- 3 Big Scoops

- Posts

- 🍦 Boeing Eyes Acquisition

🍦 Boeing Eyes Acquisition

and Nio reports record deliveries in June

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

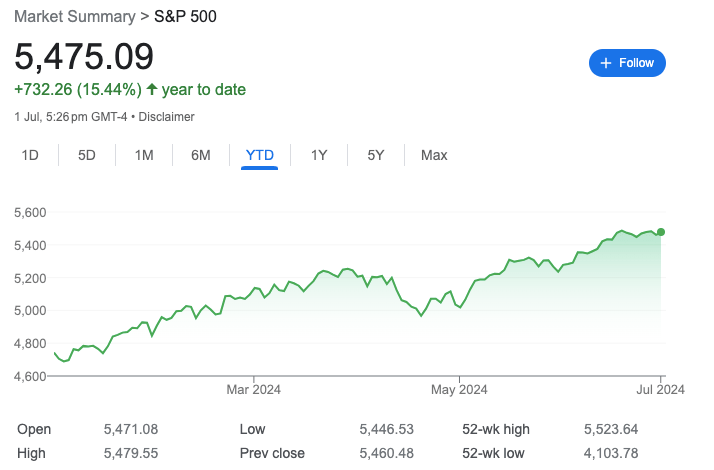

S&P 500 @ 5,475.09 ( ⬆️ 0.27%)

Nasdaq Composite @ 17,879.30 ( ⬆️ 0.83%)

Bitcoin @ $62,956.81 ( ⬇️ 0.12%)

Hey Scoopers,

Happy Tuesday! Here’s what we’re covering today:

👉 Boeing reacquires Spirit AeroSystems

👉 Oil prices tick higher

👉 Nio’s record month

So, let’s go 🚀

Market Wrap 📉

Equities moved higher yesterday, with the Nasdaq Composite closing at a fresh record high. Tech giants such as Microsoft and Apple added over 2%, while AI darling Nvidia advanced “just” 0.6%.

Wall Street continues to benefit from the excitement surrounding AI that helped prop up stocks such as Nvidia, which led the S&P 500 to a 14.5% gain in the first half of 2024. Comparatively, the Nasdaq has rallied 18.1% in the first six months.

Alternatively, investors are aware of the market's lack of breadth, which could influence moves in the second half of 2024.

The top 10 stocks in the S&P 500 now account for 33% of the index, a level of disproportion that has occurred only three times in the past.

Trending Stocks 🔥

Birkenstock- The shoe company is up 2.5% in pre-market after UBS upgraded the stock to buy from neutral. The investment bank cited higher average sales prices and strong growth in the Asia market.

Chewy - The online pet retailer fell 6.6% after a regulatory filing showed meme stock trader “Roaring Kitty” bought nine million shares, amounting to a 6.6% stake in the company.

Norwegian Cruise Line and Carnival - Shares of the cruise line operators shed over 5% as the southeastern Caribbean region braces for a Category 4 storm, which might lead to weather-related cancellations.

Boeing Inks $8.3 Billion Deal

Airline maker Boeing said it will reacquire struggling fuselage manufacturer Spirit AeroSystems in an all-stock deal, which should improve safety and quality control.

After accounting for Spirit's outstanding debt, Boeing valued the acquisition at $8.3 billion.

Source: CNBC

Boeing has been under pressure from regulators after a fuselage panel blew out midair on an Alaska Airlines 737 Max 9 flight. Spirit manufactures the fuselages for the 737 and other parts, including sections for Boeing’s 787 Dreamliners.

Boeing accounted for 70% of Spirit’s revenue in 2023; the rest was generated by making parts for Airbus.

U.S. prosecutors are planning to charge and offer Boeing a plea deal to a conspiracy fraud charge tied to the development of its 737 Max planes, two of which crashed in 2018 and 2019, killing all 346 passengers on board.

Moreover, regulators have said they won’t let Boeing expand production until they are satisfied with its production lines.

Boeing stock is down 26% in 2024.

Oil Prices Gain Pace

U.S. crude oil futures topped $83 per barrel, rising over 2% before the Fourth of July holiday.

West Texas Intermediate booked a 6% gain in June on fears of a wider Middle East war and expectations of rising fuel demand in summer.

Gas demand has been soft, but pump prices could rise as 60 million travelers are expected to hit the roads ahead of U.S. Independence Day.

Nio and Zeekr In Fourth Gear

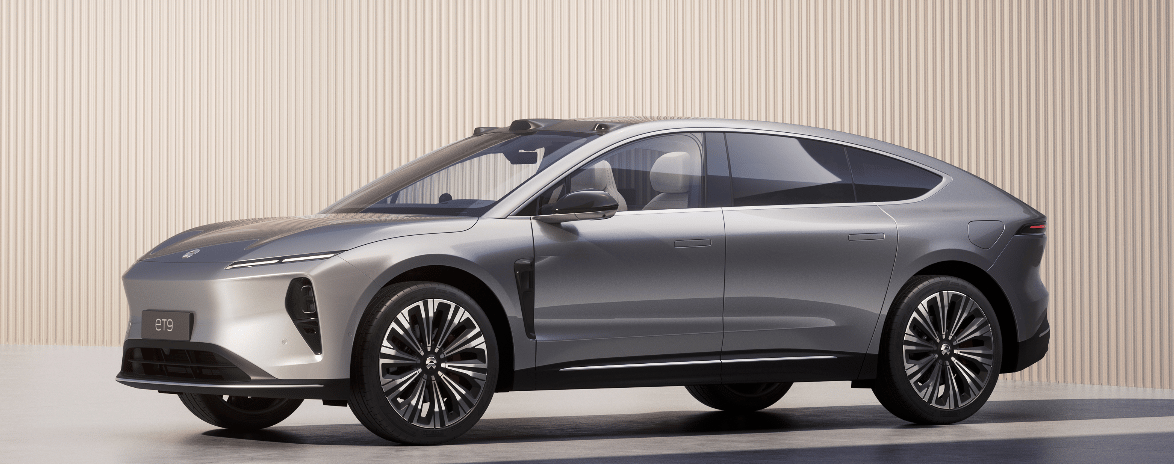

Chinese electric car company Zeekr said it delivered a record number of vehicles in June, making deliveries in the first half of 2024 the highest among the U.S.-listed Chinese companies selling pure EVs.

Zeekr delivered 20,106 cars last month, bringing the total number of deliveries in 2024 to 87,870. Nio has delivered 87,426 vehicles this year, with a record 21,209 deliveries in June. Xpeng lagged its peers with 52,028 deliveries in the last six months.

Smartphone maker Xiaomi launched its electric SU7 in March and delivered 10,000 cars in June, while total deliveries are higher at 25,000.

Meanwhile, China’s EV giant Byd delivered 1.6 million new energy passenger vehicles year-to-date, up 29% from the year-ago period.

Plug-in hybrid cars accounted for a greater share than pure-play EVs and saw higher growth, at 39.5% versus 17.5% for battery-only vehicles.

Hybrid vehicles are gaining traction in China as range anxiety is a top consumer concern. China’s new energy vehicle sales accounted for 47% of all passenger cars sold in May, up from 32% in early 2024.

Headlines You Can't Miss!

Revolut reports $545 million in profits, eyes U.K. banking license

Young people in China are revenge-saving

Paramount hunts for a streaming partner

IRS issues crypto tax guidelines

Crypto takes its fight with SEC to Biden and Trump

Chart of The Day

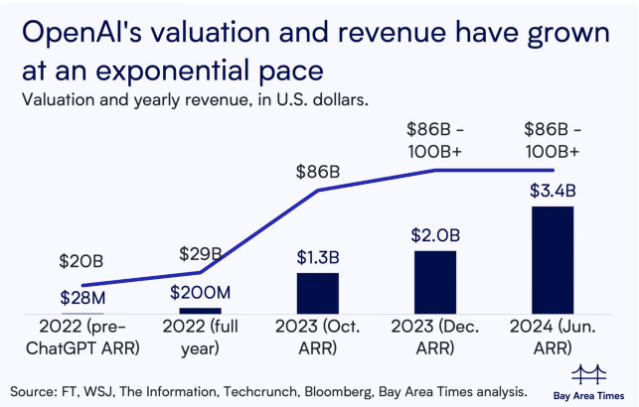

OpenAI, the parent company of ChatGPT, is currently valued at $100 billion, up from $20 billion in 2022.

A key driver of OpenAI’s valuation is its annual recurring revenue growth, which rose from $200 million in 2022 to $3.4 billion in June.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.