- 3 Big Scoops

- Posts

- Elon Musk Slams Advertisers

Elon Musk Slams Advertisers

PLUS: Singapore key driver of Nvidia sales

Bulls, Bitcoin, and Beyond

Hello Folks,

Happy Friday!! It’s the first day of December, bringing us one day closer to Christmas 🎄

Here’s what’s on the menu for today:

👉 Elon Musk vs. advertisers

👉 Singapore’s data center bet

👉 Coinbase stock surged 66% last month

So, let’s go 🚀

Elon Musk to advertisers: “Go f*** yourself”

Elon Musk, the richest man on the planet and the owner of companies such as Tesla, X (formerly known as Twitter), and Space X, expressed total disregard for advertisers at the DealBook Summit in New York.

Source: Axios

In the last few days, several companies withdrew ads from X following Elon Musk’s tweet on the Israel-Palestine conflict, which was perceived as anti-Semitic.

After Musk’s comments ignited criticism worldwide, he apologized for the tweet and agreed the post was the “worst and dumbest I’ve ever done.”

At the Summit, Musk was blatant and direct in his response to the situation, stating, “If somebody’s going to try to blackmail me with advertising? Blackmail me with money? Go f***. Is that clear?”

Musk specifically acknowledged Bob Iger, Disney’s CEO, who was present in the audience. Disney was among the companies that have taken a stance against advertising on X.

Musk further claimed his followers might boycott these advertisers in retaliation. He warned, “The whole world will know that those advertisers killed the company, and we will document it in great detail.”

Singapore Accounts for 15% of Nvidia Sales

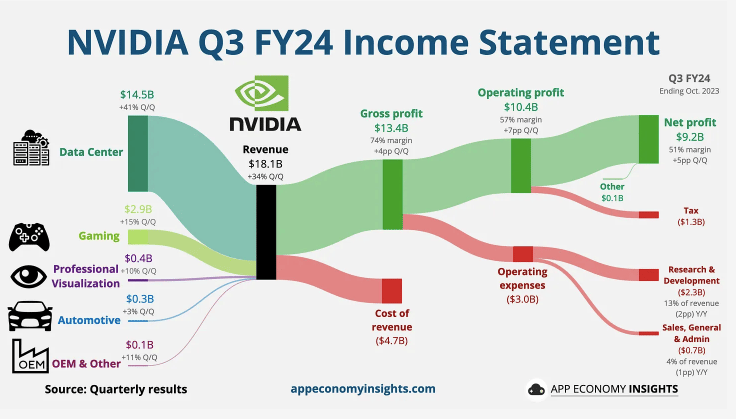

While Nvidia posted solid fiscal Q3 results last week, analysts noted that a significant portion of the semiconductor giant’s sales came from Singapore.

The Southeast Asian country accounted for 15% or $2.7 billion of Nvidia’s revenue in the October quarter. Moreover, sales were up 404% compared to $562 million in the year-ago period.

Comparatively, total Nvidia sales in Q3 rose by 205% year over year. The U.S. generates 34.7% of sales for Nivida, followed by Taiwan at 23.9% and China at 22.2% in Q3.

Wall Street has attributed a growing number of data centers and cloud service providers in Singapore to this astonishing growth.

It’s possible that data center chips are sent to Singapore for final assembly with other products that are shipped to multiple countries.

Nvidia’s data center business generated 80% of sales in Q3, while segments such as gaming and automotive accounted for the rest.

Coinbase stock gains almost 300% in 2023

Coinbase, one of the largest crypto exchanges, has been on an absolute tear this year.

👉 The stock gained 66% in November and 280% in 2023

👉 It has been named as a custodian for 9 out of the 12 Bitcoin ETF applications

👉 Unlike Binance and Kraken, which are facing legal actions in the U.S., Coinbase is flying under the radar

In a bull market, Coinbase benefits from higher trading volumes, allowing it to increase revenue at an exponential rate.

But in recent months, ithas beens diversifying its revenue bas,e which should allow it to generate more stable top-line growth across market cycles.

For instance, Coinbase has been named the custodian for the majority of spot Bitcoin ETF applications.

So, when the ETFs are approved, Coinbase will hold the assets on behalf of the investment manager.

Headlines You Can’t Miss!

2-year Treasury Yields fall on inflation data

Oil prices might touch $100 per barrel in 2024

Indian economy is in a sweet spot despite slowing private consumption growth

China’s economy continues to struggle

Crypto hacks total $343 million in November

Chart of the Day

The Dow Jones Industrial Average Index, or DJIA, rallied to a new high for 2023 on the back of cooling inflation and solid Salesforce earnings. It was the benchmark’s best month since October 2022.

The DJIA index is up over 8.5% in 2023 and over 8% last month, breaking a three-month losing streak.

Comparatively, the S&P 500 index was up 8.9%, while the tech-heavy Nasdaq index advanced 10.7% in November.

Stocks gained last month due to:

👉 A resilient economy

👉 Better-than-expected consumer spending

👉 Possibility of interest rate cuts in 2024

Salesforce was the primary driver of the uptick in the DJIA index yesterday. The CRM giant crushed estimates as its cloud data business saw sales rise by 22% year over year due to its artificial intelligence product, Einstein GPT.

Further, the personal consumption expenditures price index, which is the Fed’s favorite inflation gauge, rose 3.5% year over year in November, slowing from an annual gain of 3.7% in October.

CNBC explained, “These numbers were the latest in a string of positive inflation data seen in November that caused traders to conclude the Federal Reserve is likely done raising rates and could even begin lowering them in 2024.”

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.