- 3 Big Scoops

- Posts

- Farewell Charlie Munger 👋

Farewell Charlie Munger 👋

PLUS: Apple to exit Goldman Sachs partnership

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Wednesday!!

Here’s what’s on the menu for today:

👉 Charlie Munger’s most famous quotes

👉 Apple to end partnership with Goldman Sachs

👉 MicroStrategy’s Bitcoin bet

Investment Titan Charlie Munger Passes

Charlie Munger passed away at the age of 99, just a month short of his 100th birthday.

Munger was an investing genius, the Vice Chairman of Berkshire Hathaway, and a long-time confidant of Warren Buffett.

Source: CNBC

With a fortune estimated at $2.3 billion, Munger was a member of the Costco Wholesale board, a philanthropist, and a real estate attorney.

Here are some of Charlie Munger’s greatest bits of investing advice:

“One of the inane things that’s taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks…..That is an insane idea.”

“It’s not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather be in my best ideas instead of my worst.”

“Lifelong learning is paramount to long-term success.”

“Every time you hear EBITDA, just substitute it with bullshit.”

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get.”

“You spend less than you earn. Invest shrewdly, and avoid toxic people and toxic activities, and try and keep learning all your life. And do a lot of deferred gratification because you prefer life that way. And if you do all those things, you are almost certain to succeed. And if you don’t, you’re gonna need a lot of luck.”

“The world is not driven by greed. It’s driven by envy.”

RIP to an investing GOAT.

Apple to End Golman Partnership In 2024?

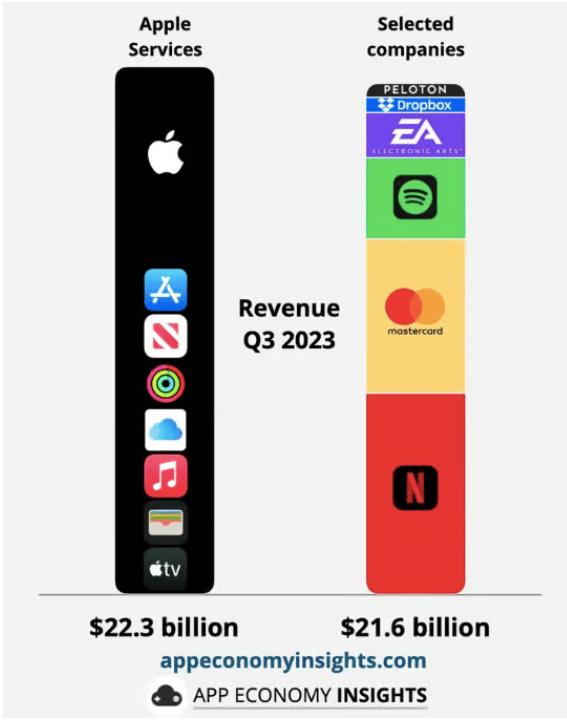

Tech giant Apple has given a proposal to end its credit-card and savings account partnership with Goldman Sachs, according to CNBC.

The exit would effectively end one of the most high-profile collaborations between a bank and a tech company on Wall Street, which cost Goldman Sachs over $1 billion in losses last year.

What would it mean for Apple?

Well, Apple would need to find a new financial partner for its popular credit card, also called the Apple Card.

Currently, Apple offers its credit card and savings account through a wallet app on iPhones. But the backend is handled by Goldman Sachs.

The Apple Card was initially launched in 2019. This credit card, as well as the savings account, provides Apple with a way to diversify its business while growing its Services business with fees.

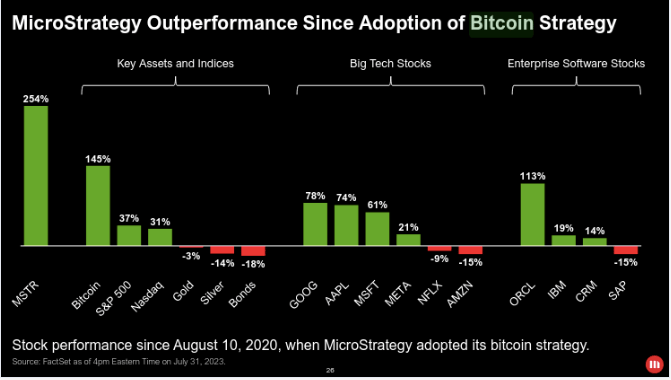

MicroStrategy Has $6 Billion Worth of Bitcoin

Valued at $7.3 billion by market cap, MicroStrategy provides enterprise-facing analytics software and services. In Q3 of 2023, MicroStrategy reported revenue of $129.5 million, an increase of 3.3% year over year.

While it is involved in the enterprise software segment, the CEO of MicroStrategy, Michael Saylor, is quite bullish on Bitcoin and has allocated significant company resources to purchase BTC over the years.

While MSTR has $45 million in cash, it also holds 158,245 bitcoins worth over $6 billion at current prices.

MicroStrategy is among the largest institutional holders of Bitcoin and first began purchasing the digital asset as a hedge against inflation back in August 2020.

In fact, MicroStrategy has raised debt to fund its BTC purchases and now owns 0.75% of the total Bitcoin circulating supply.

Headlines You Can’t Miss!

The investing world reacts to the death of Charlie Munger

CPFB fines Bank of America $12 million

Early signs of a recession?

Pinduoduo transaction sales surge 315%

South Korea to test launch CBDC

Chart of the Day

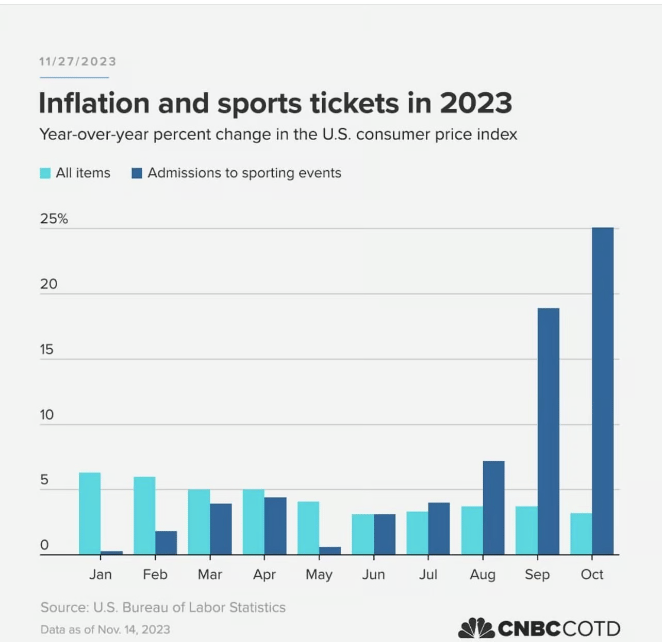

Admission tickets for sporting events jumped over 25% this October, according to the Bureau of Labor Statistics. This category saw the highest annualized inflation in the last 12 months.

CPI, or the consumer price index as a whole, rose “just” 3.2% year over year. The CPI tracks the prices of a basket of items, including milk, airfares, and jewelry.

One reason why consumers may be experiencing a surge in prices for sporting events is the use of dynamic pricing models which depends on consumer demand.

But the primary reason for the uptick can be attributed to low prices in 2022. For instance, teams slashed ticket prices in 2022 to attract crowds to stadiums post-COVID-19.

Compared to November 2019, sports ticket prices are up 14.2%, which is lower than the 19.6% increase in the entire CPI index.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.