- 3 Big Scoops

- Posts

- Birkenstock Falls Off the Shelf

Birkenstock Falls Off the Shelf

PLUS: Passive investing rules Wall Street

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,780.94 ( ⬆️ 0.88%)

Nasdaq Composite @ 15,055.65 ( ⬆️ 1.35%)

Bitcoin @ $41,280.50 ( ⬇️ 3.51%)

Hey Scoopers,

Happy Friday! We’ve got an exciting newsletter to jumpstart your day. Here’s what’s going on 👇

👉 Birkenstock slumps post-earnings

👉 Passive investing gains traction

👉 Bitcoin under pressure

So, let’s go 🚀

Birkenstock Warns of Lower Margins

Birkenstock shares fell 7.7% yesterday after the Germany-based shoe brand reported a loss of $30.8 million in its first earnings report as a publicly listed entity.

Source: Getty Images

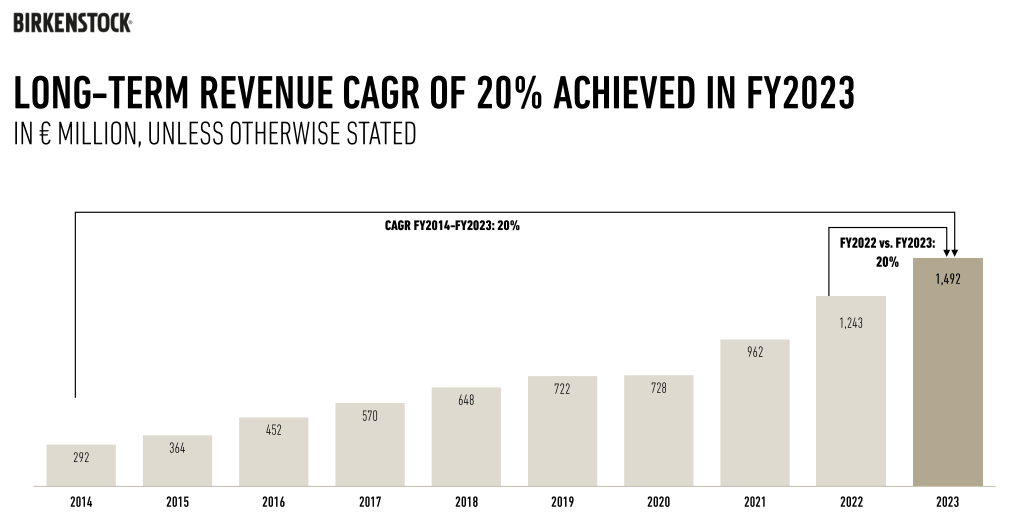

Birkenstock announced results for Q4 of fiscal 2023 (ended in September) and reported a revenue growth of 20% year over year. The 250-year-old shoe company has now increased sales by 20% annually for the last ten years.

Moreover, it ended 2023 with an adjusted EBITDA (earnings before interest, tax, deprecation, and amortization) margin of 32.4%, lower than 35% in the year-ago period.

Birkenstock warned investors that margins might continue to shrink in 2024 as it expects sales to grow between 17% and 18% in the next 12 months.

Birkenstock also emphasized investing roughly $160 million in fiscal 2024 in retail store expansion and production capacity.

Our Take

Birkenstock went public at $41 per share, and shares are currently priced at $46, valuing the company at $8.6 billion by market cap.

The company continues to expand, is highly profitable, and is reducing balance sheet debt. While margins have decreased due to rising interest rates and inflation, they are still much higher than peers.

Priced at 34x forward earnings, investors might remain cautious until the bottom line improves.

Passive Investing AUM Surges to $13.29 Trillion

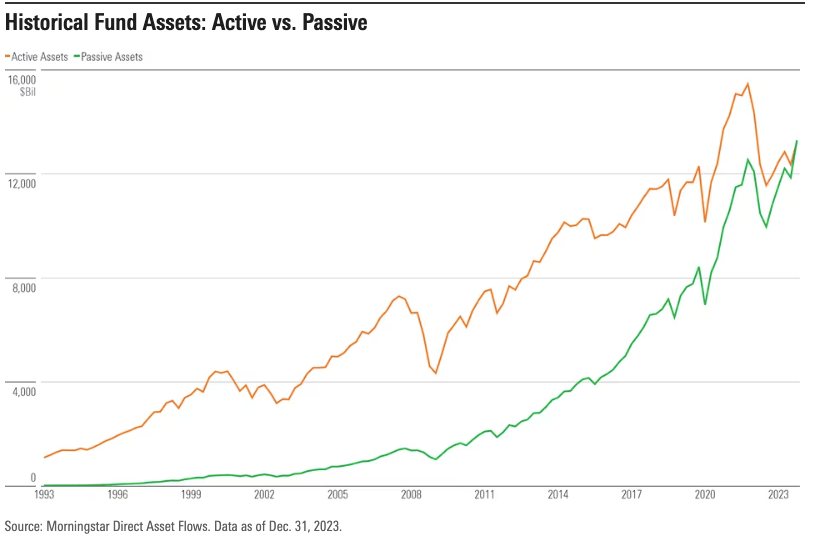

Passive investment products continue to gain popularity on Wall Street. The total assets under management or AUM for passively managed funds have surged to $13.29 trillion at the end of 2023, surpassing the $13.23 trillion held in active assets.

It is the first time passive-managed products surpassed active funds across all asset classes combined.

According to Morningstar:

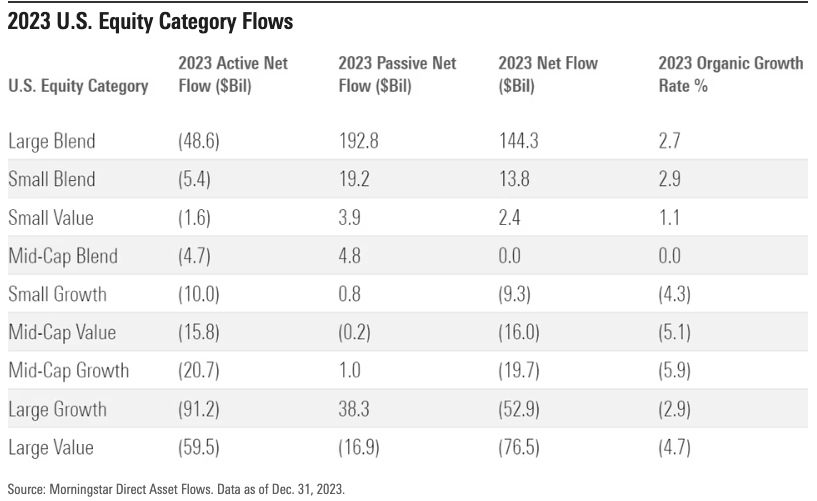

👉 Large-cap blended passive funds raked in $192.8 billion

👉 Active funds saw an outflow of $48.6 billion

👉 Large-cap growth funds saw net inflows of $38.3 billion compared to an outflow of $91.2 billion for active funds

Why are investors moving toward passive funds?

In 2023, just 38% of large-cap funds outperformed the Russell index benchmarks, down from 47% in 2022.

Passive funds track indexes such as the S&P 500, Nasdaq Composite, and the Dow Jones Industrial Average, each of which had a strong year in 2023. For instance, the S&P 500 index gained 24%, while the Nasdaq soared almost 45% last year.

Big tech companies, including Apple, Nvidia, Alphabet, Microsoft, Tesla, and Amazon, drove the uptick in 2023. The tech-heavy Nasdaq 100 index surged by an impressive 55% due to the rally in big tech.

Several managers are uncomfortable with having extensive portfolio exposure to a handful of tech companies, resulting in lower gains in 2023.

Bitcoin Pulls Back

It seems Bitcoin is a victim of the “buy the rumor and sell the news” concept, as the cryptocurrency has shed over 12% in market cap since multiple spot Bitcoin ETFs were launched last week.

The pullback in Bitcoin has driven shares of other cryptocurrency stocks, including Coinbase and Microstrategy, lower.

The unrealized profit for short-term holders fell to 16% this week from 48% in December. It may need to fall below 0% to call a bottom in BTC prices officially.

Bitcoin flows to derivative exchanges have also stalled, a trend that previously signaled price corrections and bear markets.

Headlines You Can’t Miss!

Holiday sales climb in 2023

GenZ is struggling with finances

Nvidia and AMD surge to all-time highs

China’s working-age population is shrinking

Bitcoin ETF AUM surpasses silver

Chart of The Day

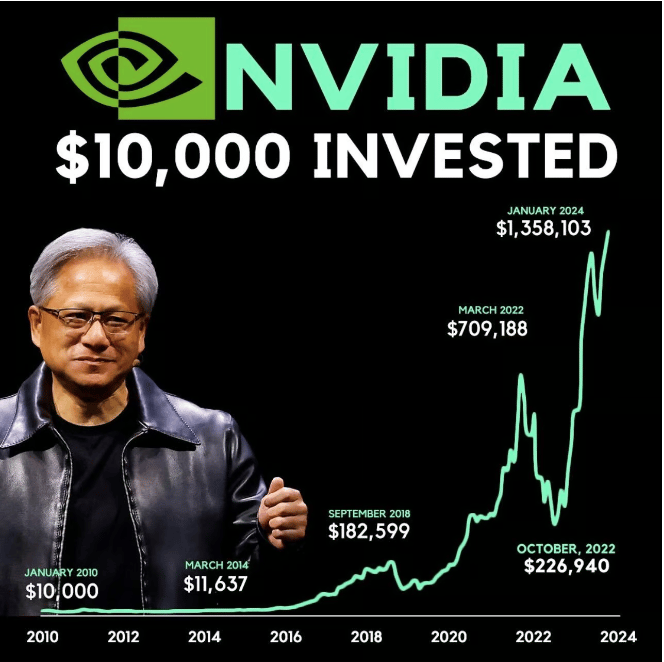

Nvidia has created massive wealth for shareholders in the past decade. The above chart shows that a $10,000 investment in Nvidia stock in January 2010 would have ballooned to $1.4 million today.

The semiconductor giant has gained momentum due to robust chip demand across verticals, including gaming, data centers, and artificial intelligence.

Valued at $1.5 trillion by market cap, Nvidia is among the most prominent companies globally. Despite its outsized gains, the tech stock trades at a reasonable valuation, given its stellar growth estimates.

If Nvidia stock is priced at 30x forward earnings, it may touch a market cap of $8.5 trillion in the next four years, as analysts expect adjusted earnings to grow to $114 per share in fiscal 2028.

While the broader markets have remained rangebound in 2024, Nvidia has gained close to 19% year-to-date.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.