- 3 Big Scoops

- Posts

- 🗞 Bitcoin Races Past $79k

🗞 Bitcoin Races Past $79k

PLUS: What next for investors?

Bulls, Bitcoin, & Beyond

Hey Scoopers,

Here’s what we’re covering in today’s Bitcoin special edition 👇

👉 How to value Bitcoin?

👉 The upcoming Bitcoin bull run

👉 When should you sell Bitcoin?

Bitcoin’s Astonishing Rise

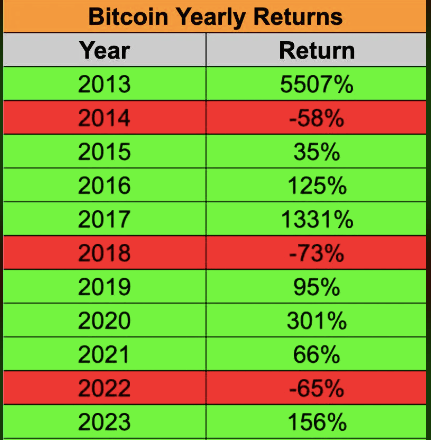

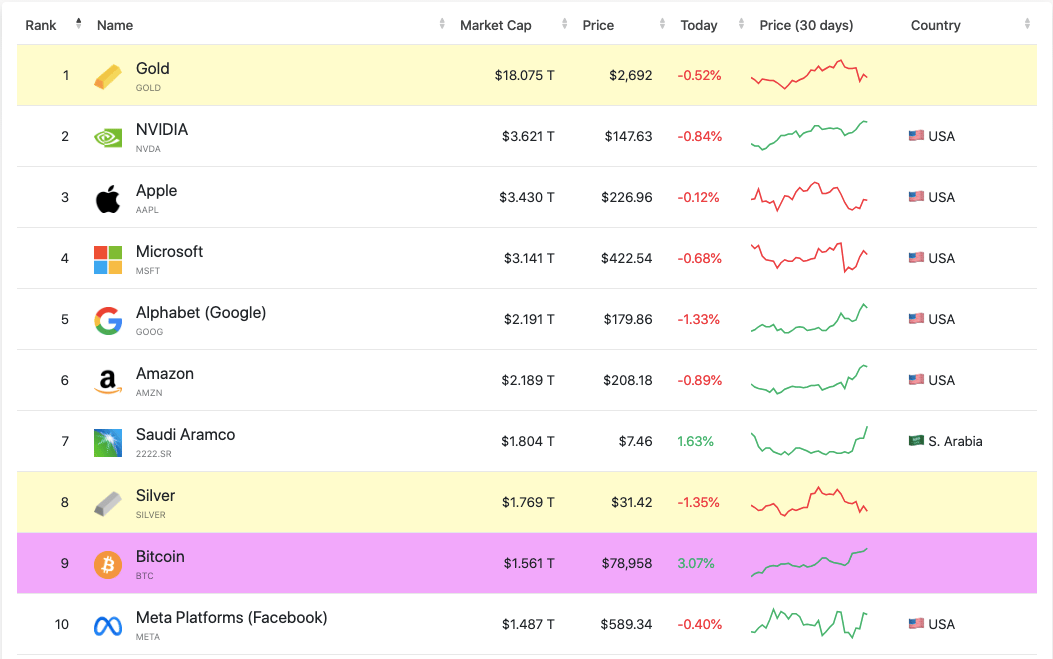

Bitcoin is the world’s largest cryptocurrency and has created massive wealth for investors over the last 15 years. With a market cap of $1.5 trillion, Bitcoin prices have more than doubled in the past year.

Further, BTC has risen by 836% in the last five years and has returned over 17,000% in the previous eight years, driving the price to over $79,000 at the time of writing.

The last time Bitcoin was priced at less than $1 was April 2011. So, $100 invested in BTC 13 years ago would be worth close to $8 million today.

In this article, we look at one easy way to value Bitcoin, the bull case for the digital asset, and when I intend to sell the cryptocurrency.

Bitcoin- An Overview

Bitcoin was launched in 2008 and is a decentralized digital currency, meaning no central authority regulates it.

More than 19 million BTC are in circulation today, but the maximum supply is capped at 21 million. Due to this limited supply, Bitcoin is viewed as a store of value and is considered a form of digital gold by several investors.

Source: Companiesmarketcap

Bitcoin has several advantages when compared to traditional fiat currencies, which include:

Decentralization: Bitcoin operates a decentralized network of nodes, meaning a single entity does not control it. This enhances security and reduces the risk of manipulation. Basically, users can transact freely without third-party interference.

Security: Transactions on the Bitcoin network are secured, as they are recorded on an immutable public ledger, which makes it difficult to alter records.

Privacy: Users are identified by wallet addresses, reducing the risk of identity theft compared to legacy banking systems.

Lower Transaction Costs: Bitcoin transactions are cheaper than traditional banking systems, especially for international transfers.

How to Value Bitcoin?

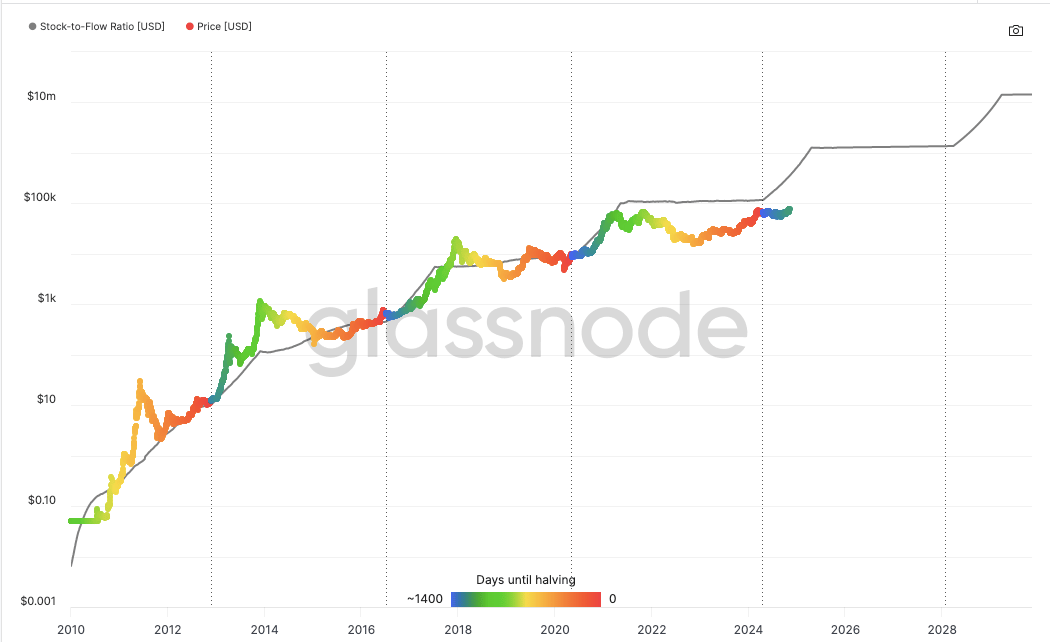

One popular way to value Bitcoin is using the Stock-to-Flow (S2F) model. Here, you treat Bitcoin as a store-of-value commodity similar to gold, silver, or platinum.

The S2F model calculates Bitcoin's scarcity to arrive at a valuation for digital assets. To do so, you need to divide the current supply of Bitcoin by the amount of new production that comes online year after year from miners and then plug the number into a simple formula.

The S2F model has two primary inputs: the total amount of BTC in supply and the rate at which Bitcoin is currently being mined.

More than 93% of all Bitcoin has already been mined, and the last BTC will be mined in 2140. So, less than 7% of the remaining BTC will be mined in the next 115 years. This scarcity will increase BTC prices over time, making it a top investment choice for long-term holders.

According to the S2F model, BTC prices will rise to $1.2 million by the end of 2025, indicating an upside potential of almost 15x from current levels.

As the above chart shows, BTC prices have surpassed their intrinsic value several times due to highly bullish investor sentiment. However, it has also traded significantly below its S2F value during bear markets.

Market participants may be pleasantly surprised if BTC prices surpass the $1 million threshold in 2025. Alternatively, I expect BTC prices to at least 4x from current levels.

VaultCraft launches V2, TVL skyrockets above $100M

VaultCraft launches V2, partners with Safe, and secures $100M+ in Bitcoin

Matrixport, Asia’s leading crypto providers, commits $100M+ in Bitcoin

OKX Web3 to launch Safe Smart Vaults with $250K+ in rewards

The Bull Case for Bitcoin

The primary reason for Bitcoin’s upward momentum is tied to the widespread adoption of the cryptocurrency. Here are three reasons that should drive Bitcoin adoption:

Source: Forbes

Bitcoin as a U.S. Treasury Asset

President-elect Donald Trump had previously disclosed plans to adopt Bitcoin as part of the U.S. treasury reserve, significantly enhancing its legitimacy and stability as a store of value.

Bitcoin ETFs

The approval of the launch of several spot Bitcoin ETFs earlier this year was a significant milestone for crypto investors. These ETFs provide easy accessibility for investors without the complexities of managing digital wallets or navigating crypto exchanges.

Moreover, it will signal regulatory acceptance, enhance investor confidence, and encourage broader adoption.

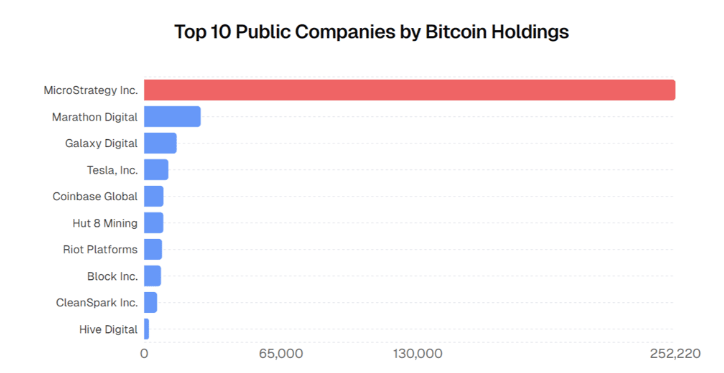

MicroStrategy’s growing bet

MicroStrategy is the largest institutional holder of Bitcoin. A few days back, it disclosed plans to invest an additional $42 billion in Bitcoin over the next four years, which could positively influence market sentiment.

When Will I Be Selling My Bitcoin?

While I am bullish over the long-term prospects of Bitcoin, it is evident that the digital asset trades within a four-year peak-to-trough cycle.

I expect Bitcoin to peak in November 2025 and then pull back over the next 15 months. So, I intend to sell a third of my crypto holdings around October 15th, 2025, and regain exposure around the start of 2027.

P.S. This is an investing strategy that I am trying out for the first time, which is purely based on historical trends. I hope I am right.

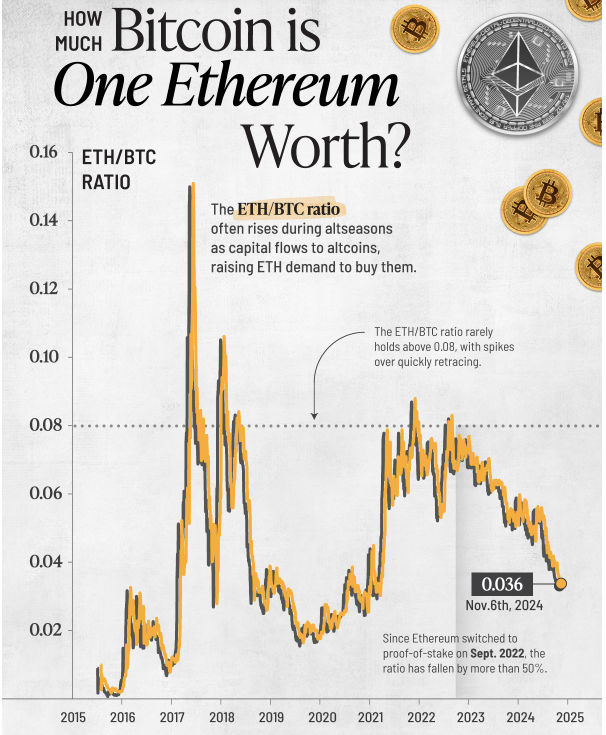

Chart of The Day

Source: Visual Capitalist

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.