sachs to “buy” from “neutral.” The investment bank sees earnings upside due to higher grocery volumes.

Taiwan Semiconductor - The chip stock rose more than 4.5% on news that its Arizona subsidiary will receive up to $6.6 billion from the Biden Administration to support semiconductor manufacturing in the U.S.

Energy Sector Ticks Higher

The energy sector has overtaken the broader markets in 2024 as higher crude prices pushed stocks to all-time highs. The energy sector is up 17% in 2024, compared to the S&P 500 gains of 9%.

ExxonMobil touched an all-time high of $122.15 last week and is up 21% in 2024. Oil refiners such as Marathon Petroleum, Phillips 66, and Valero also hit record highs on Friday, rising 47%, 27%, and 40%, respectively, in 2024.

The rally surrounding energy stocks might continue, given that the sector has trailed the broader markets by 15% in the last 12 months. Several momentum funds have not included the sector as they look at stock performance in the last 12 months.

Tesla Stock Gains Almost 5%

Shares of Tesla surged close to 5% after Elon Musk stated the company would reveal its robotaxi product on Aug. 8.

Source: Reuters

Musk has promised shareholders a robotaxi for years but has failed to deliver on his lofty goals. A date for the unveiling event comes as investors are cautious about Tesla’s slowing growth and narrowing profit margins.

Musk shared the reveal date via a social media post on X after Reuters reported plans for a low-cost electric car by Tesla had been scrapped.

Shares of GE Vernova jumped 4.8% after the stock received its first upgrade from JPMorgan. The investment bank upgraded GE Vernova to “overweight” from “neutral,” with a price target of $141, indicating a potential upside of 10% from current levels.

General Electric completed its split into three separate publicly traded companies. Its healthcare unit, GE Healthcare Technologies, was spun off in 2023. Last week, the energy and aerospace technology companies were split and are currently listed as GE Vernova and GE Aerospace, respectively.

JPMorgan explained it views GE Vernova’s 14% stock price decline from last week as an attractive entry point. It expects GE Vernova to benefit from rising electricity demand from data centers that power artificial intelligence models.

S&P 500, Inflation, and Global Equities

Wells Fargo raised its 2024 price target for the S&P 500 index to 5,535 from 4,625, indicating an upside of 6.4% from current levels.

In an investor note, it explained, “We believe equities have some upside from here, but still anticipate a volatility spike in 1H24 while a 2H24 ‘melt-up’ appears increasingly likely, partly driven by political outcomes that support greater M&A and partly by an anticipated multi-year easing cycle that supports risk-taking.”

Wells Fargo’s forecast is among the highest on Wall Street and 9% higher than consensus estimates.

While major global equity markets in the U.S., Europe, and Japan are stretched at current valuations, there might be pockets of opportunities for investors.

For instance, small-cap stocks in the U.S. should rebound in 2024 due to favorable economic conditions. The valuations for Latin American stocks are also compelling, and Indian equities are trading at a premium.

Moreover, the rally in U.S. equities might come to a screeching halt if inflation numbers move higher in the near term. Recent data supports a recovery in manufacturing activity, which is fueled by strong consumer spending.

Analysts expect higher consumption and capital expenditures to fuel inflation, which will force the Fed to keep interest rates elevated.

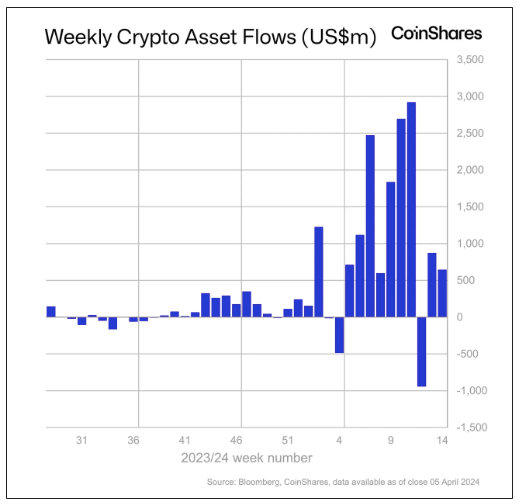

Crypto Inflows Touch All-Time Highs

The crypto bull run in 2021 was a breakthrough year as digital assets attracted more than $10.5 billion in total inflows.

In 2024, digital asset investment products have already seen total inflows of $13.8 billion.

According to a report from CoinShares:

👉 Digital asset investment products saw net inflows of $646 million last week. It was the second consecutive week of inflows of more than $500 million.

👉 Bitcoin led the way with inflows of $663 million as the world’s largest cryptocurrency has gained over 10% in the last two weeks.

👉 Ethereum saw outflows for the fourth consecutive week

Headlines You Can't Miss!

Singapore’s tech salaries fall the most in 2023

U.S. might impose tariffs on China’s green exports

Economists are uncertain about rate cuts

Biden’s forgiveness plan might lower student debt for 25 million borrowers

Jury finds Do Kwon guilty of crypto fraud

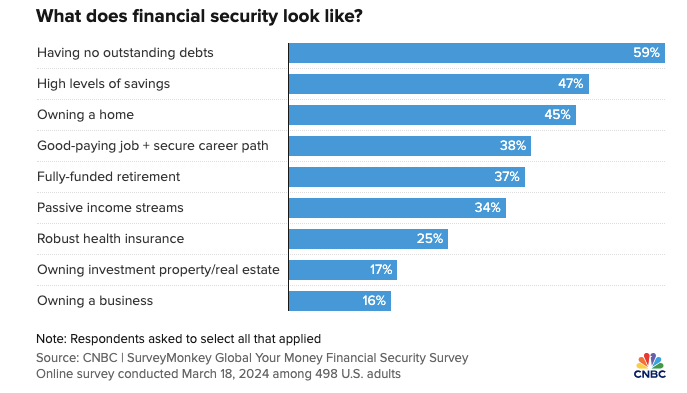

Chart of The Day

Feeling financially secure can mean many things. Depending on who you ask, it might mean having peace of mind about your money situation, earning enough to cover bills and save for the future, or having resources to weather an unexpected expense.

Among U.S. respondents in the CNBC survey, some of the most common components to feeling financially secure included having no outstanding debts (59%), accumulating “high levels” of savings (47%), and owning their own home (45%).

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.