- 3 Big Scoops

- Posts

- Bitcoin vs. Ethereum 🚀

Bitcoin vs. Ethereum 🚀

Crypto Special Edition

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,104.76 ( ⬆️ 0.51%)

Nasdaq Composite @ 16,031.54 ( ⬆️ 0.58%)

Bitcoin @ $66,377.10 ( ⬆️ 0.34%)

Hey Scoopers,

Happy Thursday! We are in the midst of a busy week, so let’s take a breather.

In today’s newsletter, we look at the bull cases for Ethereum and Bitcoin.

So, let’s go 🚀

Bitcoin Touches All-Time Highs!

Bitcoin recently hit the $69,000 mark for the first time ever, tripling in value in the last 12 months.

What does this mean?

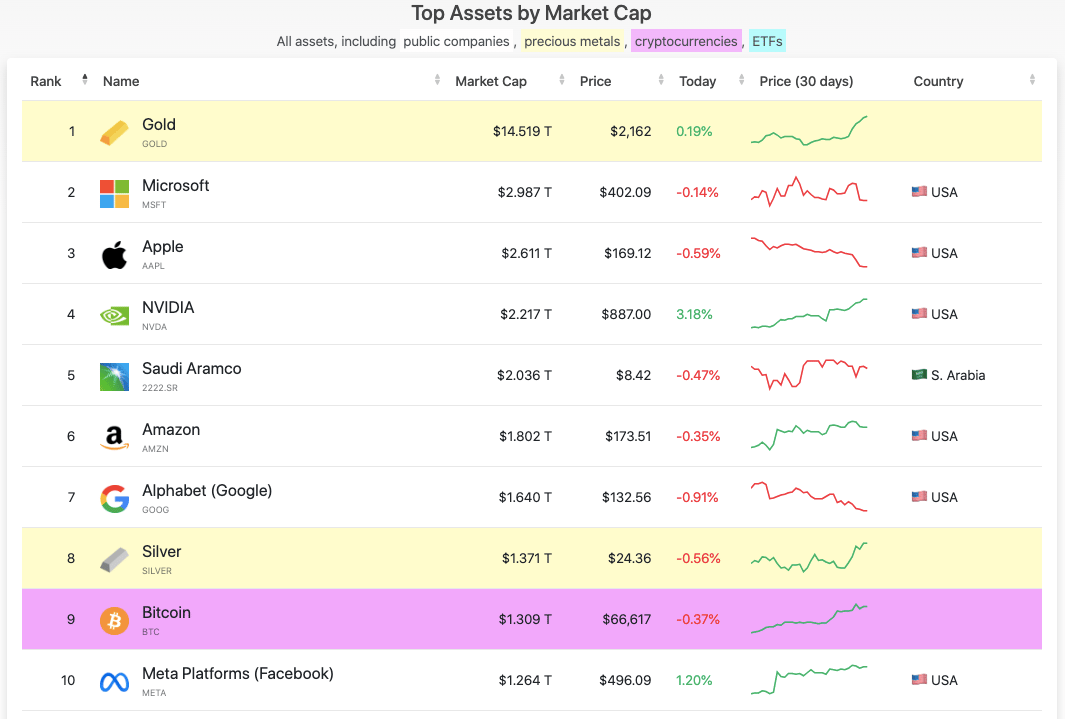

Bitcoin’s bumper price proves that crypto demand has outpaced supply. Investors have funneled some $7 billion into the newly approved Bitcoin spot exchange-traded funds, lighting a fire under Bitcoin’s price.

Source: CompaniesMarketCap

That’s forced short sellers – who took out bets expecting the price to fall – to close their positions by buying back bitcoin, increasing the price.

At the same time, longstanding investors are clinging onto their lots: 80% of bitcoin has stayed in the same hands for the last six months. With Bitcoin's next halving in April, supply is about to get even tighter.

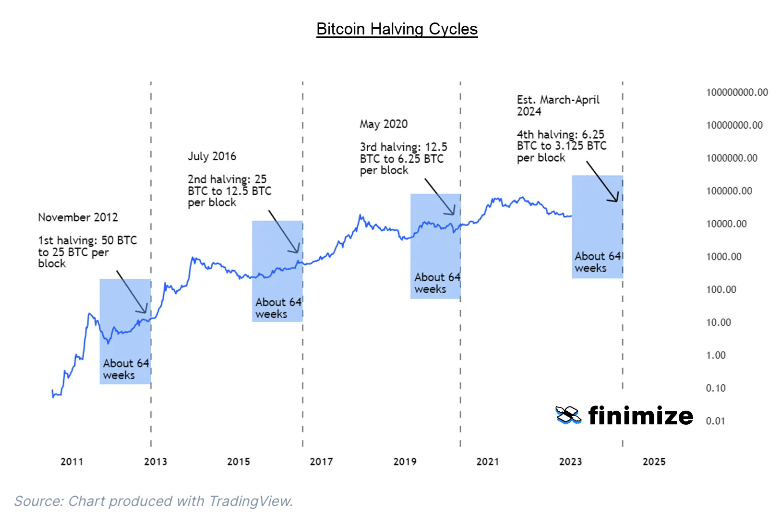

Bitcoin’s halving occurs every four years, and as the name suggests, it marks the halving of the rate at which Bitcoin is produced. That’ll continue until there are 21 million in the market—at that point, no more BTC can be mined.

After April’s halving, 450 bitcoins will be mined daily. As long as demand stays steady, that should push up the crypto’s price, as it has on every one of the previous three halvings. Mind you, some believe that’s already factored into Bitcoin’s blinged-up price.

Plenty of investors are conscious that the already volatile crypto could one day collapse into dust. Remember, though, that if you buy Bitcoin outright, you can only lose the total value of your investment.

And if Bitcoin even gets close to its full potential, you could make a lot more than 100% of your initial punt – no matter how small it was. Put simply, the scales seem balanced in your favor.

Ethereum Might Outpace Bitcoin In 2024

Bitcoin’s price rallied over 200% in the last 12 months, while ether’s gained “only” 142%. But here are three reasons why I see ether coming out ahead of Bitcoin.

Reason 1: Ether’s Scarcity

We all know Bitcoin is scarce. There will only ever be 21 million coins, and over 93% of them have already been produced by miners. But ether isn’t exactly abundant, either. What’s more, its supply is actually dropping, and its demand is on the rise.

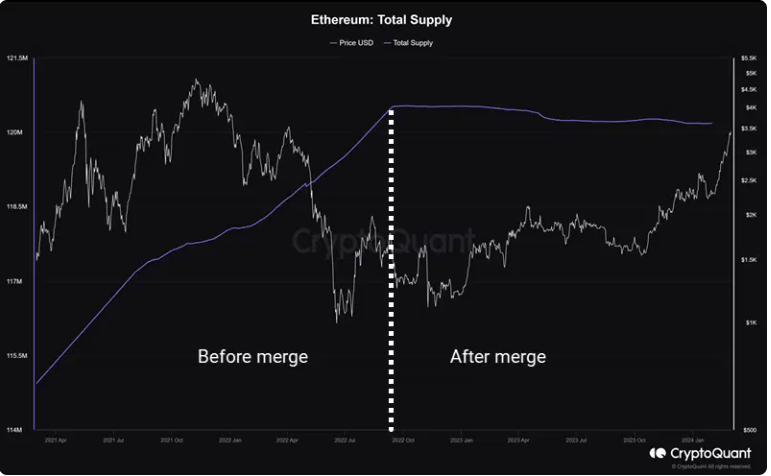

In September 2022, Ethereum completed a major technical upgrade called “the merge.” Before it happened, miners processed transactions and secured the Ethereum blockchain in exchange for newly minted ethers (in much the same way that Bitcoin mining works).

But after the merge, mining was replaced by staking – and now stakers put up their own ether as a kind of collateral to verify transactions on the Ethereum network. In return, they earn interest in ether – a.k.a. a staking yield.

The total supply of ether has actually gone down since the merge. Here’s how that works: The first thing to know is that stakers create fewer new ethers compared to miners. That’s because staking is a lot cheaper, so stakers don’t need to earn as many ethers to turn a profit.

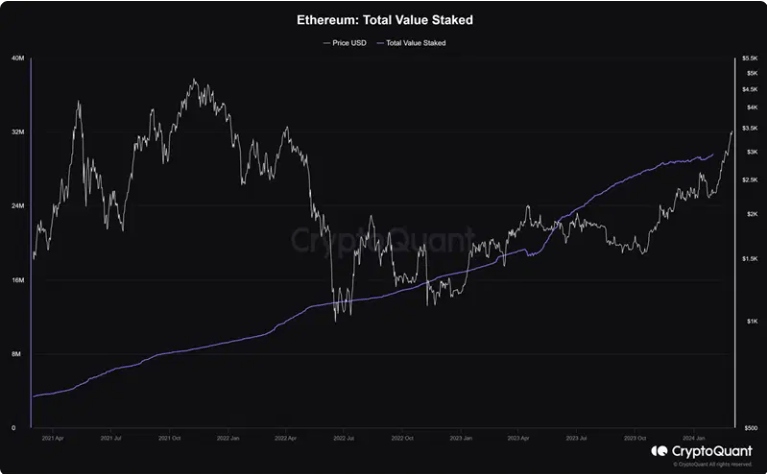

The second thing is that Ethereum “burns” a portion of ether transaction fees to make those fees more stable for its users. When ether gets burned, it’s taken out of the coin supply forever. More ether’s been burned than created since the merge, so ether’s supply (purple, chart below) has shrunk overall.

And here’s the kicker: fees are burned with each transaction. So the more the Ethereum network is used, the more fees are burned, and the scarcer ether gets. Ethereum is used for all kinds of things, like NFTs, blockchain games, and DeFi financial services. And those applications all need ether to fuel them.

Plus, investors are buying more ether and staking it to get a staking yield (purple, chart below). This locks up more of the coin supply and drives more demand for ether.

Reason 2: Ethereum ETFs

Ethereum ETFs could be trading on the US stock market as soon as May of this year. Those ETFs would have to buy enough ether to match investor demand one-for-one for their shares. There’s already been a surge in bitcoin demand with “The Nine,” the spot Bitcoin ETFs approved in January.

A similar thing could happen if and when Ethereum ETFs hit the street. Just keep in mind that there could be an initial “sell the news” price drop first—much like the one that whacked Bitcoin earlier this year: the crypto heavyweight champ fell 20% before resuming its ascent.

The world’s biggest ETF providers (including BlackRock and Fidelity) have filed for Ethereum ETFs with the US Securities and Exchange Commission (SEC). Some analysts, including Geoffrey Kendrick of Standard Chartered, expect these ETFs to get the green light by the May approval deadline (see table below).

They figure the Bitcoin ETF approvals already set a precedent, and the SEC hasn’t explicitly declared ether security yet. That means they could declare it a commodity, like Bitcoin.

What’s more, investors can already trade Ethereum “futures” ETFs on the Chicago Mercantile Exchange (CME), which could make it harder for the SEC to reject or even delay the spot ETF applications.

Reason 3: Ether’s Value

Crypto bull runs have (so far) followed similar cycles. First, bitcoin leads the charge as investors tentatively opt for the “safest” crypto investment. Then, after making good money from Bitcoin, they start to rotate profits into “riskier” investments with smaller market sizes, like ether.

The chart below shows this potentially playing out. It suggests that the ETHBTC trading pair (that is, ether priced in bitcoin) could be finding a low, meaning ether might perform relatively better than bitcoin this year.

Notice how the price appears to be bouncing off the blue support box and trying to break above the yellow downward trendline. Crypto traders like me worship technical analysis.

And no doubt, they’ll be eyeing this chart with a keen interest as they plot their next moves. Keep in mind that this says nothing about the dollar value of either asset – only that one is doing relatively better than the other.

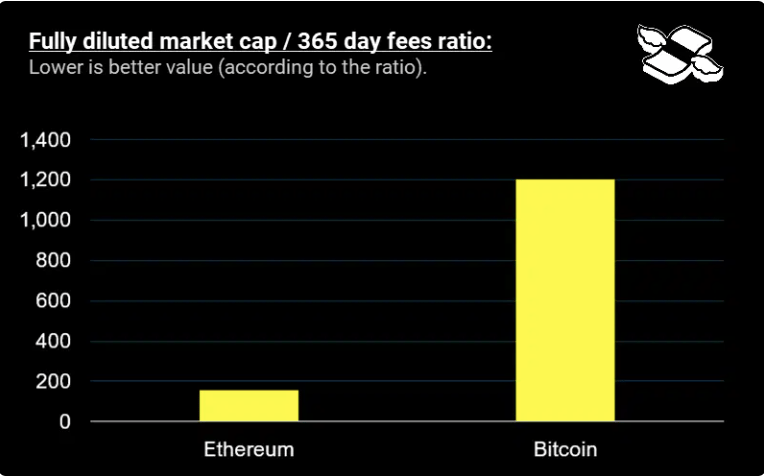

But if you’re more into fundamentals than technicals, this next chart is for you. Using the fully diluted market cap-to-fees (FDMC/F) ratio, you can compare the values of different blockchains pound-for-pound.

Think of it like a price-to-earnings ratio for crypto (if earnings are fees). Now, Ethereum raked in $2.7 billion worth of fees over the past year, according to data from TokenTerminal, while Bitcoin collected only $1.1 billion.

If you divide the market size of each asset by its fees, Ethereum has a much lower FDMC/F ratio. So, according to the ratio, ether could offer better value.

What’s the opportunity here?

Ethereum's next upgrade, called Dencun, is set for next week. After the upgrade, Ethereum could be faster and cheaper, helping it fend off rivals such as Solana and Avalanche.

But let’s not jump into this blindfolded: ether is already up over 250% since its bear market low in June of 2022. And it could easily drop 10% to 30% from here on a whim.

But if you can stomach the volatility, I think ether could be a decent bet for the long run. Just be sure to size your position based on your risk tolerance.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.