- 3 Big Scoops

- Posts

- Berkshire's Massive Cash Pile

Berkshire's Massive Cash Pile

PLUS: Xiaomi's EV bet

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

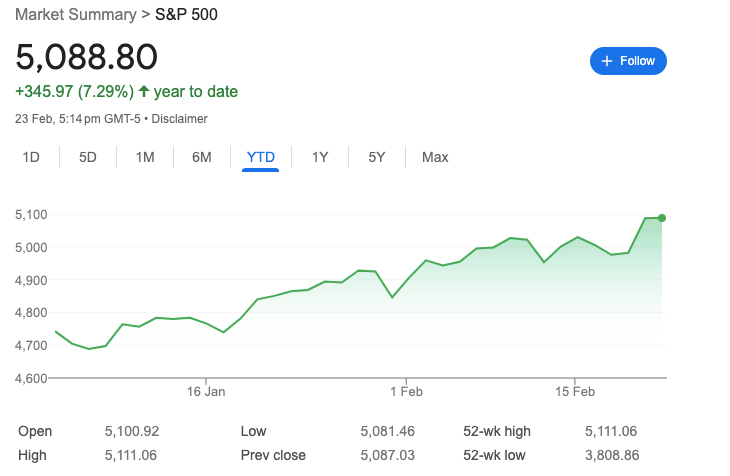

S&P 500 @ 5,088.80 (⬆️ 0.035%)

Nasdaq Composite @ 15,996.82 ( ⬇️ 0.28%)

Bitcoin @ $51,277.60 ( ⬇️ 0.12%)

Hey Scoopers,

Happy Monday! Here’s what’s making waves today:

👉 Berkshire’s Q4 results

👉 Xiaomi’s EV bet

👉 VC investments in crypto

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index stabilized on Friday and closed at record highs as investors enjoyed another week of gains.

The consumer staples sector led the charge, rising 2.2% last week. Stocks of companies such as Hormel Foods, Kraft Heinz, and Conagra Brands rose over 4% in the last five trading sessions.

The tech sector followed consumer staples, rising 2.1%, with semiconductor giants such as Nvidia, Micron, and Broadcom leading the gains.

UBS Global Wealth Management has lifted its 2024 price target for the S&P 500 to 5,200 from 5,100 due to a favorable environment, which includes steady economic growth, slowing inflation, and the possibility of interest rate cuts.

Trending Stocks 🔥

DraftKings - Shares of the sports betting company rose 4% after Barclays upgraded the stock to overweight from equal weight. Barclays claimed DraftKings is at an attractive entry point following the recent pullback.

Warner Bros. Discovery - Shares of the media conglomerate are down 10% following Q4 results as it reported a loss of $0.16 per share on revenue of $10.28 billion. Analysts forecast revenue of $10.35 billion with a loss of $0.07 per share.

Carvana - Shares of Carvana surged over 30% on Friday as it doubled gross profits in Q4 while improving the net income margin as well.

Berkshire Hathaway’s Bumper Earnings

Berkshire Hathaway reported a big rise in operating earnings in Q4, primarily led by its insurance business. The Omaha-based giant reported an operating income of $8.48 billion in Q4, up from $6.62 billion in the year-ago period. For 2023, its operating income grew by 17% year over year to $37.35 billion.

Source: CNBC

Berkshire’s operating earnings include profits from its businesses, such as insurance, railroads, and utilities.

Berkshire’s investment gains from publicly listed companies more than doubled year over year in Q4 to $37.57 billion, rising to $96.22 billion in 2023.

Berkshire ended 2023 with $167.6 billion in cash, much higher than the $157.2 billion it held at the end of 2022.

Warren Buffett warned investors and stated Berkshire Hathaway may only slightly outperform the average company in the U.S. due to its massive size and the lack of acquisition opportunities.

Buffett wrote, “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced.”

Smartphone to EVs

China’s smartphone manufacturer Xiaomi believes it has identified a consumer niche that will act as a tailwind for its upcoming electric car.

According to Xiaomi, its battery-powered car is positioned to gain traction in the premium EV segment as it already has more than 20 million premium smartphone users.

Xiaomi is developing EVs across price points and has allocated $10 billion for its lofty vision, given the company has to compete with peers such as Tesla, Byd, and Nio, as well as legacy players including Ford, Volkswagen, and General Motors.

Xiaomi revealed its SU7 EV last December and will begin deliveries in the second quarter of 2024.

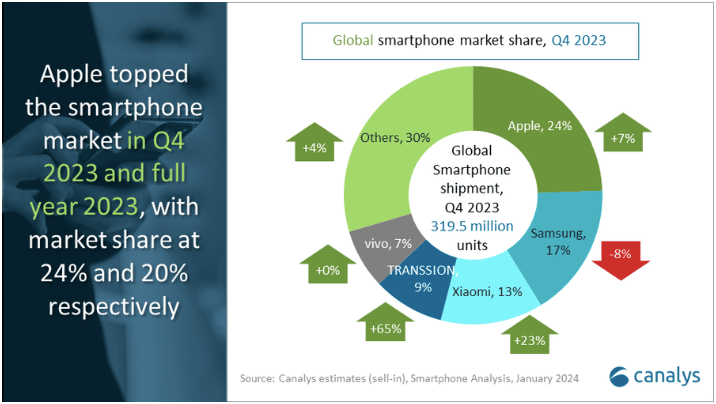

A leader in the smartphone industry, Xiaomi is the third largest mobile manufacturer in the world after Apple and Samsung. In fact, Xiaomi accounts for 13% of the global market and shipped 146.4 million devices last year.

In recent years, it has diversified into other segments, such as television and home appliances, which account for less than 30% of sales.

The EV market is under pressure and feeling the heat due to a sluggish macro environment, higher interest rates, and lower consumer demand. Several EV manufacturers, including Tesla and Byd, have slashed vehicle prices to boost demand.

Xiaomi is typically known for its affordable products. It will be interesting to see if the tech giant can enter the EV market and gain market share in the upcoming decade.

Crypto Projects Attract Over $90 Billion

According to a report from The Block Research, the cumulative amount invested in crypto-related companies has surpassed $90 billion.

Since the start of 2024, over 230 crypto deals have been reported, attracting $1.3 billion in total funding. These deals were closed across DeFi, NFTs, web3, financial services, data and analytics, and enterprise verticals.

This year, the majority of VC (venture capitalist) funding has been allocated to DeFi, NFTs, and web3.

One of the most high-profile investments in 2024 is a $25 million Series A round in Oobit, a crypto mobile payments company.

Headlines You Can't Miss!

TSMC opens a factory in Japan

Samsung unveils health-tracking smart ring

China is crucial to the global economy, says ADB

Google to launch advanced LLMs on Android in 2025

Circle partners with Kraken to build Metaverse

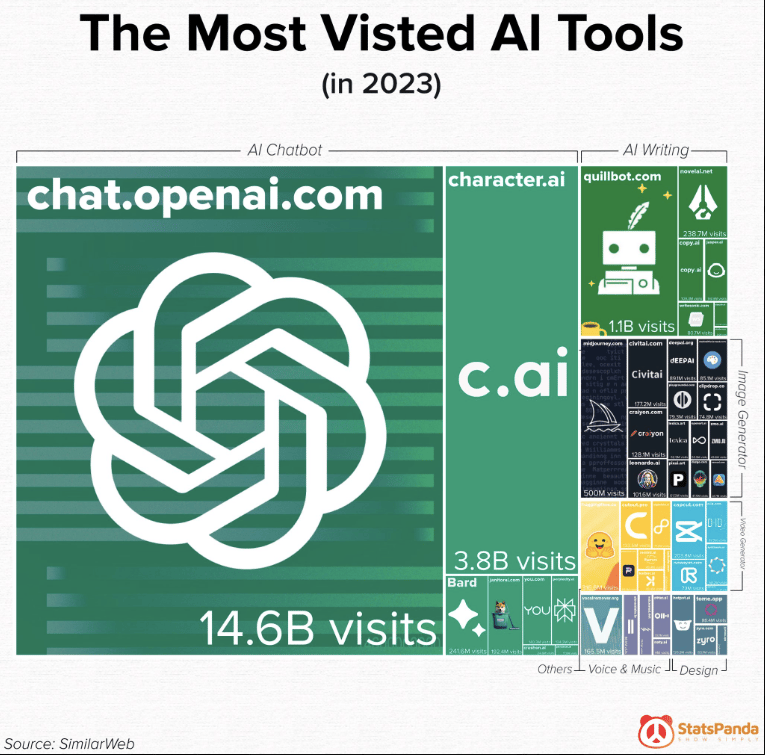

Chart of The Day

The AI (artificial intelligence) race has well and truly begun, and OpenAI is the undisputed leader in this space.

According to StatsPanda, ChatGPT is the most visited AI tool globally, attracting 14.6 billion visits in 2023.

ChatGPT was officially launched by OpenAI 15 months back and recently touched $2 billion in annual recurring revenue. Tech giant Microsoft has a sizeable stake in OpenAI and has invested several billion dollars in the company.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.