- 3 Big Scoops

- Posts

- Apple Services Rakes In $85 Billion In 2023

Apple Services Rakes In $85 Billion In 2023

PLUS: The MCU has its worst ever opening weekend

Hello Folks,

Happy Monday!!

Today, we look at how Apple’s Services business continues to gain traction as well as the worst-ever opening weekend for a Marvel movie.

Let’s go.

Apple Services Is Expanding

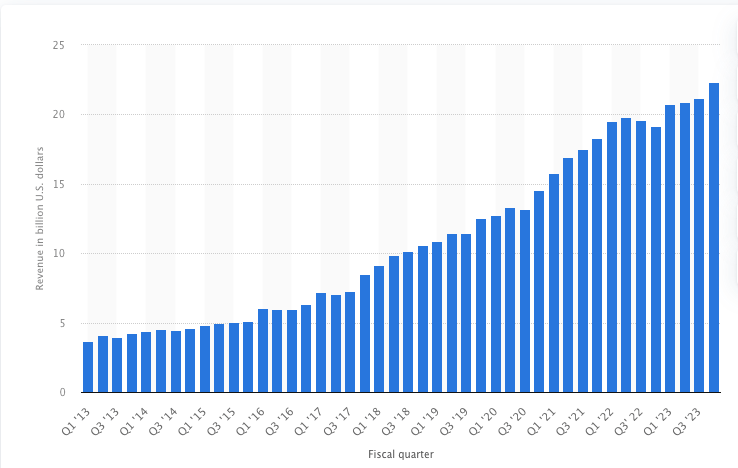

One of Apple’s key revenue drivers in recent years is its Services business. For instance, Apple Services reported over $22 billion in sales in fiscal Q4 of 2023 (ended in September) and ended the year with $85 billion in revenue. Comparatively, in Q4 of 2013, Services clocked in less than $5 billion in sales.

Apple’s Services Business Growth

Source: Statista

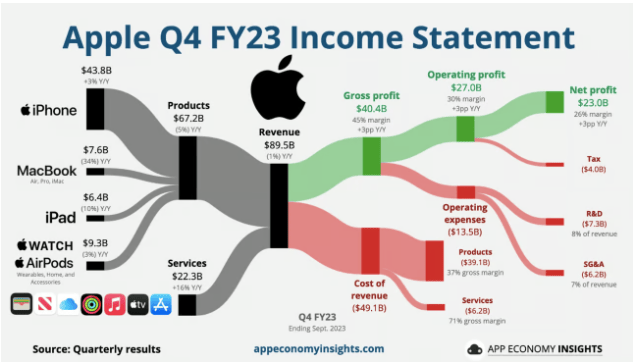

It’s impossible to talk about Apple Services without acknowledging its installed base of active devices, which is well over 1 billion. In Q4, while total revenue fell 1% for Apple, Services sales were up by 16% year over year, showcasing the strength of the Apple ecosystem.

The Services business includes verticals such as Apple Music, the App Store, Apple Care, Apple Arcade, Apple TV+, and much more.

Its portfolio of subscriptions allows the tech giant to generate recurring sales across market cycles, and it ended fiscal 2023 with 1 billion paid subscriptions, up 100% in the last three years.

A Flywheel Effect

Apple’s Services business benefits from a flywheel effect. For example, as Apple increases its content and features on the Services platform, it results in:

👉 Higher engagement

👉 Higher consumer spending

👉 Higher subscriptions

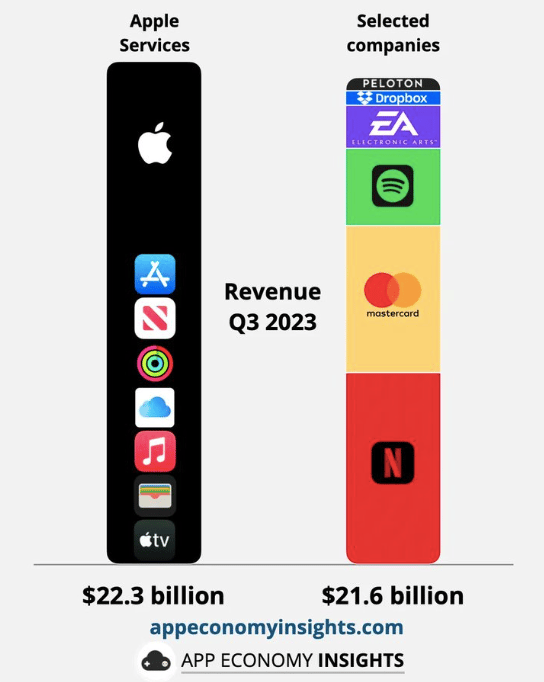

We can see that sales from Apple Services are now more than the combined revenue of companies such as Netflix, Mastercard, Spotify, Peloton, Dropbox, and Electronic Arts.

Phew!!!

A High Margin Business

Apple Services is also a critical driver of company profits. Its gross margin in Q4 stood at 70.9% compared to the 36.6% margin of the hardware business.

While sales were down 1% for Apple in Q4, its adjusted earnings surged by 13% year over year. In Q4, Services accounted for less than 25% of sales but almost 40% of gross profits.

Apple Is Feeling the Heat

Despite the stellar performance of the Services segment, Apple sales have now declined for four consecutive quarters. Total revenue was down 3% at $383.29 billion in fiscal 2023.

The iPhone business, accounting for 50% of sales, was Apple’s only hardware segment, which experienced sales growth in Q4.

It’s evident that Apple lacks a clear path to growth this holiday season after four quarters of revenue shrinkage.

The Marvels Disappoints Fans

According to CNBC:

The Marvels’ generated $47 million domestically in its debut weekend, which is the lowest in franchise history.

Initial predictions saw the latest MCU film opening between $75 million and $80 million in the U.S.

The other MCU films that opened less than $60 million were Ant-Man (2015) and The Incredible Hulk (2008).

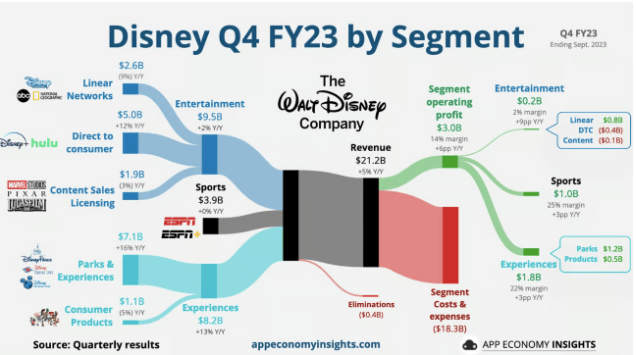

Disney and Marvel Studios are struggling to reconnect with audiences in the post-Endgame era.

The lukewarm response to The Marvels might drag shares of Disney lower, which are already trading at 10-year lows.

In the last few years, Disney has been grappling with a high cost base and elevated inflation, which is weighing heavily on the bottom line. It continues to allocate significant resources to its online stream business, draining its cash flow in the process.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.